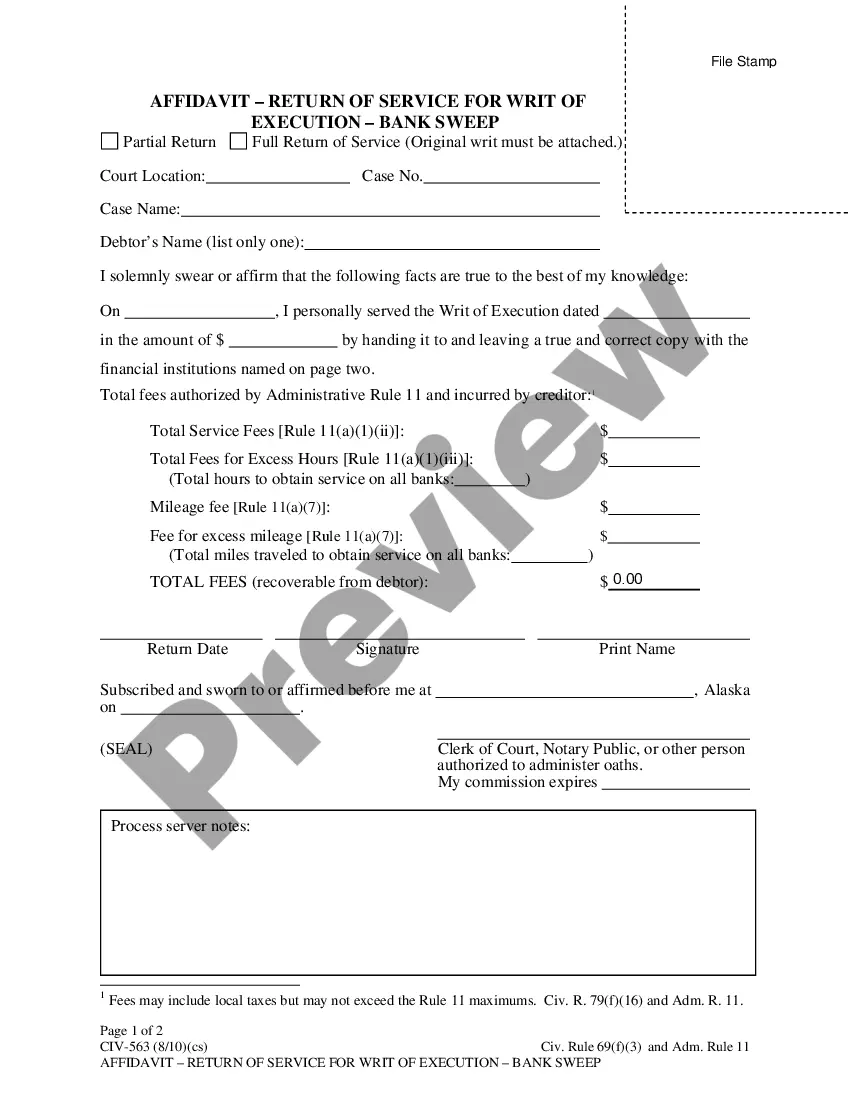

This form is a Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

South Carolina Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums

Description

How to fill out Complaint For Declaratory Judgment For Return Of Improperly Waived Insurance Premiums?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a broad array of legal form templates you can access or create. By using the website, you will find numerous forms for business and individual purposes, organized by categories, states, or keywords. You can locate the latest versions of forms such as the South Carolina Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums in just a few minutes.

If you already have a subscription, Log In and retrieve the South Carolina Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums from the US Legal Forms library. The Download option will appear on every form you view. You can access all previously downloaded forms within the My documents section of your account.

To utilize US Legal Forms for the first time, here are simple steps to get you started: Ensure you have selected the correct form for your city/state. Click the Preview button to review the form's content. Examine the form details to ensure you have selected the right document. If the form does not meet your requirements, use the Search field at the top of the screen to find one that does. Once you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose the payment plan you prefer and provide your information to register for an account. Process the transaction. Use your credit card or PayPal account to complete the transaction. Choose the format and download the document to your device. Make changes. Fill out, edit, and print and sign the downloaded South Carolina Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums. Each form you have saved to your account does not expire and is yours permanently. Therefore, if you wish to obtain or print another copy, simply go to the My documents section and click on the form you desire.

- Access the South Carolina Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

Filing a complaint with the SC Department of Insurance involves completing a complaint form available on their website. You must provide details about your issue and any supporting documents. If you are dealing with improperly waived insurance premiums, using a South Carolina Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums can streamline your efforts and help you achieve a resolution more effectively.

To file a complaint with the South Carolina Department of Insurance, you should gather all relevant documentation related to your insurance issue. You can submit your complaint online, by mail, or via email. If your complaint involves improperly waived insurance premiums, consider using the South Carolina Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums as part of your process to ensure your concerns are adequately addressed.

An insurance company may request a declaratory judgment when there is uncertainty about the interpretation of a policy or the obligations of the parties involved. This legal action helps clarify the terms of coverage and can resolve disputes before they escalate. If you believe you have been wronged, pursuing a South Carolina Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums can be an effective way to assert your rights.

Yes, insurance companies often prefer to settle out of court to avoid the costs and uncertainties associated with litigation. Settling allows them to control the outcome and resolve claims more efficiently. If you find yourself in a dispute, consider filing a South Carolina Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums to facilitate negotiations and potentially reach a fair settlement.

In South Carolina, the Department of Insurance is responsible for regulating insurance companies. This agency ensures that insurance providers comply with state laws and protects consumers' rights. If you have concerns about an insurance company's practices, you can file a South Carolina Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums to seek resolution.

Section 38-59-40 in South Carolina addresses the standards for insurance policy cancellations and non-renewals. This section outlines the rights and responsibilities of both insurers and policyholders when it comes to terminating coverage. Understanding this law can be crucial if you believe your insurance premiums were improperly waived. In such cases, pursuing a South Carolina Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums can help you seek justice.

To complain about insurance in South Carolina, you should first contact your insurance company directly to discuss your concerns. If that does not resolve the issue, you can file a complaint with the South Carolina Department of Insurance online or by mail. Providing detailed information about your situation will aid in the investigation process. For cases involving improperly waived insurance premiums, a South Carolina Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums may also be a viable path.

A DOI complaint refers to a complaint filed with the Department of Insurance regarding an insurance company’s practices or policies. This can include issues with claims, coverage, or customer service. Filing a DOI complaint is an important step in addressing grievances and ensuring that your rights as a policyholder are protected. If you feel that your insurance premiums were improperly waived, you may want to explore a South Carolina Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums.

When it comes to insurance companies, some may receive more complaints than others due to various reasons. It's essential to research the complaint history of insurers to make informed decisions. You can find this information through the National Association of Insurance Commissioners (NAIC) or your state’s Department of Insurance. If you're dealing with issues related to improperly waived insurance premiums, consider filing a South Carolina Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums.