In this guaranty, the guarantor is guaranteeing both payment and performance of all leases now or later entered into with lessee and all the obligations and liabilities due and to become due to lessor from lessee under any lease, note, or other obligation of lessee to lessor. Such a blanket guaranty would suggest a close business relationship between the lessee and guarantor like that of a parent and subsidiary corporation.

South Carolina Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease

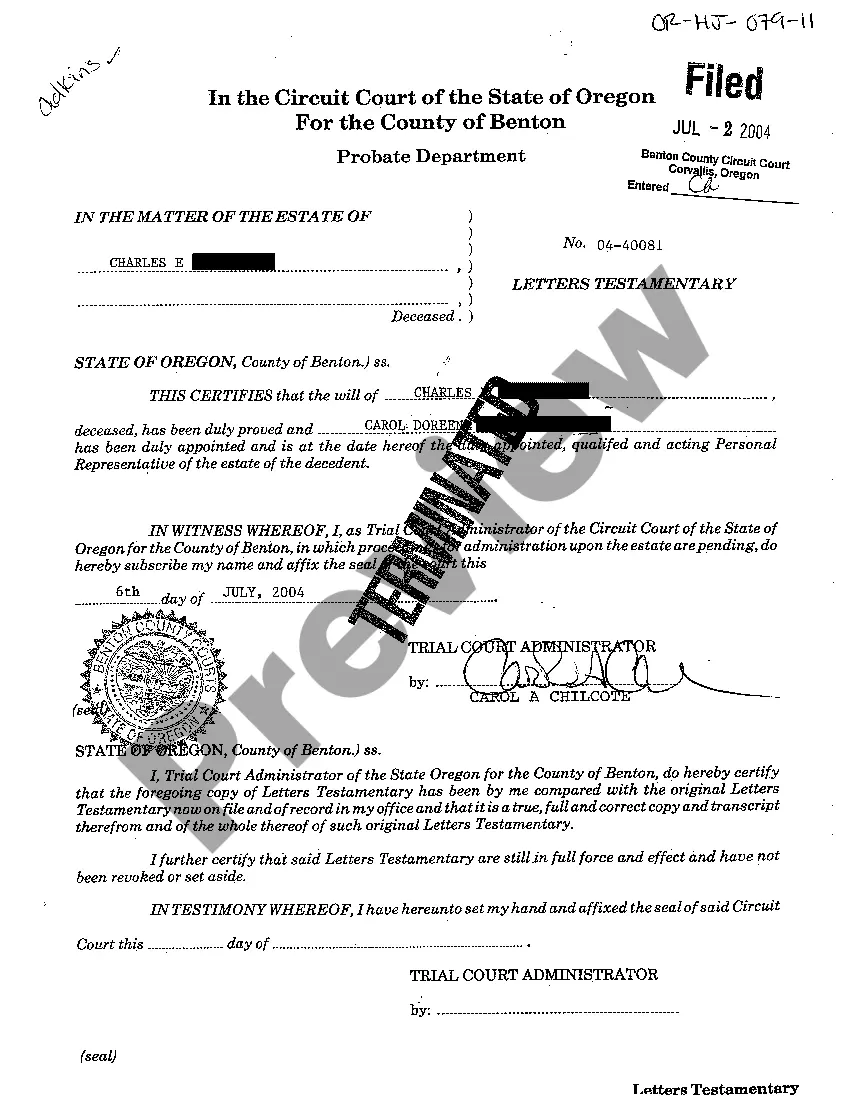

Description

How to fill out Continuing Guaranty Of Payment And Performance Of All Obligations And Liabilities Due To Lessor From Lessee Under Lease?

If you wish to finalize, acquire, or create legitimate document templates, utilize US Legal Forms, the largest assortment of legal documents, accessible online.

Make use of the site's straightforward and user-friendly search feature to obtain the documents you require.

Various templates for commercial and personal purposes are sorted by categories and states, or keywords. Use US Legal Forms to obtain the South Carolina Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Owed to Lessor from Lessee under Lease with just a few clicks.

Every legal document template you purchase is yours indefinitely. You will have access to all the forms you saved within your account. Click on the My documents section and select a form to print or download again.

Stay competitive and download, and print the South Carolina Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Owed to Lessor from Lessee under Lease with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to locate the South Carolina Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Owed to Lessor from Lessee under Lease.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the steps below.

- Step 1. Ensure you have selected the form for your specific area/region.

- Step 2. Use the Preview option to review the form's content. Remember to check the overview.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other types within the legal document template.

- Step 4. Once you have found the form you need, click the Get now button. Choose your desired pricing plan and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Obtain the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the South Carolina Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Owed to Lessor from Lessee under Lease.

Form popularity

FAQ

Renters in South Carolina enjoy numerous rights, including the right to a safe and well-maintained living environment, fair treatment regarding rent increases, and protection against retaliatory eviction. Additionally, tenants have the right to request repairs and to challenge unfair lease terms. Familiarizing oneself with the South Carolina Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease can empower renters to assert their rights confidently.

In South Carolina, leases do not generally require notarization to be legally binding. However, certain lease terms may benefit from notarization for additional security and proof of conditions. For more clarity regarding lease agreements, including the South Carolina Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, consider utilizing platforms like uslegalforms to streamline the process.

In South Carolina, landlords are required to provide at least 30 days' notice before terminating a lease agreement, particularly for month-to-month leases. For other rental agreements, notice periods may vary based on the lease conditions. It’s beneficial to refer to the South Carolina Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease to fully comprehend notice requirements.

Renters in South Carolina maintain several essential rights, including the right to a habitable living space and protection against unjust eviction. Additionally, they have the right to privacy, meaning landlords must provide notice before entering the rental property. Awareness of the South Carolina Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease can help renters understand their entitlements and obligations.

In South Carolina, a guest can typically stay for a few days without being classified as a tenant. However, once the stay exceeds multiple weeks, the host may need to consider the legal implications of tenancy. Understanding the South Carolina Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease can clarify rights and responsibilities in such situations.

Where a lease of immoveable property has determined by forfeiture for non-payment of rent, and the lessor sues to eject the lessee, if, at the hearing of the suit, the lessee pays or tenders to the lessor the rent in arrear, together with interest thereon and his full costs of the suit, or gives such security as the

Liable to compensate mortgagee When the property is in possession of the mortgagee and the mortgagee incurs the property's taxes, the mortgagor is liable to pay the mortgagee's expenses. If the property is in the mortgagor's possession, he is liable to pay all the property taxes and public charges.

Rent payment: A lessee is bound to pay rent to the lessor or his agent on the specified dates and as per the agreed mode. Maintenance: A lessee is bound to maintain and restore the property to as good a condition as it was in at the time he was put in possession.

A lessor is essentially someone who grants a lease to someone else. As such, a lessor is the owner of an asset that is leased under an agreement to a lessee. The lessee makes a one-time payment or a series of periodic payments to the lessor in return for the use of the asset.

Through the rights and liabilities, it is clear that a lessor must disclose facts and shall avoid interruptions while the lessee is leased the property. A lessee, on the other hand, is bound to take reasonable care of the property and at the same time pay his/her rent.