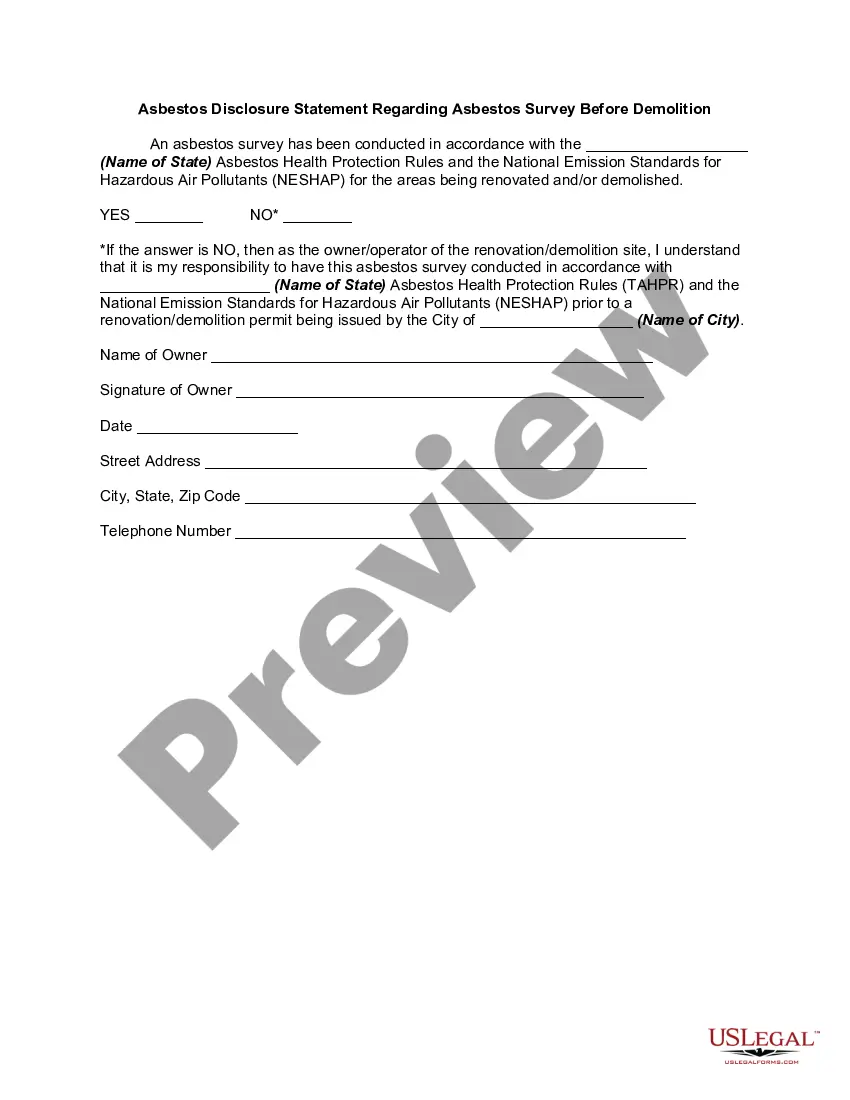

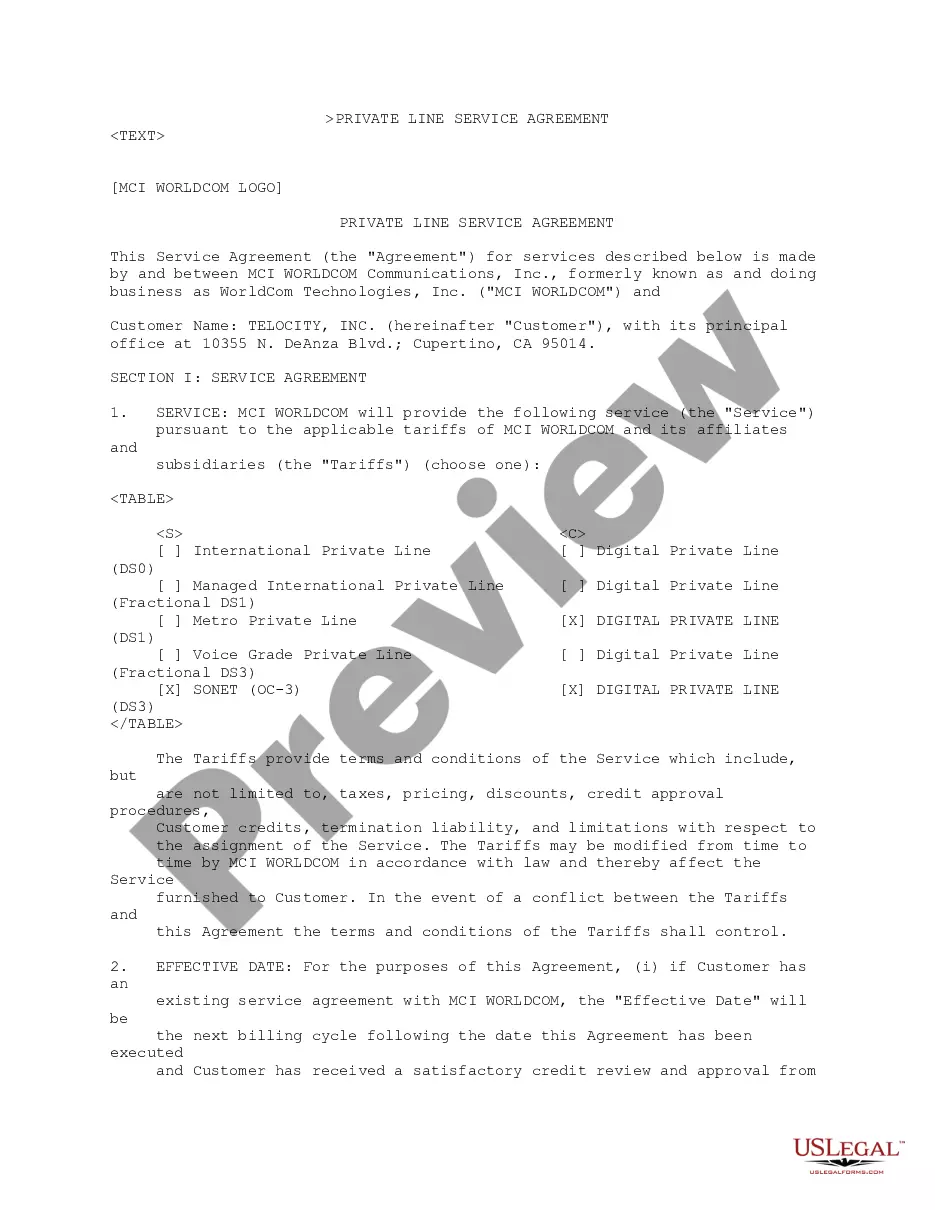

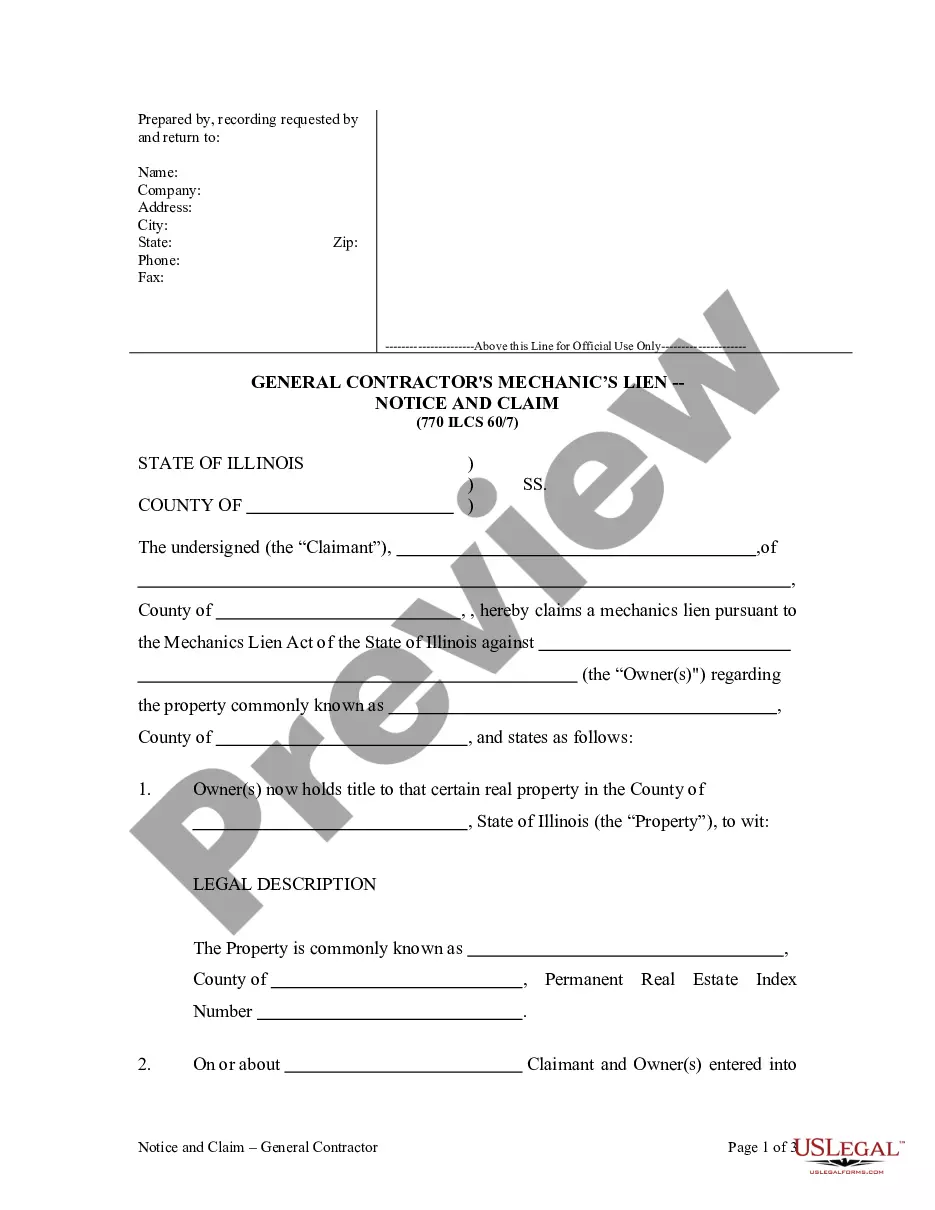

A South Carolina Owner Financing Contract for Home is a legal agreement between a seller and a buyer in the state of South Carolina, where the seller acts as the lender and the buyer makes installment payments directly to the seller instead of obtaining a traditional mortgage from a bank or other financial institution. This type of financing arrangement is often sought after by buyers who may not qualify for a conventional loan or want to bypass the strict requirements and lengthy approval process. Keywords: South Carolina, Owner Financing, Contract, Home, seller, buyer, legal agreement, lender, installment payments, traditional mortgage, financing arrangement, conventional loan. Different Types of South Carolina Owner Financing Contracts for Home: 1. Installment Sale Agreement: This is the most common type of owner financing contract for homes in South Carolina. It outlines the terms and conditions of the agreement, including the purchase price, interest rate, repayment schedule, and any additional terms negotiated between the parties. 2. Land Contract: A land contract, also known as a contract for deed or a land installment contract, is a type of owner financing where the seller retains legal title to the property until the buyer fulfills the terms of the contract. Once all payments are made, the buyer receives the deed to the property. 3. Lease Option Agreement: This type of owner financing contract combines a lease agreement and an option to purchase. The buyer will lease the property for a specific period with an option to buy it at a predetermined price within a certain time frame. A portion of the lease payments may be credited towards the purchase price. 4. Equity Share Agreement: In an equity share agreement, the seller finances a portion of the home's purchase price while the buyer secures a conventional mortgage for the remaining amount. The seller and the buyer then become co-owners of the property, sharing equity and profits. This type of contract can benefit buyers with limited funds for a down payment. 5. Contract for Deed: Similar to a land contract, a contract for deed gives the buyer immediate possession of the property but delays the transfer of legal title until full payment is made. The buyer makes regular payments to the seller, who retains legal ownership until the contract is fulfilled. It is important for both the seller and the buyer to carefully review and understand the terms and conditions outlined in the South Carolina Owner Financing Contract for Home before entering into the agreement. Consulting with a real estate attorney or a knowledgeable professional can help ensure that all legal requirements are met and that the interests of both parties are protected.

Owner Finance Contract

Description owner finance house contract

How to fill out Owner Financing Agreement Template?

You are able to invest time online looking for the authorized file template that fits the state and federal requirements you require. US Legal Forms gives a large number of authorized kinds that happen to be reviewed by professionals. You can actually acquire or print the South Carolina Owner Financing Contract for Home from the service.

If you already possess a US Legal Forms accounts, you are able to log in and then click the Download option. Next, you are able to total, revise, print, or indicator the South Carolina Owner Financing Contract for Home. Each and every authorized file template you purchase is your own property permanently. To get one more version for any obtained form, check out the My Forms tab and then click the corresponding option.

If you are using the US Legal Forms web site for the first time, keep to the easy guidelines listed below:

- Initial, be sure that you have selected the correct file template for that area/metropolis of your liking. See the form information to ensure you have chosen the proper form. If readily available, utilize the Review option to appear with the file template too.

- In order to locate one more variation in the form, utilize the Lookup industry to get the template that fits your needs and requirements.

- After you have located the template you desire, simply click Purchase now to continue.

- Choose the rates prepare you desire, enter your credentials, and register for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You can use your credit card or PayPal accounts to purchase the authorized form.

- Choose the formatting in the file and acquire it to the product.

- Make alterations to the file if needed. You are able to total, revise and indicator and print South Carolina Owner Financing Contract for Home.

Download and print a large number of file templates using the US Legal Forms site, which provides the most important selection of authorized kinds. Use professional and status-specific templates to take on your business or personal needs.

land for sale in south carolina owner financing Form popularity

seller finance contract Other Form Names

typical contract for deed terms FAQ

If the buyer defaults on the South Carolina Owner Financing Contract for Home, the seller can initiate foreclosure proceedings to reclaim the property. Default can lead to the buyer losing any equity built up in the home, which emphasizes the importance of understanding the terms before signing. The seller often has the right to keep any payments made prior to the default as compensation. Thus, both parties should carefully consider their financial situation and commitments.

A South Carolina Owner Financing Contract for Home has disadvantages to consider. For starters, the buyer does not gain full legal ownership until fulfilling the contract, which may discourage future investment in the property. Additionally, buyers might face higher costs if they fail to comply with the contract terms, leading to financial loss.

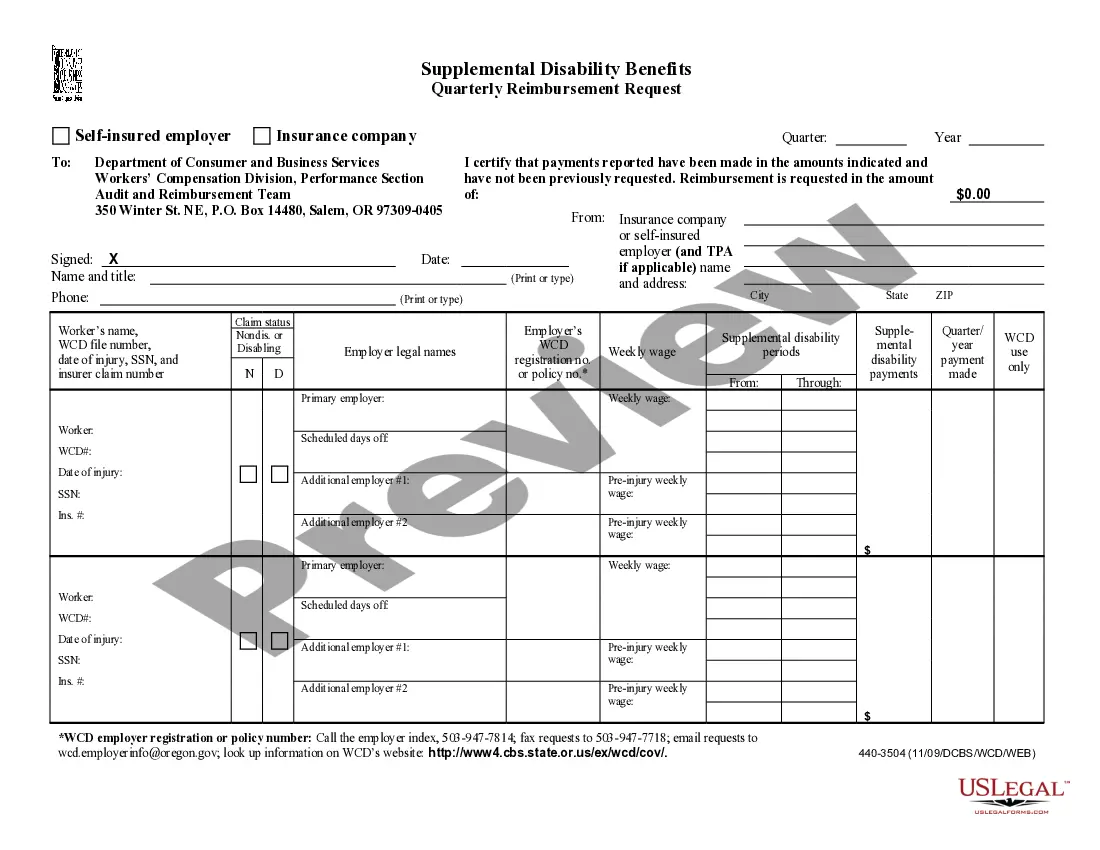

Writing a finance contract requires clear terms outlining payment schedules, interest rates, and responsibilities under a South Carolina Owner Financing Contract for Home. Start with the identifying details of both parties and describe the property involved. Include terms for default and any legal obligations to ensure clarity for both the buyer and the seller.

The interest rate on a South Carolina Owner Financing Contract for Home can vary widely based on the agreement between the buyer and seller. Generally, this range can be higher than conventional rates, reflecting the increased risk taken by the seller. Buyers should research current market rates to negotiate a fair interest.

Under a South Carolina Owner Financing Contract for Home, the buyer usually assumes responsibility for property taxes. This arrangement is typical as the buyer is using the property as their own. However, it's wise for both parties to clarify payment responsibilities in the contract to avoid any unexpected issues.

Foreclosing on an owner-financed property under a South Carolina Owner Financing Contract for Home requires understanding the state's laws regarding contracts. Typically, the seller can initiate a foreclosure if the buyer defaults on their obligations. This process involves providing proper notice and may require legal assistance to navigate effectively.

Using a South Carolina Owner Financing Contract for Home can be beneficial, especially for buyers with limited access to traditional financing. However, it is crucial to assess the terms of the contract, including payment schedules and obligations. Ultimately, if crafted correctly, it can be a fair solution for both buyers and sellers.

People might choose owner financing for various reasons, including easier qualification, flexibility in terms, or faster closing times. Sellers can also benefit by attracting more buyers and securing ongoing income through interest payments. Overall, owner financing offers unique advantages that cater to diverse financial needs.

Writing an owner finance contract involves several key elements, starting with the basic details of both parties and the property. Clearly define the financing terms, including payment schedules, interest rates, and any penalties for late payments. Consider using templates from reliable platforms like U.S. Legal Forms to ensure that your contract meets all legal requirements.

Several issues can arise with seller financing, such as undisclosed property defects or unfulfilled promises regarding repairs. If the buyer defaults on payments, the seller may face prolonged legal battles to reclaim the property. To minimize these risks, it’s essential to draft a clear and legal South Carolina Owner Financing Contract for Home.