South Carolina Minimum Checking Account Balance — Corporate Resolutions Form is a legal document that pertains to the establishment and management of minimum checking account balances for corporate entities in the state of South Carolina. This form is essential for businesses operating in the state as it outlines the requirements, guidelines, and procedures related to maintaining a minimum balance in corporate checking accounts. The minimum checking account balance is the lowest amount of funds that a corporate entity must keep in its checking account(s) to meet regulatory and financial obligations. It ensures that businesses have sufficient funds to cover expenses, obligations, and potential financial liabilities. By using the South Carolina Minimum Checking Account Balance — Corporate Resolutions Form, businesses can formalize their commitment to maintaining a minimum balance in their checking accounts. This form may require the signatures of key individuals within the organization, such as corporate officers, directors, or authorized representatives, who have the authority to make financial decisions on behalf of the company. It is important to note that there may be different types of South Carolina Minimum Checking Account Balance — Corporate Resolutions Forms based on the specific needs and requirements of different businesses or industries. Some variations of this form may include: 1. General Corporate Resolutions Form: This type of form is applicable to all types of corporate entities, regardless of their business activities or industry. 2. Non-profit Corporate Resolutions Form: Non-profit organizations, such as charities or foundations, may have specific requirements for maintaining a minimum balance in their checking accounts due to their unique financial circumstances. The Non-profit Corporate Resolutions Form caters to these specific needs. 3. Small Business Corporate Resolutions Form: Small businesses often have different financial capacities and requirements compared to larger corporations. Therefore, a specialized Small Business Corporate Resolutions Form may exist to address these particular needs, especially regarding minimum balance thresholds. Businesses in South Carolina should consult with legal professionals, accountants, or financial advisors to determine the appropriate South Carolina Minimum Checking Account Balance — Corporate Resolutions Form that best suits their specific circumstances. Compliance with these regulations ensures businesses operate lawfully, efficiently, and responsibly while maintaining the necessary financial stability to meet their obligations within the state of South Carolina.

South Carolina Minimum Checking Account Balance - Corporate Resolutions Form

Description

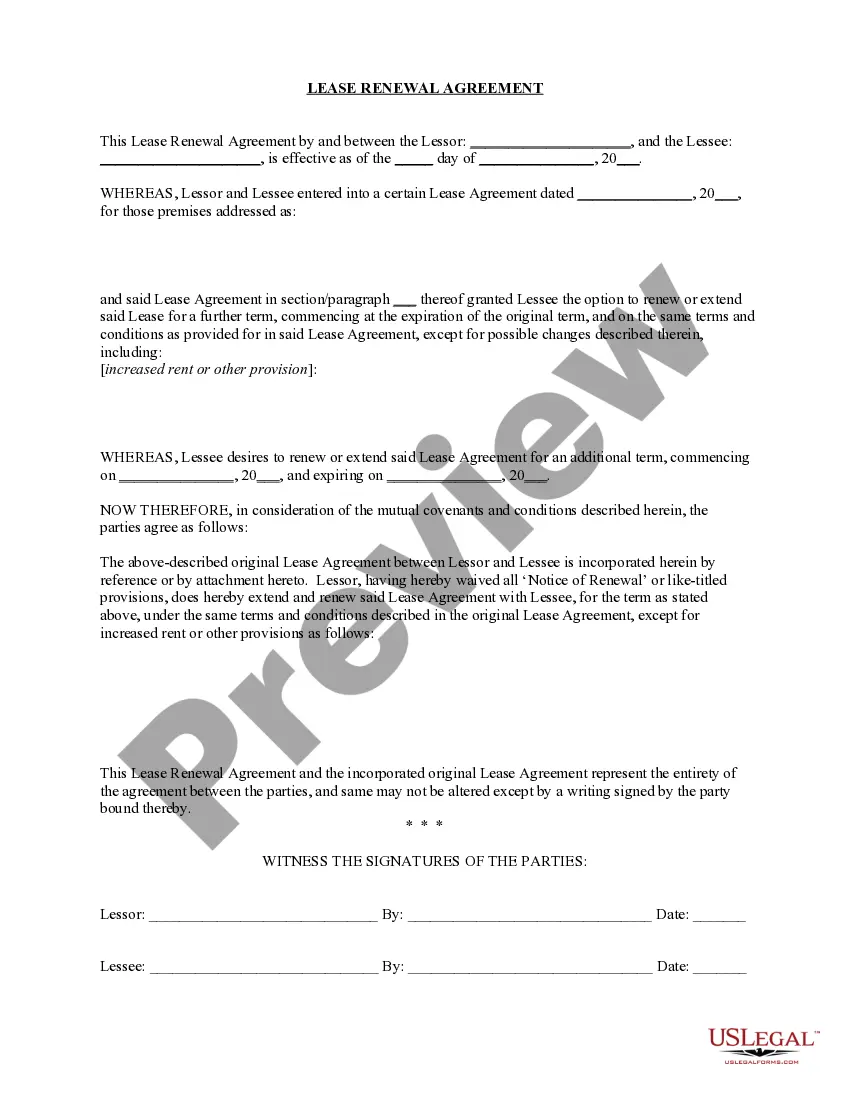

How to fill out South Carolina Minimum Checking Account Balance - Corporate Resolutions Form?

If you want to total, acquire, or print authorized record web templates, use US Legal Forms, the largest selection of authorized varieties, which can be found on the web. Make use of the site`s easy and hassle-free search to discover the files you will need. A variety of web templates for company and personal purposes are categorized by types and suggests, or keywords. Use US Legal Forms to discover the South Carolina Minimum Checking Account Balance - Corporate Resolutions Form with a number of click throughs.

If you are currently a US Legal Forms buyer, log in in your accounts and click the Down load switch to have the South Carolina Minimum Checking Account Balance - Corporate Resolutions Form. You may also entry varieties you in the past saved from the My Forms tab of your respective accounts.

If you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Ensure you have chosen the form for the appropriate area/land.

- Step 2. Utilize the Review option to examine the form`s content material. Don`t forget to see the explanation.

- Step 3. If you are not happy with the kind, make use of the Research industry on top of the screen to locate other models of the authorized kind format.

- Step 4. Once you have found the form you will need, click on the Get now switch. Pick the rates program you favor and add your qualifications to sign up to have an accounts.

- Step 5. Method the transaction. You may use your bank card or PayPal accounts to accomplish the transaction.

- Step 6. Select the file format of the authorized kind and acquire it on the product.

- Step 7. Total, change and print or indicator the South Carolina Minimum Checking Account Balance - Corporate Resolutions Form.

Every single authorized record format you get is your own property for a long time. You might have acces to every kind you saved with your acccount. Select the My Forms segment and pick a kind to print or acquire yet again.

Be competitive and acquire, and print the South Carolina Minimum Checking Account Balance - Corporate Resolutions Form with US Legal Forms. There are thousands of skilled and condition-distinct varieties you can utilize for your company or personal requires.