A contract is based upon an agreement. An agreement arises when one person, the offeror, makes an offer and the person to whom is made, the offeree, accepts. There must be both an offer and an acceptance. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Carolina Letter Offering to Purchase a Residence

Description

How to fill out Letter Offering To Purchase A Residence?

If you desire to complete, download, or print permitted document templates, utilize US Legal Forms, the largest collection of legal forms that are accessible online.

Employ the website’s straightforward and convenient search feature to find the documents you need.

A selection of templates for business and personal purposes are categorized by type and state, or keywords.

Every legal document template you purchase is yours indefinitely. You will have access to all forms you downloaded in your account.

Navigate to the My documents section and select a form to print or download again.

- Use US Legal Forms to locate the South Carolina Letter Offering to Purchase a Residence in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download option to obtain the South Carolina Letter Offering to Purchase a Residence.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are utilizing US Legal Forms for the first time, please follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

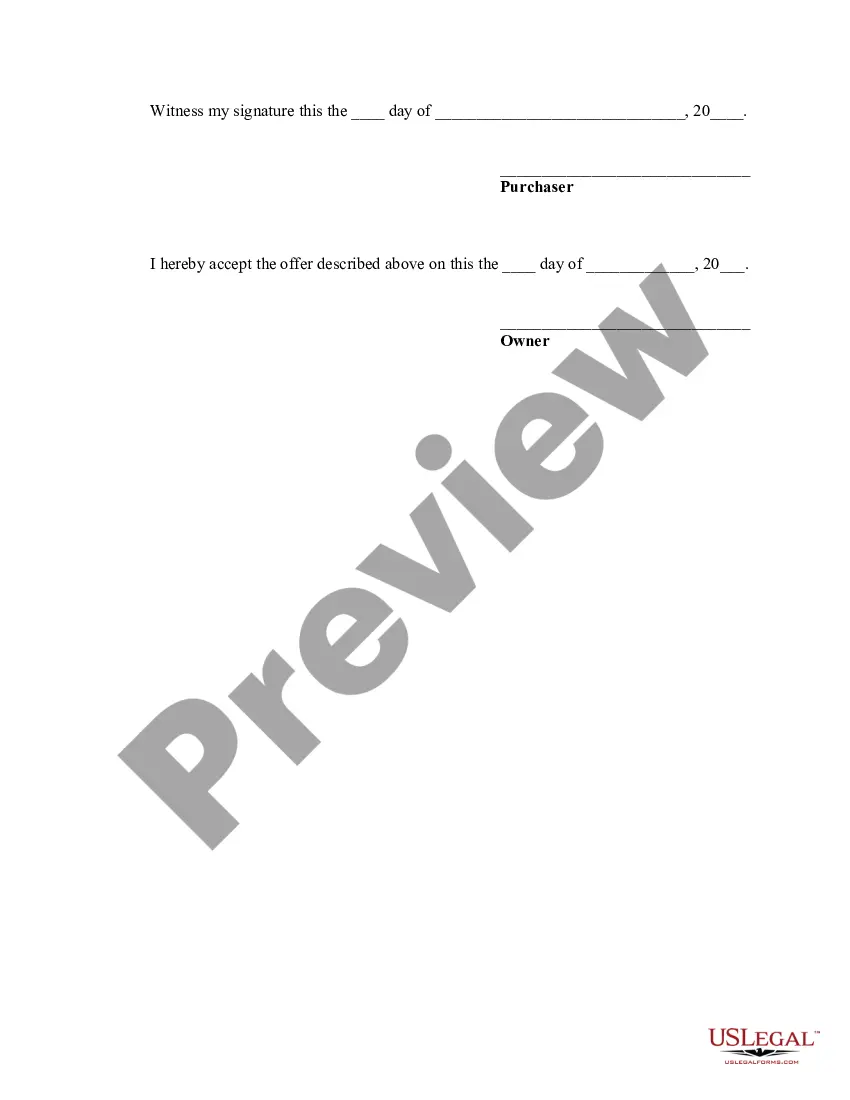

- Step 2. Use the Preview option to review the contents of the form. Be sure to read the information thoroughly.

- Step 3. If you are not satisfied with the form, utilize the Search bar at the top of the page to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Complete the payment. You can use your Misa or MasterCard or PayPal account to make the payment.

- Step 6. Select the format of the legal form and download it onto your device.

- Step 7. Complete, modify and print or sign the South Carolina Letter Offering to Purchase a Residence.

Form popularity

FAQ

The real estate offer rejection form must be used in South Carolina when a buyer decides not to accept an offer for a property. This form serves as a formal notification to all parties involved in the transaction. Using this document ensures clarity and prevents any misunderstandings about the status of the offer. Having a clear record of rejection can also facilitate future negotiations.

An offer letter for a home is similar to an offer letter for a potential job. It outlines your homeownership goals, a bit of personal background, and why you're the ideal buyer for the home in question. Before the pandemic, offer letters were still considered a nice, personal touch to a home buyer's offer.

A letter of intent (LOI) or "offer letter" outlines the terms of employment in a much simpler format than what will be presented in a contract. The LOI is a preliminary document based on the mutual interest and good faith of both parties.

The offer should include the following:Expiration date of the offer.Purchase price.Initial deposit.Down payment amount.Financing terms.Required home inspection.Contingencies.Warranties.More items...

Open with a proper salutation for the owner of the land, such as "Dear Martha Jones." Introduce yourself in the first paragraph and generally describe your interest in the land without offering specifics. Simply indicate that you are interested in the land for business development, or some other general reason.

The LOI should be in writing; it should be signed by the parties; it should state all needed terms of a property sale agreement or lease, like price or rent, party names and descriptions of the property and the interest conveyed and finally, it should state clearly that the parties may (or will) prepare a final written

7 Tips for Writing the Perfect Real Estate Offer LetterAddress the Seller By Name.Highlight What You Like Most About the Home.Share Something About Yourself.Throw in a Personal Picture.Discuss What You Have in Common.Keep it Short.Close the Letter Appropriately.

For the purchase of property, an offer is considered under contract when it has been accepted in writing and signed by both parties. This written contract is called a purchase agreement.

The Purchase & Sale Agreement (P&S) is a legally binding contract that dictates how the sale of a home will proceed. It comes after the Offer to Purchase, and supersedes that earlier document once it's signed.

7 Tips for Writing the Perfect Real Estate Offer LetterAddress the Seller By Name.Highlight What You Like Most About the Home.Share Something About Yourself.Throw in a Personal Picture.Discuss What You Have in Common.Keep it Short.Close the Letter Appropriately.