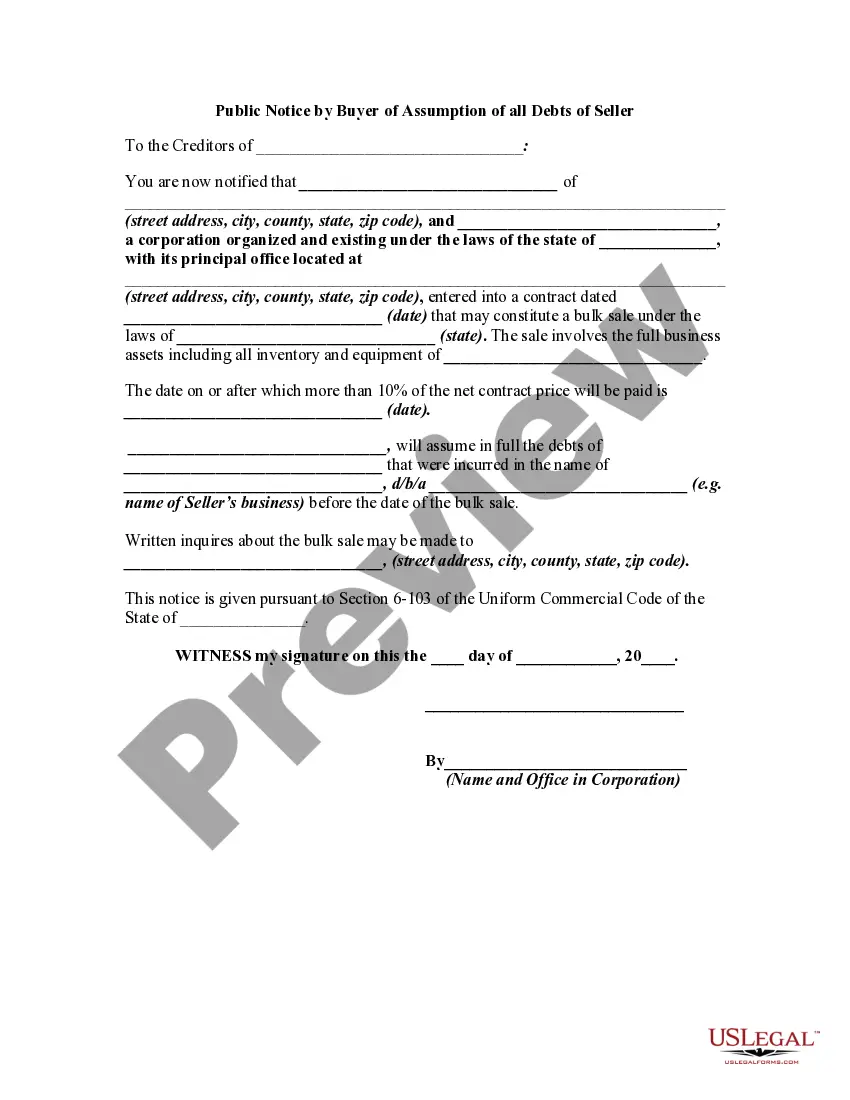

A bulk sale is a sale of goods by a business which engages in selling items out of inventory, often in liquidating or selling a business, and is governed by Article 6 of the Uniform Commercial Code (UCC) which deals with bulk sales. Article 6 has been adopted at least in part in all states. If the parties do not comply with the notification process for a bulk sale, creditors of the seller may obtain a declaration that the sale was invalid against the creditors and the creditors may take possession of the goods or obtain judgment for any proceeds the buyer received from a subsequent sale.

Section 6-103(5) provides in part that the buyer must give notice that he has assumed or will assume the debts that were incurred in the seller's business before the date of the bulk sale. Notice of the assumption must be given not later than 30 days after the date of the bulk sale by either: (a) sending or delivering a notice to each creditor whose debt is assumed; or (b) filing a notice in a central state office designated by the local variation of the Code.

Title: South Carolina Public Notice by Buyer of Assumption of all Debts of Seller Introduction: A South Carolina public notice by the buyer of the assumption of all debts of the seller is a legal document that serves to inform the public, creditors, and relevant authorities about the transfer of debts from the seller to the buyer in a transaction. This notice is essential to ensure transparency and protect the interests of all parties involved. In South Carolina, there are several types of public notices by the buyer of assumption of all debts of the seller, including: 1. Notice of Assumption of Debts by Buyer: This type of public notice is filed by the buyer when they assume all the debts and liabilities of the seller in a transaction. It provides comprehensive information regarding the transfer of debts and serves as a formal declaration of responsibility. 2. Notice of Assumption of Debts by Buyer in a Business Acquisition: In certain circumstances, the assumption of debts by the buyer may occur as part of a larger business acquisition. In such cases, this notice is filed to specifically address the transfer of debts and liabilities associated with the acquired business. 3. Notice of Assumption of Debts by Buyer in Real Estate Transactions: Real estate transactions often involve the assumption of existing debts, such as mortgages or liens, by the buyer. This type of public notice is filed to notify concerned parties, such as lenders and creditors, about the transfer of these obligations to the buyer. Key Elements in a South Carolina Public Notice of Assumption of all Debts: 1. Identification of Parties: The notice should clearly identify the buyer and seller involved in the transaction, including their legal names, contact information, and any relevant business affiliations. 2. Description of the Debts: A detailed account of the debts being assumed by the buyer should be provided, including the type of debt, outstanding balances, creditor information, and any associated collateral or security interests. 3. Effective Date: The notice must specify the effective date of the assumption, indicating when the buyer officially takes on the responsibility for the debts and liabilities from the seller. 4. Contact Information: Contact details of the buyer's representative should be provided to allow interested parties to address any questions or concerns regarding the assumption of debts. 5. Acknowledgment: The notice should contain a clause, often referred to as an acknowledgment, in which the buyer affirms their understanding and acceptance of assuming all the debts and liabilities associated with the transaction. Conclusion: In South Carolina, a public notice by the buyer of assumption of all debts of the seller is an essential document outlining the transfer of debts and liabilities from the seller to the buyer. This notice ensures transparency and protects the interests of various stakeholders involved in the transaction. By providing comprehensive information, it allows creditors and concerned parties to take necessary actions, if required, and avoid any disputes or complications arising from the assumption of debts.Title: South Carolina Public Notice by Buyer of Assumption of all Debts of Seller Introduction: A South Carolina public notice by the buyer of the assumption of all debts of the seller is a legal document that serves to inform the public, creditors, and relevant authorities about the transfer of debts from the seller to the buyer in a transaction. This notice is essential to ensure transparency and protect the interests of all parties involved. In South Carolina, there are several types of public notices by the buyer of assumption of all debts of the seller, including: 1. Notice of Assumption of Debts by Buyer: This type of public notice is filed by the buyer when they assume all the debts and liabilities of the seller in a transaction. It provides comprehensive information regarding the transfer of debts and serves as a formal declaration of responsibility. 2. Notice of Assumption of Debts by Buyer in a Business Acquisition: In certain circumstances, the assumption of debts by the buyer may occur as part of a larger business acquisition. In such cases, this notice is filed to specifically address the transfer of debts and liabilities associated with the acquired business. 3. Notice of Assumption of Debts by Buyer in Real Estate Transactions: Real estate transactions often involve the assumption of existing debts, such as mortgages or liens, by the buyer. This type of public notice is filed to notify concerned parties, such as lenders and creditors, about the transfer of these obligations to the buyer. Key Elements in a South Carolina Public Notice of Assumption of all Debts: 1. Identification of Parties: The notice should clearly identify the buyer and seller involved in the transaction, including their legal names, contact information, and any relevant business affiliations. 2. Description of the Debts: A detailed account of the debts being assumed by the buyer should be provided, including the type of debt, outstanding balances, creditor information, and any associated collateral or security interests. 3. Effective Date: The notice must specify the effective date of the assumption, indicating when the buyer officially takes on the responsibility for the debts and liabilities from the seller. 4. Contact Information: Contact details of the buyer's representative should be provided to allow interested parties to address any questions or concerns regarding the assumption of debts. 5. Acknowledgment: The notice should contain a clause, often referred to as an acknowledgment, in which the buyer affirms their understanding and acceptance of assuming all the debts and liabilities associated with the transaction. Conclusion: In South Carolina, a public notice by the buyer of assumption of all debts of the seller is an essential document outlining the transfer of debts and liabilities from the seller to the buyer. This notice ensures transparency and protects the interests of various stakeholders involved in the transaction. By providing comprehensive information, it allows creditors and concerned parties to take necessary actions, if required, and avoid any disputes or complications arising from the assumption of debts.