South Carolina Receipt as Payment in Full

Description

How to fill out Receipt As Payment In Full?

You might spend numerous hours online looking for the legitimate document template that satisfies the federal and state requirements you need.

US Legal Forms offers a wide variety of legal forms that are reviewed by professionals.

You can easily obtain or create the South Carolina Receipt as Payment in Full from their service.

If available, utilize the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can complete, modify, produce, or sign the South Carolina Receipt as Payment in Full.

- Every legal document template you receive is yours permanently.

- To get another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct form template for the region/city of your choice.

- Check the form description to confirm you have chosen the correct one.

Form popularity

FAQ

Yes, South Carolina offers a Pass-Through Entity (PTE) election, which allows certain business entities to opt for a different tax treatment. This can benefit owners as it allows them to report income on their personal tax returns while potentially accessing benefits like the South Carolina Receipt as Payment in Full. Using US Legal Forms can simplify the process of making informed decisions regarding PTE elections and your tax strategy.

You should mail your SC 1040ES form to South Carolina Department of Revenue, PO Box 100153, Columbia, SC 29202-3153. It is important to ensure that you address the envelope correctly to avoid any delays. This form is essential for making estimated tax payments, especially when dealing with South Carolina Receipt as Payment in Full issues. Using a reliable service like US Legal Forms can provide clarity on tax obligations.

In South Carolina, there is no specific age at which you stop paying state taxes. However, retirees may find certain exemptions that can reduce their tax burden. It’s essential to review your income and any applicable deductions each tax season. For clarity, obtaining a South Carolina Receipt as Payment in Full will help you track your contributions over the years.

You can make an estimated tax payment to South Carolina using the Department of Revenue’s online portal. First, gather your financial information to determine your estimated tax amount. After that, follow the instructions to complete your payment securely online. Remember, keeping a South Carolina Receipt as Payment in Full is crucial for your records.

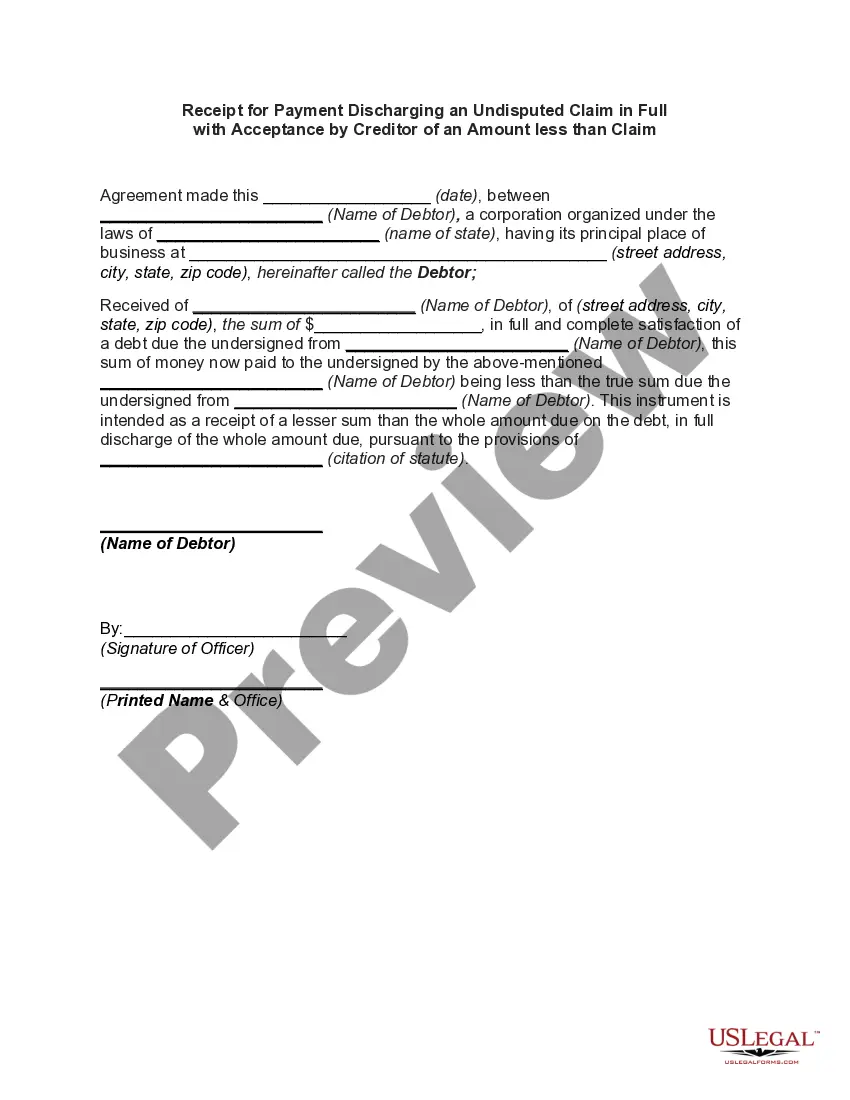

To write a receipt for a payment received, start by identifying the transaction details, including the payee, date, and amount. Clearly state that the payment is received and for what purpose, along with any relevant identifiers, such as invoice numbers. It is vital to keep a copy for your records. US Legal Forms provides user-friendly templates for crafting these receipts, ensuring accuracy and compliance.

A receipt acknowledging payment in full serves as a formal document confirming that a debtor has settled their obligation entirely. This receipt eliminates any future claims regarding that debt and protects both parties involved. It typically includes pertinent transaction details such as date, amount, and a written acknowledgment. By utilizing platforms like US Legal Forms, you can easily access templates suited for this purpose.

Writing a receipt for payment in full involves several key components: the date of transaction, the names of the payer and payee, the total amount received, and a statement indicating the payment is for the full balance owed. You should also include any relevant invoice numbers or reference numbers for clarity. Using a template from US Legal Forms can simplify this process, ensuring you meet all legal requirements while maintaining professionalism.

To acknowledge receipt of payment in full in South Carolina, you should provide a clear and detailed receipt. This receipt should state that the payment has been accepted in full satisfaction of the amount owed. Using standard language helps ensure that both parties understand the transaction's completion. A well-drafted receipt mitigates disputes, making it an essential step in financial transactions.

The penalty for underpayment of taxes in South Carolina usually involves a percentage of the unpaid taxes accruing in addition to interest. The specifics can vary based on individual tax situations. To prevent underpayment issues, using financial tools that track your payments, like the South Carolina Receipt as Payment in Full, is highly recommended.

The case number on a traffic ticket in South Carolina is typically located at the top or bottom of the ticket. This number is essential for tracking your case and making any necessary payments or inquiries. If you receive a ticket, keeping a record using a South Carolina Receipt as Payment in Full can help simplify addressing any fines.