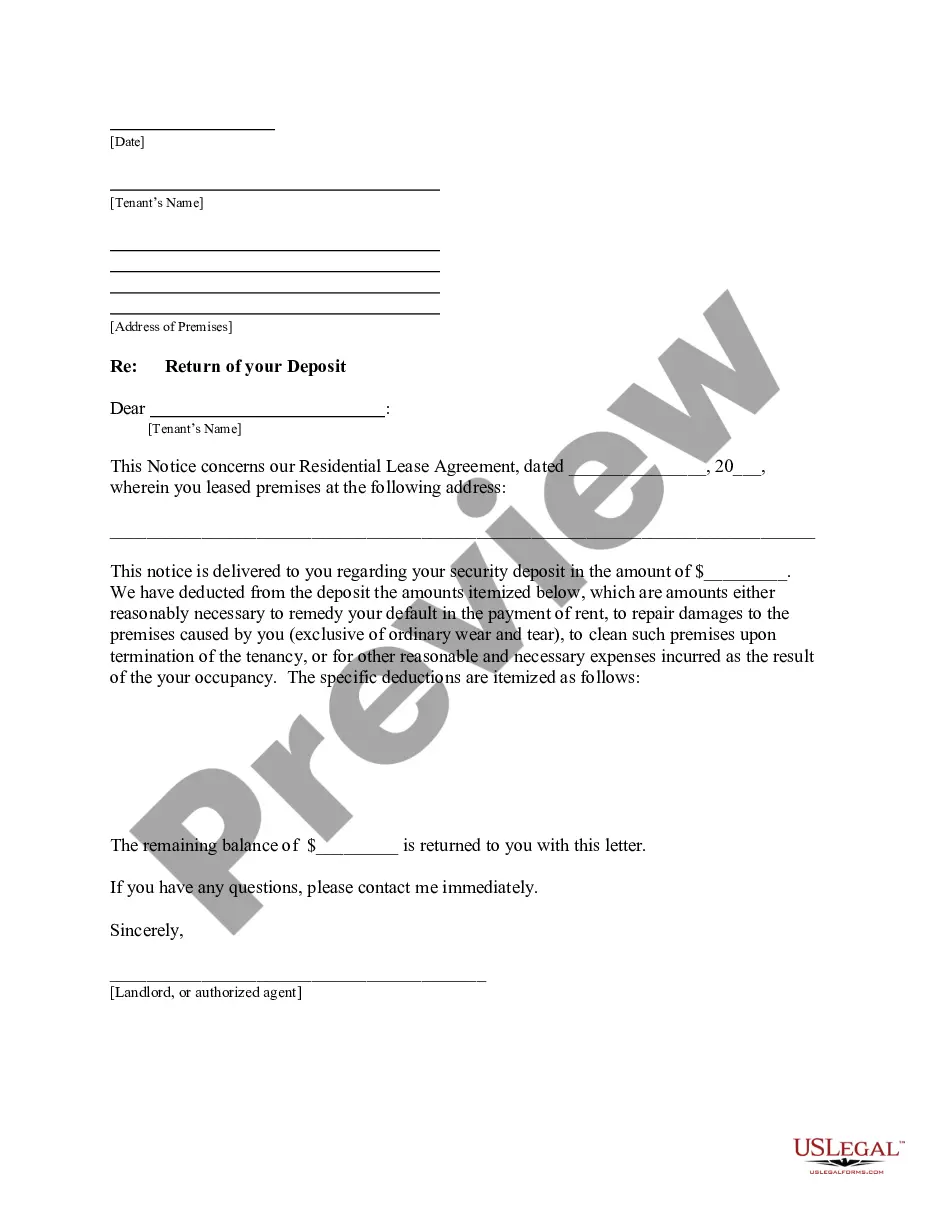

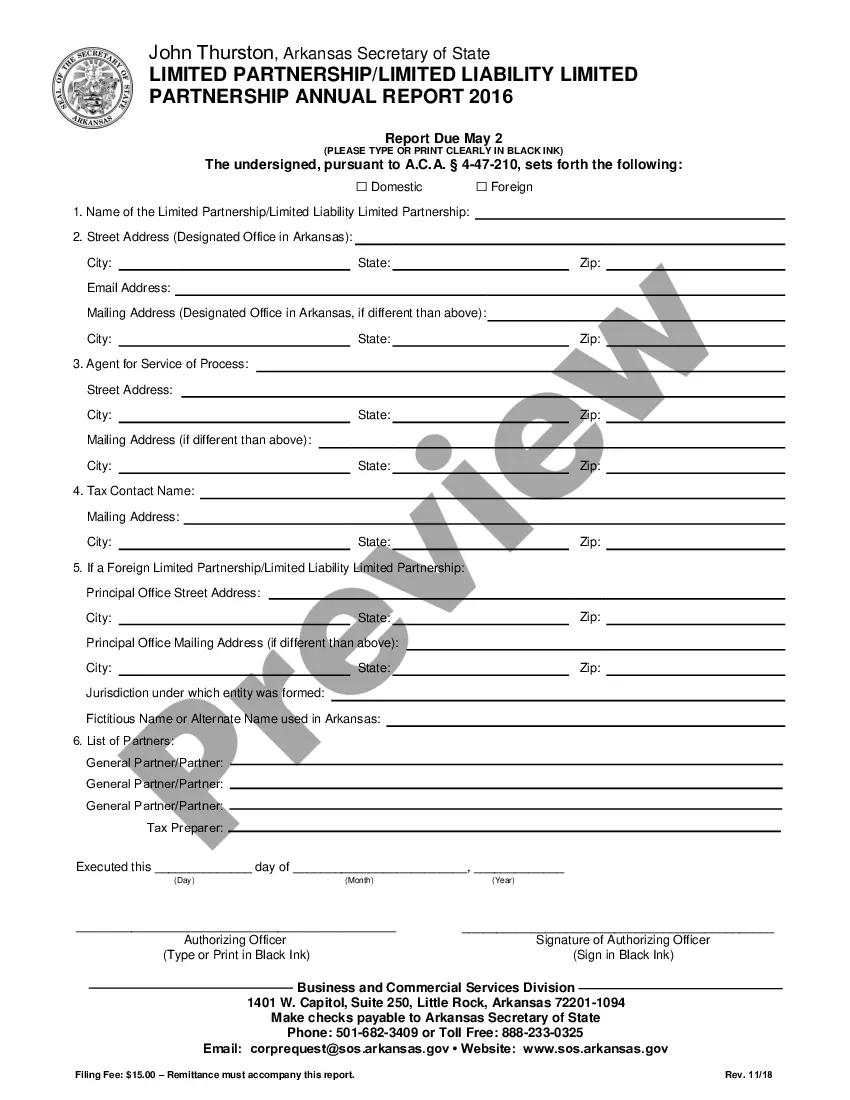

Dear [Credit Bureau], Subject: Notification of Death and Request for Estate Account Closure I am writing to inform you about the unfortunate demise of [Full Name], [Relationship to the deceased], who passed away on [Date of Death]. As the appointed Estate Administrator of his/her estate, it is my duty to handle the financial matters in order to settle the affairs appropriately. Before I proceed with the estate settlement, it is essential to close any existing accounts related to the deceased. Hence, I kindly request the closure of all credit accounts associated with [Full Name], as well as the termination of any associated credit privileges and services. To assist you in verifying this information, please find enclosed the following essential documents: 1. Certified copy of the Death Certificate of [Full Name] 2. Official appointment letter confirming my authority as the Estate Administrator 3. Proof of identification and my contact information In regard to any outstanding amounts or pending bills, I will ensure that all valid debts owed by the deceased are duly settled from the estate funds. If there are any specific instructions or protocols required to hasten and simplify this process, please provide them promptly to ensure a smooth resolution. I kindly request that you mark all relevant accounts as "Deceased — Account Closed" with immediate effect. This will prevent any unauthorized usage of the deceased's accounts. Additionally, I kindly ask for a written confirmation, specifying the closure and the subsequent removal of [Full Name]'s name from your records. As the Estate Administrator, it is my responsibility to inform all credit bureaus of this unfortunate event to prevent any potential fraudulent activities and protect the estate's finances. Thank you for your prompt attention to this matter and for your cooperation throughout this process. If you require any further documentation or information, please do not hesitate to contact me at [Your Contact Information]. I appreciate your understanding and assistance during this difficult time. Yours sincerely, [Your Name] Estate Administrator --- Types of South Carolina Sample Letter to Credit Bureau — Estate Administrator: 1. South Carolina Sample Letter to Credit Bureau — EstatAdministratorto— - Request for Estate Account Closure 2. South Carolina Sample Letter to Credit Bureau — EstatAdministratorto— - Notification of Death and Debt Settlement 3. South Carolina Sample Letter to Credit Bureau — EstatAdministratorto— - Request for Account Closure and Removal of Name.

South Carolina Sample Letter to Credit Bureau - Estate Administrator

Description

How to fill out Sample Letter To Credit Bureau - Estate Administrator?

If you wish to comprehensive, down load, or produce authorized papers web templates, use US Legal Forms, the biggest selection of authorized forms, that can be found on-line. Utilize the site`s simple and easy hassle-free lookup to get the papers you want. Various web templates for company and individual functions are categorized by types and states, or keywords. Use US Legal Forms to get the South Carolina Sample Letter to Credit Bureau - Estate Administrator with a number of clicks.

In case you are presently a US Legal Forms customer, log in for your profile and then click the Down load key to find the South Carolina Sample Letter to Credit Bureau - Estate Administrator. You can also gain access to forms you in the past saved inside the My Forms tab of your profile.

If you work with US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the form for that right area/land.

- Step 2. Make use of the Preview option to look over the form`s information. Don`t forget to read through the description.

- Step 3. In case you are unhappy with all the form, take advantage of the Research field on top of the display to get other models from the authorized form format.

- Step 4. Upon having located the form you want, select the Buy now key. Choose the prices strategy you favor and add your accreditations to register on an profile.

- Step 5. Approach the financial transaction. You can use your charge card or PayPal profile to perform the financial transaction.

- Step 6. Select the format from the authorized form and down load it in your gadget.

- Step 7. Total, modify and produce or indication the South Carolina Sample Letter to Credit Bureau - Estate Administrator.

Every single authorized papers format you buy is your own property for a long time. You have acces to every form you saved with your acccount. Click the My Forms portion and choose a form to produce or down load again.

Be competitive and down load, and produce the South Carolina Sample Letter to Credit Bureau - Estate Administrator with US Legal Forms. There are many skilled and status-specific forms you may use for your personal company or individual needs.

Form popularity

FAQ

How to Notify Credit Bureaus of Death Obtain the death certificate. Call the credit agencies and request a credit freeze. Send the death certificate. Request a copy of the credit report. Work with the estate executor to close out credit accounts or pay off any remaining balance.

Call that person and ask. Explain that you're taking steps to repay your debts, clean up your credit, and be more responsible. Emphasize that a clean credit report will help you achieve your goals. Be honest, but paint the bleakest possible picture of your finances.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

Based on my otherwise spotless payment history, I would like to request that you apply a goodwill adjustment to remove the late payment mark from my credit report. Granting this request will help me improve my overall credit history and demonstrate my consistency as a creditworthy borrower.

Dear , I would like you to remove all the inaccurate and misleading information from my credit report. These inaccurate details have adversely affected my credit worthiness and hampered my chances of acquiring new credit.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

How to remove negative items from your credit report yourself Get a free copy of your credit report. ... File a dispute with the credit reporting agency. ... File a dispute directly with the creditor. ... Review the claim results. ... Hire a credit repair service. ... Send a request for ?goodwill deletion? ... Work with a credit counseling agency.

Removal of Inquiries Letter Template Dear , Re: This is to bring to your notice that my credit report shows an inquiry from your company, which I do not understand. As far as I know you are not permitted to inquire about any of my debt amounts without my authorization.