South Carolina Agreement to Sell Personal Property

Description

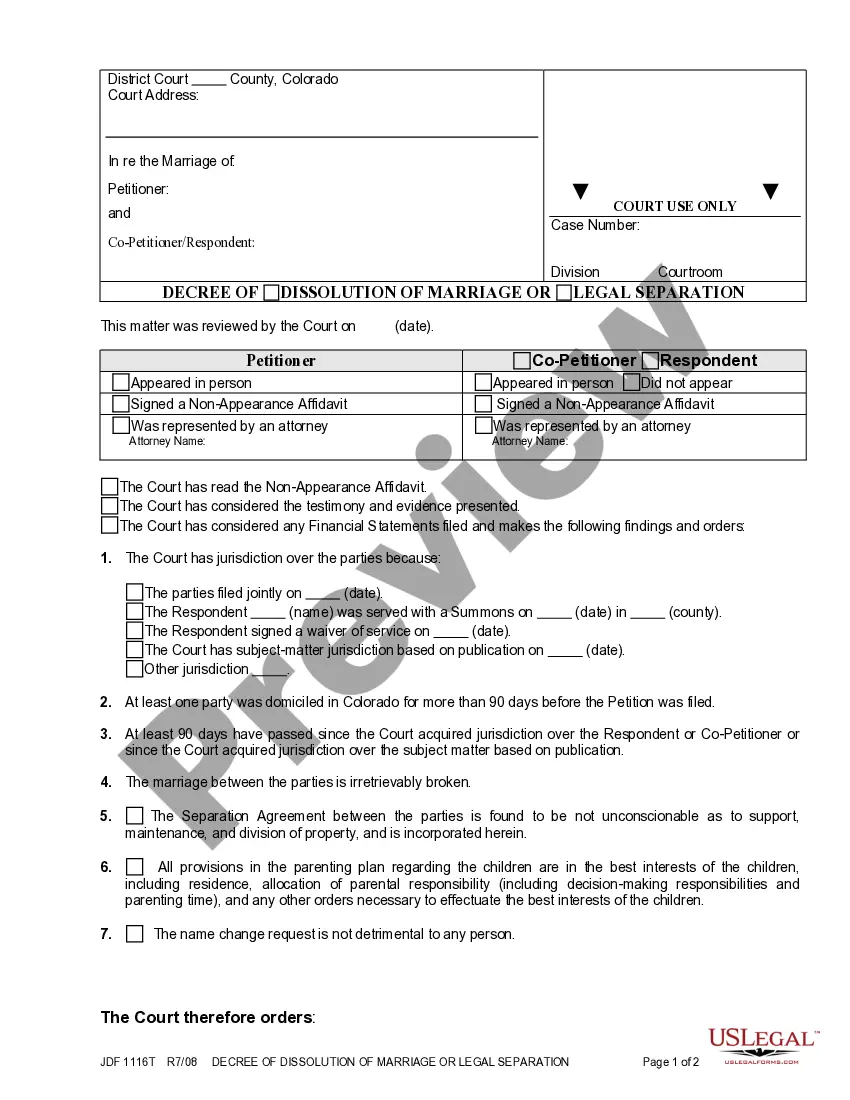

How to fill out Agreement To Sell Personal Property?

If you require extensive, obtain, or generate authentic document templates, utilize US Legal Forms, the most extensive selection of official forms that can be accessed online.

Employ the site’s straightforward and user-friendly search function to locate the documents you seek.

Different templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you find the form you need, click the Acquire now button. Select the pricing plan that suits you and enter your credentials to create an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the South Carolina Agreement to Sell Personal Property in just a few clicks.

- If you are already a user of US Legal Forms, Log In to your account and click the Acquire button to get the South Carolina Agreement to Sell Personal Property.

- You can also access forms you previously stored in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to browse through the form’s details. Remember to check the overview.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other versions of the official form template.

Form popularity

FAQ

The hardest months to sell a house often vary by region, but generally, winter months present challenges due to fewer buyers. The South Carolina Agreement to Sell Personal Property can be affected by market conditions. In contrast, spring and summer typically see increased activity and more competitive offers. For tailored advice on timing and strategy, consider exploring resources available through uslegalforms.

In South Carolina, all heirs typically must agree to sell inherited property. This consensus is crucial for executing the South Carolina Agreement to Sell Personal Property. If there is a disagreement among heirs, it can complicate the sale process. To address these challenges, consulting legal resources such as uslegalforms can help you manage the situation effectively.

In South Carolina, if you plan to sell real estate as a business, you need a real estate license. However, individuals can sell their own property without a license. When completing the South Carolina Agreement to Sell Personal Property, it's vital to make sure all paperwork is accurate. Using uslegalforms can provide you with the correct forms and guidance for a successful sale.

Selling your house in South Carolina does not require you to hire an attorney, but it is strongly recommended. The South Carolina Agreement to Sell Personal Property involves legal documents that can be complex. Having an attorney can help you navigate the process, ensure compliance with local laws, and protect your interests during the sale. You can rely on uslegalforms to access the necessary documents and resources, making your transaction smoother.

To file a PT100 in South Carolina, you need to complete the form accurately. This form is essential for reporting the sale of a personal property agreement. After filling it out, submit the PT100 to the county auditor's office where the property is located. Using the right forms and procedures will ensure your South Carolina Agreement to Sell Personal Property is processed correctly.

To sell property in South Carolina, start by determining the market value and preparing your property for sale. Listing the property, either on your own or with the help of a realtor, can attract potential buyers. Drafting a South Carolina Agreement to Sell Personal Property will ensure that the sale is legally sound and protects both parties involved.

A contract becomes legally binding in South Carolina when it includes an offer, acceptance, and consideration. Additionally, both parties must have the legal capacity to enter into the agreement. Clarity in terms, such as those found in a South Carolina Agreement to Sell Personal Property, helps ensure that all parties understand their obligations.

You can avoid or minimize capital gains tax in South Carolina by taking advantage of certain exclusions and deductions. For instance, if you sell your primary residence, the IRS allows an exclusion for capital gains up to $250,000, or $500,000 for married couples. It’s advisable to consult with a tax professional to navigate this while using a South Carolina Agreement to Sell Personal Property.

Yes, a personal representative can sell property in South Carolina, particularly when authorized through the estate’s probate process. This role is typically held by someone appointed to manage the deceased person's estate. They must follow legal guidelines and ensure that the sale adheres to the terms outlined in the South Carolina Agreement to Sell Personal Property.

Yes, in South Carolina, it is recommended for the seller to have a closing attorney involved in the transaction. The attorney can guide you through the legal aspects of the sales contract, ensuring all documents are properly prepared and filed. This professional assistance helps mitigate potential issues during the closing process. Engaging a knowledgeable attorney can make navigating the South Carolina Agreement to Sell Personal Property much easier.