South Carolina Buy Sell Agreement Between Shareholders and a Corporation

Description

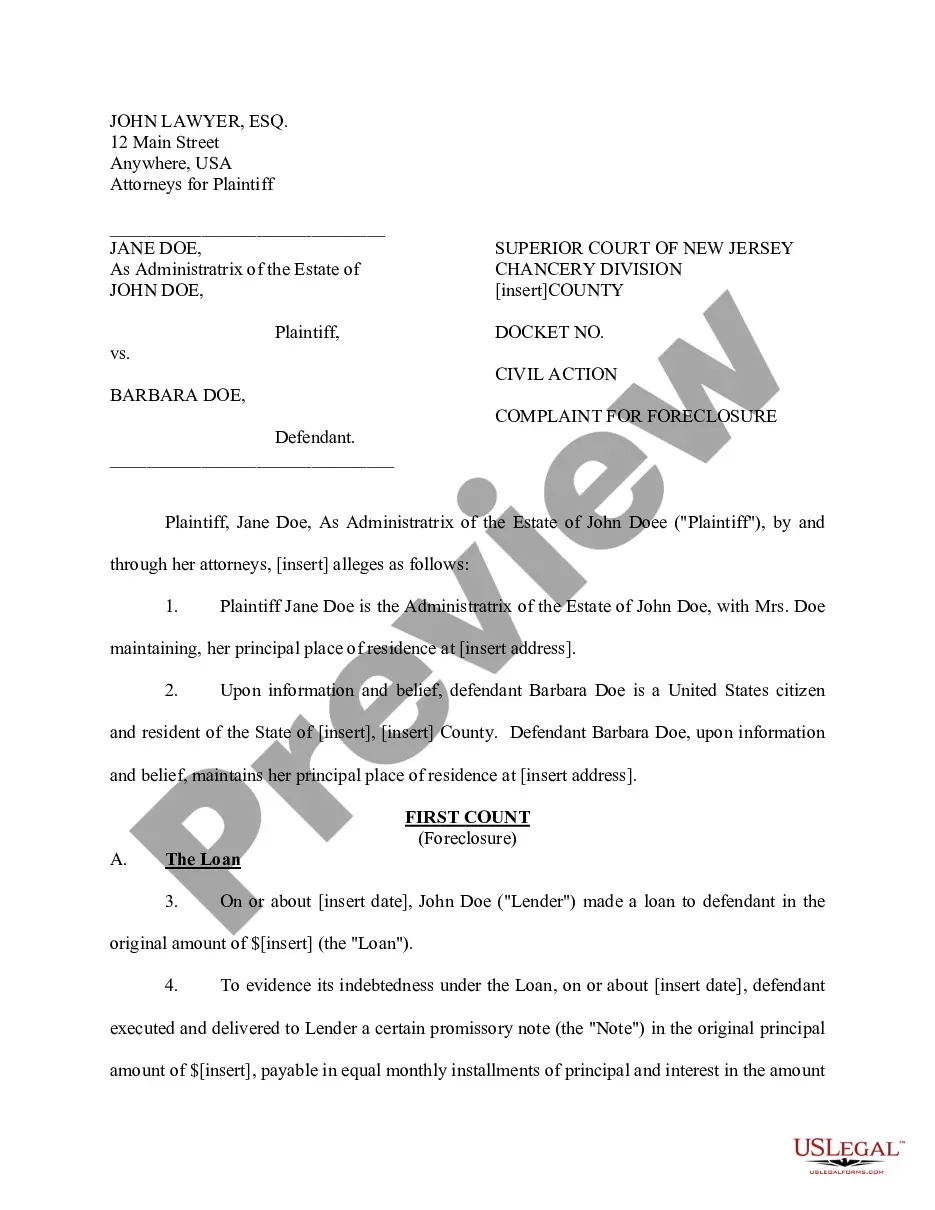

How to fill out Buy Sell Agreement Between Shareholders And A Corporation?

Finding the appropriate legitimate document template can be challenging.

Naturally, many templates are accessible online, but how do you find the precise type you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the South Carolina Buy Sell Agreement Between Shareholders and a Corporation, which you can utilize for business and personal needs.

If the form does not meet your requirements, use the Search field to find the appropriate document.

- All documents are verified by experts and comply with state and federal regulations.

- If you are already registered, sign in to your account and click on the Obtain button to access the South Carolina Buy Sell Agreement Between Shareholders and a Corporation.

- Use your account to browse the legal documents you have previously purchased.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps for you to follow.

- First, ensure you have chosen the correct form for your city/state. You can view the form using the Review button and read the form description to confirm it is suitable for you.

Form popularity

FAQ

The purpose of a shareholder agreement is to establish clear guidelines regarding the management and ownership of a corporation. Such agreements, including the South Carolina Buy Sell Agreement Between Shareholders and a Corporation, help prevent disputes by outlining the rights and obligations of shareholders. They provide a framework for decision-making, facilitating smoother operations and protecting the interests of all parties involved.

Filling out a buy-sell agreement involves gathering necessary information regarding your corporation and its shareholders. Utilize the South Carolina Buy Sell Agreement Between Shareholders and a Corporation template, ensuring you carefully fill in sections covering share valuation, sale procedures, and other critical terms. For convenience and accuracy, consider using platforms like US Legal Forms, which can streamline the process and provide legally sound documents.

Not necessarily. Depending on the terms defined in the South Carolina Buy Sell Agreement Between Shareholders and a Corporation, some agreements may allow for the sale of shares with majority consent, while others may require unanimous agreement. Therefore, understanding the specific provisions in the buy sell agreement is crucial for shareholders contemplating a sale.

A shareholder agreement outlines the rights and responsibilities among all shareholders, while a buy sell agreement specifies the process for selling shares within a corporation. The South Carolina Buy Sell Agreement Between Shareholders and a Corporation focuses on the specifics of transferring shares and often includes valuation methods. It's important to understand that both agreements serve distinct purposes, ensuring smooth operations and clear expectations.

A shareholder buy-sell agreement is a legal document that outlines how shares will be transferred between shareholders in specific situations. It is crucial for protecting the interests of all parties involved and provides a clear process for ownership changes. In South Carolina, a Buy Sell Agreement Between Shareholders and a Corporation serves as an essential tool for maintaining stability and harmony within the business.

The primary purpose of a buy-sell agreement is to ensure a smooth transfer of ownership among shareholders under specific circumstances. It addresses important issues such as valuation and terms of sale, helping prevent conflicts. A well-drafted South Carolina Buy Sell Agreement Between Shareholders and a Corporation can provide security to all parties involved.

When a company buys out your contract, it means they are purchasing your rights or interests in a certain agreement or partnership. This buyout typically results in you receiving compensation while transferring your obligations and shares to the company. Using a South Carolina Buy Sell Agreement Between Shareholders and a Corporation can clarify such transactions and protect your interests.

Yes, a buy-sell agreement can help avoid probate by transferring interests directly to the surviving shareholders or the corporation upon a triggering event, like death. This mechanism streamlines the process and bypasses court involvement, ensuring a smoother transition. A South Carolina Buy Sell Agreement Between Shareholders and a Corporation is designed with these concerns in mind.

An example of a buyout agreement could include a scenario where one partner buys the interests of another following a partnership dissolution. This agreement would detail the payment structure, share valuation, and obligations of both parties. Utilizing a South Carolina Buy Sell Agreement Between Shareholders and a Corporation enhances this process by providing clear guidelines and expectations.

While a buy-sell agreement offers various advantages, it can also present certain downsides. For instance, it may limit the options for shareholders if they wish to sell their shares outside of the agreement's terms. Furthermore, valuation methods outlined in a South Carolina Buy Sell Agreement Between Shareholders and a Corporation may not reflect current market conditions, which can be a concern.