In view of the fact that insurance is a closely regulated business, local state law and insurance regulations should be consulted when using this form.

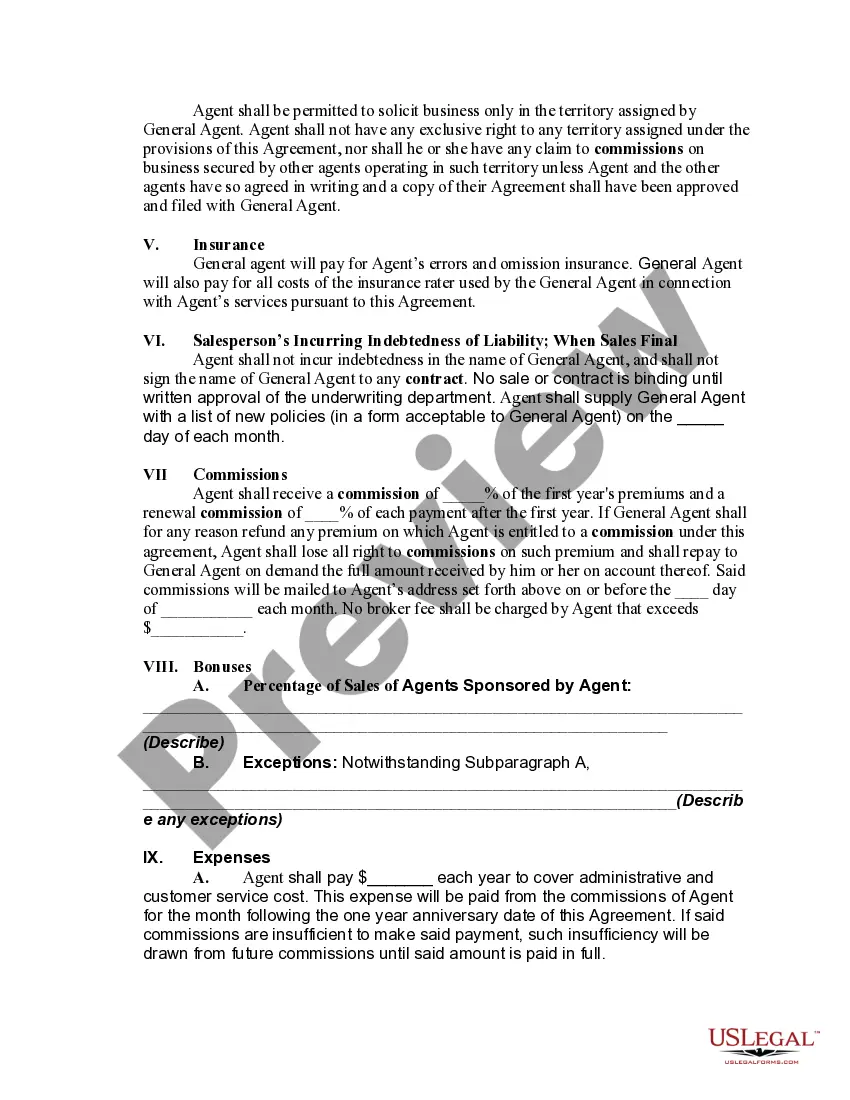

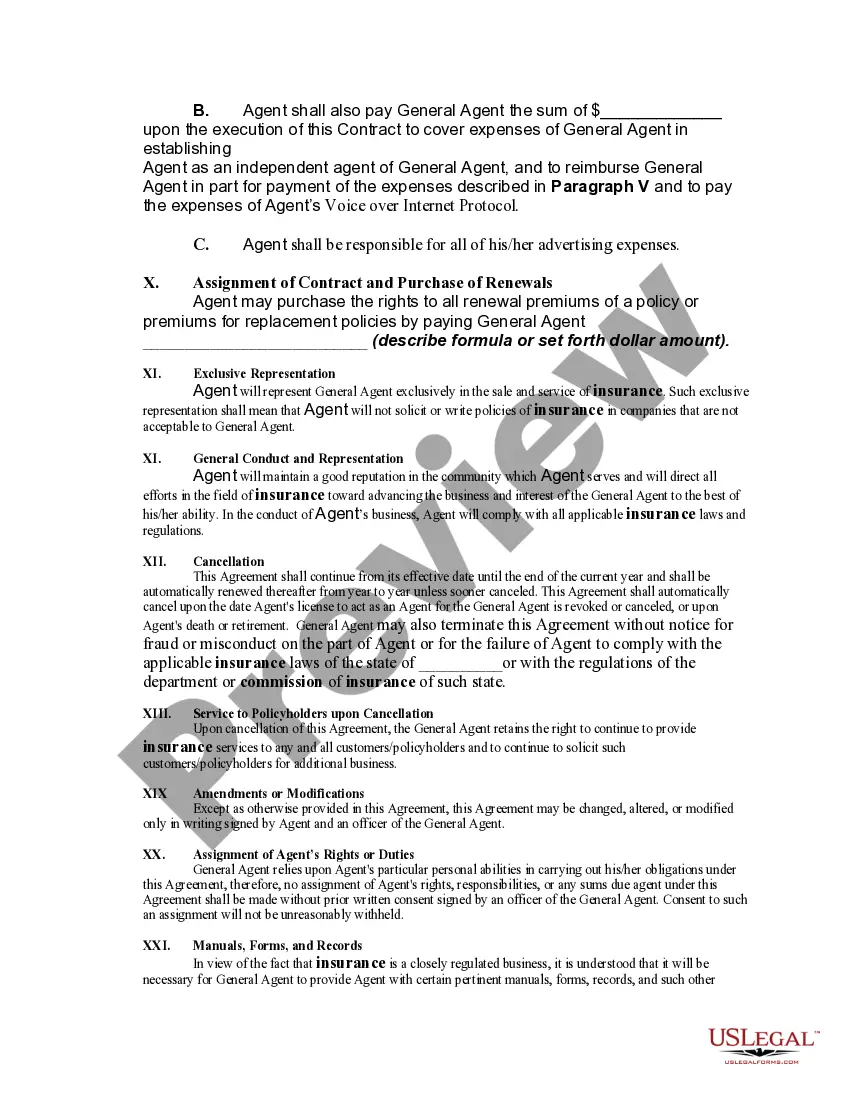

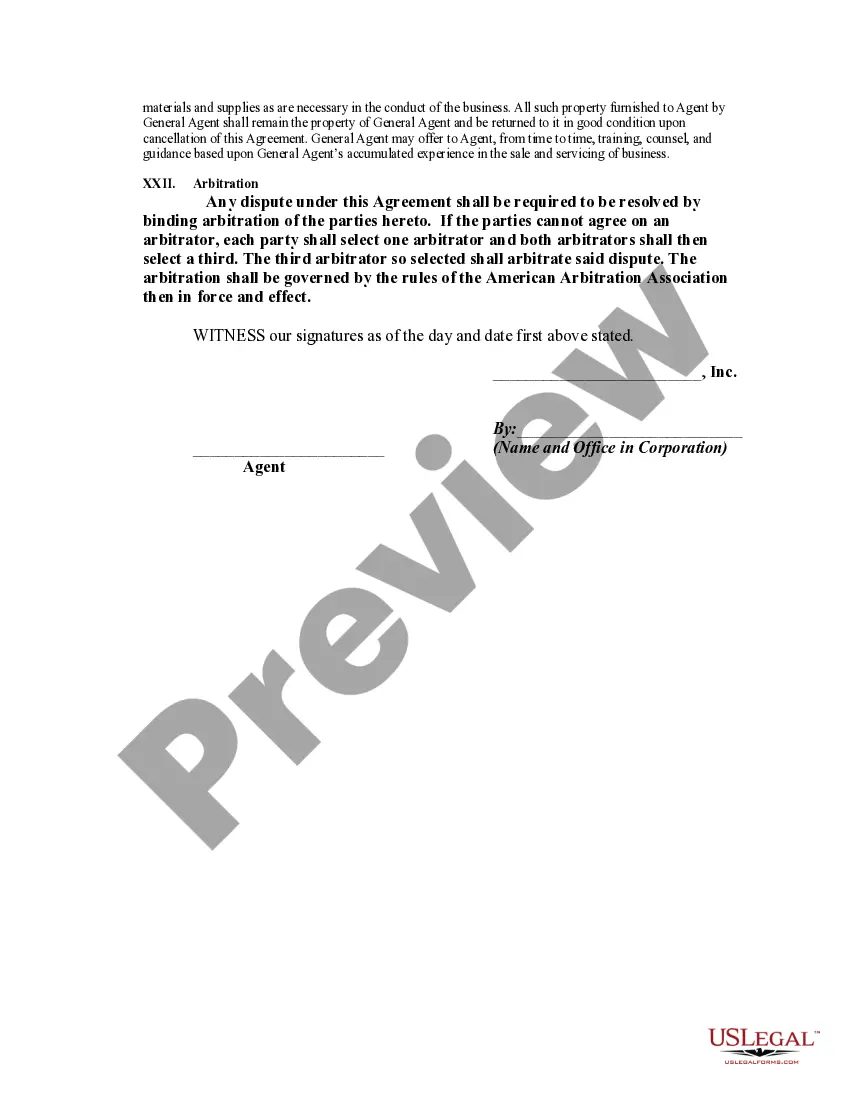

A South Carolina Contract between a General Agent of an Insurance Company and an Independent Agent outlines the legal agreement between these two entities within the insurance industry. The contract establishes the terms and conditions under which the independent agent acts as a representative of the general agent and sells insurance policies on behalf of the company. This contract is crucial in defining the rights, responsibilities, and obligations of both parties involved. Here, we will delve into the various types of South Carolina Contracts between General Agent of Insurance Company and Independent Agent: 1. General Agent Agreement: This agreement is the primary contract between the insurance company and the general agent. It defines the general agent's authority to appoint and supervise independent agents, specifies their territorial jurisdiction, commission structure, and outlines the general agent's responsibilities in marketing and training independent agents. 2. Independent Agent Agreement: This agreement establishes the relationship between the general agent and the independent agent. It details the agent's authority to represent the insurance company, their obligations, and compensation structure. This contract may also outline the standards and requirements the independent agent needs to adhere to while selling insurance policies on behalf of the general agent. 3. Exclusive Agency Agreement: In an exclusive agency agreement, the general agent grants exclusivity to the independent agent within a specific territory, prohibiting them from representing any other insurance company. This type of agreement presents an opportunity for the independent agent to build a long-term relationship and loyalty with the general agent in exchange for certain benefits, such as higher commission rates or additional marketing support. 4. Non-Exclusive Agency Agreement: Contrary to an exclusive agency agreement, a non-exclusive agency agreement allows the independent agent to represent multiple insurance companies simultaneously. This type of contract gives the agent more flexibility and freedom to diversify their product offerings and potentially target a wider client base. 5. Termination Agreement: A termination agreement outlines the terms and conditions under which the contract between the general agent and the independent agent may be terminated by either party. It includes provisions for notice periods, transitional support, and any post-termination obligations. When drafting a South Carolina Contract between a General Agent of an Insurance Company and an Independent Agent, it is essential to consider relevant keywords such as insurance regulations, commission structure, territorial jurisdiction, exclusivity, compensation, conflict of interest, marketing support, training, termination, and post-termination obligations. Additionally, ensuring compliance with South Carolina's insurance laws and regulations is vital to protect the interests of both parties involved.

A South Carolina Contract between a General Agent of an Insurance Company and an Independent Agent outlines the legal agreement between these two entities within the insurance industry. The contract establishes the terms and conditions under which the independent agent acts as a representative of the general agent and sells insurance policies on behalf of the company. This contract is crucial in defining the rights, responsibilities, and obligations of both parties involved. Here, we will delve into the various types of South Carolina Contracts between General Agent of Insurance Company and Independent Agent: 1. General Agent Agreement: This agreement is the primary contract between the insurance company and the general agent. It defines the general agent's authority to appoint and supervise independent agents, specifies their territorial jurisdiction, commission structure, and outlines the general agent's responsibilities in marketing and training independent agents. 2. Independent Agent Agreement: This agreement establishes the relationship between the general agent and the independent agent. It details the agent's authority to represent the insurance company, their obligations, and compensation structure. This contract may also outline the standards and requirements the independent agent needs to adhere to while selling insurance policies on behalf of the general agent. 3. Exclusive Agency Agreement: In an exclusive agency agreement, the general agent grants exclusivity to the independent agent within a specific territory, prohibiting them from representing any other insurance company. This type of agreement presents an opportunity for the independent agent to build a long-term relationship and loyalty with the general agent in exchange for certain benefits, such as higher commission rates or additional marketing support. 4. Non-Exclusive Agency Agreement: Contrary to an exclusive agency agreement, a non-exclusive agency agreement allows the independent agent to represent multiple insurance companies simultaneously. This type of contract gives the agent more flexibility and freedom to diversify their product offerings and potentially target a wider client base. 5. Termination Agreement: A termination agreement outlines the terms and conditions under which the contract between the general agent and the independent agent may be terminated by either party. It includes provisions for notice periods, transitional support, and any post-termination obligations. When drafting a South Carolina Contract between a General Agent of an Insurance Company and an Independent Agent, it is essential to consider relevant keywords such as insurance regulations, commission structure, territorial jurisdiction, exclusivity, compensation, conflict of interest, marketing support, training, termination, and post-termination obligations. Additionally, ensuring compliance with South Carolina's insurance laws and regulations is vital to protect the interests of both parties involved.