A South Carolina Consulting Agreement — Assist Company Obtain Loan is a legally binding document that outlines the terms and conditions for a consulting service to help a company secure a loan. This agreement is specific to the state of South Carolina, ensuring compliance with the jurisdiction's laws and regulations. The purpose of this agreement is to establish a professional relationship between the consulting firm and the company seeking a loan. The consulting firm, often comprised of financial experts, specializes in guiding businesses through the loan application process, identifying potential lenders, and assisting with the application paperwork. The agreement typically begins by clearly stating the names and contact information of the consulting firm and the company seeking the loan. It also defines the scope of services to be provided, delineating the specific tasks and responsibilities of the consulting firm. This may include reviewing the company's financial statements, preparing loan application packages, and assisting with lender negotiations. The agreement also addresses the compensation for the consulting services. It specifies the fees and payment schedule, whether they are fixed or variable, and any additional expenses the company may be responsible for, such as travel costs or document filing fees. Confidentiality is a crucial aspect of this agreement. It includes provisions to protect any confidential information shared between the parties during the consulting process, ensuring that all sensitive financial data or trade secrets remain secure. Furthermore, the agreement may address ownership of work products. If the consulting firm generates any reports, documents, or recommendations during the engagement, it clarifies whether these belong to the company or the consulting firm. In South Carolina, there may be various types or variations of the Consulting Agreement — Assist Company Obtain Loan, depending on the parties involved and the specific nature of the consulting services. Some possible types of agreements within this category could include agreements for: 1. Financial Consulting: This agreement focuses on providing financial advice and assistance, such as maximizing financial resources or restructuring debt, to help the company secure a loan. 2. Application Preparation Consulting: This agreement concentrates on preparing the loan application package by collecting the necessary documentation, completing forms, and ensuring compliance with lender requirements. 3. Lender Negotiation Consulting: This agreement emphasizes negotiating with potential lenders on behalf of the company to secure favorable loan terms such as interest rates, repayment schedules, or collateral requirements. 4. Debt Restructuring Consulting: This agreement specifically deals with assisting the company in reorganizing its existing debts or obligations in order to enhance its eligibility for obtaining a loan. It is important to note that the specific variations of the South Carolina Consulting Agreement — Assist Company Obtain Loan may vary depending on the specific needs and goals of the company seeking the consulting services.

South Carolina Consulting Agreement - Assist Company Obtain Loan

Instant download

Description

Consultant is engaged to perform consulting services for certain clients regarding the preparation and structuring of financial data including financial statements and related financial reports for the purpose of assisting clients in preparation of presentations to lenders and/or equity prospects. In the event that it becomes necessary to enforce any of the terms of this agreement the defaulting party agrees to pay all reasonable attorneys fees incurred.

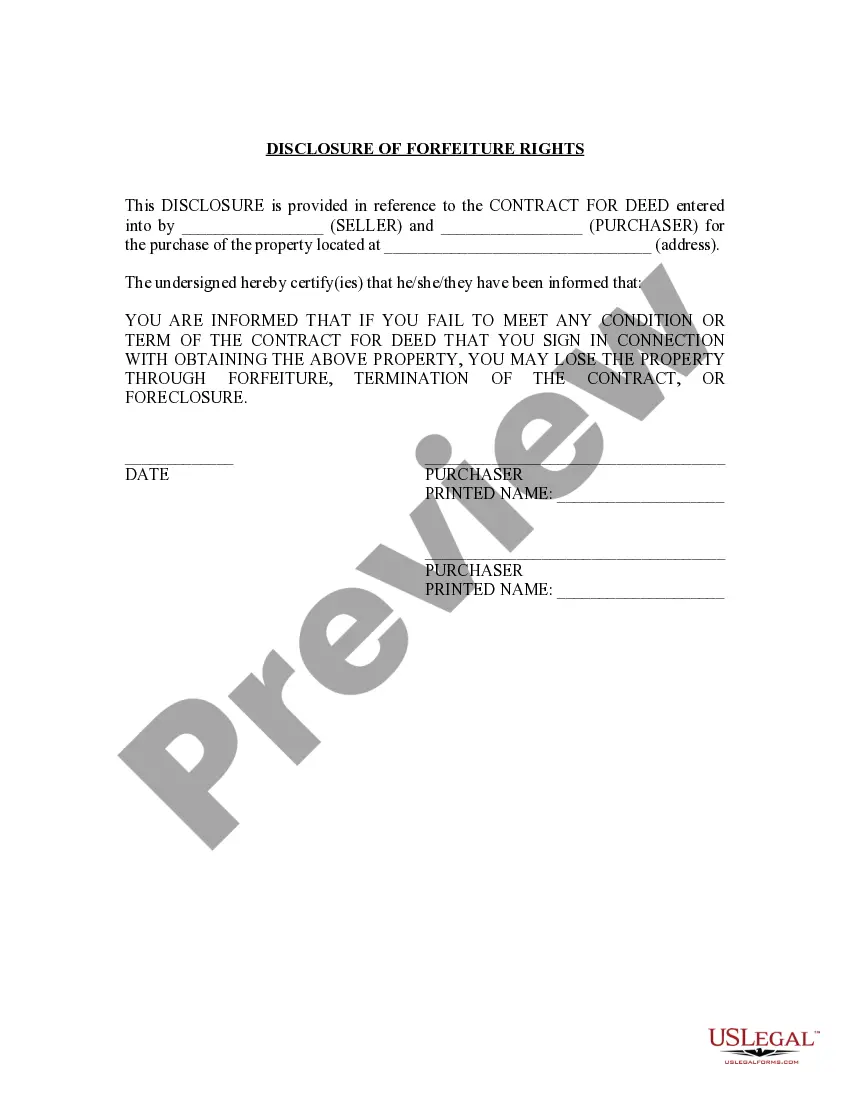

Free preview

How to fill out Consulting Agreement - Assist Company Obtain Loan?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can discover the latest forms such as the South Carolina Consulting Agreement - Assist Company Obtain Loan in just minutes.

Check the form description to confirm that you have chosen the right form.

If the form doesn't meet your needs, use the Search bar at the top of the screen to find one that does.

- If you already have an account, Log In to download the South Carolina Consulting Agreement - Assist Company Obtain Loan from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If you want to use US Legal Forms for the first time, here are simple instructions to get started.

- Make sure you have selected the correct form for your region/area.

- Click on the Preview button to review the form's content.

Form popularity

Interesting Questions

More info

Checking and savings accounts, credit cards, mortgages, investments, small business, and commercial banking. Your journey to better banking starts with ... HR consultant: As small companies grow, they rely on HR consultants to ensure that they are meeting their legal obligations as an employer while also developing ...Widely recognized as industry standard legal forms and agreements that define the relationships and terms involved in design and construction projects. What would you like the power to do? For you and your family, your business and your community. At Bank of America, our purpose is to help make financial ... Hiring an independent contractor or freelancer? Clearly outline the terms of the job with an Independent Contract Agreement. Committed to the financial health of our customers and communities. Explore bank accounts, loans, mortgages, investing, credit cards & banking services» 1906 · ?InsuranceAGENCY COMPANY'S TROUBLE State Life officers have promised CONSULTING AUTUARY to render any assistance they can in making it complete and satisINDIANA ... 1918 · ?Military art and science( Machine Works ) SUCCESSORS TO The Westinghouse Machine Company , WashingtonSurgeon B. W. Brown , attend meeting of the South Carolina Medical Society ... Citizens offers personal and business banking, student loans, home equity products, credit cards, and more. You're made ready and so are we. ? Find a Financial Advisor, Branch and Private Wealth Advisor near you. Check the background of Our Firm and Investment Professionals on FINRA's Broker/Check ...

Your credit card will not be charged. We will pay your invoices on (insert date). You can order and get more than one quote as per the following terms: Free quotes are for the sole purpose to assist you in getting the best pricing and the best deal for a business project or program. For specific business services or consulting projects, you should hire a business consultant for your project. We are not affiliated with your business. We are independent consultants and service providers. You retain all legal rights and liabilities in connection with your use of the services. We cannot promise that the services will get any project done, nor can we promise that you can get business to work for you. You are responsible to pay for the fees, taxes, insurance, and overhead costs that are applicable to the services offered. We can provide you only Business Consulting Services in order to get the best deal from business and help you get it done the right way and fast.

Your credit card will not be charged. We will pay your invoices on (insert date). You can order and get more than one quote as per the following terms: Free quotes are for the sole purpose to assist you in getting the best pricing and the best deal for a business project or program. For specific business services or consulting projects, you should hire a business consultant for your project. We are not affiliated with your business. We are independent consultants and service providers. You retain all legal rights and liabilities in connection with your use of the services. We cannot promise that the services will get any project done, nor can we promise that you can get business to work for you. You are responsible to pay for the fees, taxes, insurance, and overhead costs that are applicable to the services offered. We can provide you only Business Consulting Services in order to get the best deal from business and help you get it done the right way and fast.