South Carolina Application By Foreign Corporation For Certificate of Authority

Description

How to fill out South Carolina Application By Foreign Corporation For Certificate Of Authority?

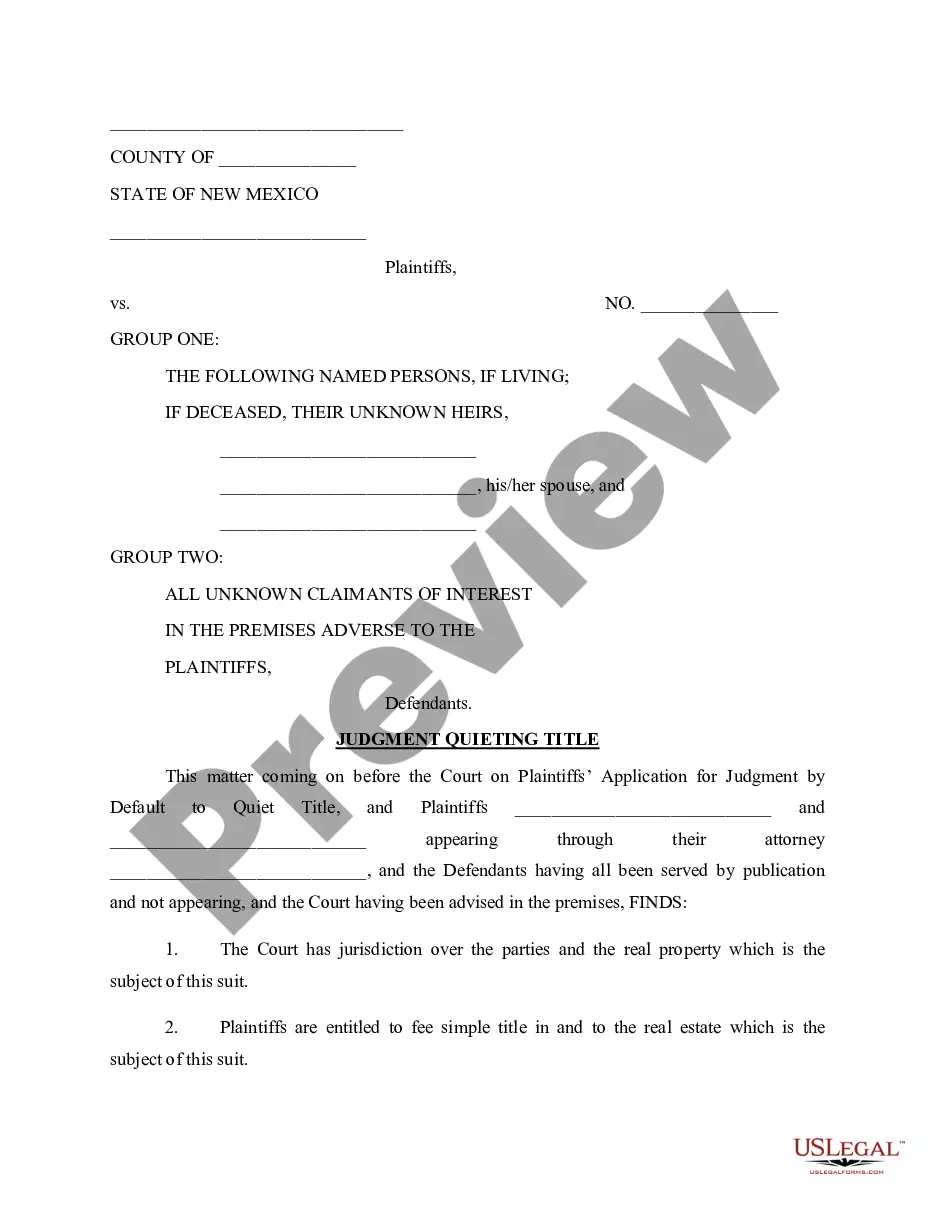

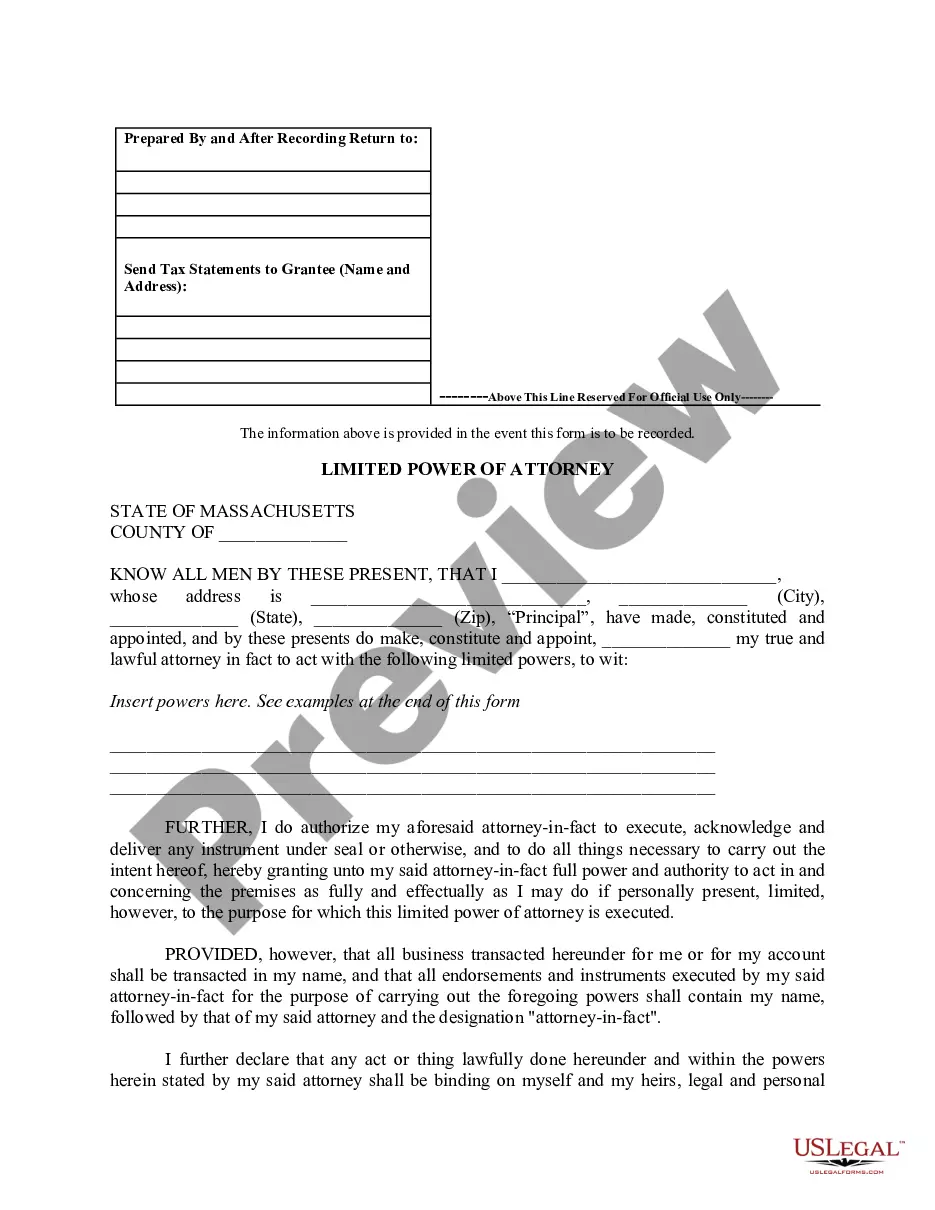

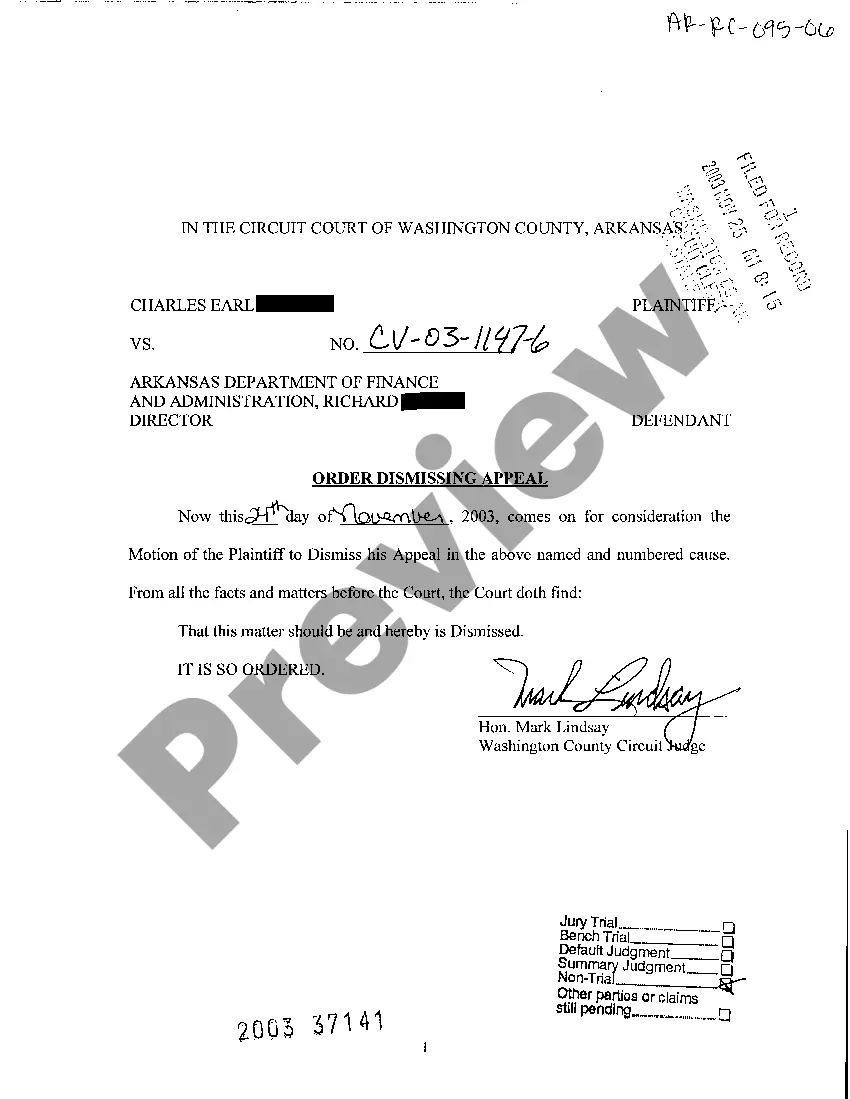

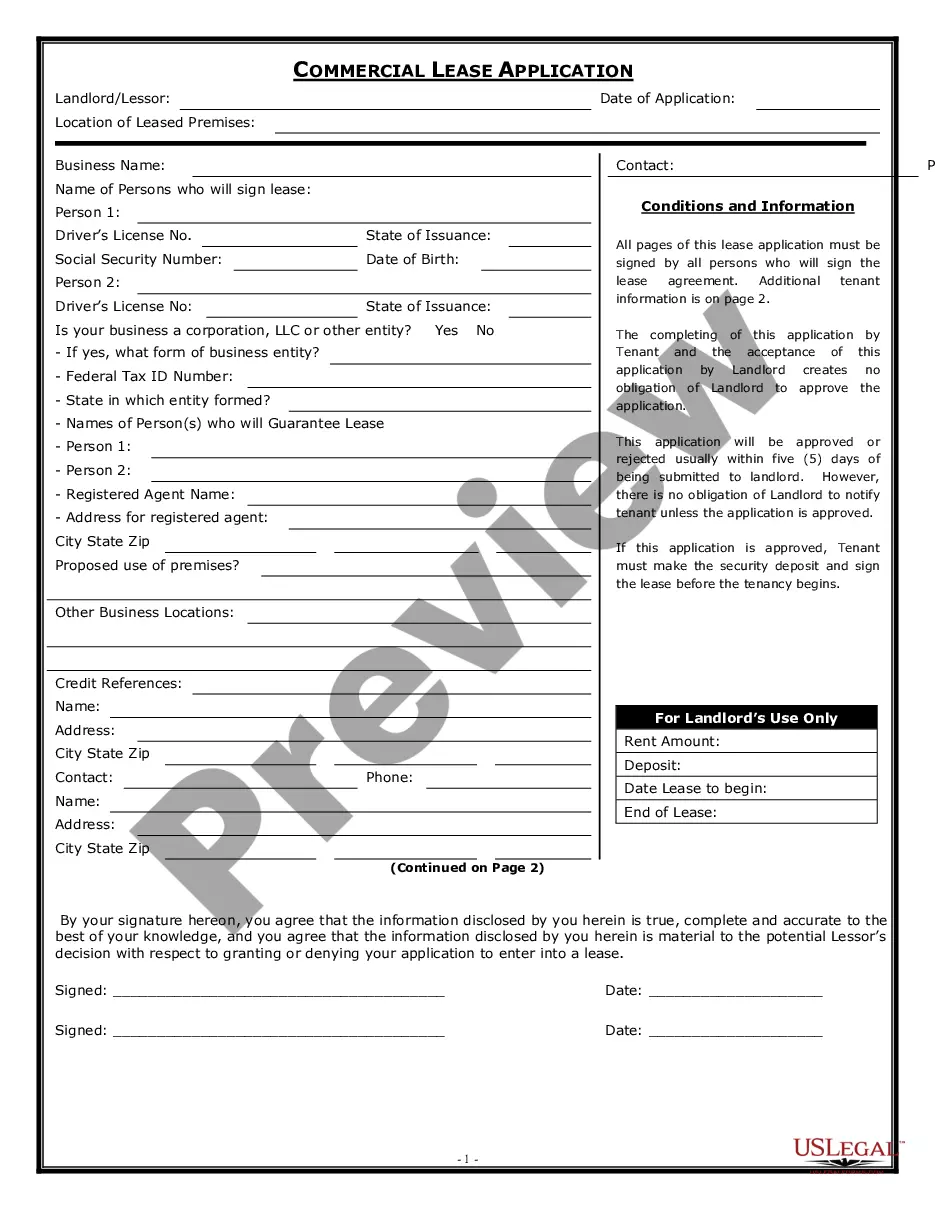

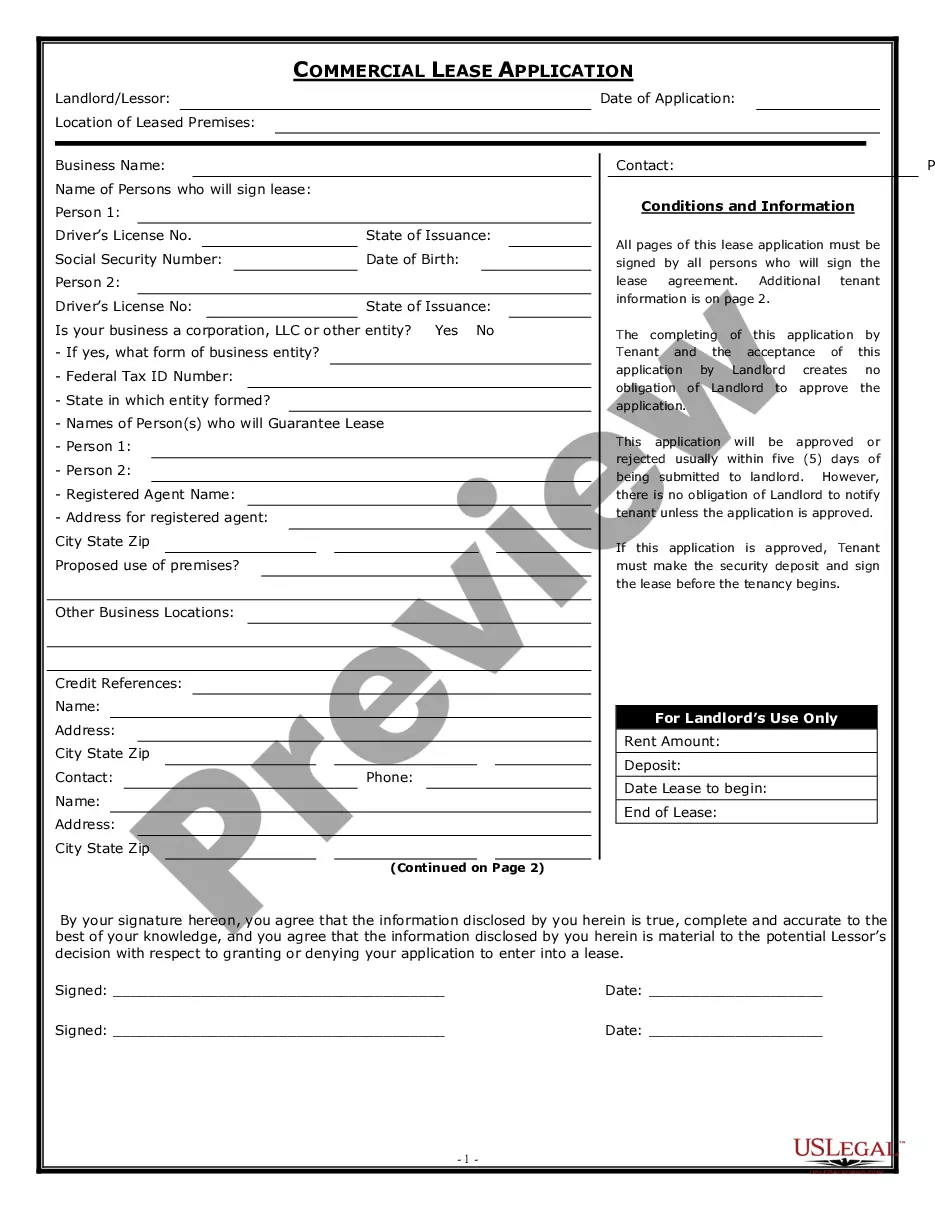

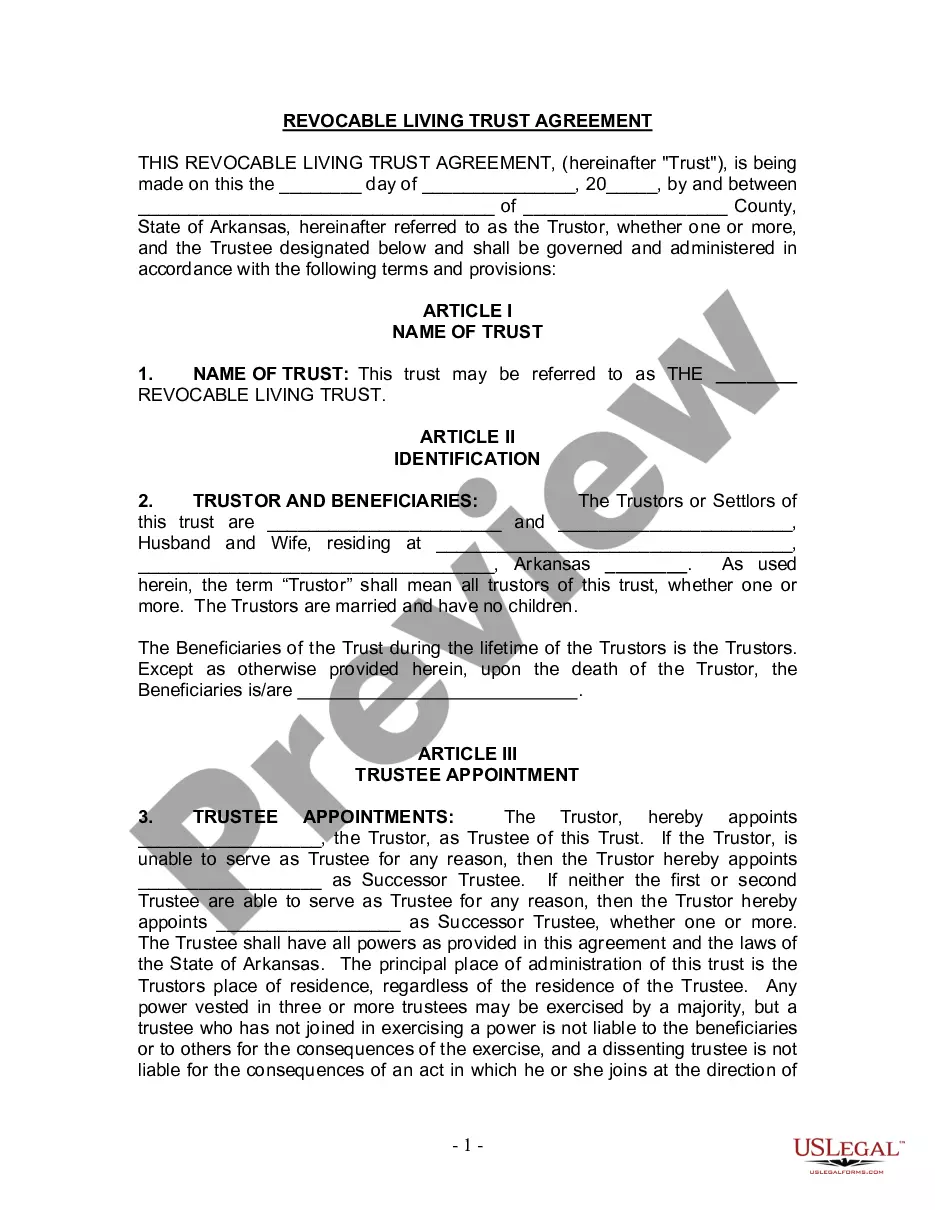

Preparing legal paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them correspond with federal and state laws and are verified by our experts. So if you need to fill out South Carolina Application By Foreign Corporation For Certificate of Authority, our service is the best place to download it.

Getting your South Carolina Application By Foreign Corporation For Certificate of Authority from our service is as simple as ABC. Previously registered users with a valid subscription need only sign in and click the Download button once they find the proper template. Afterwards, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few moments. Here’s a quick guideline for you:

- Document compliance check. You should carefully review the content of the form you want and make sure whether it satisfies your needs and meets your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library using the Search tab on the top of the page until you find a suitable template, and click Buy Now once you see the one you need.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your South Carolina Application By Foreign Corporation For Certificate of Authority and click Download to save it on your device. Print it to complete your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service today to get any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

Key Takeaways A domestic corporation conducts its affairs in its home country or state. Businesses that are located in a country different from the one where they originated are referred to as foreign corporations. Corporations also may be deemed foreign outside of the state where they were incorporated.

To register a foreign LLC in South Carolina, you'll need to file an Application for Certificate of Authority with the South Carolina Secretary of State and pay a $110 fee ($125 if filing online).

A South Carolina certificate of authority is a document required by companies that are not registered in South Carolina but intend to operate in the state. Before companies can do business in South Carolina, they must register with the South Carolina Secretary of State.

A foreign corporation is a corporation which is incorporated or registered under the laws of one state or foreign country and does business in another. In comparison, a domestic corporation is a corporation which is incorporated in the state it is doing business in.

To register a foreign corporation in South Carolina, you must file a South Carolina Application for Certificate of Authority with the South Carolina Secretary of State, Business Filings Division. You can submit this document by mail, in person, or online.

For South Carolina purposes, if your LLC is formed in another state, then it is known as a foreign LLC in South Carolina. In other words, foreign doesn't mean from another country. Instead, it means your business was organized under the laws of another state.

Form CL-1 Initial Annual Report of Corporations must be submitted by both domestic and foreign corporations to the Secretary of State. LLC's filing as a corporation must submit Form CL-1 to SCDOR within 60 days of conducting business in this state.

The main advantage of establishing a foreign entity is that it ensures compliance with local laws, making it easier to operate and do business in a different market. It also helps establish credibility with local authorities and build trust among local customers.