Barter is the trading of goods or services directly for other goods or services, without using money or any other similar unit of account or medium of exchange. Bartering is sometimes used among business as the method for the exchange of goods and services. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Carolina Bartering Contract or Exchange Agreement

Description

How to fill out Bartering Contract Or Exchange Agreement?

Locating the appropriate legal document template can be a challenge.

Of course, there is an assortment of templates accessible online, but how can you find the legal form you require.

Utilize the US Legal Forms website.

Firstly, ensure you have selected the correct form for your city/region. You can view the form using the Preview button and check the form details to confirm it is the right one for you.

- The service offers thousands of templates, including the South Carolina Bartering Contract or Exchange Agreement, that can serve both business and personal needs.

- All forms are validated by experts and meet state and federal standards.

- If you are already registered, Log In to your account and click the Acquire button to access the South Carolina Bartering Contract or Exchange Agreement.

- Use your account to search for the legal forms you have previously purchased.

- Go to the My documents tab of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions you should follow.

Form popularity

FAQ

Yes, the IRS recognizes bartering as a legitimate form of trade. However, it is essential to report the fair market value of the goods or services exchanged as income. Using a South Carolina Bartering Contract or Exchange Agreement can help document the transaction properly, aiding in accurate reporting to the IRS. This way, you can enjoy the benefits of bartering while staying compliant with tax regulations.

For a barter exchange to occur, both parties must agree on the value of the items or services being exchanged. Clear communication and mutual consent are crucial to creating a successful transaction. A South Carolina Bartering Contract or Exchange Agreement can help solidify the terms and expectations, ensuring that both parties are satisfied. This agreement can prevent misunderstandings and maintain a positive relationship.

Indeed, bartering continues to be a viable option for many individuals and businesses today. With the rise of online platforms, people can easily trade goods and services without monetary exchange. Engaging in a South Carolina Bartering Contract or Exchange Agreement can help facilitate these transactions, making the process smoother and more efficient. You might find that bartering opens doors to valuable opportunities.

Yes, bartering does count as income according to the IRS. When you engage in a South Carolina Bartering Contract or Exchange Agreement, the fair market value of the goods or services exchanged is considered taxable income. It is crucial to accurately report this income on your tax return to comply with state and federal regulations. Keeping detailed records of each barter transaction will ensure you remain in good standing with tax authorities.

The law on bartering varies by state, but generally, bartering is legal as long as both parties agree to the terms. In South Carolina, a Bartering Contract or Exchange Agreement must comply with applicable laws, including those governing contracts. It's essential to ensure that both parties fully understand their obligations and rights to avoid any legal issues. Consulting with a legal professional can help clarify the specifics of your bartering agreement.

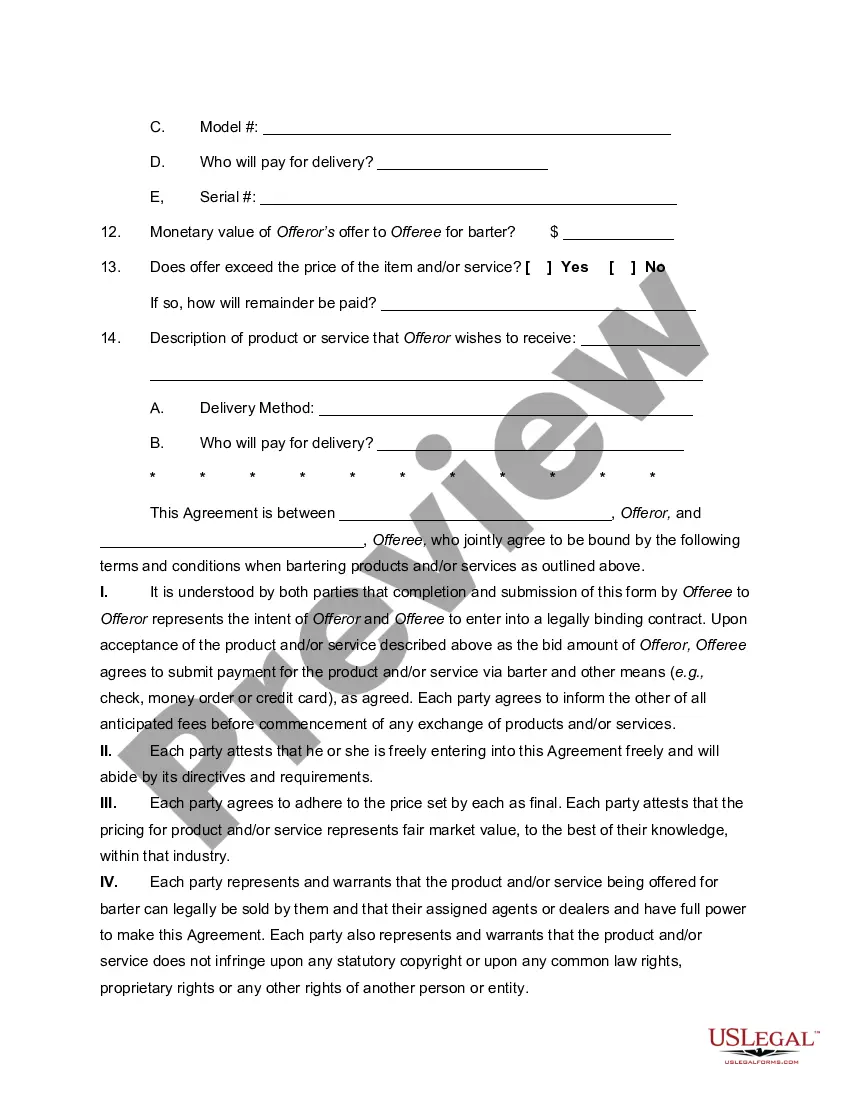

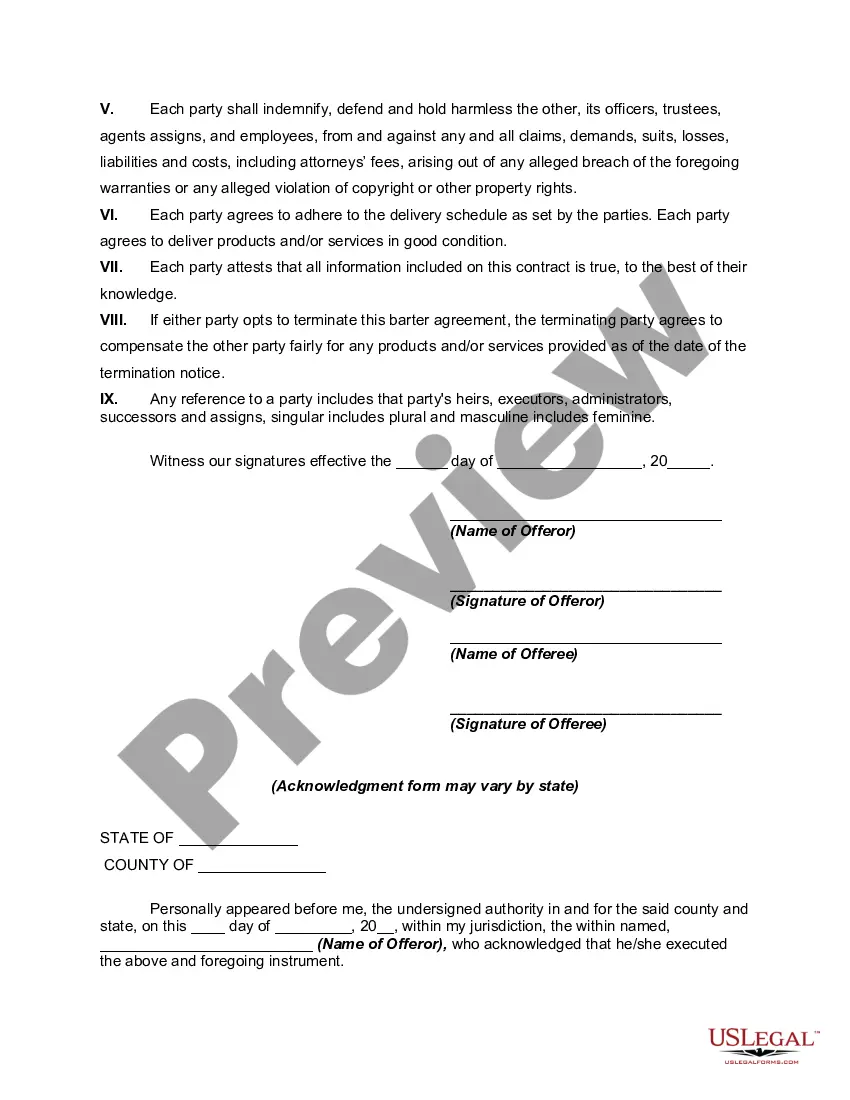

To write an effective barter agreement, start by clearly identifying the parties involved, including their full names and contact information. Next, outline the items or services being exchanged, ensuring to specify their value. You should also include the terms of the exchange, such as delivery dates, conditions for the transaction, and any follow-up obligations. By utilizing a South Carolina Bartering Contract or Exchange Agreement template from uslegalforms, you can ensure all key aspects are covered.

Bartering is not illegal in the US; it is a legitimate form of trade as long as both parties agree to the terms. However, it is important to note that bartered goods or services must still be reported as income on tax returns. Utilizing a South Carolina Bartering Contract or Exchange Agreement can ensure your arrangement is compliant with local regulations.

An agreement between a buyer and a seller should include details such as the identities of both parties, a description of the item or service being sold, and the payment terms. If the agreement involves bartering, consider including the value of the goods or services being exchanged. A well-formulated South Carolina Bartering Contract or Exchange Agreement can significantly enhance clarity for both parties.

To write a barter agreement, start with a clear title and the names of the parties involved. Specify the goods or services being exchanged, their agreed-upon values, and the terms of the agreement, such as delivery dates. Creating a comprehensive South Carolina Bartering Contract or Exchange Agreement ensures that both parties are on the same page.

The rules for bartering generally require that both parties enter into the agreement voluntarily and agree on the value of the items being exchanged. Additionally, both parties responsible for reporting their earned income from bartering must adhere to IRS guidelines. A South Carolina Bartering Contract or Exchange Agreement can help clarify these rules and keep the exchange transparent.