South Carolina Subsequent Administration Inventory

Description

How to fill out South Carolina Subsequent Administration Inventory?

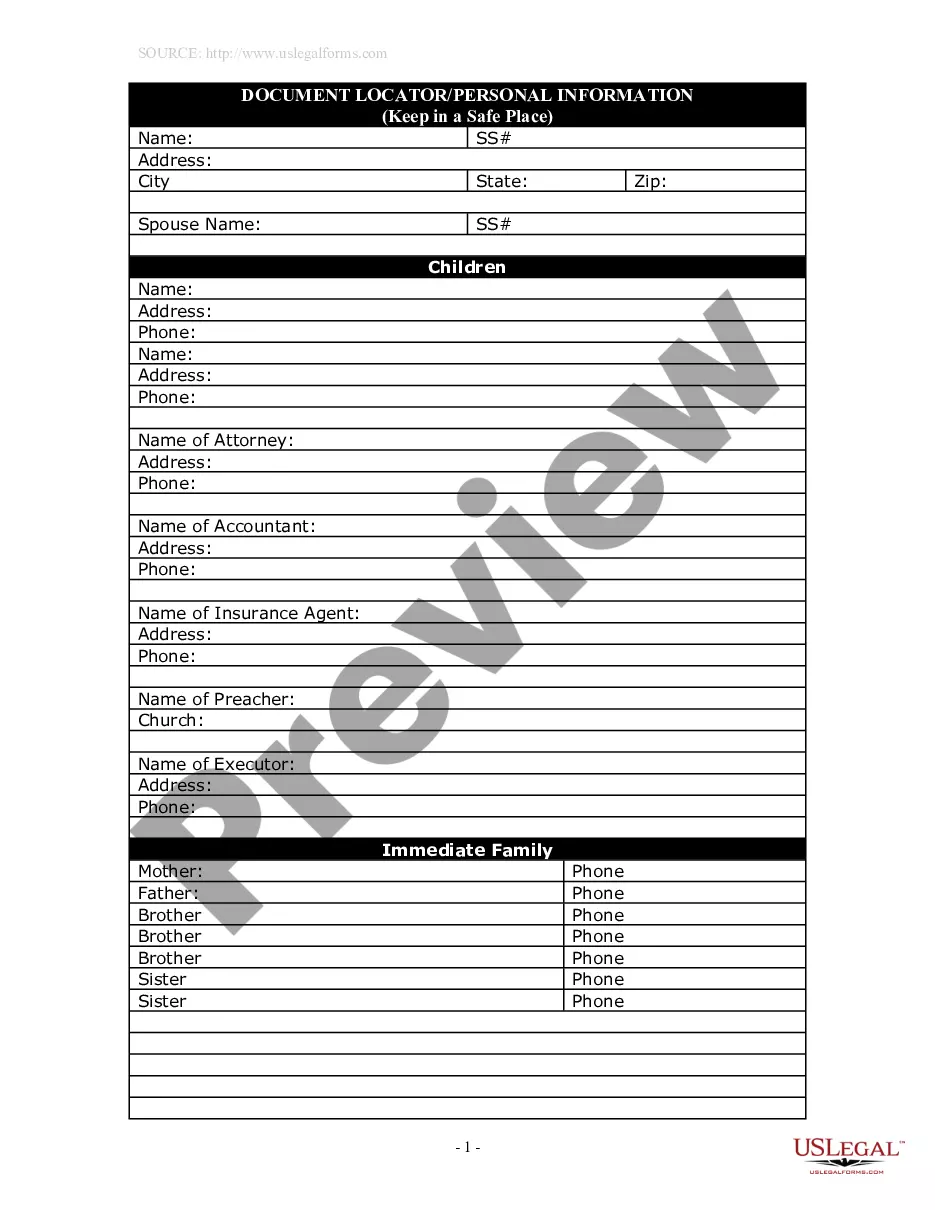

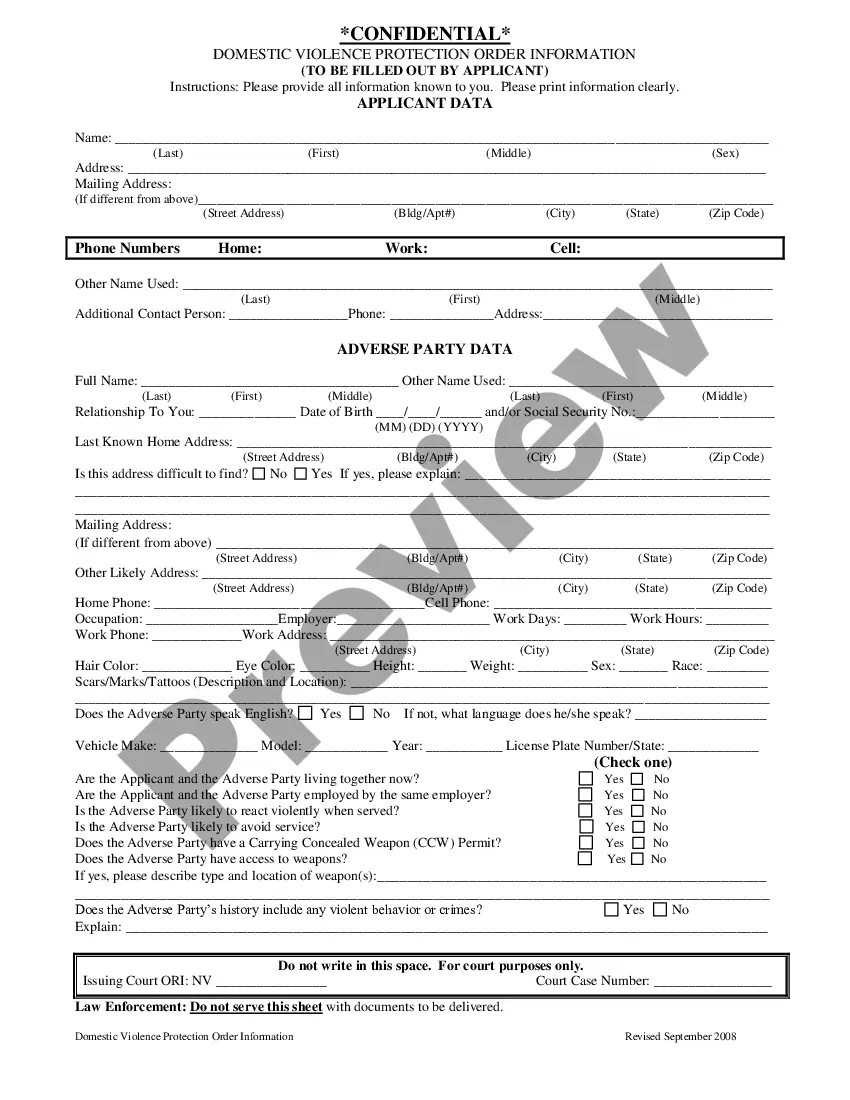

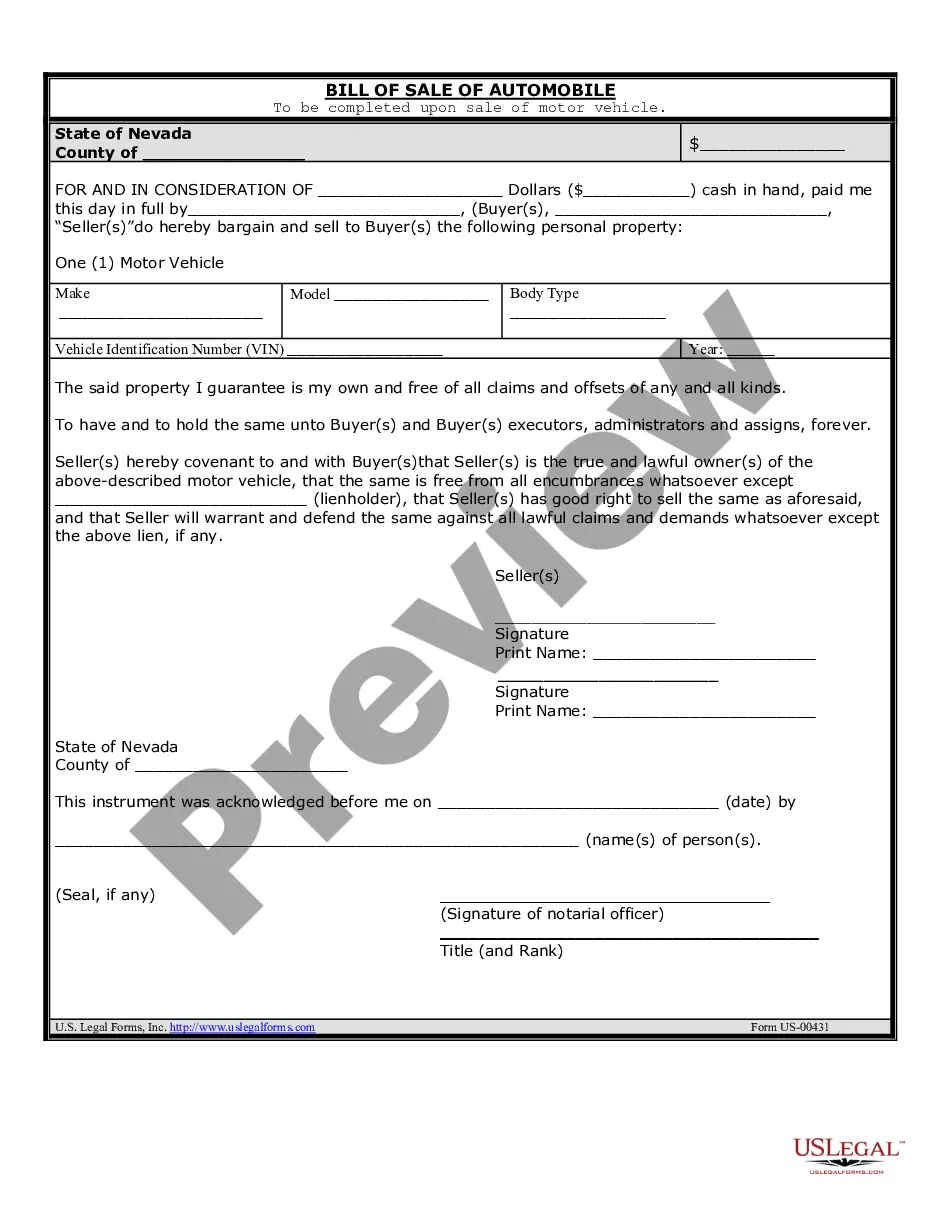

Preparing official paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them correspond with federal and state laws and are checked by our experts. So if you need to fill out South Carolina Subsequent Administration Inventory, our service is the perfect place to download it.

Getting your South Carolina Subsequent Administration Inventory from our service is as easy as ABC. Previously registered users with a valid subscription need only sign in and click the Download button after they find the correct template. Afterwards, if they need to, users can take the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few minutes. Here’s a brief guideline for you:

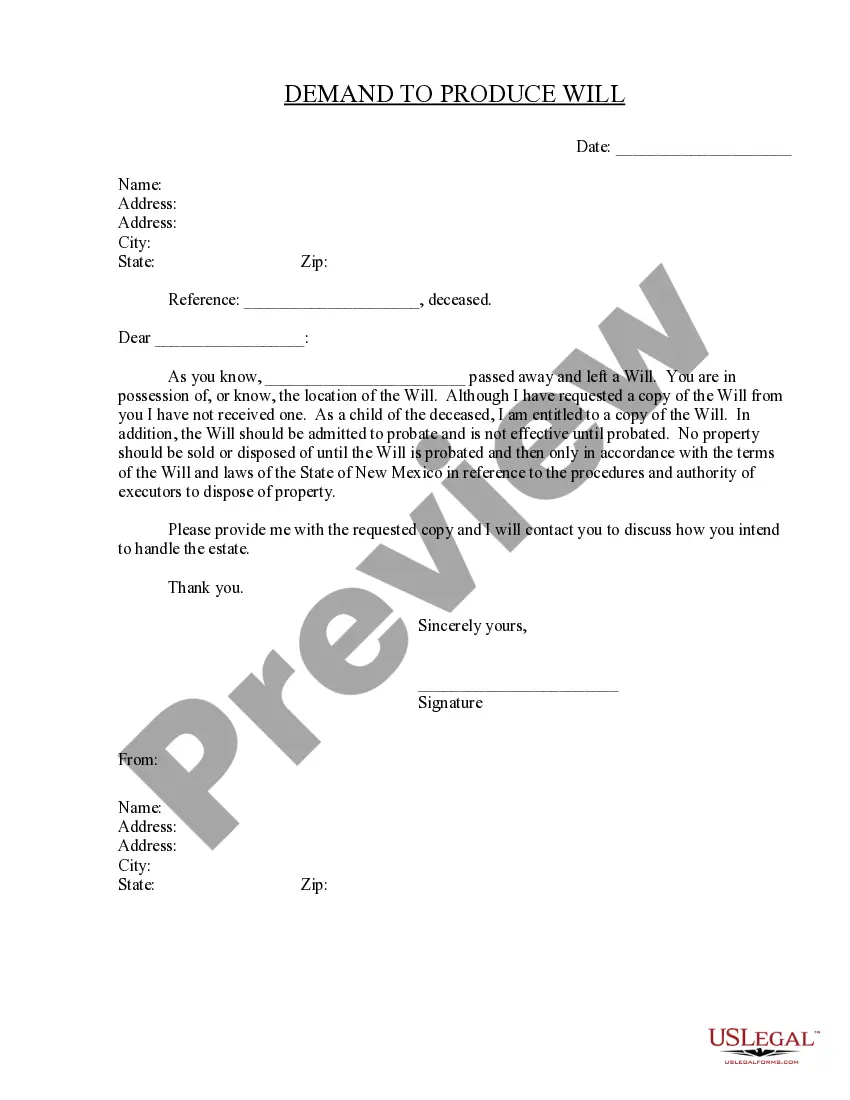

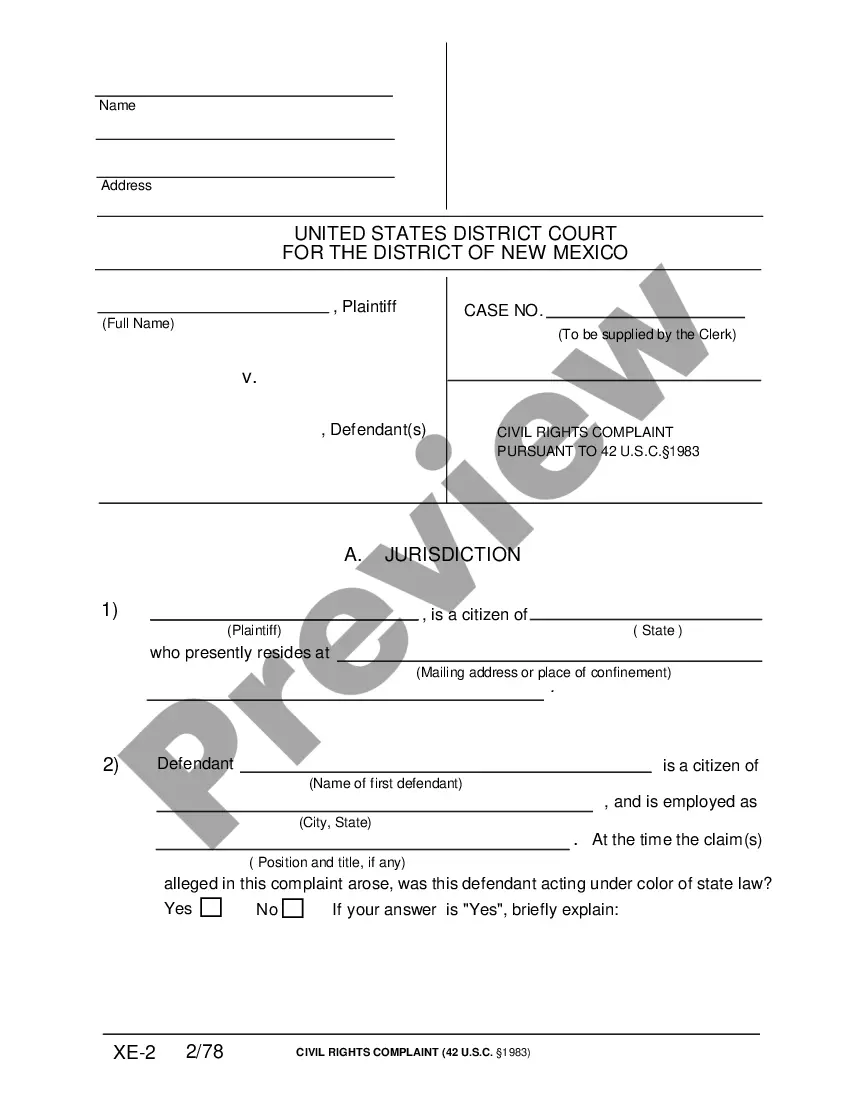

- Document compliance check. You should attentively examine the content of the form you want and ensure whether it suits your needs and meets your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab above until you find an appropriate blank, and click Buy Now once you see the one you want.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your South Carolina Subsequent Administration Inventory and click Download to save it on your device. Print it to complete your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

South Carolina offers a procedure that allows inheritors to skip probate altogether. To qualify, the estate (the property you own at death) must meet these requirements: the net value of the estate can't exceed $25,000. there's no real estate.

In South Carolina, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Any executor, devisee, legatee, guardian, attorney, or other person who fails to deliver to the judge of the probate court having jurisdiction to admit it to probate any last will and testament, including any codicil or codicils thereto, upon conviction must be punished as for a misdemeanor.

Section 62-2-512 - Separate writing identifying bequest of tangible property.

SECTION 62-2-101. Intestate estate. Any part of the estate of a decedent not effectively disposed of by his will passes to his heirs as prescribed in the following sections of this Code.

In most cases, probate will be a necessary step in distributing the assets of the estate. This process is necessary because the court must monitor this process to ensure the decedent's wishes are followed as indicated in the will. However, there are a few ways in which one can avoid going through probate.

In South Carolina, the following assets are subject to probate: Property only held in the deceased's name. Any real estate that the decedent held as a tenant in common. The deceased's interest in an LLC, corporation or a partnership.

If you are unmarried and die intestate in South Carolina and have children, your children will inherit your estate in equal shares. If the deceased has no children but has living parents, their estate will pass on to their parents. If parents are no longer living, the estate then goes to siblings.