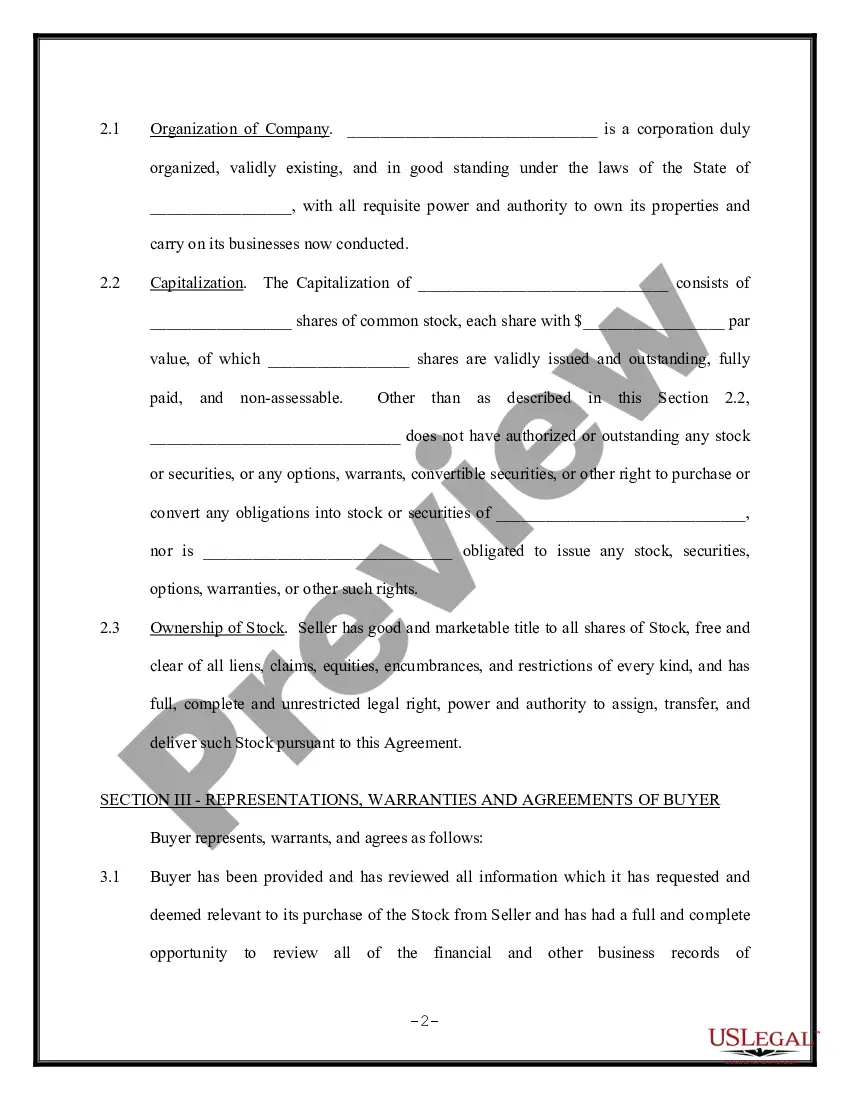

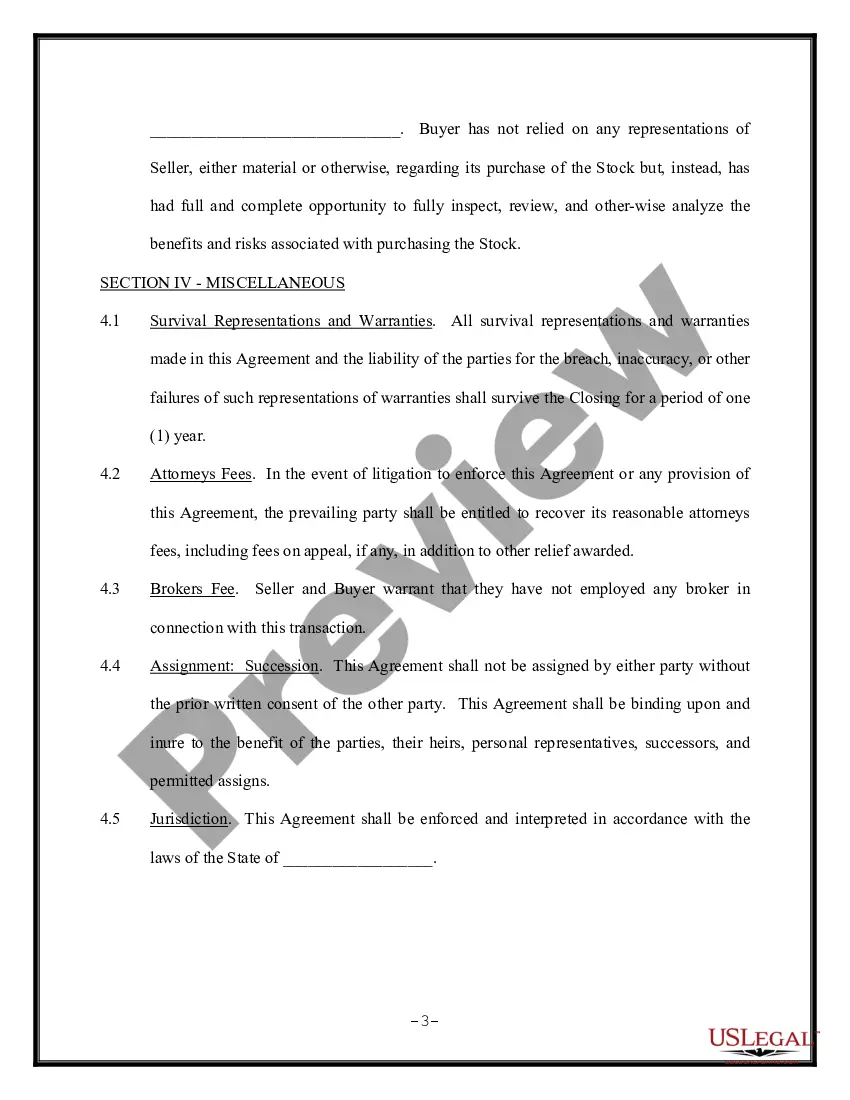

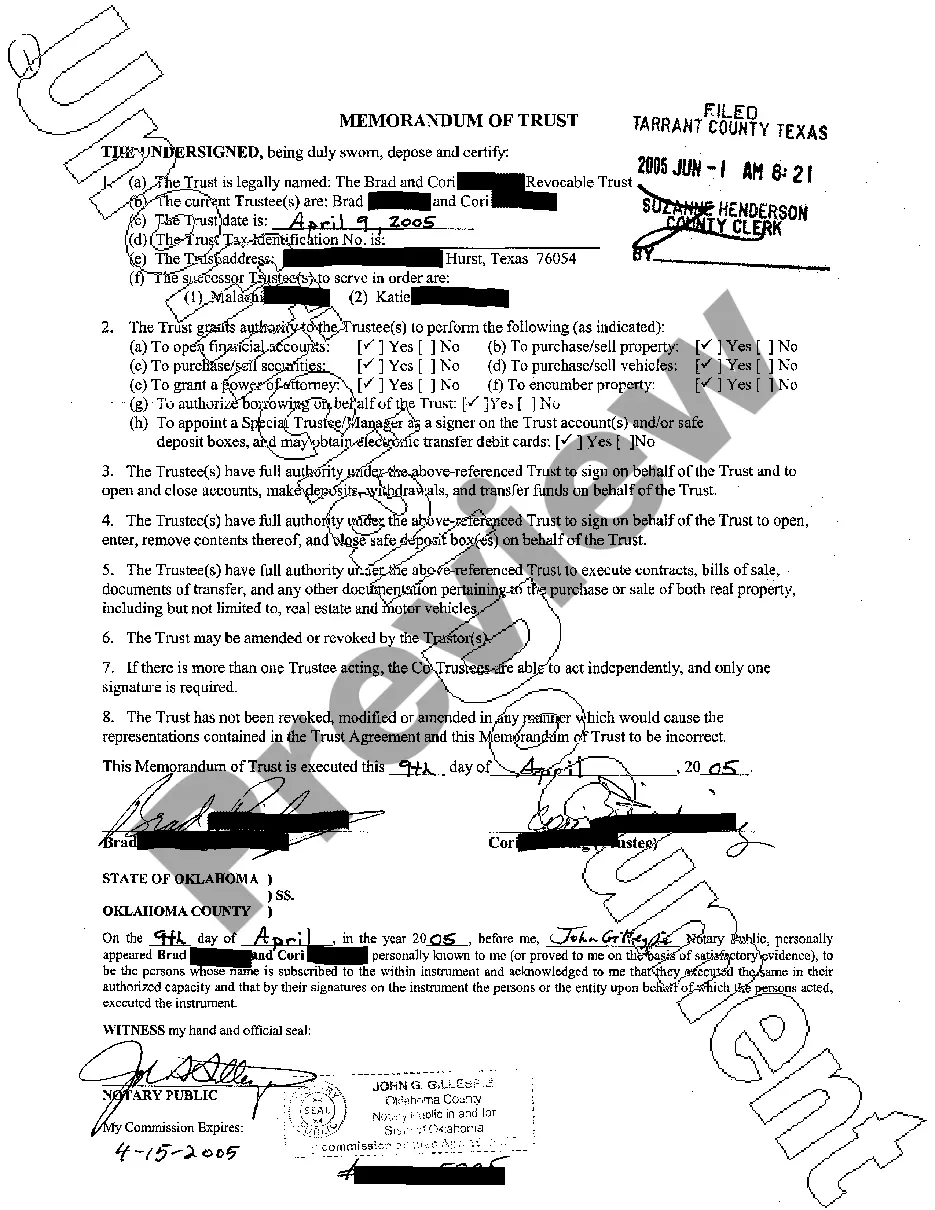

The South Carolina Stock Sale and Purchase Agreement — Short Form is a legal document that outlines the terms and conditions of the sale and purchase of stocks in a company based in South Carolina. This agreement is typically used when the buyer intends to acquire the majority or all of the stocks of a company, thereby gaining control and ownership of the business. Keywords: 1. Stock Sale: The agreement governs the sale of stocks, which represent ownership interests in a company. The buyer agrees to purchase the stocks from the seller, who is typically the current owner or shareholder of the company. 2. Purchase Agreement: It is a binding contract that sets out the terms and conditions of the stock purchase. This agreement ensures that both parties understand their rights, obligations, and responsibilities related to the transaction. 3. South Carolina: This refers to the jurisdiction where the agreement is created and enforced. Since laws may vary from state to state, the agreement is specifically tailored to comply with South Carolina's legal requirements and regulations. 4. Short Form: The term "short form" indicates that the agreement is a simplified version of a stock sale and purchase agreement. It focuses on the essential terms necessary for the transaction without delving into extensive details. This format is generally suitable for straightforward stock sales or purchases. Different types of South Carolina Stock Sale and Purchase Agreement — Short Form: 1. Standard Stock Sale and Purchase Agreement — Short Form: This is the general template used for most stock sale transactions in South Carolina. It covers the fundamental aspects of the sale, including the purchase price, stock transfer, representations and warranties, indemnification, and closing conditions. 2. Asset-Specific Stock Sale and Purchase Agreement — Short Form: This type of agreement is customized to accommodate specific circumstances where the stock purchase is limited to particular assets or business segments rather than acquiring the entire company. It may include additional provisions that are relevant to the specific assets being transferred. 3. Stock Sale and Purchase Agreement with Earn out — Short Form: In certain cases, the purchase price of the stocks may include a Darn out provision. This means that a portion of the payment is contingent on the future performance or earnings of the company. This type of agreement addresses to earn out provisions, including the calculation method, target performance, and payment schedule. It is important to consult legal professionals or attorneys experienced in South Carolina corporate law to ensure that the Stock Sale and Purchase Agreement — Short Form accurately reflects the intentions of the parties involved and complies with applicable laws and regulations.

South Carolina Stock Sale and Purchase Agreement - Short Form

Description

How to fill out South Carolina Stock Sale And Purchase Agreement - Short Form?

Are you presently in the position where you will need documents for possibly business or individual uses just about every day? There are tons of authorized papers themes available on the net, but getting ones you can trust isn`t effortless. US Legal Forms offers a huge number of develop themes, much like the South Carolina Stock Sale and Purchase Agreement - Short Form, which are written to meet state and federal demands.

If you are already familiar with US Legal Forms website and also have a free account, basically log in. Following that, you may obtain the South Carolina Stock Sale and Purchase Agreement - Short Form format.

If you do not offer an account and wish to begin using US Legal Forms, adopt these measures:

- Get the develop you require and ensure it is for your appropriate town/county.

- Take advantage of the Preview button to review the shape.

- Read the description to ensure that you have chosen the correct develop.

- In case the develop isn`t what you`re looking for, utilize the Lookup industry to find the develop that meets your requirements and demands.

- If you find the appropriate develop, click Acquire now.

- Select the rates program you want, submit the necessary details to create your account, and buy your order using your PayPal or credit card.

- Choose a practical paper file format and obtain your duplicate.

Locate all of the papers themes you may have bought in the My Forms food selection. You can obtain a further duplicate of South Carolina Stock Sale and Purchase Agreement - Short Form at any time, if necessary. Just click on the needed develop to obtain or print the papers format.

Use US Legal Forms, one of the most considerable collection of authorized varieties, to save time as well as steer clear of faults. The services offers professionally made authorized papers themes that you can use for a range of uses. Produce a free account on US Legal Forms and initiate making your life a little easier.