A Chattel Mortgage on a Mobile Home in South Carolina is a legal document that serves as a lien against a mobile or manufactured home, giving the lender the right to take possession of the property if the borrower fails to repay the loan. It is commonly used when financing the purchase of a mobile home. Some relevant keywords for this topic are "South Carolina Chattel Mortgage," "Mobile Home Financing," "Manufactured Home Loan," "Mobile Home Lien," "Mobile Home Finance Regulations," and "Mobile Home Ownership." In South Carolina, there are two types of Chattel Mortgages on Mobile Homes: 1. Non-Permanent Foundation Chattel Mortgage: This type of Chattel Mortgage is applicable to mobile homes that are not permanently affixed to the land. These homes remain movable and can be transported to a different location. The lender holds a lien on the mobile home until the loan is fully repaid. 2. Permanent Foundation Chattel Mortgage: This type of Chattel Mortgage is used for mobile homes that are placed on a permanent foundation, making them more like traditional homes. Permanent foundation homes may be eligible for real estate financing, depending on certain conditions set by lenders and state regulations. However, in South Carolina, if a mobile home is classified as real property or converted into real property, it is subject to different regulations, such as a Deed of Trust instead of a Chattel Mortgage. When applying for a Chattel Mortgage on a Mobile Home in South Carolina, certain documents are typically required, including: — Proof of ownership or title documents of the mobile home — Bill of sale or purchase agreement showing the price and terms of purchase — Personal identification documents such as driver's license or passport — Proof of income, employment, or financial capability to repay the loan — Credit history anrediscoveror— - Insurance documents covering the mobile home — Appraisal or valuation of the mobile home It is essential for borrowers to thoroughly understand the terms and conditions of the Chattel Mortgage agreement, including interest rates, repayment tenure, and any associated fees. Non-payment or defaulting on the loan can result in the lender initiating repossession proceedings to take possession of the mobile home. Before entering a Chattel Mortgage agreement, it is advisable to consult with a legal professional or financial advisor to ensure compliance with South Carolina's regulations and to fully understand the implications and obligations involved in the loan agreement.

South Carolina Chattel Mortgage on Mobile Home

Description

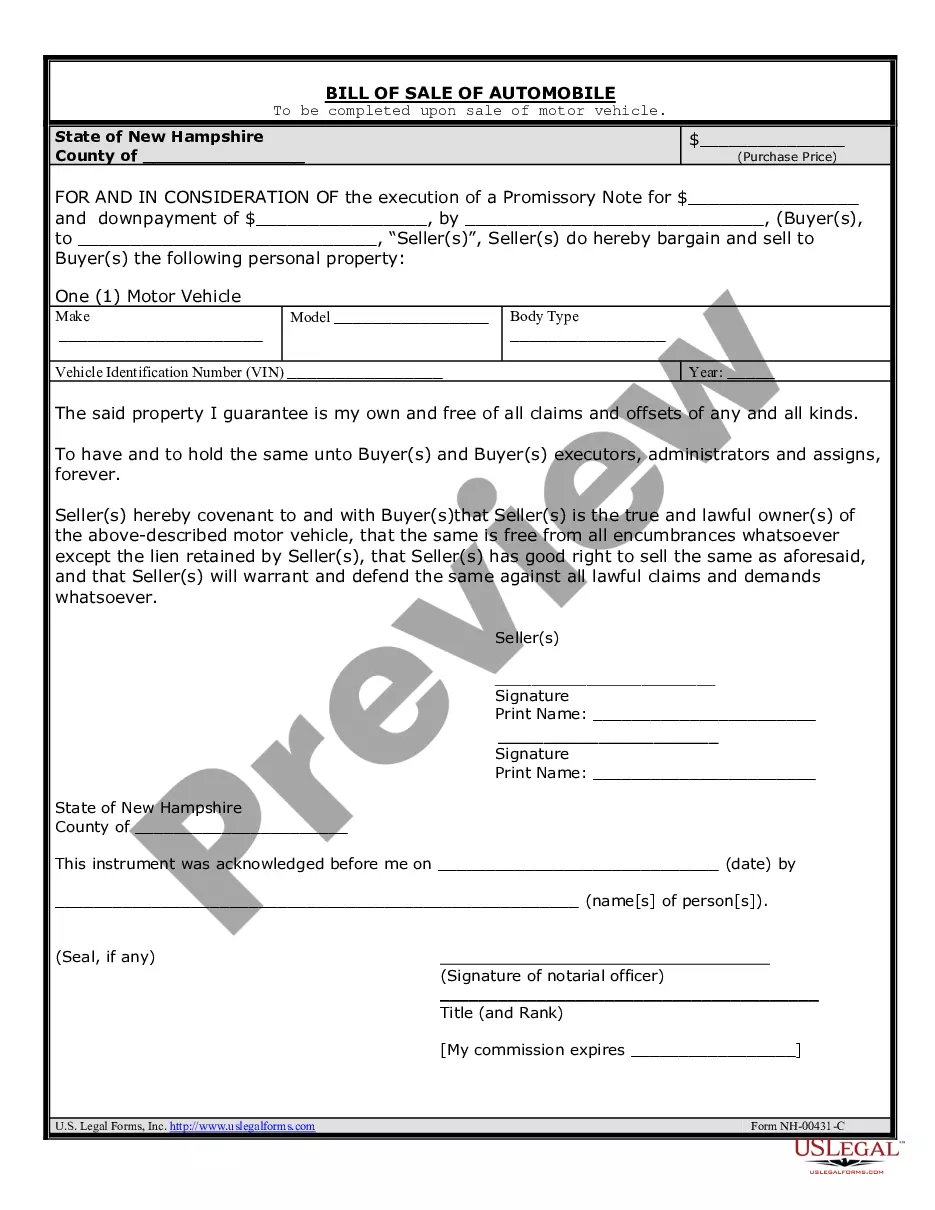

How to fill out South Carolina Chattel Mortgage On Mobile Home?

US Legal Forms - one of the greatest libraries of authorized types in the USA - delivers an array of authorized document templates you may download or produce. While using internet site, you can get a large number of types for business and personal functions, sorted by categories, suggests, or keywords and phrases.You can get the most recent types of types just like the South Carolina Chattel Mortgage on Mobile Home within minutes.

If you currently have a membership, log in and download South Carolina Chattel Mortgage on Mobile Home through the US Legal Forms library. The Down load switch can look on every single type you view. You have accessibility to all formerly delivered electronically types inside the My Forms tab of your respective accounts.

If you would like use US Legal Forms the first time, allow me to share easy directions to get you started:

- Be sure to have selected the best type for your area/county. Select the Review switch to examine the form`s content. Browse the type outline to ensure that you have chosen the appropriate type.

- When the type doesn`t fit your needs, make use of the Lookup area near the top of the monitor to obtain the the one that does.

- Should you be satisfied with the shape, validate your selection by clicking the Purchase now switch. Then, select the pricing program you want and give your accreditations to register to have an accounts.

- Process the transaction. Make use of credit card or PayPal accounts to finish the transaction.

- Select the formatting and download the shape on the gadget.

- Make changes. Fill out, modify and produce and indication the delivered electronically South Carolina Chattel Mortgage on Mobile Home.

Every design you included in your money does not have an expiration particular date and it is the one you have permanently. So, if you would like download or produce yet another version, just proceed to the My Forms section and click on in the type you will need.

Obtain access to the South Carolina Chattel Mortgage on Mobile Home with US Legal Forms, probably the most comprehensive library of authorized document templates. Use a large number of skilled and state-certain templates that fulfill your company or personal needs and needs.