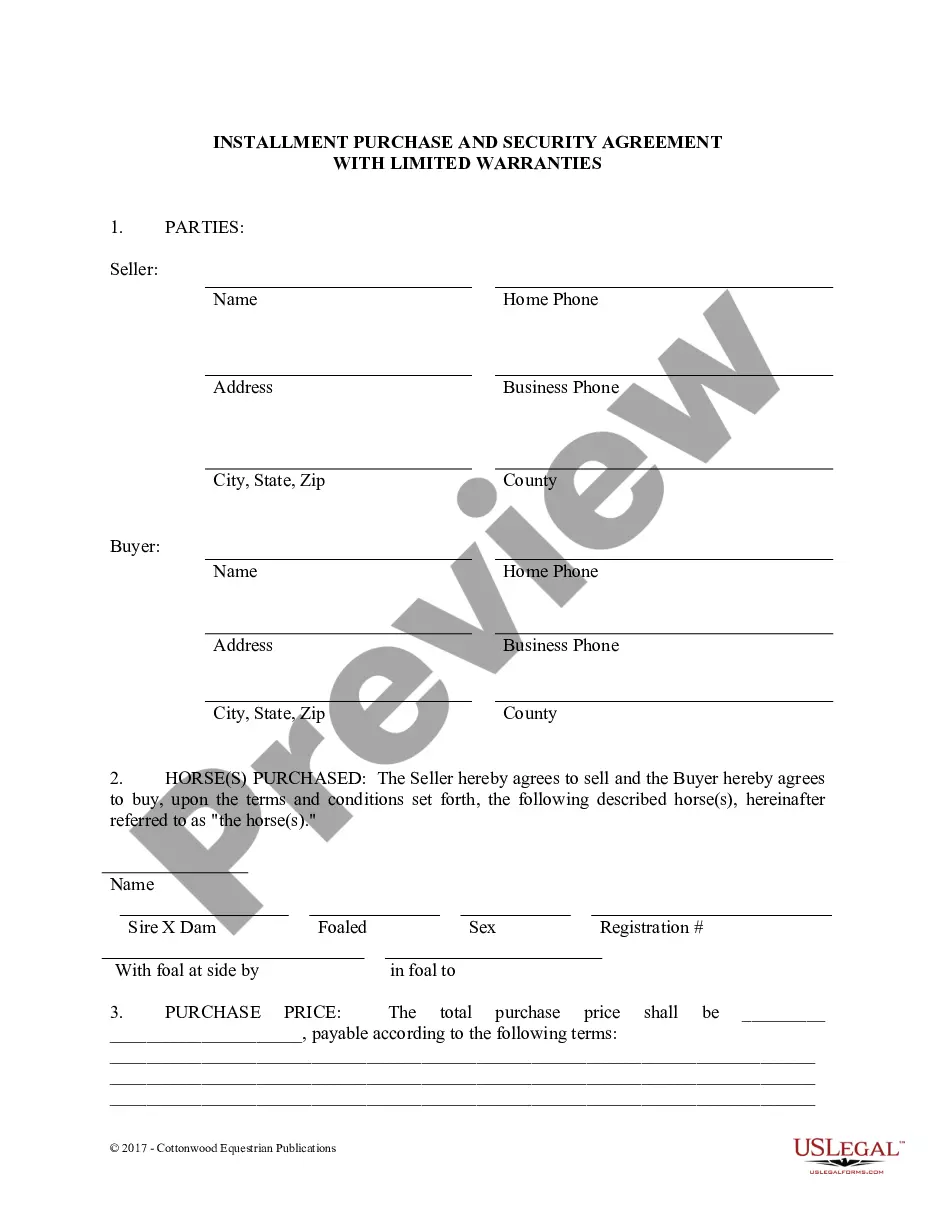

In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

South Carolina Security Agreement with Farm Products as Collateral

Description

How to fill out Security Agreement With Farm Products As Collateral?

US Legal Forms - among the most important repositories of legal documents in the United States - offers a diverse selection of legal document templates that you can download or generate.

By utilizing the website, you can find thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can access the most current versions of forms such as the South Carolina Security Agreement with Farm Products as Collateral within moments.

If you already hold a subscription, Log In and download the South Carolina Security Agreement with Farm Products as Collateral from your US Legal Forms library. The Download button will be available on every form you view.

If you are satisfied with the form, confirm your choice by clicking the Acquire now button. Next, select your preferred pricing plan and enter your information to sign up for the account.

Complete the transaction. Use your Visa, Mastercard, or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make edits. Fill out, modify, print, and sign the saved South Carolina Security Agreement with Farm Products as Collateral.

Each template you add to your account does not have an expiration date and is yours indefinitely. Thus, if you wish to download or print another version, simply navigate to the My documents section and click on the form you need. Access the South Carolina Security Agreement with Farm Products as Collateral via US Legal Forms, the largest repository of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Access all previously saved forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are straightforward steps to get started.

- Ensure you have selected the correct form for your city/region.

- Click on the Review button to examine the content of the form.

- Read the form details to confirm you've chosen the accurate form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

Form popularity

FAQ

Perfection of a security interest in aircraft involves unique procedures under federal law due to the aircraft's classification as a registered asset. You need to file a notice with the Federal Aviation Administration (FAA) to perfect your interest, even if you utilize a South Carolina Security Agreement with Farm Products as Collateral. Ensuring that these steps are completed correctly protects your financial interests if the borrower defaults.

To perfect a secured interest, you need to take specific steps, including creating a security agreement and filing a financing statement in the appropriate jurisdiction. In the case of a South Carolina Security Agreement with Farm Products as Collateral, this process helps you establish priority over others who may have claims against the collateral. You may consider using platforms like uslegalforms to access necessary templates and guidance in this process.

Perfection of a security interest in patents requires specific actions to establish the secured party’s rights in the patent as collateral. For a South Carolina Security Agreement with Farm Products as Collateral, the process typically involves filing a financing statement with the United States Patent and Trademark Office. This action provides public notice, ensuring that your interests are protected against claims from other creditors.

Automatic perfection occurs without the need for filing when you create a security interest in particular types of collateral. Under the South Carolina Security Agreement with Farm Products as Collateral, certain farm products may automatically perfect the security interest upon attachment. This process eliminates the requirement for filing, simplifying enforcement and protecting your interests more efficiently.

Perfection of a security interest refers to the legal process that establishes a secured party's rights in collateral, ensuring priority in case of default. By perfecting your security interest under a South Carolina Security Agreement with Farm Products as Collateral, you protect your claim against other creditors. This process typically involves filing a financing statement, which provides public notice of your interest.

Yes, South Carolina does have a collateral source rule that permits plaintiffs to recover damages despite receiving compensation from another source. This principle maintains that defendants remain liable for the full extent of damages incurred. If you are engaging with a South Carolina Security Agreement with Farm Products as Collateral, understanding this rule can be vital for ensuring appropriate protection under the law.

The collateral source rule varies across all 50 states, with each state establishing its own interpretation and application. Generally, it allows plaintiffs to receive full compensation for damages regardless of other payments made on their behalf. If you are working with a South Carolina Security Agreement with Farm Products as Collateral, knowing your state’s specifics can help you navigate potential legal complications effectively.

In South Dakota, the collateral source rule functions similarly to the version in other states, allowing plaintiffs to receive damages even if they have received other compensation. This ensures that the full extent of damages is recoverable, regardless of external compensation. In situations concerning a South Carolina Security Agreement with Farm Products as Collateral, understanding this rule can help in assessing potential recoveries.

The collateral source rule in North Carolina allows a plaintiff to recover damages from a defendant even if the plaintiff has already received compensation from another source, such as insurance. This rule ensures that defendants cannot benefit from payments made by another party when assessing liability. If you're navigating a South Carolina Security Agreement with Farm Products as Collateral, understanding liability and compensation can be essential.

In South Carolina, the statute of limitations for a promissory note is generally three years. This means that you must initiate any legal action regarding the note within this timeframe. It is crucial to keep this in mind, especially when dealing with a South Carolina Security Agreement with Farm Products as Collateral, as timing can significantly impact your legal rights.