South Carolina Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment

Description

How to fill out Agreement For Assignment And Sale Of Partnership Interest And Reorganization With Purchaser As New Partner Including Assignment?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a diverse selection of legal form templates that you can download or print.

By using the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the South Carolina Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment within minutes.

If you have a monthly subscription, Log In and download the South Carolina Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment from the US Legal Forms library. The Download option will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use your Visa, Mastercard, or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill, edit, print, and sign the downloaded South Carolina Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment.

Every template you save to your account does not have an expiration date and is yours forever. Therefore, if you want to download or print another copy, just go to the My documents section and click on the form you need.

Access the South Carolina Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/state.

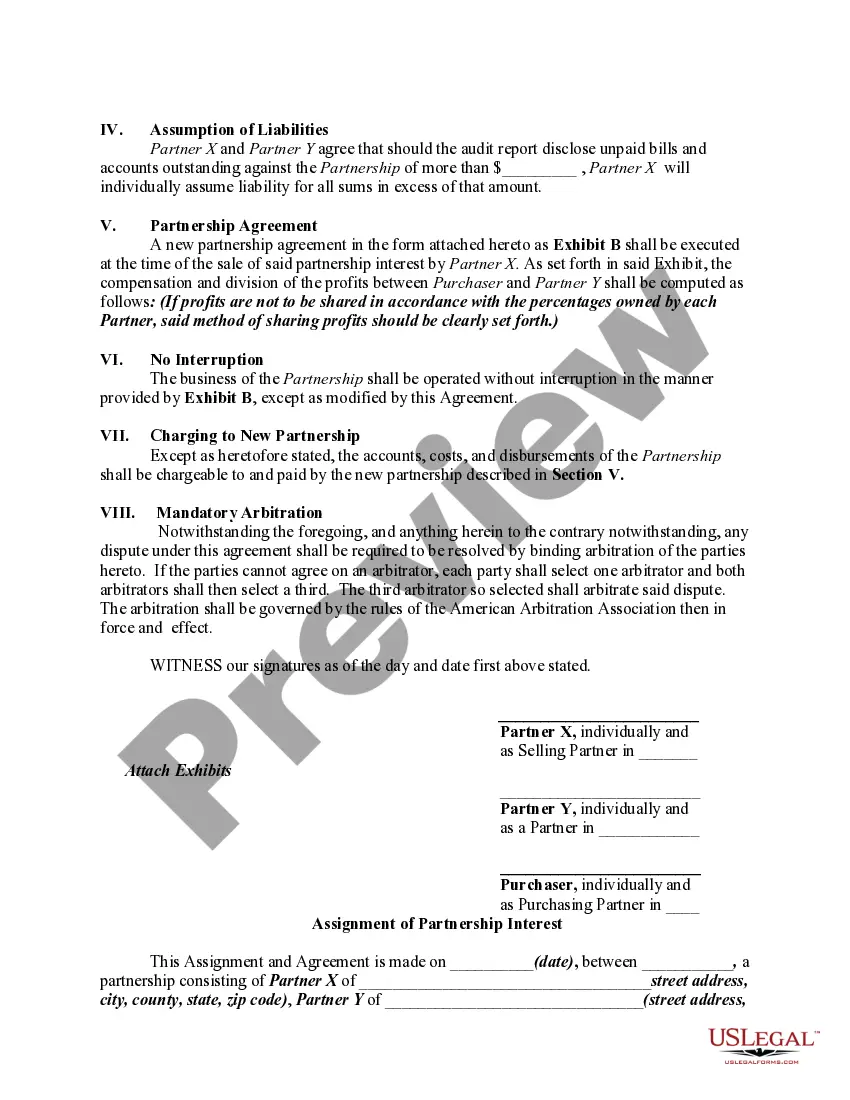

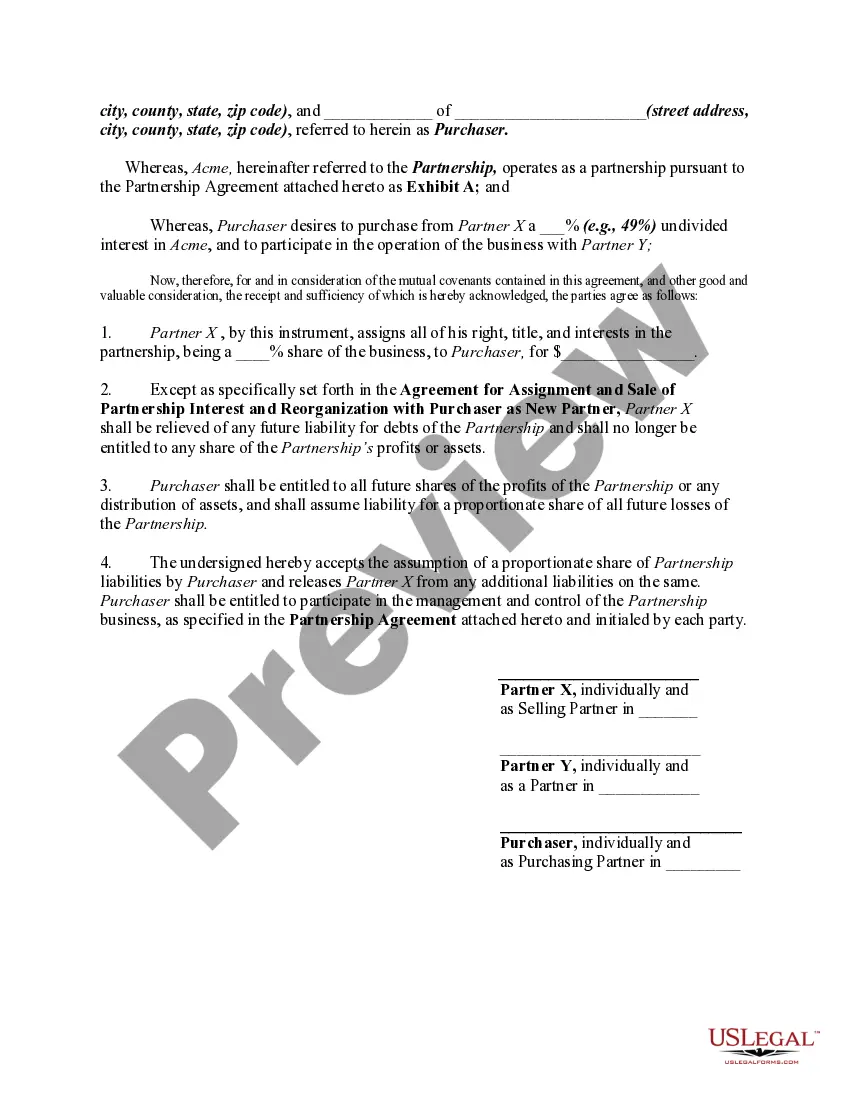

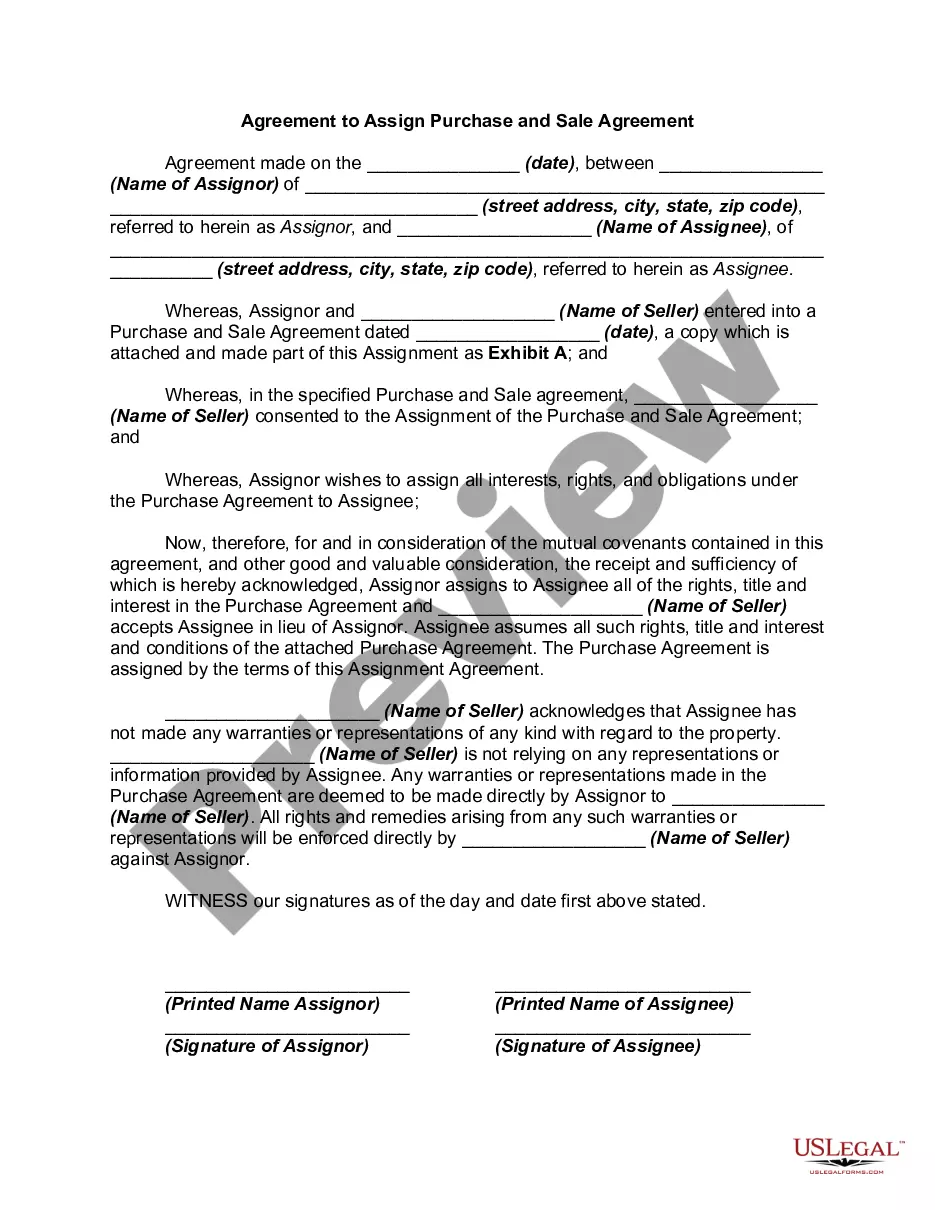

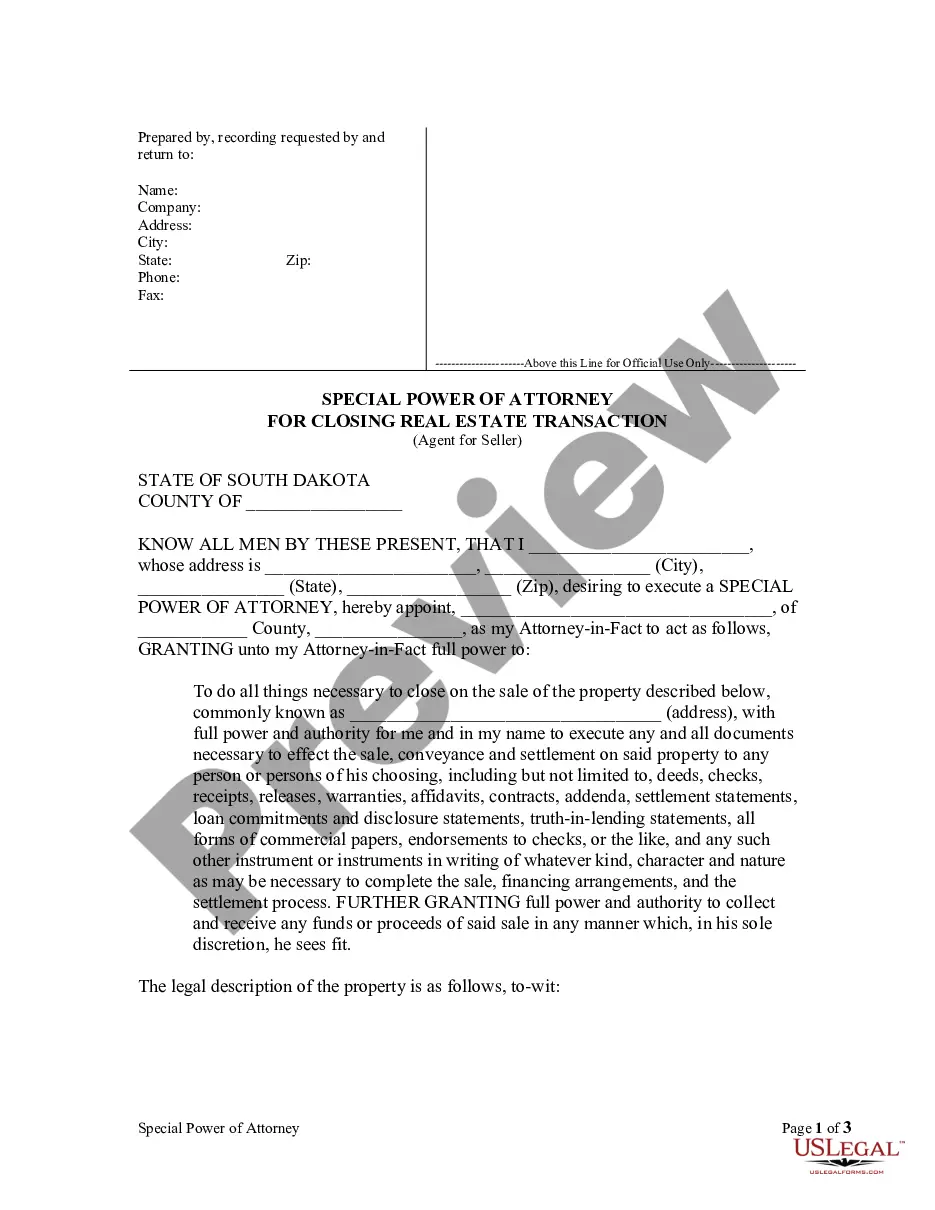

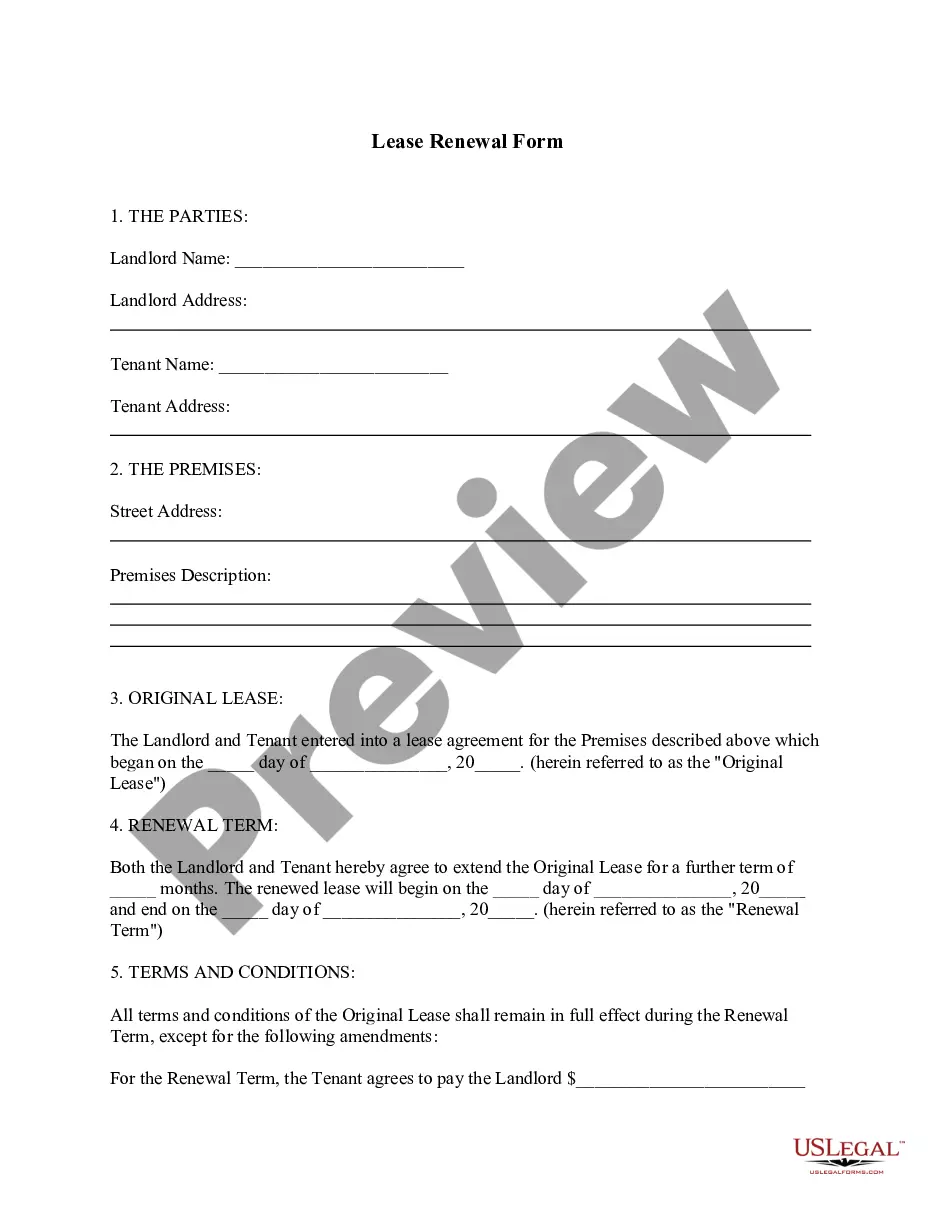

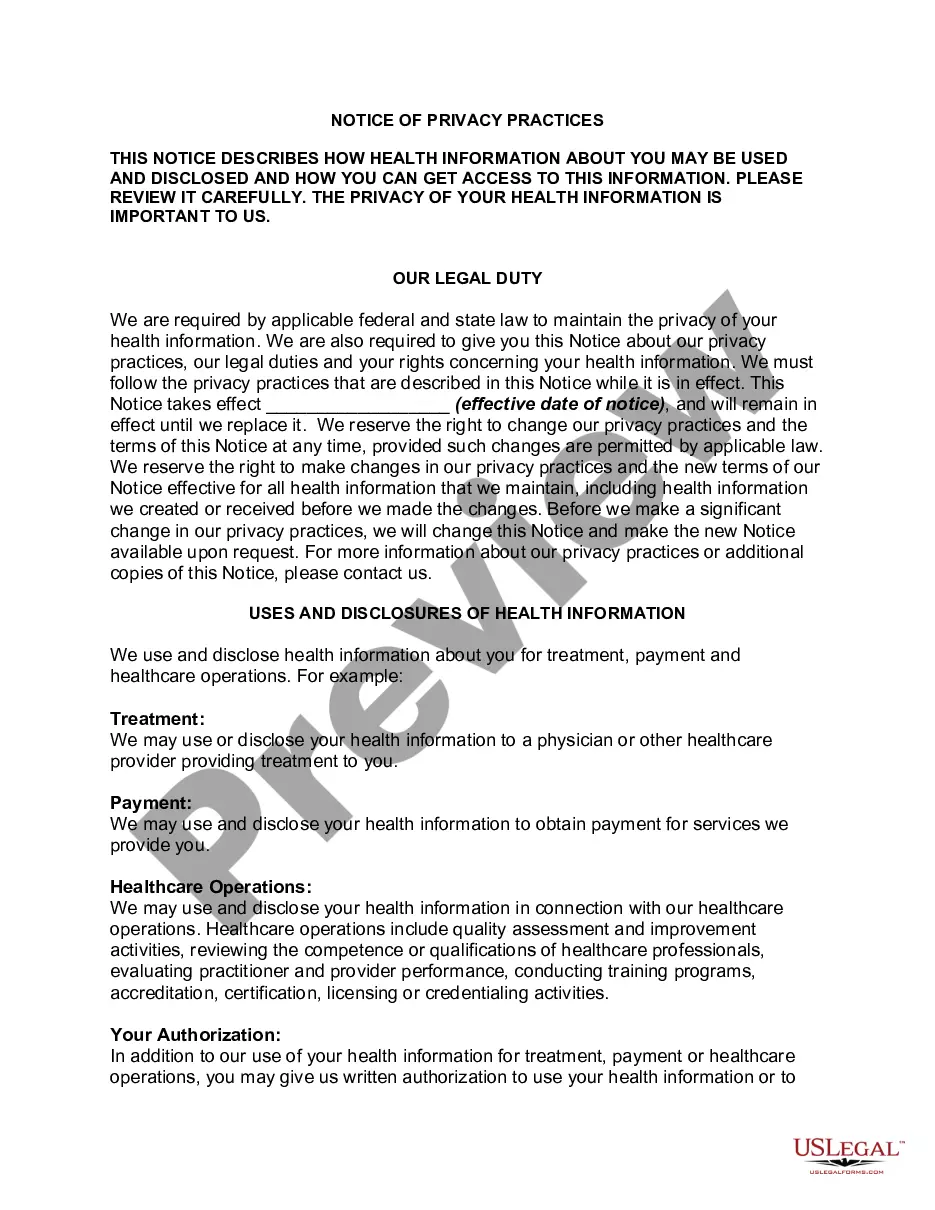

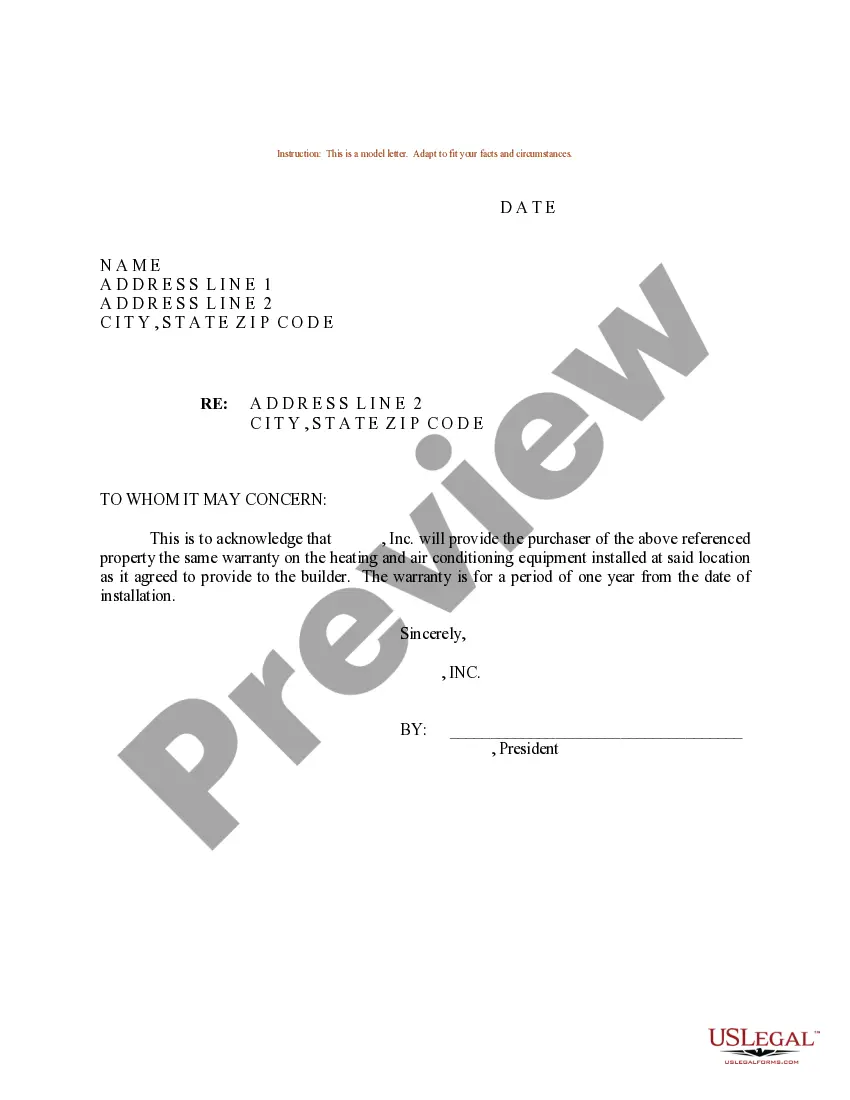

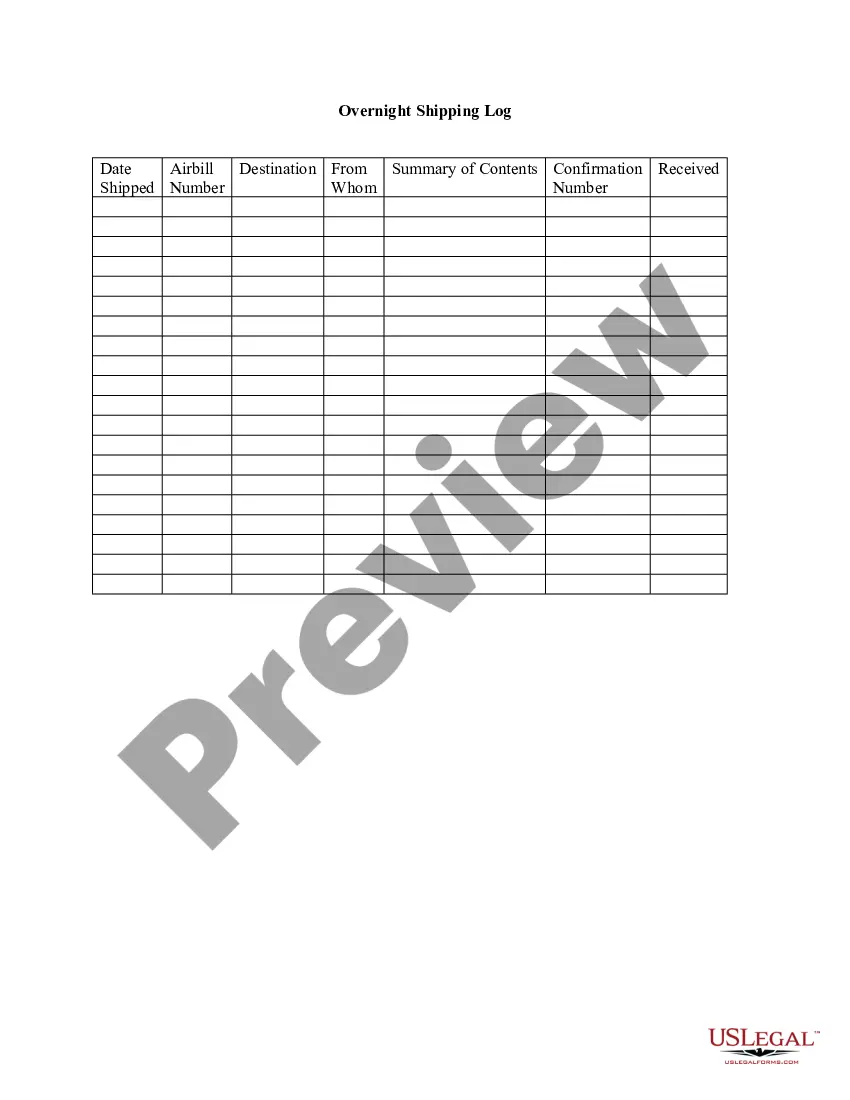

- Use the Preview option to review the form's content.

- Check the form description to confirm you have chosen the right form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your selection by clicking the Purchase now option.

- Then, choose the pricing plan you prefer and provide your details to create an account.

Form popularity

FAQ

A partnership agreement should include the identity of all partners, the purpose and duration of the partnership, financial contributions, profit-sharing arrangements, and procedures for resolving disagreements. It should also cover the process for adding or leaving partners, and future decision-making authority. Referencing the South Carolina Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment will enhance the agreement's effectiveness and clarity.

Transferring partnership interest to another person is possible through a formal assignment agreement. This agreement should detail the terms of the transfer and must be agreed upon by all current partners. Utilizing the South Carolina Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment will facilitate a transparent and efficient transfer process.

Yes, you can create your own partnership agreement as long as you include all essential elements. However, it is wise to consult legal resources or templates to ensure compliance with state laws. The South Carolina Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment can serve as a reliable guide to create a legally sound agreement.

To create a partnership agreement example, start with a title and introduce all partners by name. Then, lay out the key details such as contributions, management roles, and profit distribution clearly and concisely. Finally, ensure you reference the South Carolina Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment to guide the structure and legal requirements of the document.

A comprehensive partnership agreement should include the names of the partners, the purpose of the partnership, capital contributions, and profit-sharing ratios. Additionally, it should outline procedures for decision-making, dispute resolution, and partner withdrawal. Incorporating these elements will strengthen your South Carolina Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment.

Assigning partnership interest involves drafting an Assignment of Partnership Interest document. This document should detail the transfer of interest from the current partner to the new partner, including any financial obligations. By following the guidelines of the South Carolina Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment, you ensure a smooth transition and compliance with legal standards.

To create a partnership agreement, start by identifying the partners involved and their contributions. Clearly outline the roles, responsibilities, and the distribution of profits among partners. It is essential to include terms for managing any disputes and the process for adding or removing partners, which aligns with the South Carolina Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment.

Reporting a sale of partnership interest involves submitting specific forms and documentation to the IRS, disclosing your gain or loss on the transaction. This process is guided by the details outlined in the South Carolina Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment. It's advisable to consult with a tax professional to ensure compliance and accuracy in reporting.

Transferring partnership interest to another partner involves an official process, typically requiring consent from all partners. This process is documented within the framework of the South Carolina Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment. Handling this transfer correctly ensures ongoing partnership viability and adherence to agreements.

A 351 transfer refers to a tax provision where partners can transfer property to a partnership without immediate tax consequences, given certain conditions are met. This concept may apply to the South Carolina Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment. Understanding this provision can help partners make informed decisions about their interest transfers.