A South Carolina Exempt Property Claim is a legal document used to protect certain types of property from creditors in the event of a bankruptcy filing. This type of claim is made by a debtor in order to protect their assets from creditors and allow them to keep possession of those assets. The types of South Carolina exempt property claims include: homestead exemption, motor vehicle exemption, wildcard exemption, and personal property exemption. The homestead exemption protects up to $60,000 of a debtor’s equity in their primary residence. The motor vehicle exemption protects up to $3,500 of a debtor’s equity in one motor vehicle. The wildcard exemption protects up to $5,000 of a debtor’s equity in any type of property. The personal property exemption protects up to $2,000 of a debtor’s equity in any type of personal property, including jewelry, firearms, and household items. These claims are intended to help debtors maintain possession of assets that can help them rebuild their financial future after bankruptcy.

South Carolina Exempt Property Claim

Description

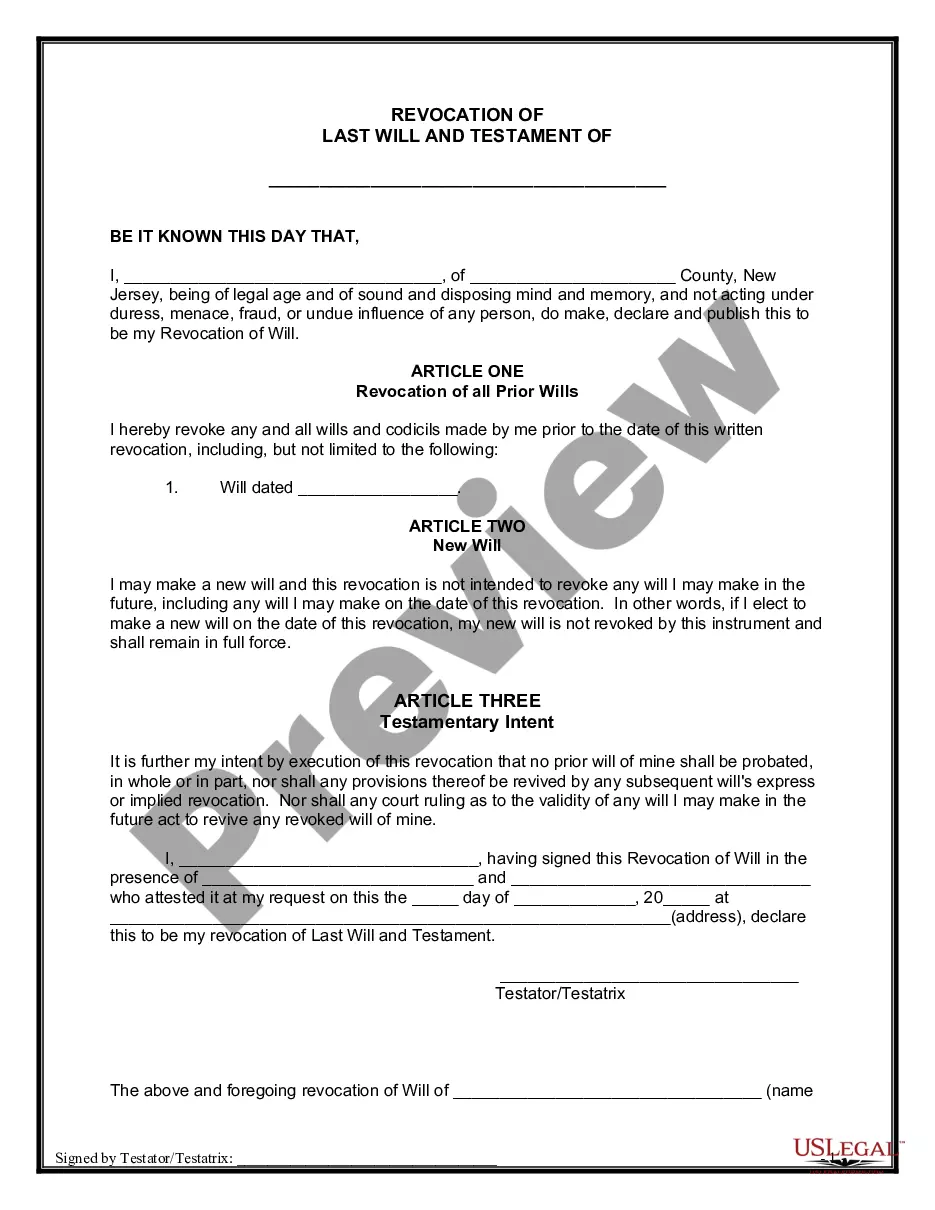

How to fill out South Carolina Exempt Property Claim?

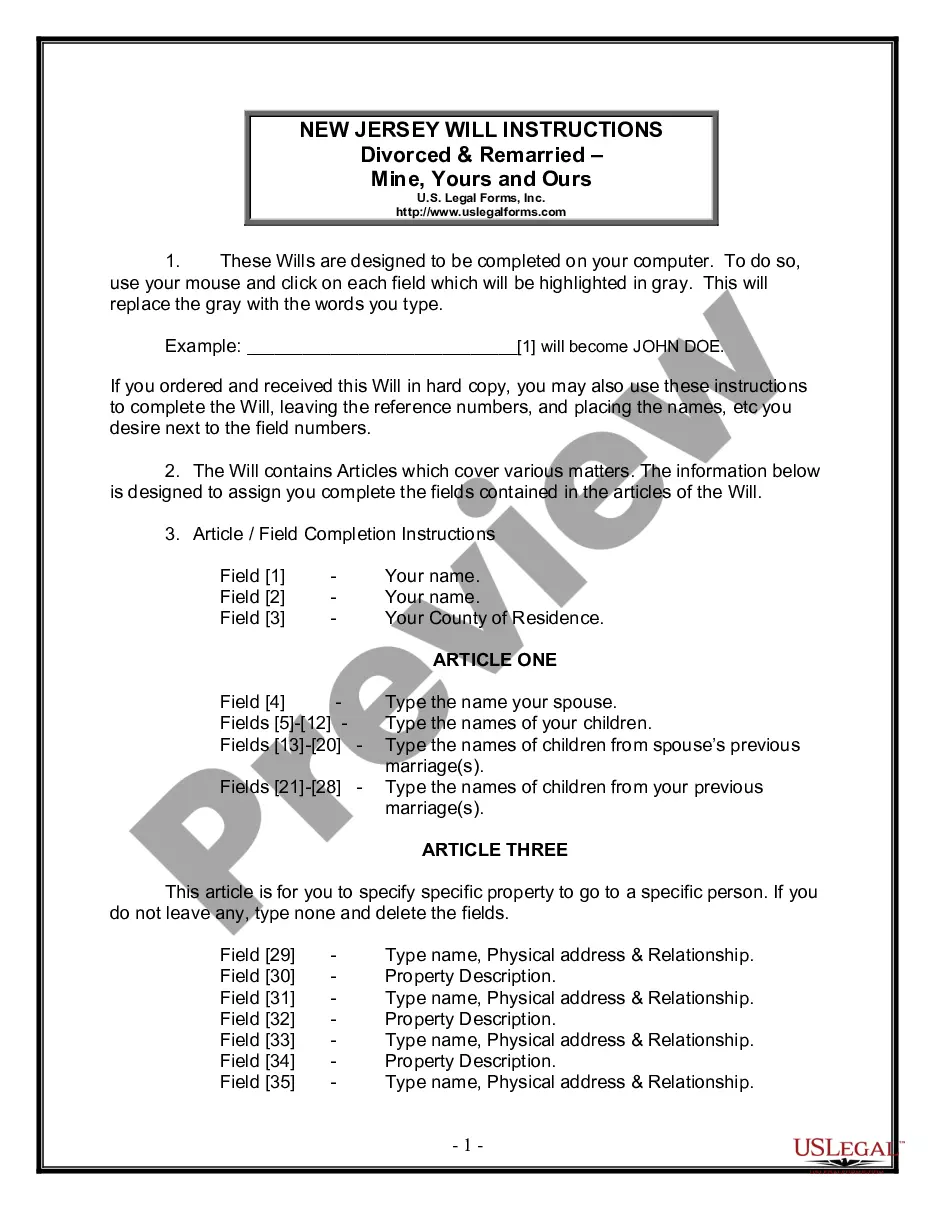

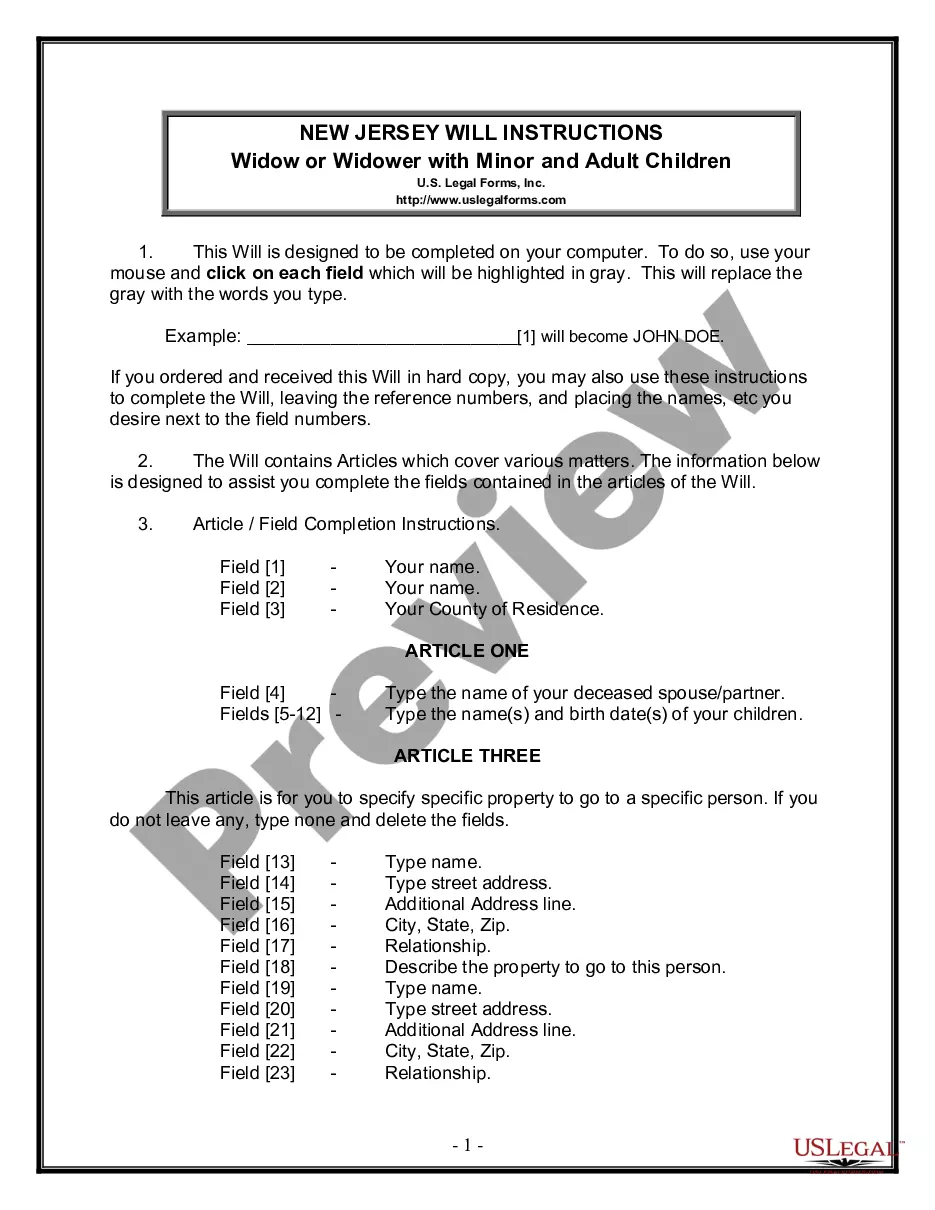

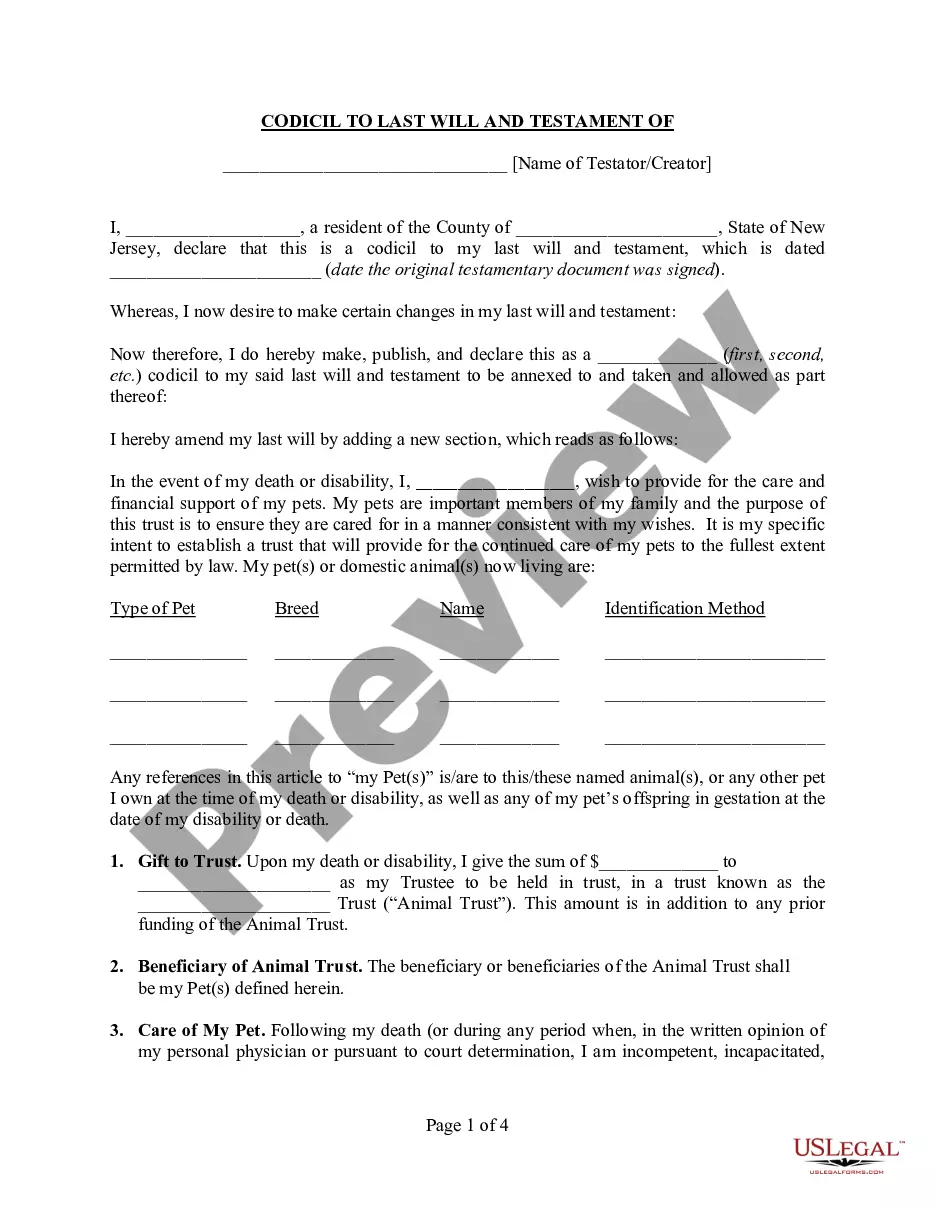

Preparing official paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them comply with federal and state laws and are examined by our experts. So if you need to complete South Carolina Exempt Property Claim, our service is the best place to download it.

Getting your South Carolina Exempt Property Claim from our library is as easy as ABC. Previously registered users with a valid subscription need only log in and click the Download button once they locate the proper template. Later, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few moments. Here’s a brief guide for you:

- Document compliance check. You should attentively examine the content of the form you want and make sure whether it satisfies your needs and fulfills your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab above until you find a suitable template, and click Buy Now when you see the one you want.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your South Carolina Exempt Property Claim and click Download to save it on your device. Print it to complete your papers manually, or use a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any formal document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

Send in your application using one of the following ways: Mail to: SCDOR, Government Services Division, PO Box 125, Columbia, SC 29214-0720 Apply using our free online tax portal, MyDORWAY. Visit dor.sc.gov/MyDORWAY to get started. We also accept applications in person at any of our service centers.

Any asset that is in a trust. Assets in a pension plan. Any asset that already has a beneficiary attached to it. Insurance policy with a beneficiary. Retirement funds with a named beneficiary. Real estate with joint tenancy with right of survivorship.

All Application for Exemption Certificate requests must be submitted on our free online tax portal, MyDORWAY, at MyDORWAY.dor.sc.gov. a MyDORWAY account to request Sales and Use Tax exemptions. If you do not have a Sales and Use Tax account, complete the Business Tax Application at dor.sc.gov/register.

Even though there is no South Carolina estate tax, the federal estate tax might still apply to you. The federal estate tax exemption is $12.06 million in 2022 and #12.92 million in 2o23.

To qualify for the special 4% property tax assessment ratio, the owner of the property must have actually owned and occupied the residence as his legal residence and been occupying that address for some period during the applicable tax year. Only an owner-occupant is eligible to apply for the 4% special assessment.

Judgment Proof Assets and Consumer Debt While a judgment can feel like a win, finding assets to collect can be challenging. In South Carolina, judgment exemptions generally apply to a person's personal property and their homestead.

Residents of South Carolina may be exempt from paying a portion of property taxes for the following criteria: resident of the state for a full calendar year and either over 65 years of age or permanently disabled or legally blind.