South Carolina Owner Financing Contract for Land is a legally binding agreement between a property owner and a buyer, wherein the owner provides financing for the purchase of land in South Carolina. This type of financing eliminates the need for a traditional mortgage lender, allowing individuals with limited access to conventional financing options to acquire property. One of the main benefits of South Carolina Owner Financing Contract for Land is that it offers greater flexibility and opportunity for individuals who may not qualify for a traditional loan due to poor credit history, self-employment status, or other financial constraints. This contract allows the buyer and owner to negotiate the terms of the loan, including the purchase price, down payment, interest rate, repayment schedule, and any other conditions specific to the transaction. There are two primary types of South Carolina Owner Financing Contracts for Land: 1. Contract for Deed: Also known as a land contract or installment contract, this type of owner financing agreement allows the buyer to occupy and use the land while making regular payments directly to the owner. However, the owner retains legal title to the property until the buyer completes the payment obligations. Once the payments are complete, the owner transfers the legal title to the buyer. 2. Promissory Note and Mortgage: In this type of owner financing, the buyer signs a promissory note detailing the amount borrowed, interest rate, repayment schedule, and other terms. Simultaneously, the buyer grants a mortgage on the property to secure the loan, providing the owner with a legal right to foreclose if the buyer defaults on payments. Once the loan is fully repaid, the mortgage is released, transferring complete ownership to the buyer. It's important to note that South Carolina Owner Financing Contracts for Land should be drafted by qualified professionals, such as real estate attorneys, to ensure compliance with state laws and protect the interests of both parties involved. These contracts typically include clauses covering default remedies, property maintenance responsibilities, insurance requirements, and dispute resolution procedures. In conclusion, South Carolina Owner Financing Contract for Land provides an alternative financing option for individuals interested in purchasing land but facing limitations with traditional mortgage lenders. Whether through a Contract for Deed or a Promissory Note and Mortgage, owner financing allows buyers and owners to negotiate terms and achieve their real estate goals while bypassing the usual stringent borrowing criteria. However, it is crucial to seek legal advice to draft a comprehensive and enforceable agreement to safeguard the interests of all parties involved.

South Carolina Owner Financed Properties For Sale

Description land for sale in south carolina owner financing

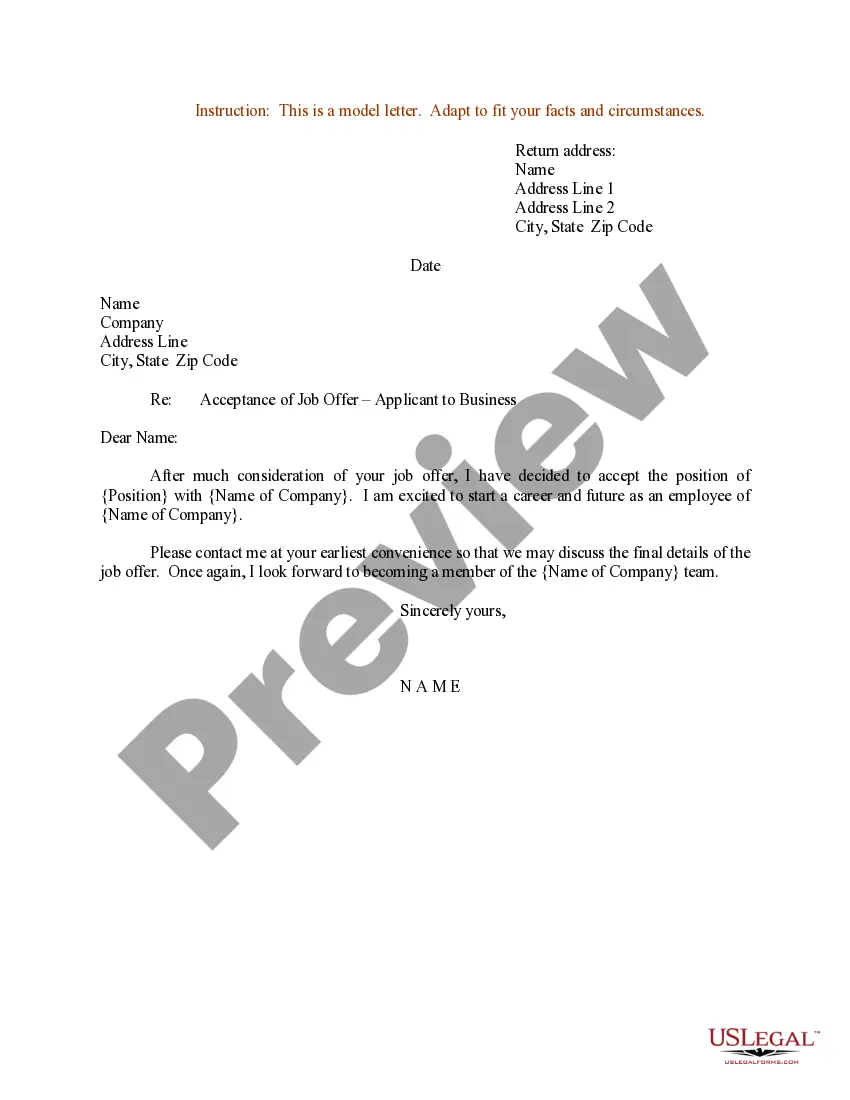

How to fill out South Carolina Owner Financing Contract For Land?

Discovering the right legal document format might be a have a problem. Needless to say, there are tons of web templates available on the net, but how can you find the legal develop you want? Utilize the US Legal Forms internet site. The assistance delivers thousands of web templates, for example the South Carolina Owner Financing Contract for Land, which you can use for organization and personal demands. All of the forms are checked out by specialists and fulfill federal and state specifications.

When you are previously signed up, log in to the profile and then click the Download switch to have the South Carolina Owner Financing Contract for Land. Use your profile to look throughout the legal forms you possess acquired previously. Go to the My Forms tab of the profile and obtain yet another duplicate of your document you want.

When you are a whole new user of US Legal Forms, allow me to share basic instructions that you can adhere to:

- Very first, be sure you have selected the right develop to your area/county. You can look through the form while using Preview switch and look at the form explanation to make sure it will be the best for you.

- In case the develop does not fulfill your requirements, make use of the Seach area to discover the appropriate develop.

- Once you are positive that the form is acceptable, go through the Buy now switch to have the develop.

- Pick the pricing prepare you desire and type in the needed information. Design your profile and pay for the order using your PayPal profile or Visa or Mastercard.

- Opt for the submit format and obtain the legal document format to the device.

- Full, edit and print and indicator the attained South Carolina Owner Financing Contract for Land.

US Legal Forms is the greatest local library of legal forms where you will find various document web templates. Utilize the company to obtain professionally-created files that adhere to express specifications.

owner financing contract for deed Form popularity

FAQ

Owner financing is also referred to as 'seller financing.' This term emphasizes the role of the seller in providing financial assistance to the buyer directly. Recognizing the term 'seller financing' can simplify your search and discussions regarding South Carolina Owner Financing Contracts for Land, making the buying process more straightforward.

The main difference lies in the possession of the title. In a land contract, the seller retains the title until full payment is made, while owner financing often involves transferring the title to the buyer with a promissory note. This distinction is crucial for potential buyers interested in South Carolina Owner Financing Contracts for Land, as it influences both rights and responsibilities.

Another common term for a land contract is a 'contract for deed.' This alternative term highlights the similar principle of selling property while the buyer makes periodic payments. Understanding the term 'contract for deed' is essential when navigating South Carolina Owner Financing Contracts for Land, as it can affect your negotiations and agreements.

Owner financing is often associated with a land contract, but they are not identical. In a land contract, the seller retains the title to the property until the buyer fulfills the payment obligations. This arrangement creates a unique dynamic in South Carolina Owner Financing Contracts for Land, allowing buyers to invest in property without traditional bank financing.

Yes, you can write your own land contract, but it is crucial to follow state guidelines to avoid legal issues. Your South Carolina Owner Financing Contract for Land should clearly state all terms, conditions, and responsibilities of each party involved. However, to ensure accuracy and compliance, using a professional resource like uslegalforms can help streamline the process.

Writing an owner finance contract begins with including key elements such as buyer and seller information, property details, and payment terms. Make sure to outline consequences for payment defaults, and include any seller obligations. A well-crafted South Carolina Owner Financing Contract for Land helps clarify these details. Consider templates from uslegalforms to ensure you cover all necessary points.

To do owner financing on land, start by agreeing on terms with the buyer, including down payment, interest rate, and repayment schedule. Next, draft a South Carolina Owner Financing Contract for Land that details all agreed terms to protect both parties. It is essential to consult relevant laws in South Carolina to ensure your contract complies. Using a platform like uslegalforms can provide templates to simplify this process.

One downside of owner financing is that it may come with higher interest rates compared to traditional mortgages, which can increase overall costs. Additionally, sellers may carry some risk, such as a buyer defaulting on payments. It's essential to weigh these risks carefully and consider drafting a clear and comprehensive South Carolina Owner Financing Contract for Land to protect both parties.

Getting financing for land often involves exploring various options, including traditional bank loans, private lenders, and owner financing contracts. You should assess your financial readiness and be prepared to present a solid plan to potential lenders. Additionally, platforms like USLegalForms can help you create necessary documents, such as a South Carolina Owner Financing Contract for Land, making the process smoother.

To obtain owner financing on land, you should start by identifying suitable properties and discussing financing options with the seller. Clearly communicate your financial situation, and be prepared to negotiate terms like down payment and interest rates. Many sellers are open to creative financing options, so maintaining a positive dialogue can lead to a successful agreement.

Interesting Questions

More info

Free Sign with Paradox Free Download Owner Financing Contract Template Complete Sign Agreement Terms Sign Up for Free Sign up here for an owner financing contract template from Paradox. This is our most popular template and comes with all the details necessary to build an agreement with your clients. Complete terms for the form are included in the template, just fill them in.