South Carolina Borrow Money on Promissory Note — Resolution For— - Corporate Resolutions A Promissory Note Resolution is a legal document used by corporations in South Carolina to borrow money. This resolution serves as a formal agreement between the corporation and the lender, outlining the terms and conditions of the loan. By executing this document, the corporation acknowledges its obligation to repay the borrowed funds according to the agreed-upon terms. The South Carolina Borrow Money on Promissory Note — Resolution For— - Corporate Resolutions typically contains several key elements: 1. Corporate Identification: The resolution begins by identifying the corporation, including its legal name, registered address, and any relevant identification numbers or certificates. 2. Lender Information: The resolution specifies the lender's name, contact details, and any additional information required to establish their legal authority. 3. Loan Amount and Terms: This section outlines the specific amount of money being borrowed and the agreed-upon interest rate, repayment schedule, and any applicable fees or penalties. It may also include provisions regarding late payments or default scenarios. 4. Board Approval: The resolution confirms that the corporation's board of directors has reviewed and authorized the loan, ensuring compliance with internal bylaws and legal requirements. 5. Corporate Authority: It further verifies that the corporation possesses the necessary authority and power to enter into loan agreements and incur debt. 6. Execution and Signatures: The resolution concludes with spaces for signatures, including the names and positions of those authorized to sign on behalf of the corporation, such as the CEO or CFO. Different variations or types of South Carolina Borrow Money on Promissory Note — Resolution For— - Corporate Resolutions may exist based on specific circumstances or additional requirements. Some possible variations include: 1. Secured Promissory Note Resolution: This form of resolution includes provisions where the loan is secured by collateral, such as real estate or assets owned by the corporation. This provides the lender with additional assurance that they can recover their funds if the borrower defaults. 2. Unsecured Promissory Note Resolution: In contrast to secured loans, this resolution does not require any collateral from the corporation. However, it may involve higher interest rates or stricter repayment terms to compensate for the increased risk faced by the lender. 3. Revolving Line of Credit Resolution: This type of resolution establishes a revolving credit facility where the corporation can access funds up to a predetermined limit. It allows the borrower to withdraw and repay funds as needed within the specified terms, similar to a credit card. In conclusion, the South Carolina Borrow Money on Promissory Note — Resolution For— - Corporate Resolutions is a legally binding document that solidifies the borrowing arrangement between a corporation and a lender. By defining the loan amount, terms, and obligations of both parties, this resolution ensures transparency and establishes a framework for a successful financial relationship.

South Carolina Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions

Description

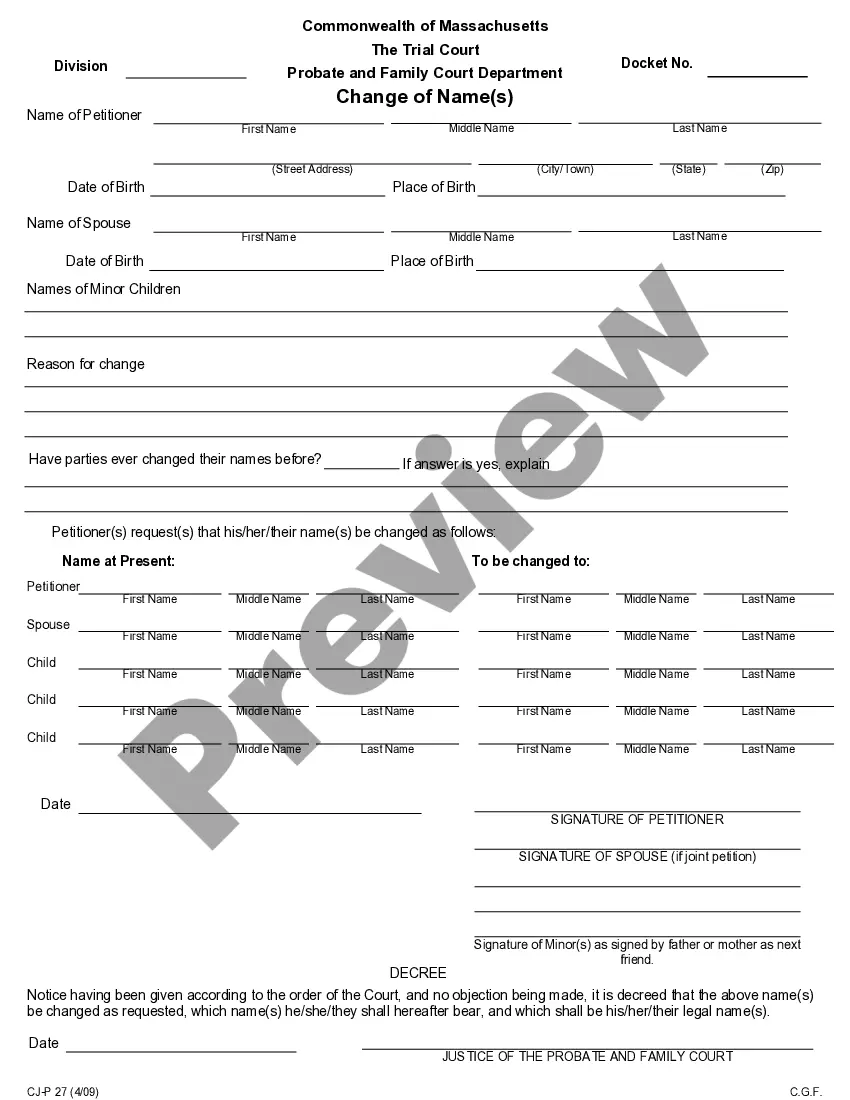

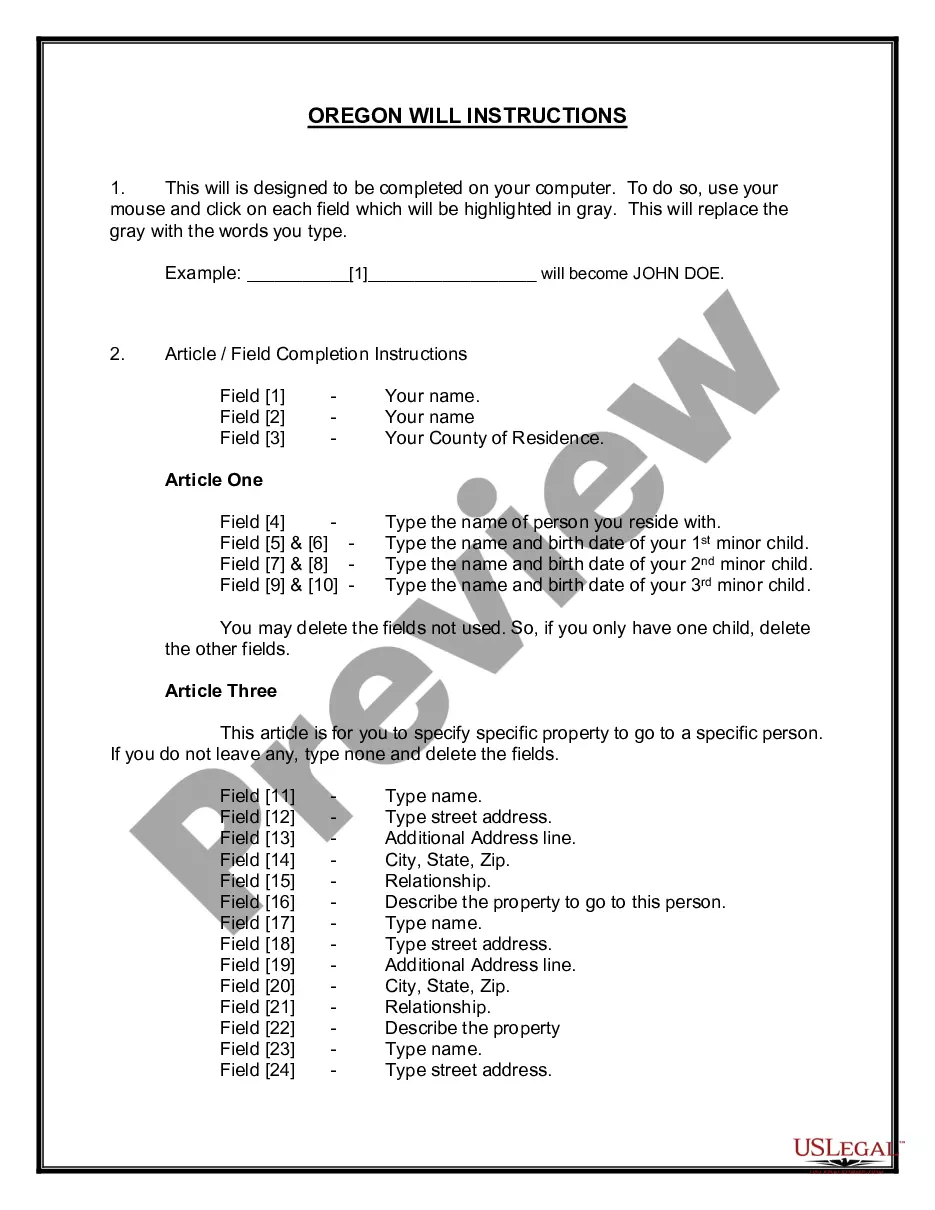

How to fill out South Carolina Borrow Money On Promissory Note - Resolution Form - Corporate Resolutions?

If you intend to compile, download, or generate legal document templates, utilize US Legal Forms, the finest collection of legal forms, which are accessible online.

Use the website's straightforward and user-friendly search function to locate the documents you require.

A range of templates for business and personal purposes are categorized by groups, states, or keywords. Utilize US Legal Forms to find the South Carolina Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions with just a few clicks.

Every legal document template you acquire belongs to you indefinitely. You have access to each form you downloaded within your account. Navigate to the My documents section and select a form to print or download again.

Complete and download, and print the South Carolina Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the South Carolina Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Review option to check the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Get now button. Choose the payment plan you prefer and enter your credentials to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the South Carolina Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions.

Form popularity

FAQ

A corporate resolution that authorizes borrowing on a line of credit is often referred to a borrowing resolution. This resolution indicates that the members (LLC) or Board of Directors (Corporation) have held a meeting and conducted a vote allowing the company to borrow a specific loan amount.

Loan Resolution means that certain Resolution, adopted by the Board of the City on March 8, 2021, authorizing a loan under a loan agreement between the Borrower and the Issuer to finance the Project.

A corporate resolution is a written document created by the board of directors of a company detailing a binding corporate action. A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances.

A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances. Corporate resolutions provide a paper trail of the decisions made by the board and the executive management team.

A corporate resolution to open a business bank account is a document that clearly shows the bank who has the authority to start an account on behalf of your corporation. If this information isn't specifically covered in your Articles of Incorporation or bylaws, your bank may require a resolution.

Name of the lender from whom they will borrow sums of money. Signature of authorized member/director that will execute and endorse all such documents required by said bank as well as agreement to perform all acts and sign all agreements and obligations required by said bank. The state where the business is formed.

A corporate resolution that authorizes borrowing on a line of credit is often referred to a borrowing resolution. This resolution indicates that the members (LLC) or Board of Directors (Corporation) have held a meeting and conducted a vote allowing the company to borrow a specific loan amount.

What to Include in a Corporate Resolution FormThe date of the resolution.The state in which the corporation is formed and under whose laws it is acting.Signatures of officers designated to sign corporate resolutionsusually the board chairperson or the corporate secretary.Title the document with its purpose.More items...?

RESOLVED THAT the company do hereby obtain and avail financial assistance/Credit facility of an amount not exceeding (Loan or Credit/Overdraft amount) from (Name, Branch and Address of the bank) in order to meet the (requirements of the company), and such loan shall be obtained on such terms and conditions as specified

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

Interesting Questions

More info

Com? Who is dili.com? Which kind of person? How many sites are there? Where can you have help from the team? How do I find a local dili.com? How many sites are there? Why Do I Need To Use Dili.com? Dili.com is your place to connect to the real world. If you're looking for help with a difficult area of life, search for answers from the millions of members using Dili.com. You can find a real person by sending your issue to dili.com, get information on how to find local support from the network, learn about the community, and get involved with the network. If you are looking for help at home, try looking on your own. As a user, you have a place to connect with the network. You can create a profile, make your profile private, or connect directly with other members. As a member, you have a place to connect with other members to have discussions where you can learn about issues, ask questions, and exchange information.