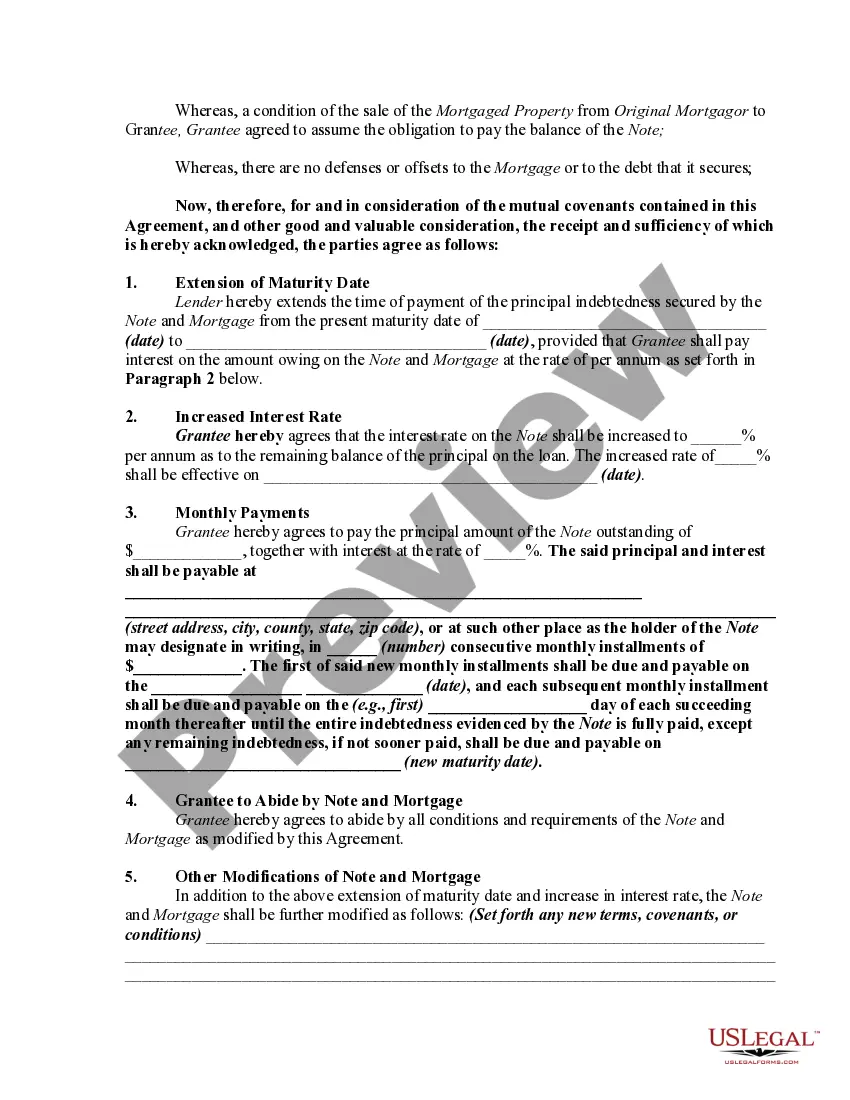

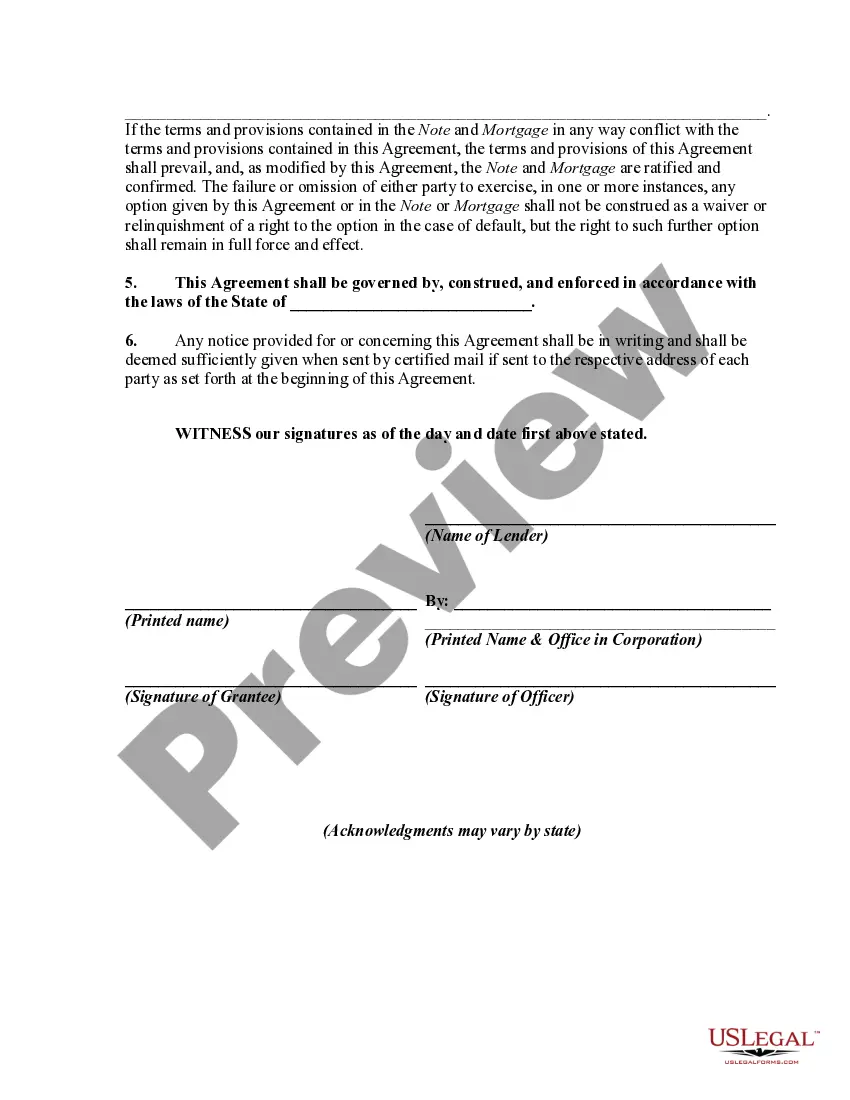

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Carolina Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest

Description

How to fill out Mortgage Extension Agreement With Assumption Of Debt By New Owner Of Real Property Covered By The Mortgage And Increase Of Interest?

Are you presently in a placement the place you need to have files for both business or individual functions just about every day? There are a lot of legitimate record themes available on the Internet, but locating versions you can trust is not straightforward. US Legal Forms offers a huge number of type themes, much like the South Carolina Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest, that are created to satisfy state and federal specifications.

If you are currently familiar with US Legal Forms website and have a free account, basically log in. Following that, it is possible to obtain the South Carolina Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest design.

Should you not provide an bank account and need to start using US Legal Forms, adopt these measures:

- Get the type you need and ensure it is to the correct metropolis/area.

- Make use of the Preview button to examine the form.

- See the explanation to ensure that you have chosen the correct type.

- When the type is not what you`re searching for, take advantage of the Search discipline to find the type that meets your needs and specifications.

- Once you get the correct type, click on Get now.

- Select the rates prepare you desire, submit the specified details to create your money, and pay for an order using your PayPal or bank card.

- Select a practical document file format and obtain your version.

Discover each of the record themes you might have purchased in the My Forms food selection. You can obtain a additional version of South Carolina Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest whenever, if required. Just select the essential type to obtain or print the record design.

Use US Legal Forms, by far the most comprehensive assortment of legitimate kinds, to save lots of time as well as avoid faults. The services offers expertly manufactured legitimate record themes which you can use for a range of functions. Produce a free account on US Legal Forms and commence producing your daily life a little easier.

Form popularity

FAQ

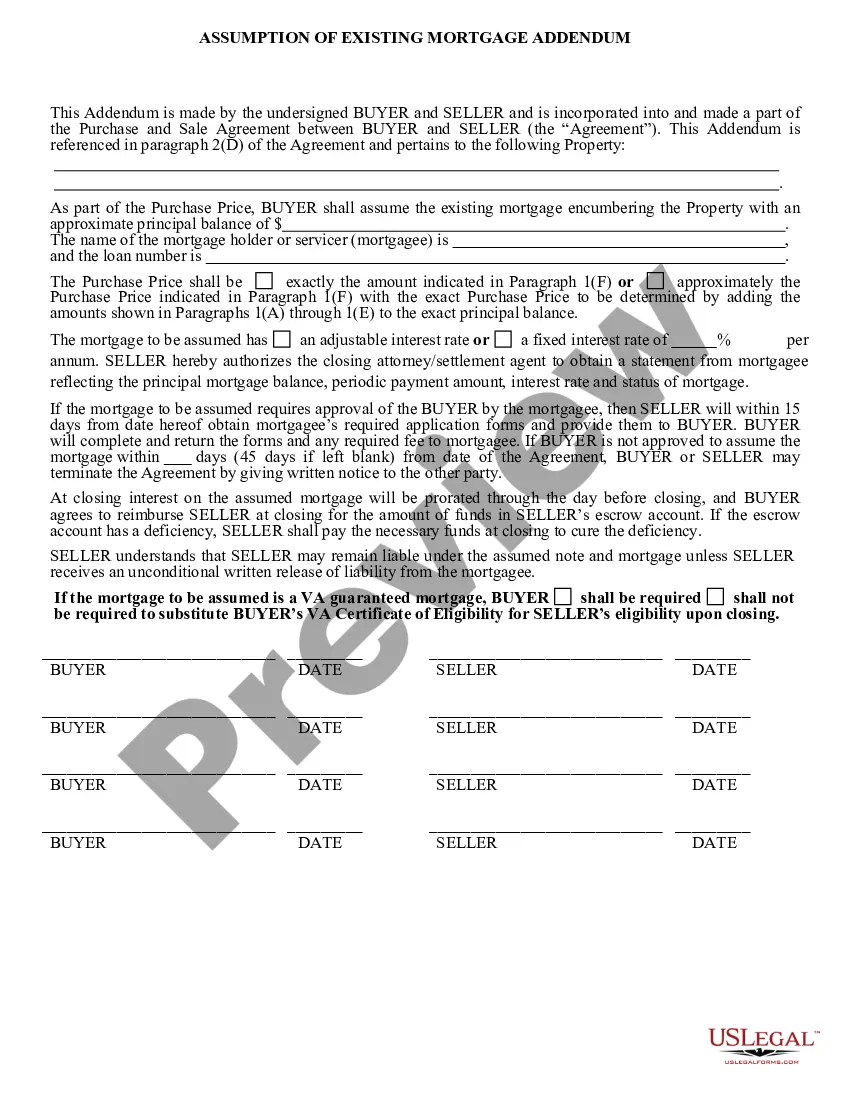

How do assumable mortgages work? When you assume a mortgage, the current borrower signs the balance of their loan over to you, and you become responsible for the remaining payments. That means the mortgage will have the same terms the previous homeowner had, including the same interest rate and monthly payments.

How does the loan assumption process work? Getting approved to assume a loan is similar to getting approved for a new mortgage. You will need to complete an application, provide documents, and meet the lender's credit, income, and financial requirements to get the loan assumption approved.

An assumption agreement, sometimes called an assignment and assumption agreement, is a legal document that allows one party to transfer rights and/or obligations to another party. It allows one party to "assume" the rights and responsibilities of the other party.

Loan assumption, however, allows a buyer to take over the current owner's mortgage while the loan's terms ? including the repayment period and interest rate ? remain the same. Ultimately, it can help people get into a home at a lower interest rate even as the housing market around them becomes more expensive.

An assumable mortgage allows a homebuyer to assume the current principal balance, interest rate, repayment period, and any other contractual terms of the seller's mortgage. Rather than going through the rigorous process of obtaining a home loan from the bank, a buyer can take over an existing mortgage.

Lenders must typically approve an assumable mortgage. If done without approval, sellers run the risk of having to pay the full remaining balance upfront. Sellers also risk buyers missing payments, which can negatively impact their credit score.

Chapter 23 - High-cost And Consumer Home Loans. Section 37-23-70. Prohibited acts; complaints; penalties; statute of limitations; enforcement; costs. (A) A lender may not engage knowingly or intentionally in the unfair act or practice of "flipping" a consumer home loan.

Keep in mind that the average loan assumption takes anywhere from 45-90 days to complete. The more issues there are with underwriting, the longer you'll have to wait to finalize your agreement.