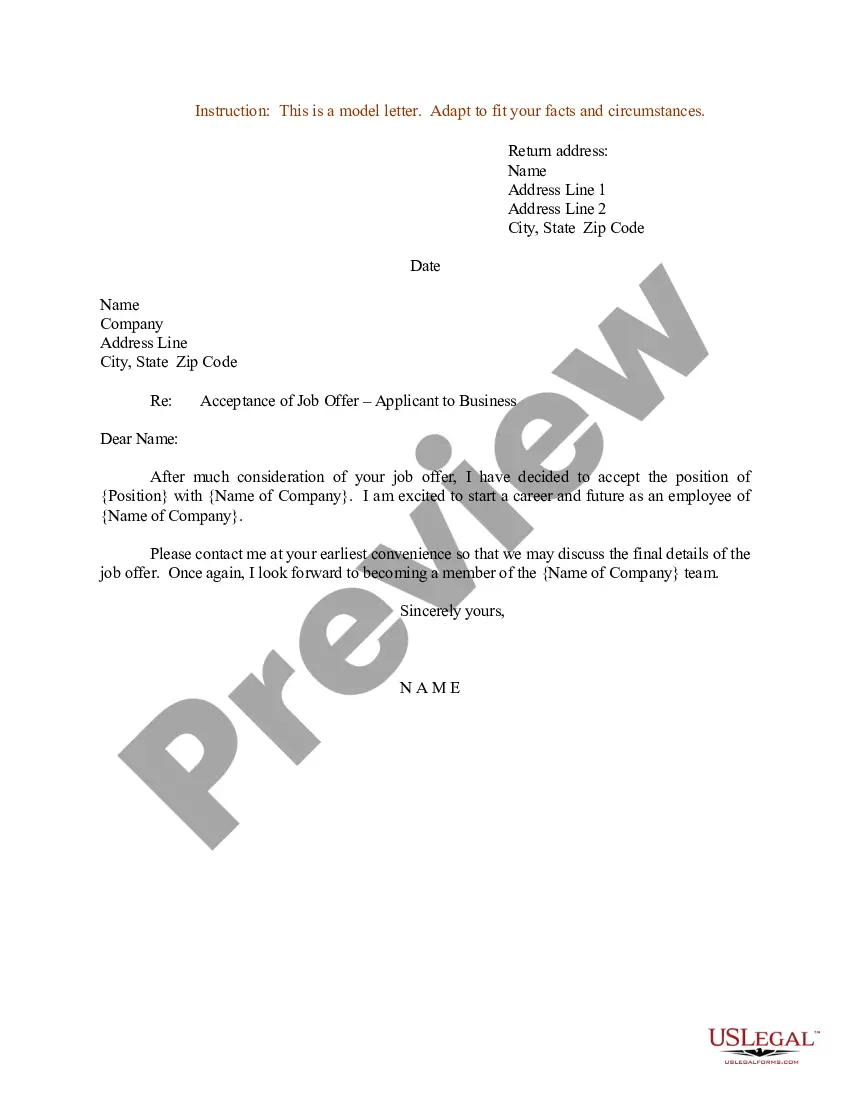

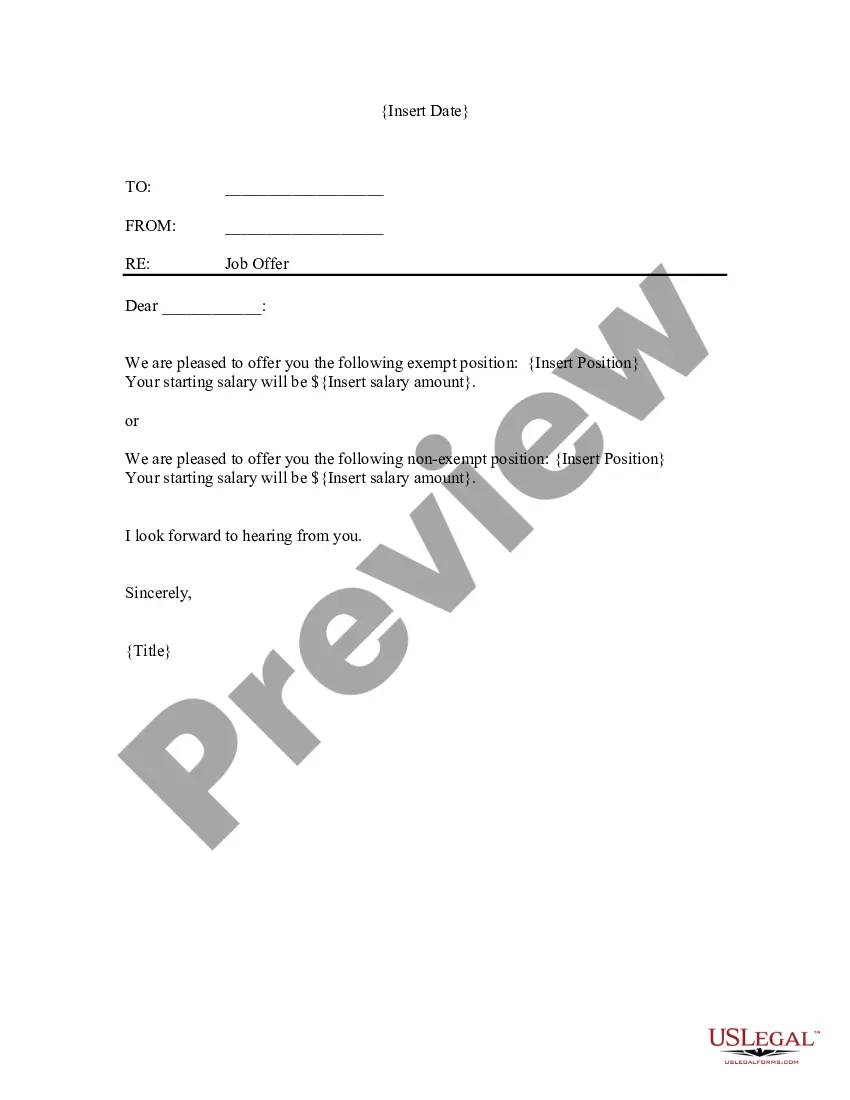

South Carolina Job Acceptance Letter for Labourer

Description

How to fill out Job Acceptance Letter For Labourer?

US Legal Forms - one of the largest compilations of legal documents in the United States - offers an extensive selection of legal form templates that you can access or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the South Carolina Job Acceptance Letter for Laborer in just a few seconds.

If you have an account, Log In to download the South Carolina Job Acceptance Letter for Laborer from the US Legal Forms library. The Download option will appear on every form you view. You can view all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Make edits. Fill out, modify, and print and sign the downloaded South Carolina Job Acceptance Letter for Laborer. All templates added to your account have no expiration date and are yours forever. Thus, to download or print another copy, simply head to the My documents section and click on the form you need. Access the South Carolina Job Acceptance Letter for Laborer with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements and preferences.

- Make sure you have selected the correct form for your city/county.

- Check the Review option to examine the form's content.

- Read the form's description to confirm that you have chosen the correct one.

- If the form doesn't meet your needs, use the Search area at the top of the screen to find the one that does.

- If you are happy with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Work comp rates for all job classification codes are always expressed as a percentage of $100 in wages. An annual policy is always subject to an audit because it was based on estimated wages and not actual wages. In order to calculate the cost of the policy you only need to multiply each rate with its divided payroll.

Compensation Rate means a rate of remuneration, including cost-of-living adjustments, or, where no such rate exists, any fixed or ascertainable amount of remunera- tion established under a compensation plan; Sample 1.

South Carolina child labor lawsThey may work between the hours of 7 a.m. and 7 p.m. They may not work during school hours. When school is not in session, they may work a maximum of 8 hours a day, no more than 40 hours a week. They may work between the hours of 7 a.m. and 9 p.m. from June 1 to Labor Day.

South Carolina payment of wages and child labor laws are administered by the Wages and Child Labor Section in the S.C. Department of Labor, Licensing and Regulation.

The immunity laws generally provide protection from claims by former employees for defamation of character. Under South Carolina law, an employer is immune from civil liability for the disclosure of an employee's or former employee's dates of employment, pay level, and wage history to a prospective employer (S.C.

If you're completely unable to work because of your injury, you're entitled to receive benefits equal to two-thirds of your average weekly wage before the injury, up to the legal maximum. For injuries that happen in 2020, the maximum is $866.67.

If a worker doesn't get paid, he or she can file a complaint with the South Carolina Department of Labor for unpaid wages. However, even if the Department performs an investigation and determines that the employee is owed the wages, it can't force the employer to pay.

Like some other states, South Carolina does not have its own overtime laws. Therefore, the state follows the federal Fair Labor and Standards Act (FLSA), which requires employers pay employees time and a half (1.5 times an employee's normal rate of pay) for hours worked in excess of 40 hours per week.

In South Carolina, workers have the right to organize and the right to designate representatives of their own choosing to negotiate the terms and conditions of employment. No employer may discharge or discriminate in the payment of wages against any person because of his or her membership in a labor organization.