South Carolina Articles of Incorporation Benefit Corporation Professional Corporation-Statutory Close Corporation

Description

How to fill out South Carolina Articles Of Incorporation Benefit Corporation Professional Corporation-Statutory Close Corporation?

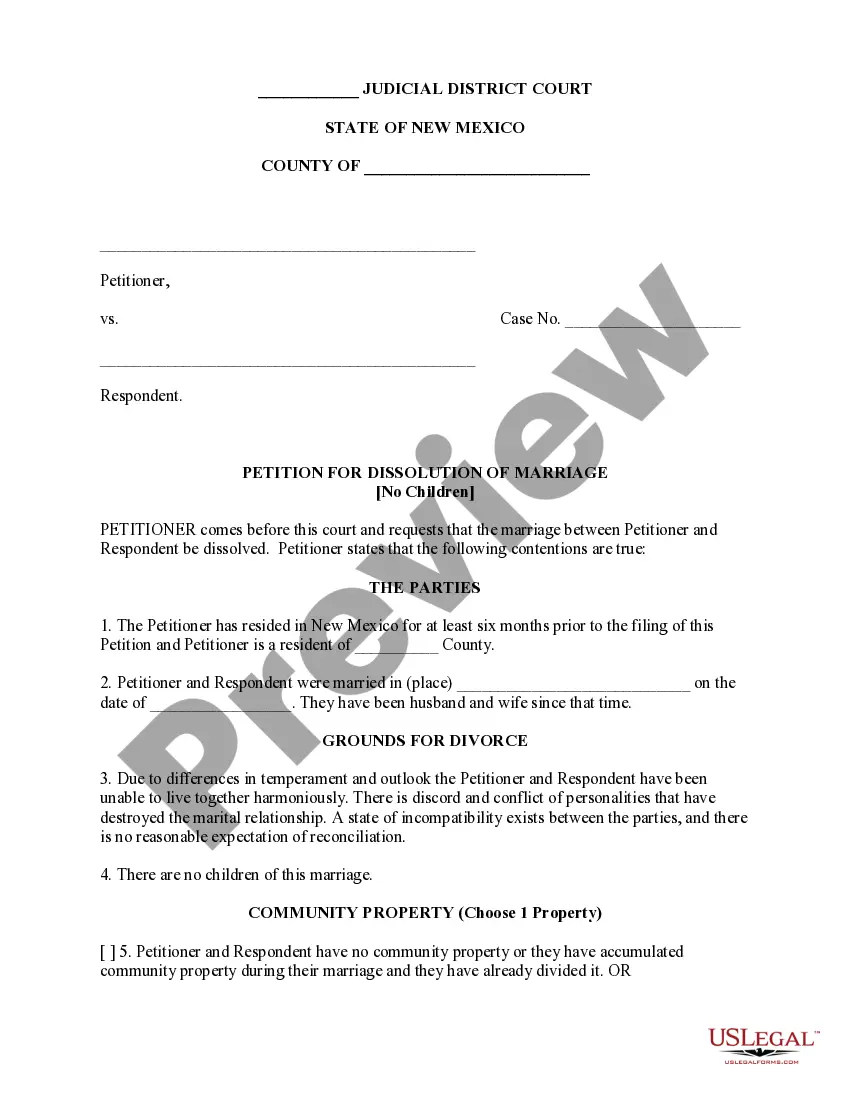

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them comply with federal and state regulations and are checked by our specialists. So if you need to fill out South Carolina Articles of Incorporation Benefit Corporation Professional Corporation-Statutory Close Corporation, our service is the perfect place to download it.

Getting your South Carolina Articles of Incorporation Benefit Corporation Professional Corporation-Statutory Close Corporation from our library is as simple as ABC. Previously registered users with a valid subscription need only sign in and click the Download button once they locate the proper template. Afterwards, if they need to, users can take the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few minutes. Here’s a quick guideline for you:

- Document compliance check. You should carefully review the content of the form you want and ensure whether it suits your needs and meets your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab above until you find a suitable template, and click Buy Now when you see the one you need.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your South Carolina Articles of Incorporation Benefit Corporation Professional Corporation-Statutory Close Corporation and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

If a corporation is owned by a small number of shareholders, it is considered closely held. South Carolina corporations with a single shareholder or more can make the statutory close corporation election.

It is a legal entity with its own legal personality and perpetual succession and must register as a taxpayer in its own right. A CC has no share capital and therefore no shareholders. The owners of a CC are the members of the CC. Members have a membership interest in the CC.

Unlike general corporations where management of the business operations of the corporation is reserved for the board of directors or the officers, shareholders in close corporations may enter into agreements that give them authority to run the company.

Disadvantages to a Close Corporation Close corporations do not exist in all states.A close corporation often costs more money to organize. While shareholders have the benefit of greater control over the sale of shares, shareholders in a close corporation are also burdened with increased responsibility.

Unlike normal corporations, statutory close corporations are not required to have company bylaws. Instead, these corporations can include legally required bylaw provisions in their Articles of Incorporations. Required provisions include: The location and time of shareholders meetings.

(a) Unless prohibited or limited by the articles or bylaws, any action that may be taken at any annual, regular, or special meeting of members may be taken without a meeting if the corporation delivers a written or electronic ballot to every member entitled to vote on the matter.

A Statutory Close Corporation (also known as ?Close Corporation?) is a corporation that does not publicly trade stock and is formed under a special statute. This type of corporation is held by a limited number of shareholders.