South Carolina Miscellaneous Broker-Dealer Requirements

Description

How to fill out South Carolina Miscellaneous Broker-Dealer Requirements?

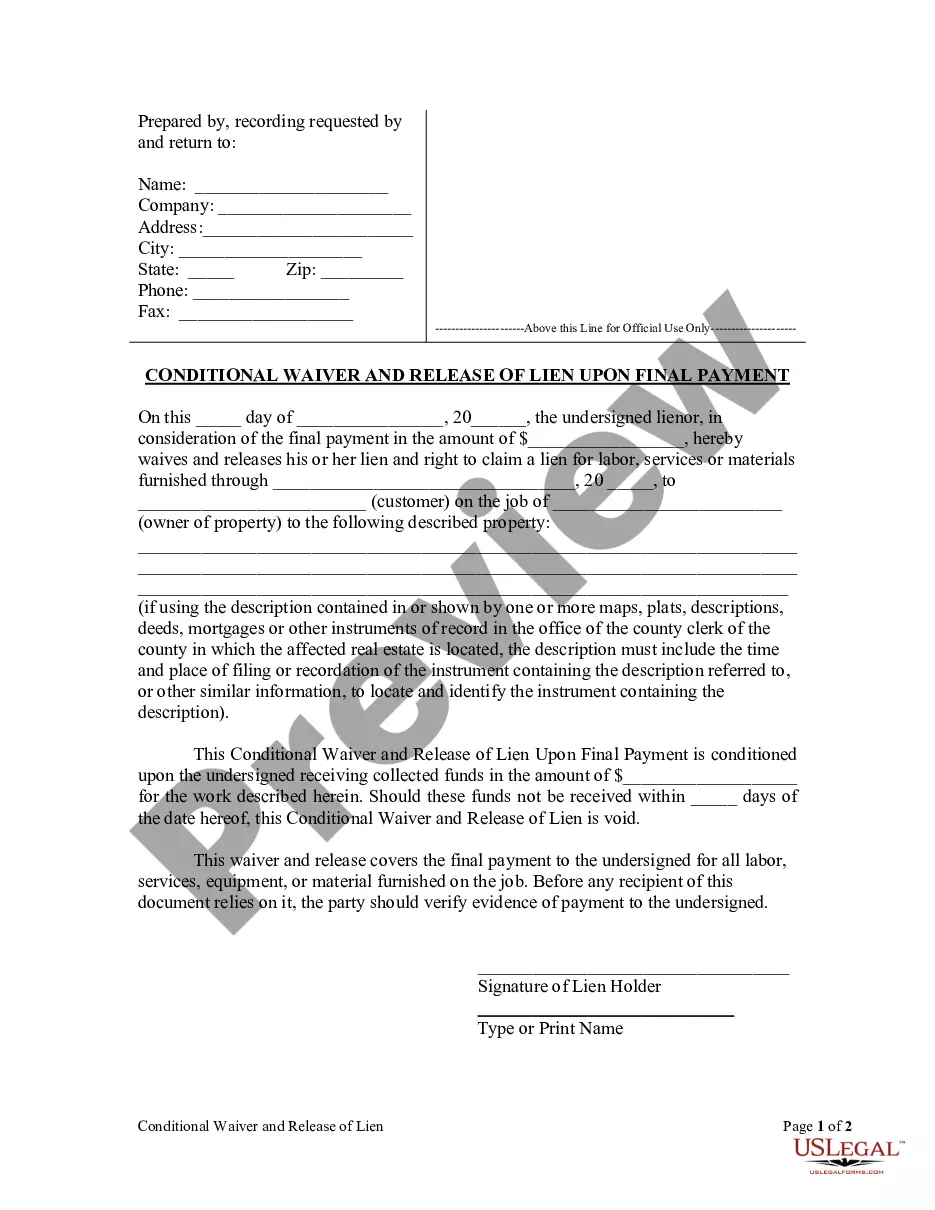

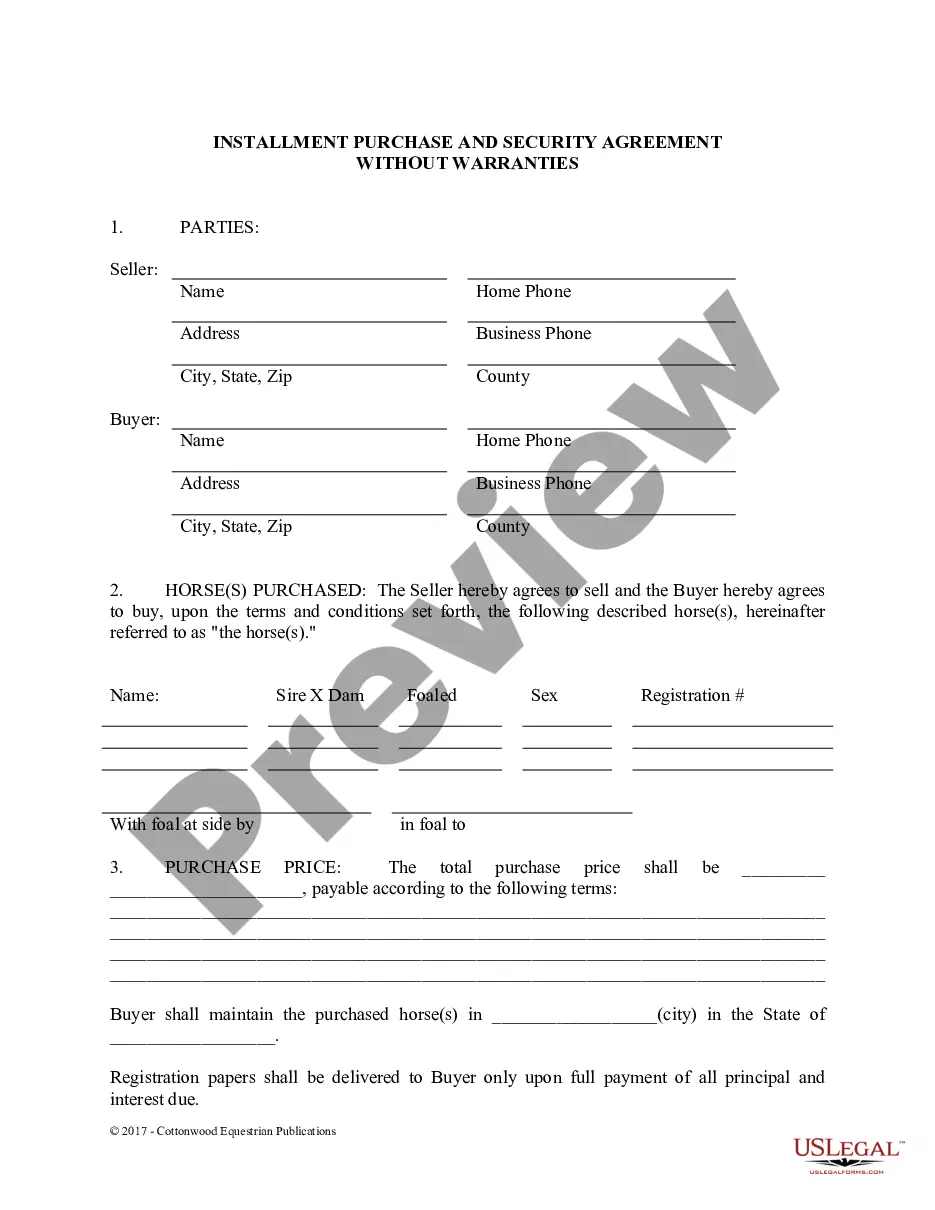

Coping with official paperwork requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your South Carolina Miscellaneous Broker-Dealer Requirements template from our library, you can be certain it complies with federal and state regulations.

Dealing with our service is straightforward and quick. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to obtain your South Carolina Miscellaneous Broker-Dealer Requirements within minutes:

- Make sure to attentively examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for another official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the South Carolina Miscellaneous Broker-Dealer Requirements in the format you prefer. If it’s your first experience with our service, click Buy now to continue.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to submit it electronically.

All documents are created for multi-usage, like the South Carolina Miscellaneous Broker-Dealer Requirements you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

Under the Patriot Act, broker-dealer AML requirements should facilitate: Customer identification and due diligence procedures. Transaction monitoring and suspicious activity reporting. Information sharing upon the request of federal law enforcement authorities.

Details of Regulation BI A care obligation means that a broker-dealer must exercise reasonable diligence, care, and skill when making a recommendation to a retail customer.

What Is the Difference Between a Broker and a Dealer? A broker is an individual or financial services company that enables the trading of securities for other individuals. A dealer is an individual or financial services company that enables the trading of securities for themselves.

The rule requires a broker-dealer to have possession or control of all fully-paid or excess margin securities held for the account of customers. The broker-dealer must periodically determine how much money it is holding that is either customer money or obtained from the use of customer securities.

Reg BI's obligation to act in the retail customer's best interest is satisfied only by complying with each of the rule's four component obligations: Disclosure, Care, Conflict of Interest, and Compliance. Exchange Act rule 15l-1; Reg BI Adopting Release, supra note 3, at 33320-21.

Independent broker-dealers were created to accommodate financial advisors who carry securities licenses and need back-office support for services such as compliance and trade execution. These firms typically cater to more experienced advisors who generate high streams of revenue from a sophisticated client base.

dealer is required to initially register with the SEC. They use form BD for this, which is a brokerdealer registration form.

dealer must comply with relevant state law as well as federal law and applicable SRO rules.