Partnerships may be dissolved by acts of the partners, order of a Court, or by operation of law. From the moment of dissolution, the partners lose their authority to act for the firm.

From the moment of dissolution, the partners lose their authority to act for the firm except as necessary to wind up the partnership affairs or complete transactions which have begun, but not yet been finished.

A partner has the power to withdraw from the partnership at any time. However, if the withdrawal violates the partnership agreement, the withdrawing partner becomes liable to the co partners for any damages for breach of contract. If the partnership relationship is for no definite time, a partner may withdraw without liability at any time.

DISSOLUTION BY ACT OF THE PARTIES

A partnership is dissolved by any of the following events:

* agreement by and between all partners;

* expiration of the time stated in the agreement;

* expulsion of a partner by the other partners; or

* withdrawal of a partner.

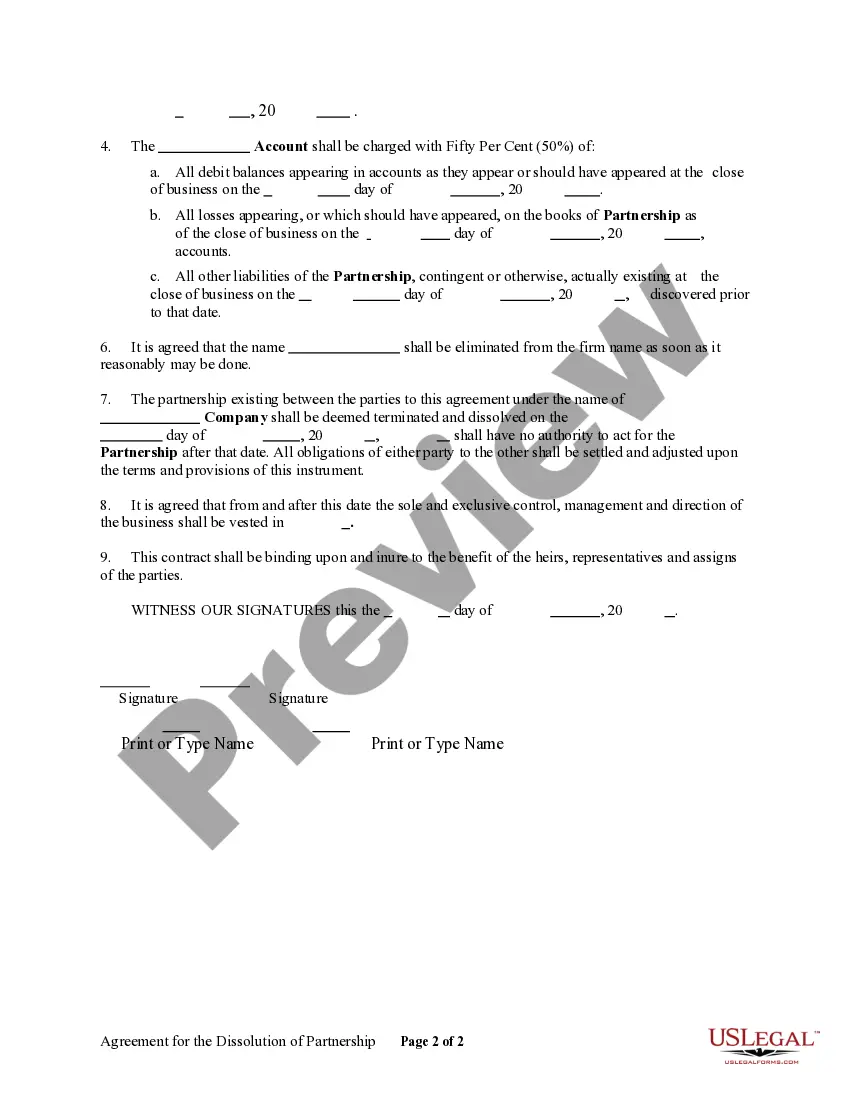

The South Carolina Agreement for the Dissolution of a Partnership is a legal document that outlines the terms and conditions to dissolve a partnership in the state of South Carolina. It serves as a written agreement between the partners, ensuring a smooth and orderly dissolution process. The agreement typically includes various key provisions, such as: 1. Identification of the Partnership: This section provides details about the partnership, including its legal name and business address. 2. Effective Date: The effective date specifies when the dissolution process officially begins and when the agreement takes effect. 3. Basis for Dissolution: The agreement outlines the reasons for dissolution, such as expiration of the partnership term, death or withdrawal of a partner, bankruptcy, or mutual agreement. 4. Distribution of Assets and Liabilities: This section describes how the partnership's assets and liabilities will be distributed among the partners. It specifies the allocation of profits, losses, debts, and any other obligations. 5. Business Liquidation: If necessary, the agreement may detail the process of liquidating the partnership's business assets, including the sale of properties, settlement of outstanding debts, and payment of final expenses. 6. Notification to Creditors and Third Parties: The partners agree on their responsibility to notify creditors, financial institutions, and other relevant parties about the partnership's dissolution. This ensures that all necessary parties are aware of the changes and can coordinate accordingly. 7. Dispute Resolution: This provision outlines the mechanism for resolving any disputes that may arise during the dissolution process. It may specify alternative dispute resolution methods, such as mediation or arbitration, to avoid litigation. 8. Release and Indemnity: The agreement may include a release clause where all partners agree to release each other from any claims, liabilities, or obligations arising from the partnership's business activities or its dissolution. 9. Governing Law: Since this agreement pertains to dissolution in South Carolina, it will typically specify that the laws of the state govern the terms and interpretation of the agreement. There may be different types of South Carolina Agreements for the Dissolution of a Partnership, depending on the circumstances. These include: 1. Voluntary Dissolution: When partners agree to dissolve the partnership mutually and without external pressure, this agreement will address the terms and conditions of the voluntary dissolution. 2. Involuntary Dissolution: In some cases, a partner may petition for the dissolution of the partnership against the wishes of other partners. This type of agreement will provide a framework for the dissolution process when it is court-ordered. 3. Dissolution due to Bankruptcy: If the partnership is forced to dissolve due to bankruptcy proceedings, this type of agreement will focus on specific steps to be taken in compliance with bankruptcy laws and regulations. It is essential to consult a legal professional familiar with South Carolina partnership laws to ensure that the Agreement for the Dissolution of a Partnership accurately reflects the partners' intentions and complies with state regulations.