South Carolina Notice of

Description

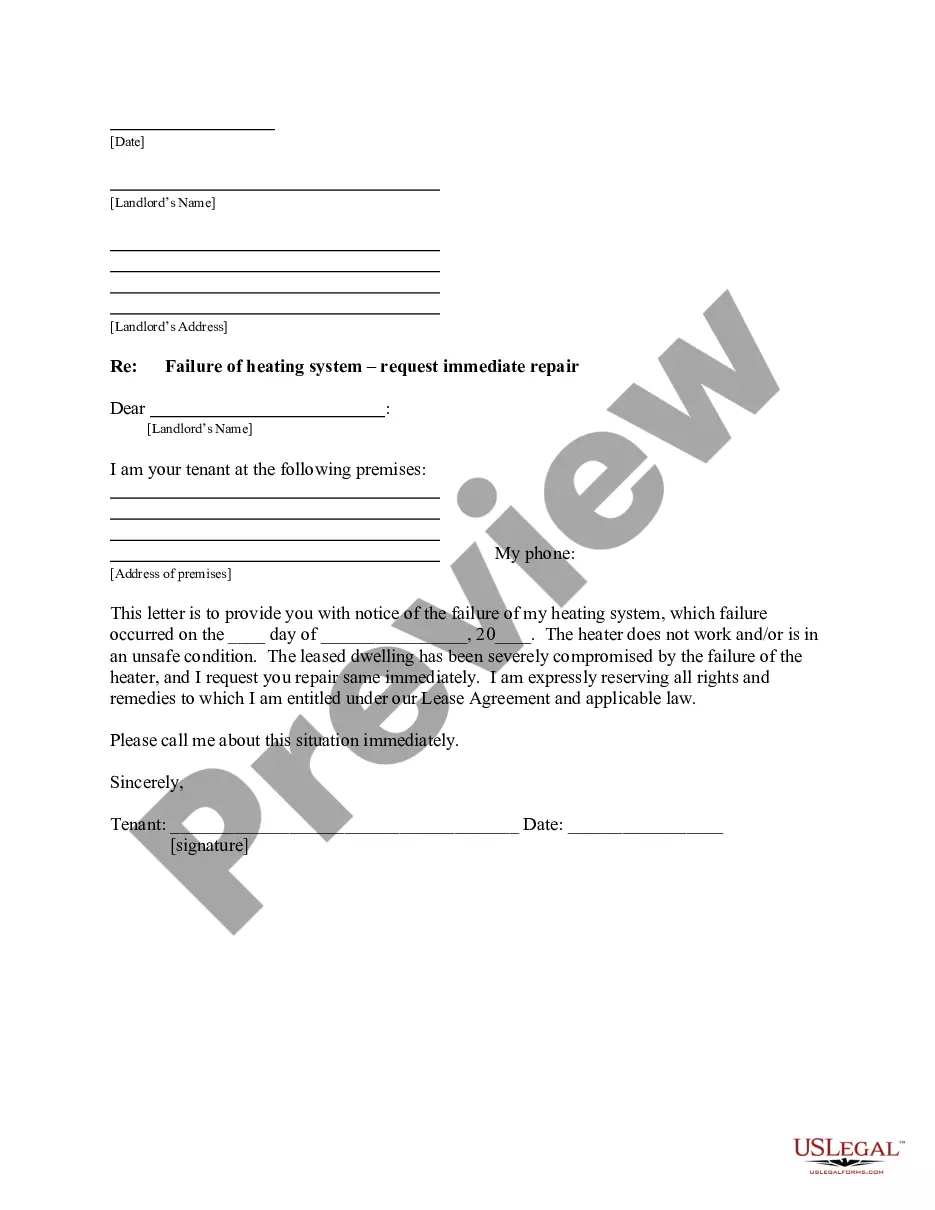

How to fill out South Carolina Notice Of?

If you’re looking for a way to properly complete the South Carolina Notice of without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every personal and business scenario. Every piece of documentation you find on our web service is designed in accordance with nationwide and state regulations, so you can be sure that your documents are in order.

Adhere to these straightforward guidelines on how to get the ready-to-use South Carolina Notice of:

- Make sure the document you see on the page corresponds with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Enter the document title in the Search tab on the top of the page and select your state from the list to find an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to get your South Carolina Notice of and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it rapidly or print it out to prepare your paper copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

The claimant agency may request more information by contacting the SCDOR's Setoff Debt/GEAR coordinator at setoffdebt@dor.sc.gov or 803-898-5755.

Wage garnishment is prohibited in South Carolina EXCEPT in 3 cases: 1) If money is owed to the government (i.e., unpaid taxes, defaulted federal student loans)

Summary. Corporations transacting or conducting business within South Carolina are required to file a corporate tax return. Domestic corporations must submit the "Articles of Incorporation" and related documents to the Secretary of State.

The Department of Revenue is a department of the South Carolina state government responsible for the administration of 32 different state taxes in South Carolina. The Department is responsible for licensing and taxing all manufacturers, wholesalers and retailers of alcoholic liquors.

Individual Income Tax rates range from 0% to a top rate of 7% on taxable income for tax years 2021 ?and prior and from 0% to a top rate of 6.5% on taxable i?ncome for tax year 2022. Tax brackets are adjusted annually for inflation.

A Notice of Commencement is optional in South Carolina. When the notice is filed, it's filed by the general contractor who is receiving some protection by filing the notice. Whether or not the notice is filed effects which parties subs and suppliers can file liens against ? and for how much.

Common reasons the SCDOR may send you a notice: You have a balance due. You are due a larger or smaller refund. We have a question about your return or need additional information or documents.

Rebates have been issued? In June 2022, SC state lawmakers approved a state tax rebate for elig?ible taxpayers who filed a 2021 state Individual Income Tax return. Rebates were issued by December 31, 2022 for the first round of rebates - and again in March 2023.