Title: South Carolina Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft Introduction: In South Carolina, victims of imposter identity theft have the right to dispute fraudulent activities on their credit reports and seek assistance from credit reporting companies or bureaus. This detailed description aims to inform individuals about various types of letters that can be used to report imposter identity theft and provide guidance on their content. Types of South Carolina Letters to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft: 1. Initial Alert Letter: Upon discovering fraudulent activity on their credit report in South Carolina, victims should immediately notify the credit reporting company or bureau responsible for the inaccurate information. The initial alert letter is the first step in disputing imposter identity theft. Keywords to include in this type of letter are "South Carolina," "imposter identity theft," "credit reporting company," "bureau," and "notification." 2. Formal Identity Theft Report Letter: To strengthen their case against the imposter identity theft, victims should file an official identity theft report with the relevant authorities and attach a copy of this report to their letter. Keywords for this type of letter include "formal identity theft report," "South Carolina authorities," "legal documentation," and "attaching evidence." 3. Request for Fraudulent Accounts Removal Letter: After reporting imposter identity theft to the credit reporting company or bureau, victims should specifically request the removal of any fraudulent accounts from their credit report. Keywords to include in this letter are "removal of fraudulent accounts," "credit report correction," "imposter identity theft resolution," "South Carolina rights," and "request for investigation." 4. Verification of Identity Letter: To ensure proper authentication, victims may be required to submit additional documentation to support their claims of imposter identity theft. A verification of identity letter should be sent alongside any required documents to prove the authenticity of the victim's claim. Keywords for this letter include "identity verification," "documentation submission," "proof of imposter identity theft," and "supporting evidence." 5. Follow-up Letter: In cases where the credit reporting company or bureau does not respond promptly or fails to resolve the imposter identity theft issue, victims should send a follow-up letter. The follow-up letter should express concerns, reiterate the details of the previous correspondence, and request an immediate resolution of the matter. Keywords to include in this type of letter are "non-response," "escalation," "South Carolina consumer rights," "improper handling," and "timely resolution." Conclusion: South Carolina residents facing imposter identity theft must take immediate action to protect their financial well-being. By utilizing the appropriate type of letter when communicating with credit reporting companies or bureaus, victims can effectively report the incident and seek justice. It is essential to remember that personalized information, details, and supporting evidence should be included in these letters to maximize the chances of a successful resolution.

South Carolina Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft

Description

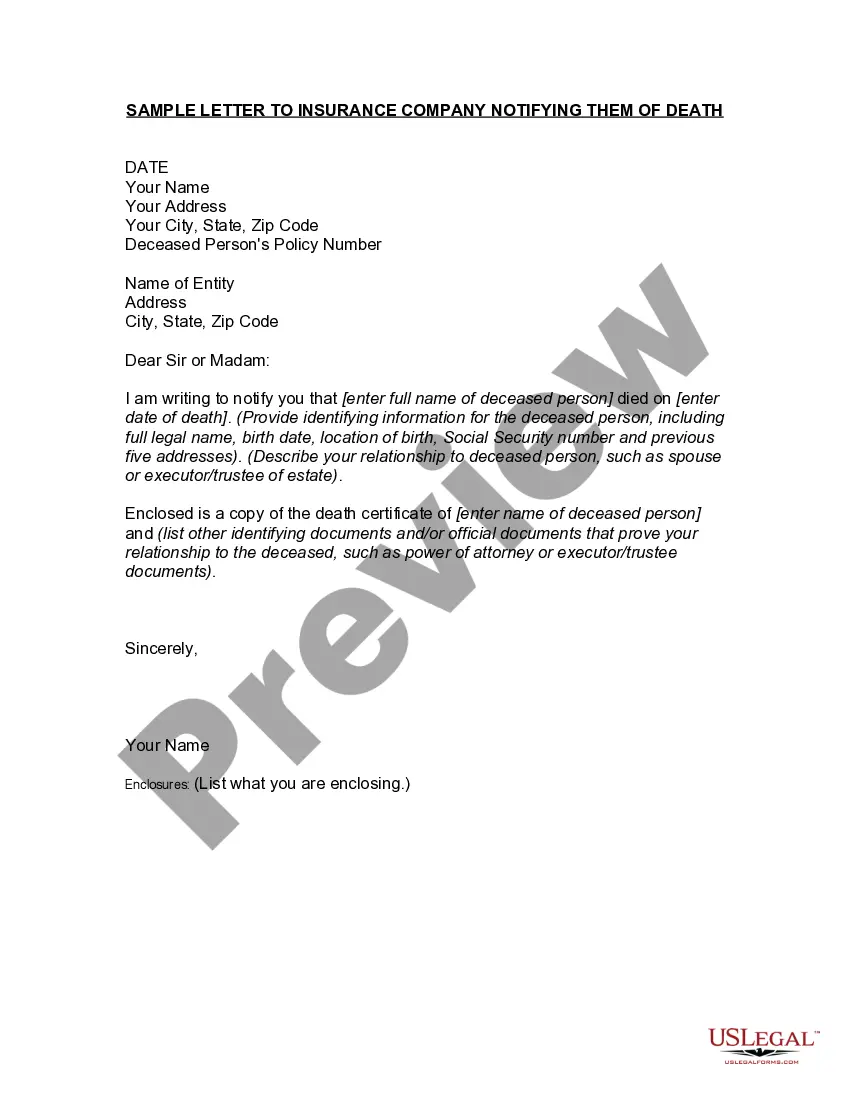

How to fill out South Carolina Letter To Credit Reporting Company Or Bureau Regarding Known Imposter Identity Theft?

You may invest time on the Internet searching for the authorized record format which fits the state and federal specifications you will need. US Legal Forms supplies a large number of authorized types that are analyzed by professionals. You can easily down load or produce the South Carolina Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft from my assistance.

If you currently have a US Legal Forms bank account, you are able to log in and then click the Down load option. Afterward, you are able to comprehensive, revise, produce, or indicator the South Carolina Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft. Each authorized record format you acquire is the one you have for a long time. To get one more version of any purchased type, proceed to the My Forms tab and then click the related option.

If you are using the US Legal Forms web site the first time, keep to the easy instructions under:

- Initially, make sure that you have chosen the proper record format to the region/city of your choosing. Read the type explanation to ensure you have selected the right type. If accessible, make use of the Review option to search through the record format too.

- If you would like get one more version in the type, make use of the Research discipline to get the format that meets your needs and specifications.

- After you have found the format you want, just click Purchase now to carry on.

- Pick the costs prepare you want, type in your qualifications, and sign up for an account on US Legal Forms.

- Complete the deal. You may use your Visa or Mastercard or PayPal bank account to pay for the authorized type.

- Pick the formatting in the record and down load it in your gadget.

- Make alterations in your record if necessary. You may comprehensive, revise and indicator and produce South Carolina Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft.

Down load and produce a large number of record web templates while using US Legal Forms Internet site, which provides the largest collection of authorized types. Use expert and express-particular web templates to take on your small business or specific needs.

Form popularity

FAQ

If you're not sure of the victim's identity, the FCRA allows you to ask for proof of identity, such as a copy of a government-issued identification. You also may ask for proof of a claim of identity theft, such as an Identity Theft Report issued by the FTC or a police report.

This affidavit has two parts: Part One ? the ID Theft Affidavit ? is where you report general informa- tion about yourself and the theft. Part Two ? the Fraudulent Account Statement ? is where you describe the fraudulent account(s) opened in your name.

File a police report with your local law enforcement agency. A police report provides you with a document saying you've been a victim, which can be helpful ? when requesting a 7-year extended fraud alert on your credit reports, for instance. This type of fraud alert requires a police or FTC Identity Theft Report.

File a Complaint You may File a Complaint with the Federal Trade Commission (FTC). Call 1-877-ID-THEFT. Write to: Identity Theft Clearinghouse - Federal Trade Commission. 600 Pennsylvania Avenue NW. Washington, DC, 20580. Visit Identity Theft.

FTC ID Theft Affidavit The FTC provides an ID Theft Affidavit to help victims of identity theft quickly and accurately dispute new unauthorized accounts. It is especially helpful in cases where consumers are unable to file or obtain a police report. Some creditors will accept this affidavit instead of a police report.

Identity theft occurs when someone gets or steals your personal information. The information can then be used to open credit accounts in your name or receive benefits, such as employment, insurance or housing.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.