Have you been inside a position that you require files for either business or personal reasons virtually every day time? There are plenty of lawful file layouts available on the net, but getting kinds you can rely on isn`t simple. US Legal Forms offers 1000s of form layouts, much like the South Carolina Result of Investigation of Disputed Credit Information and Disclosure of Consumer Rights in Event of Continued Dispute, that happen to be created to meet state and federal specifications.

When you are already familiar with US Legal Forms web site and possess your account, simply log in. Afterward, you are able to acquire the South Carolina Result of Investigation of Disputed Credit Information and Disclosure of Consumer Rights in Event of Continued Dispute template.

Should you not have an profile and want to begin to use US Legal Forms, follow these steps:

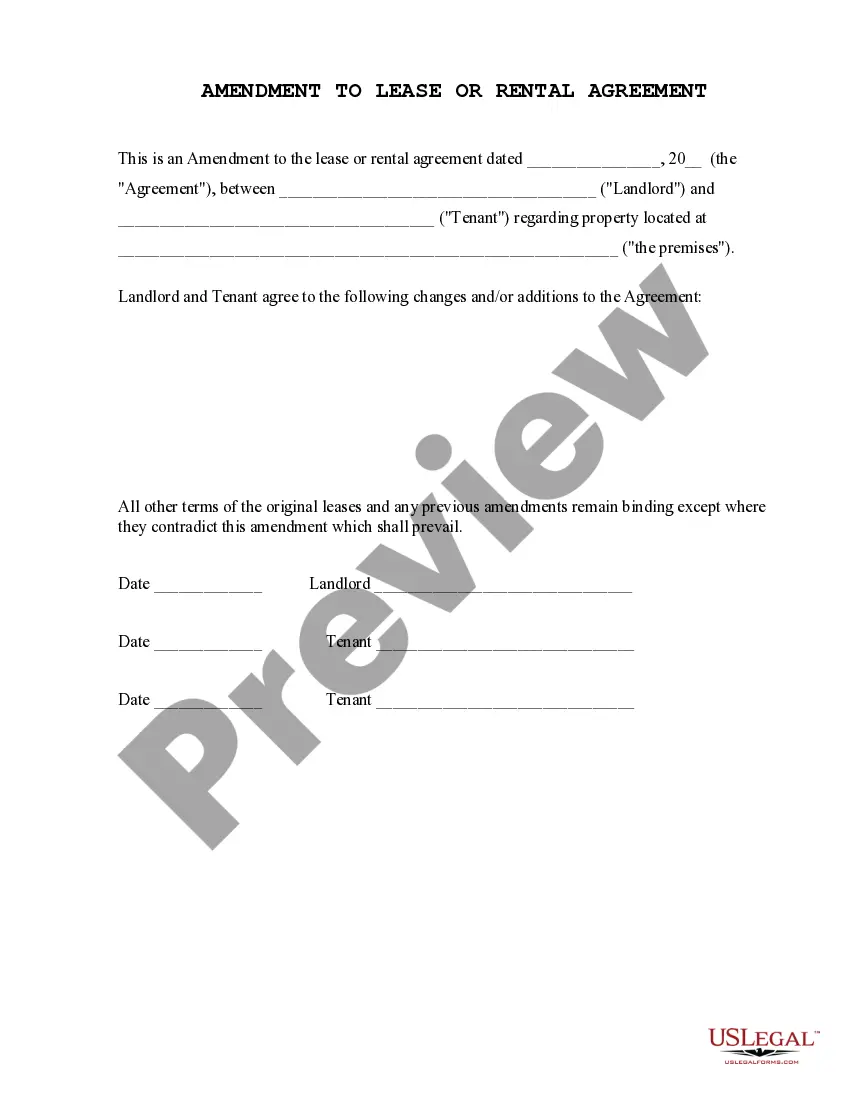

- Discover the form you will need and make sure it is for the appropriate area/region.

- Use the Review option to analyze the form.

- Browse the explanation to ensure that you have chosen the right form.

- In the event the form isn`t what you are searching for, take advantage of the Look for industry to discover the form that suits you and specifications.

- If you obtain the appropriate form, click Acquire now.

- Select the rates program you desire, fill out the desired info to produce your account, and pay for an order utilizing your PayPal or bank card.

- Decide on a handy document formatting and acquire your version.

Get every one of the file layouts you might have bought in the My Forms food selection. You can aquire a more version of South Carolina Result of Investigation of Disputed Credit Information and Disclosure of Consumer Rights in Event of Continued Dispute whenever, if possible. Just click on the required form to acquire or print the file template.

Use US Legal Forms, probably the most extensive variety of lawful forms, to conserve time and steer clear of errors. The support offers skillfully created lawful file layouts that you can use for a variety of reasons. Create your account on US Legal Forms and initiate creating your lifestyle easier.

(i) in the case of a consumer credit sale, consumer lease, or consumer rental-purchase agreement, knowledge by the seller or lessor at the time of the sale ... For the purpose of making the report, the administrator is authorized to conduct research and make appropriate studies, the report shall include a description ...(1) Conduct a reasonable investigation with respect to the disputed information; ... (3) Complete its investigation of the dispute and report the results of the ... (III) a notice that the consumer has the right to add a statement to the consumer's file disputing the accuracy or completeness of the disputed information. Result of investigation of disputed credit information—Disclosure of consumer rights in event of continued dispute. This content is locked. Nov 10, 2022 — The CFPB is aware that consumer reporting agencies and furnishers have sought to evade the obligation to investigate disputes by requiring ... Report the results of the investigation to the consumer reporting agency; and ... Complete its investigation of the dispute and report the results of the ... Oct 2, 2023 — File a complaint: The complaint process begins when you submit a complaint using the online NCUA Consumer Assistance Form or the PDF version to ... Include the reason for the determination and, if relevant, any information the consumer needs to submit so you can investigate the disputed information. ... consumer information is accurate, precise, and complete in credit reports. Online dispute exchanges were stood up by our members as well. Fraud alerts and ...