South Carolina Application By Foreign Nonprofit Corporation For Certificate of Withdrawal

Description

How to fill out South Carolina Application By Foreign Nonprofit Corporation For Certificate Of Withdrawal?

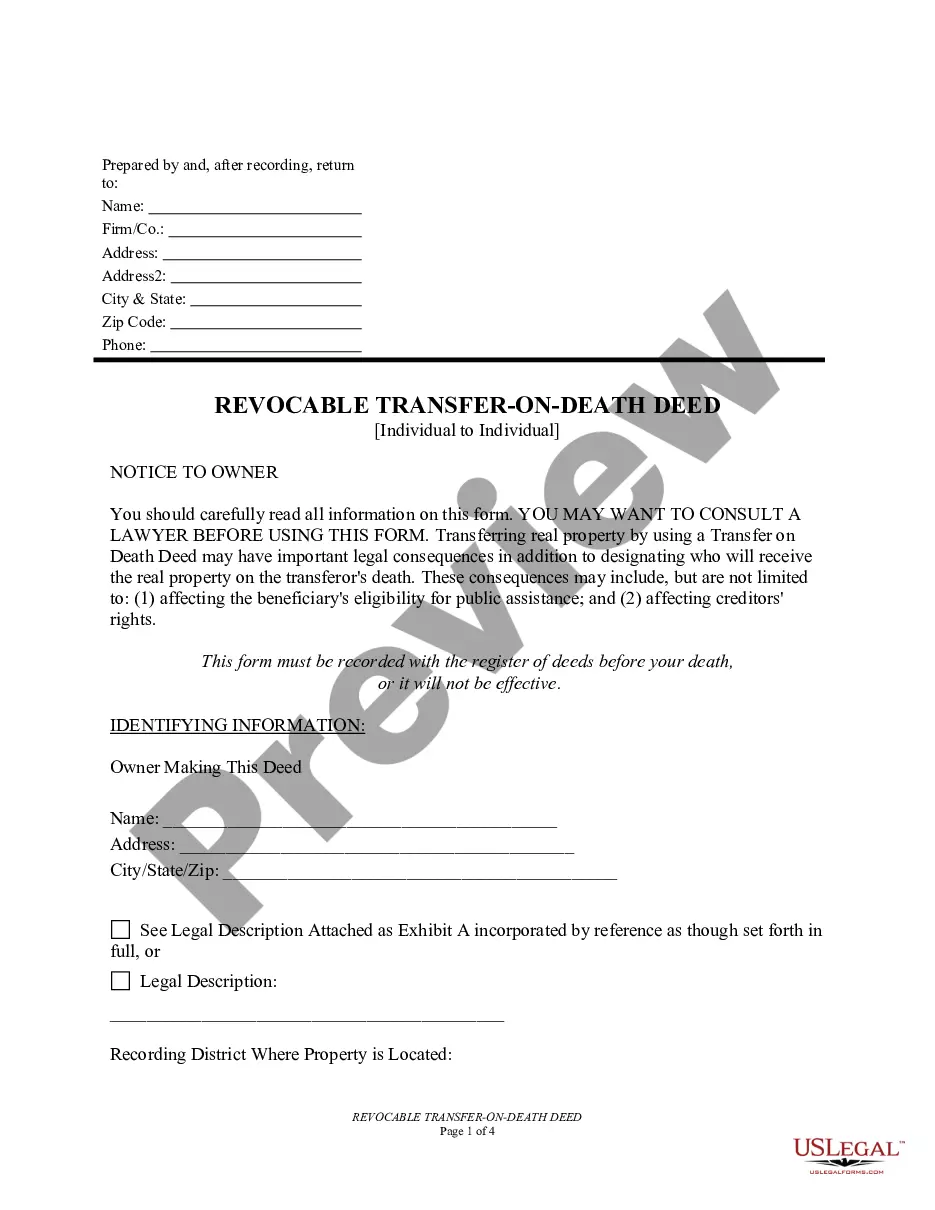

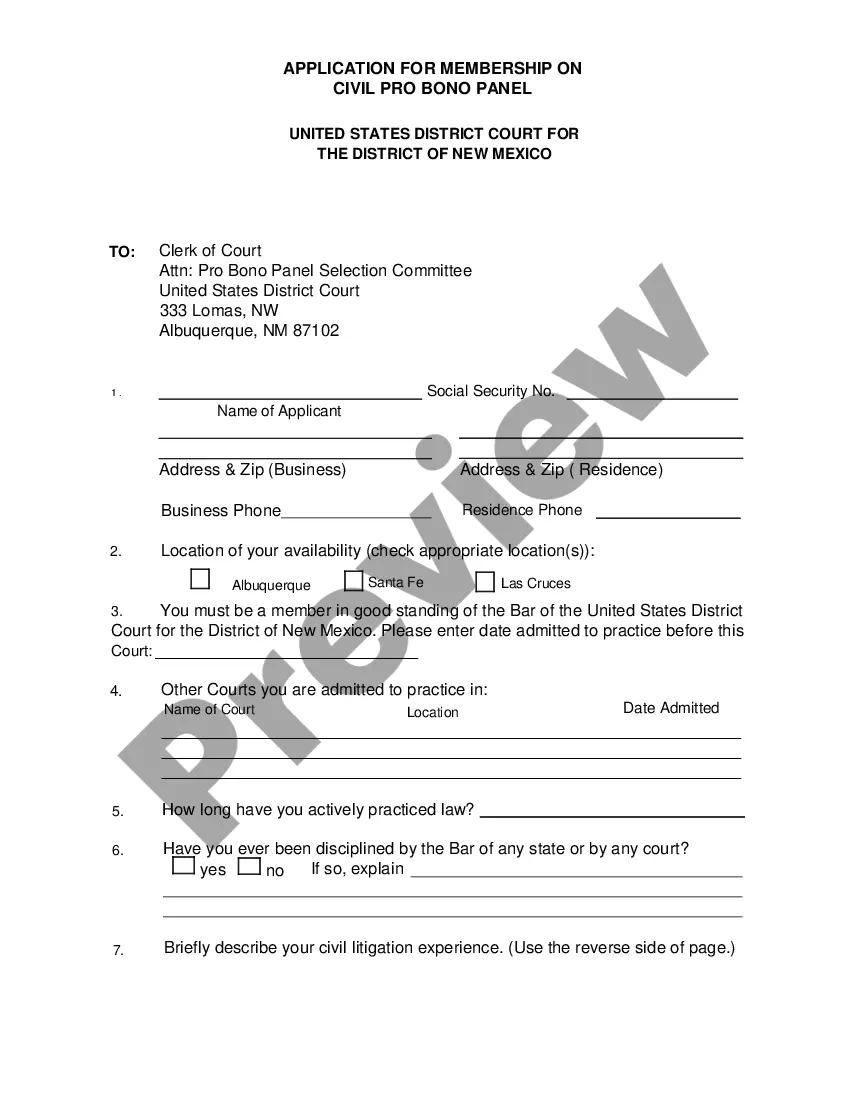

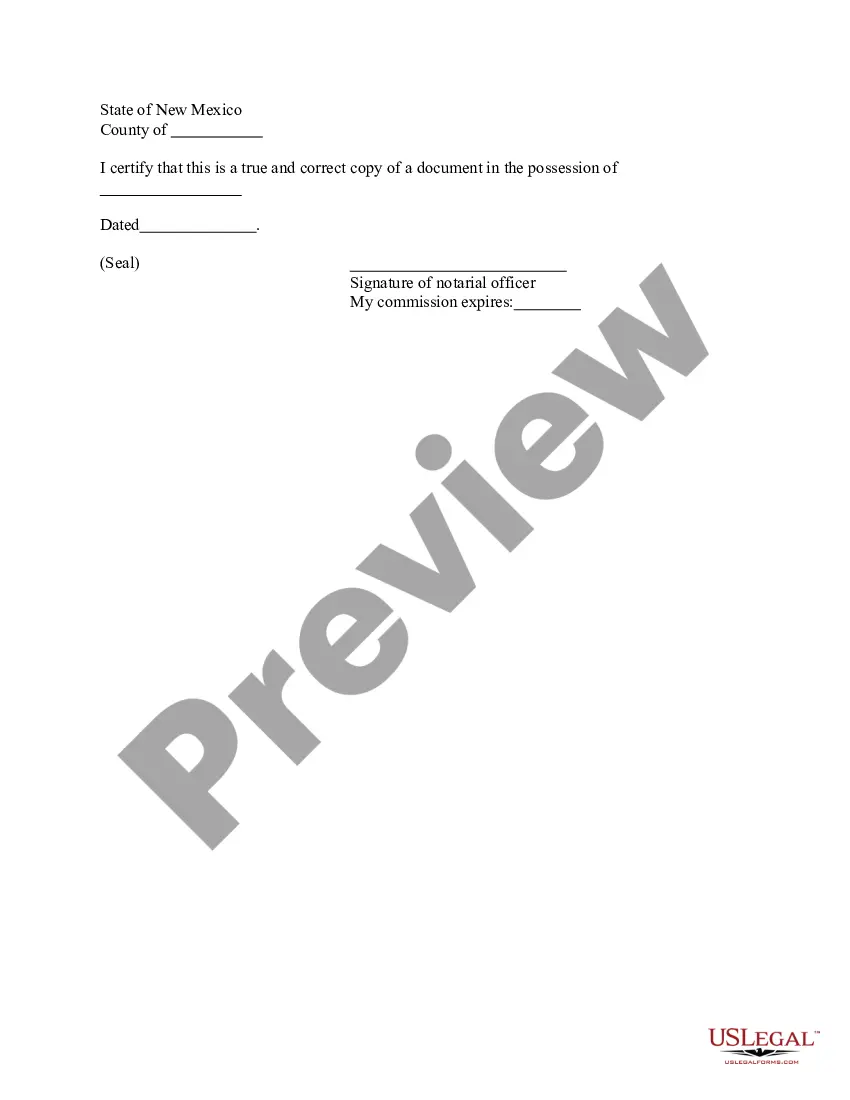

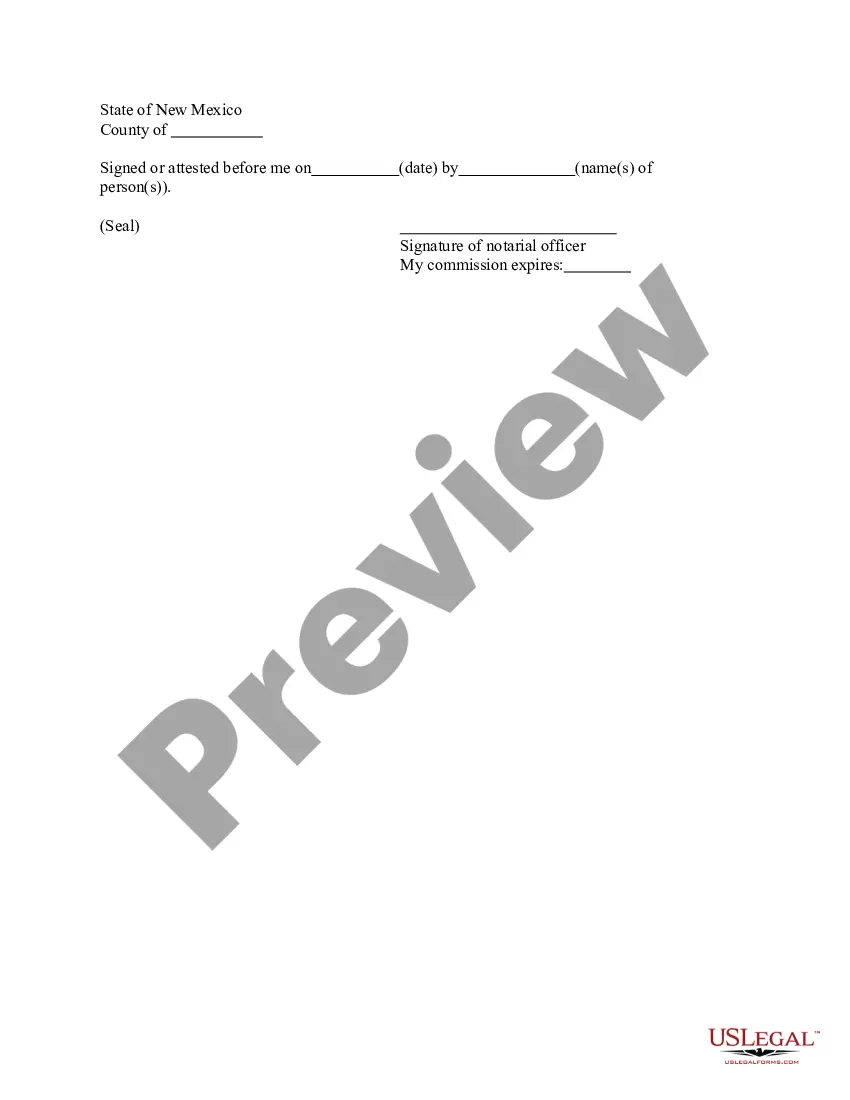

How much time and resources do you typically spend on composing official documentation? There’s a better opportunity to get such forms than hiring legal experts or spending hours searching the web for a proper template. US Legal Forms is the leading online library that provides professionally drafted and verified state-specific legal documents for any purpose, such as the South Carolina Application By Foreign Nonprofit Corporation For Certificate of Withdrawal.

To obtain and prepare an appropriate South Carolina Application By Foreign Nonprofit Corporation For Certificate of Withdrawal template, follow these easy steps:

- Examine the form content to make sure it complies with your state laws. To do so, read the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your requirements, find another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the South Carolina Application By Foreign Nonprofit Corporation For Certificate of Withdrawal. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct blank. Select the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely reliable for that.

- Download your South Carolina Application By Foreign Nonprofit Corporation For Certificate of Withdrawal on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously acquired documents that you securely store in your profile in the My Forms tab. Get them anytime and re-complete your paperwork as often as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most trustworthy web services. Sign up for us today!

Form popularity

FAQ

The online filing process is usually completed within 24 hours. If the filing is mailed, the Secretary of State's Office will usually complete the process within two to three business days after it is received, though longer filing times may be experienced depending on workload volume.

To dissolve a South Carolina corporation, file Articles of Dissolution with the South Carolina Secretary of State, Division of Business Filings (SOS). Submit the form in duplicate, with a self-addressed stamped envelope, so the SOS can return a copy to you. You may type or print on SOS forms in black ink.

South Carolina businesses are not legally required to obtain a certificate of existence. However, your business may choose to get one if you decide to do business outside of South Carolina or get a business bank account.

Certificates of Existence may be used for a variety of purposes, including but not limited to opening a bank account or applying for a certificate of authority to do business in another state.

What does it cost to register a foreign corporation in South Carolina? South Carolina charges $150 to register foreign corporations. This total includes the $135 filing fee plus a $15 admin portal fee/online fee.

The online filing process is usually completed within 24 hours. If the filing is mailed, the Secretary of State's Office will usually complete the process within two to three business days after it is received, though longer filing times may be experienced depending on workload volume.

Form CL-1 Initial Annual Report of Corporations must be submitted by both domestic and foreign corporations to the Secretary of State. LLC's filing as a corporation must submit Form CL-1 to SCDOR within 60 days of conducting business in this state.

If a foreign corporation or LLC is no longer doing business in South Carolina, the entity should file an application to cancel its registration with the South Carolina Secretary of State, Division of Business Filings (SOS).