South Carolina Affidavit of Amount Due on Open Account

Description

How to fill out Affidavit Of Amount Due On Open Account?

Finding the right authorized papers format might be a have a problem. Naturally, there are a variety of themes available on the net, but how would you find the authorized develop you want? Take advantage of the US Legal Forms site. The service gives 1000s of themes, like the South Carolina Affidavit of Amount Due on Open Account, that you can use for enterprise and private requirements. All of the types are inspected by pros and meet up with federal and state requirements.

When you are already signed up, log in to the accounts and then click the Down load button to get the South Carolina Affidavit of Amount Due on Open Account. Use your accounts to look from the authorized types you possess bought formerly. Go to the My Forms tab of your own accounts and have one more copy of your papers you want.

When you are a new consumer of US Legal Forms, listed below are easy directions for you to comply with:

- Initially, make sure you have selected the proper develop for your personal area/area. It is possible to check out the shape utilizing the Preview button and browse the shape description to guarantee it is the best for you.

- If the develop will not meet up with your preferences, utilize the Seach area to discover the right develop.

- Once you are positive that the shape is proper, click on the Acquire now button to get the develop.

- Choose the costs strategy you desire and enter in the necessary details. Design your accounts and pay for your order utilizing your PayPal accounts or Visa or Mastercard.

- Choose the data file file format and obtain the authorized papers format to the product.

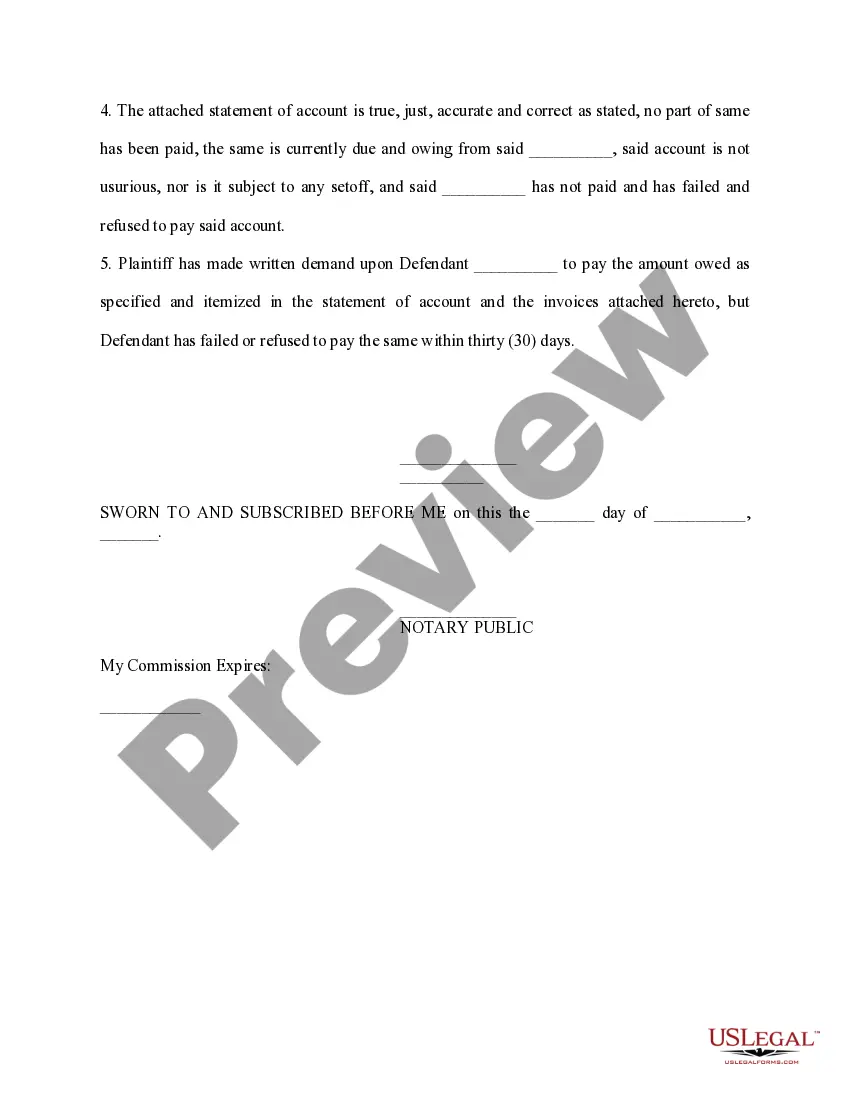

- Full, change and produce and signal the attained South Carolina Affidavit of Amount Due on Open Account.

US Legal Forms will be the biggest library of authorized types where you can see various papers themes. Take advantage of the service to obtain skillfully-made paperwork that comply with express requirements.

Form popularity

FAQ

Jurisdiction over minor offenses; restitution; contempt; maximum consecutive sentences. (A) Magistrates have jurisdiction of all offenses which may be subject to the penalties of a fine or forfeiture not exceeding five hundred dollars, or imprisonment not exceeding thirty days, or both.

SECTION 22-3-710. Proceedings commenced on information. All proceedings before magistrates in criminal cases shall be commenced on information under oath, plainly and substantially setting forth the offense charged, upon which, and only which, shall a warrant of arrest issue.

SC Judicial Branch. (a) Entry. When a party against whom a judgment for affirmative relief is sought has failed to plead or otherwise defend as provided by these rules and that fact is made to appear by affidavit or otherwise, the clerk shall enter his default upon the calendar (file book). (b) Judgment.

Cruelty to animals is defined as ?Maliciously and intentionally mains, mutilates, tortures, or wounds a living animal, or maliciously and intentionally kills an animal; or overdrives, overloads, drives when overloaded, overworks, tortures, torments, deprives of necessary sustenance, drink, or shelter, cruelly beats, ...

Section 22-3-10, as limited by § 22-3-20, sets out magisterial jurisdiction over fourteen areas of civil subject matter as follows: 1. Actions on contracts for the recovery of money, where the claim does not exceed $7,500.00; 2.

Under South Carolina Code § 16-11-510, Malicious Injury to Personal Property is where the defendant facing criminal charges allegedly acted with intent (intentionally) damages the personal possessions (property), goods, or chattel (common law term for personal items or property) that belong to another person.

Section 22-3-540 provides that magistrates (and by implication, municipal judges) have exclusive jurisdiction over all criminal cases in which the punishment does not exceed a fine of one hundred dollars or imprisonment for thirty days.

After the process server serves the papers, he or she must prepare an affidavit that they completed service of process. This affidavit must be notarized. File the affidavit with the Clerk of Court's office where the case is filed.