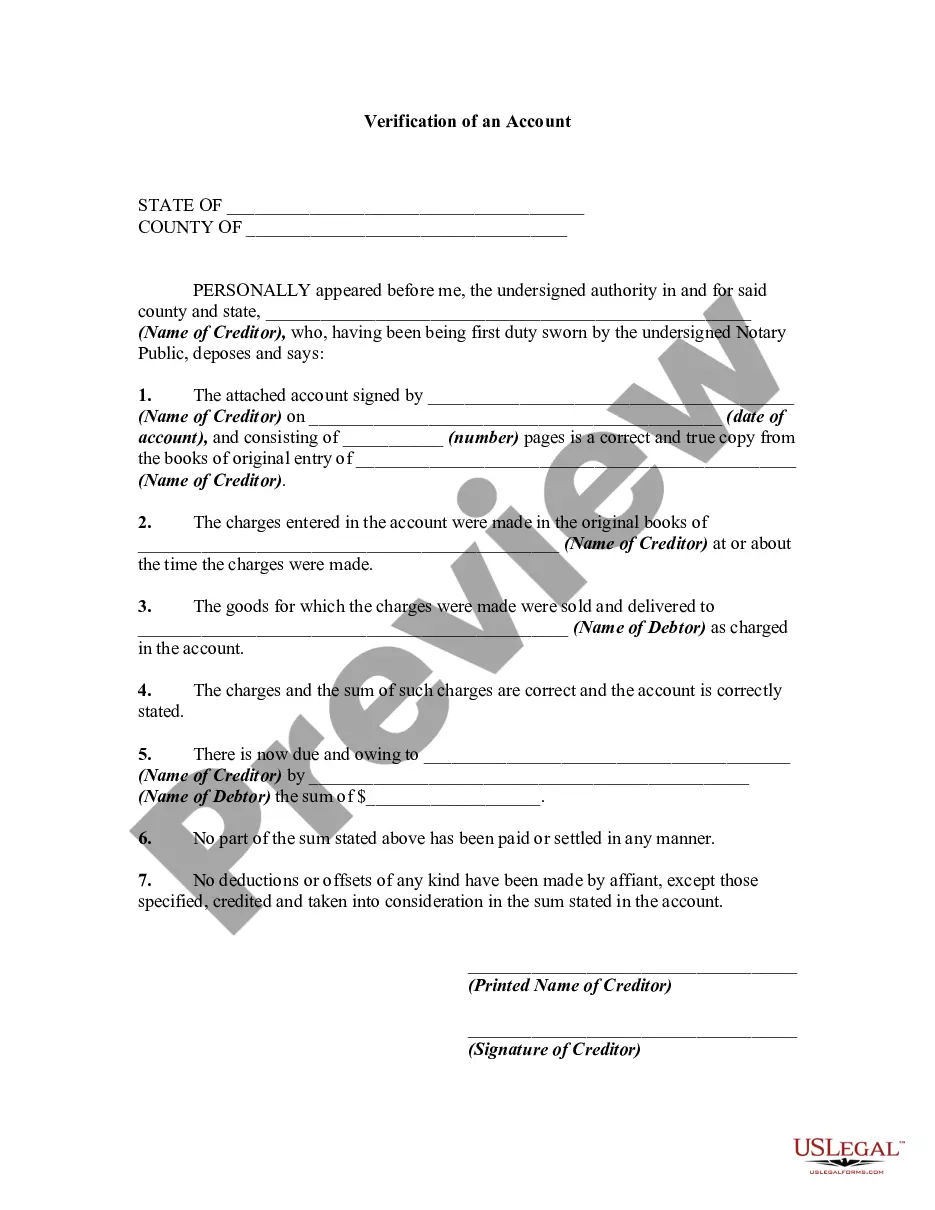

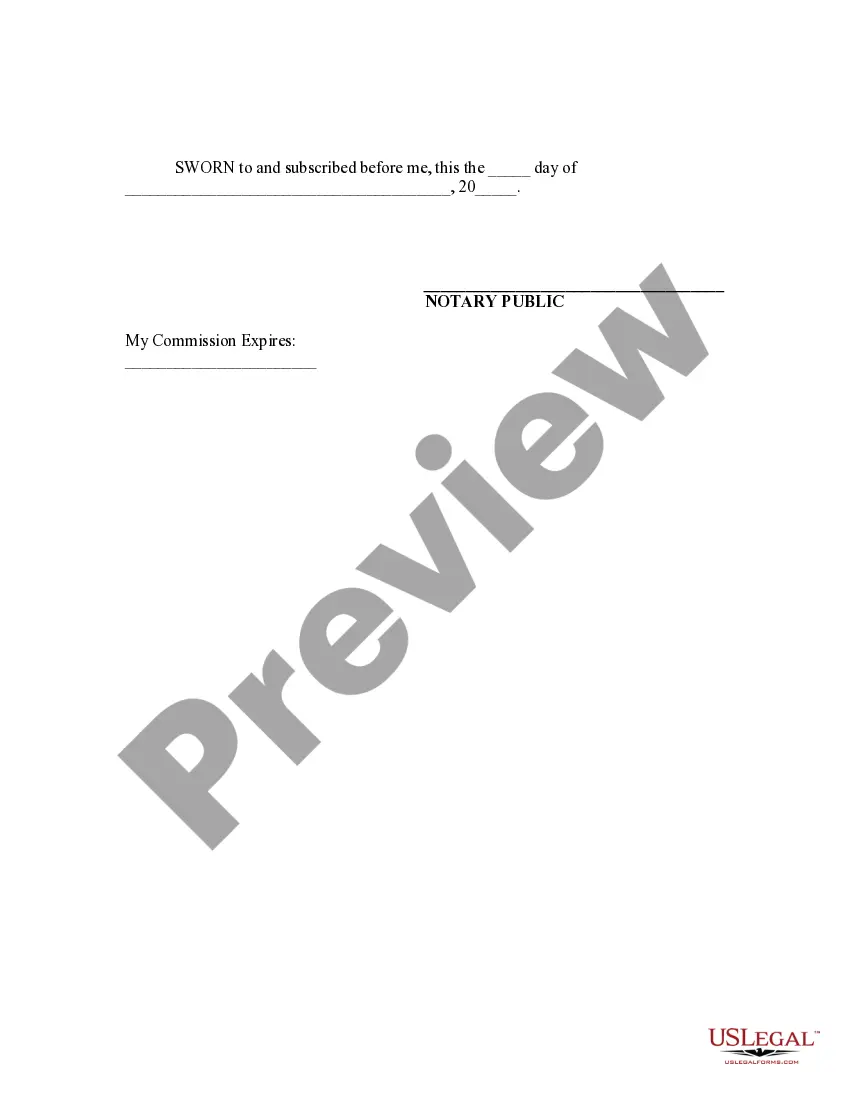

An account is an unsettled claim or demand by one person against another based on a transaction creating a debtor-creditor relationship between the parties. A verified account usually takes the form of an affidavit, in which a statement of an account is verified under oath as to the accuracy of the account. Ordinarily, where an action is based on an itemized account, the correctness of which is verified, the account is taken as true. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Carolina Verification of an Account is a process that entails verifying the accuracy and authenticity of financial accounts held by individuals or businesses in the state of South Carolina. It is typically conducted by financial institutions, regulatory bodies, or government agencies to ensure compliance with state laws and regulations, combat fraud, and protect consumers. The verification process involves thorough examination of account-related documents, transactions, and statements by authorized personnel. By doing so, the financial institution or regulatory body confirms the legitimacy of the account, evaluates the account holder's financial activities, and identifies any irregularities or potential risks. There are several types of South Carolina Verification of an Account, each serving specific purposes. These include: 1. Personal account verification: This type of verification is initiated by individuals who need to verify their own personal financial accounts, such as checking accounts, savings accounts, or credit card accounts. It may involve providing identification documents, account statements, and other relevant paperwork to prove ownership and authorize the verification process. 2. Business account verification: Primarily targeting business entities, this verification aims to establish the legitimacy of a company's financial accounts, including business bank accounts, merchant accounts, or corporate credit accounts. The verification may require submission of corporate documents, financial records, tax filings, and other supporting evidence. 3. AML (Anti-Money Laundering) account verification: Anti-money laundering regulations in South Carolina necessitate financial institutions to verify accounts more comprehensively when there are suspicions of illicit activities or potential money laundering. AML verification typically involves enhanced due diligence measures like conducting background checks, source of funds verification, and risk assessments. 4. Compliance account verification: As part of regulatory compliance frameworks, financial institutions may conduct periodic or random verifications of accounts to ensure adherence to banking policies, privacy regulations, and transparency standards. This verification type helps in assessing if the account holder complies with the institution's established rules and guidelines. 5. Fraud account verification: South Carolina Verification of an Account may also be prompted by suspicious activities, anomalies, or reported fraudulent incidents associated with an account. Financial institutions will investigate such claims, examine account-related evidence, and potentially freeze or close accounts if fraudulent activities are substantiated. It is essential for individuals and businesses in South Carolina to cooperate with the verification process as required by law. Non-compliance or failure to provide accurate information during the verification process may lead to consequences, such as freezing of account funds, termination of banking services, or legal actions. In conclusion, South Carolina Verification of an Account is a critical mechanism implemented to safeguard the state's financial system and protect consumers from fraudulent activities. By employing various verification types and ensuring compliance, financial institutions and regulatory bodies play a vital role in maintaining the integrity of the banking sector in South Carolina.South Carolina Verification of an Account is a process that entails verifying the accuracy and authenticity of financial accounts held by individuals or businesses in the state of South Carolina. It is typically conducted by financial institutions, regulatory bodies, or government agencies to ensure compliance with state laws and regulations, combat fraud, and protect consumers. The verification process involves thorough examination of account-related documents, transactions, and statements by authorized personnel. By doing so, the financial institution or regulatory body confirms the legitimacy of the account, evaluates the account holder's financial activities, and identifies any irregularities or potential risks. There are several types of South Carolina Verification of an Account, each serving specific purposes. These include: 1. Personal account verification: This type of verification is initiated by individuals who need to verify their own personal financial accounts, such as checking accounts, savings accounts, or credit card accounts. It may involve providing identification documents, account statements, and other relevant paperwork to prove ownership and authorize the verification process. 2. Business account verification: Primarily targeting business entities, this verification aims to establish the legitimacy of a company's financial accounts, including business bank accounts, merchant accounts, or corporate credit accounts. The verification may require submission of corporate documents, financial records, tax filings, and other supporting evidence. 3. AML (Anti-Money Laundering) account verification: Anti-money laundering regulations in South Carolina necessitate financial institutions to verify accounts more comprehensively when there are suspicions of illicit activities or potential money laundering. AML verification typically involves enhanced due diligence measures like conducting background checks, source of funds verification, and risk assessments. 4. Compliance account verification: As part of regulatory compliance frameworks, financial institutions may conduct periodic or random verifications of accounts to ensure adherence to banking policies, privacy regulations, and transparency standards. This verification type helps in assessing if the account holder complies with the institution's established rules and guidelines. 5. Fraud account verification: South Carolina Verification of an Account may also be prompted by suspicious activities, anomalies, or reported fraudulent incidents associated with an account. Financial institutions will investigate such claims, examine account-related evidence, and potentially freeze or close accounts if fraudulent activities are substantiated. It is essential for individuals and businesses in South Carolina to cooperate with the verification process as required by law. Non-compliance or failure to provide accurate information during the verification process may lead to consequences, such as freezing of account funds, termination of banking services, or legal actions. In conclusion, South Carolina Verification of an Account is a critical mechanism implemented to safeguard the state's financial system and protect consumers from fraudulent activities. By employing various verification types and ensuring compliance, financial institutions and regulatory bodies play a vital role in maintaining the integrity of the banking sector in South Carolina.