Subject: Urgent Final Notice Before Legal Action — Demand for Payment Dear [Debtor's Name], We hope this letter finds you well. However, we regret to inform you that your outstanding payment in the amount of [Amount Owed] is now seriously overdue. Despite previous attempts to amicably address this matter, we have not yet received any payment or a response from you. This letter serves as a final notice before initiating legal action against you to recover the debt owed. It is important to highlight that South Carolina law provides a legal basis for pursuing legal actions to collect unpaid debts. Failure to address this issue promptly will leave us with no choice but to move forward with the necessary legal proceedings. To recap, the following details pertain to the debt in question: — [Invoice/Payment Reference]: [Include relevant information such as invoice number, date, and any other reference numbers specified in previous communication] — [Description of Services/Products Provided]: [Provide a clear description of the goods or services provided, ensuring accuracy in order to avoid any potential misunderstandings] — [Agreed Payment Terms]: [Indicate the agreed-upon payment terms, including due date, payment method, and any applicable late fees or interest charges] Despite our repeated reminders and attempts to reach a resolution, there has been no communication or payment from your side. This lack of response is both surprising and disappointing, as our previous interactions have indicated a commitment to resolving this matter promptly. We strongly urge you to take immediate action to pay the outstanding debt to prevent further legal consequences. Failure to do so may result in the following actions: 1. Collection Agency Involvement — We may engage a professional collection agency to assist us in recovering the debt. You will be liable for any additional collection fees incurred. 2. Credit Reporting — We may report the outstanding debt to major credit reporting agencies, which could have a severe impact on your credit rating and future creditworthiness. 3. Legal Action — We will have no choice but to pursue legal action against you to obtain a court judgment if the amount remains unpaid. This may result in additional costs, including but not limited to legal fees, court expenses, and interest charges. We strongly encourage you to reach out to us within [number of days, typically 7-10 days] of receiving this letter to discuss payment arrangements or any additional information necessary to clear this overdue account. We believe that resolving this matter amicably is in the best interest of both parties and will save both time and resources. Please note that ignoring this letter will only further deteriorate our relationship and may negatively impact your financial standing moving forward. To avoid any miscommunication, it is essential that all future correspondence regarding this matter be in writing. You can contact us by replying to this letter or by calling our offices at [Your Contact Information]. We sincerely hope that it does not come to legal action and that we can resolve this matter promptly. We look forward to hearing from you within the specified timeframe. Thank you for your immediate attention to this matter. Yours sincerely, [Your Name] [Your Company Name] [Your Contact Information] Optional: Different types of South Carolina Sample Letter for Demand for Payment — Final Notice Before Legal Action: 1. South Carolina Sample Letter for Demand for Payment — Final Notice Before LegaActionio— - Commercial Debt 2. South Carolina Sample Letter for Demand for Payment — Final Notice Before LegaActionio— - Consumer Debt 3. South Carolina Sample Letter for Demand for Payment — Final Notice Before LegaActionio— - Personal Loan Debt 4. South Carolina Sample Letter for Demand for Payment — Final Notice Before LegaActionio— - Professional Services Debt.

South Carolina Sample Letter for Demand for Payment - Final Notice Before Legal Action

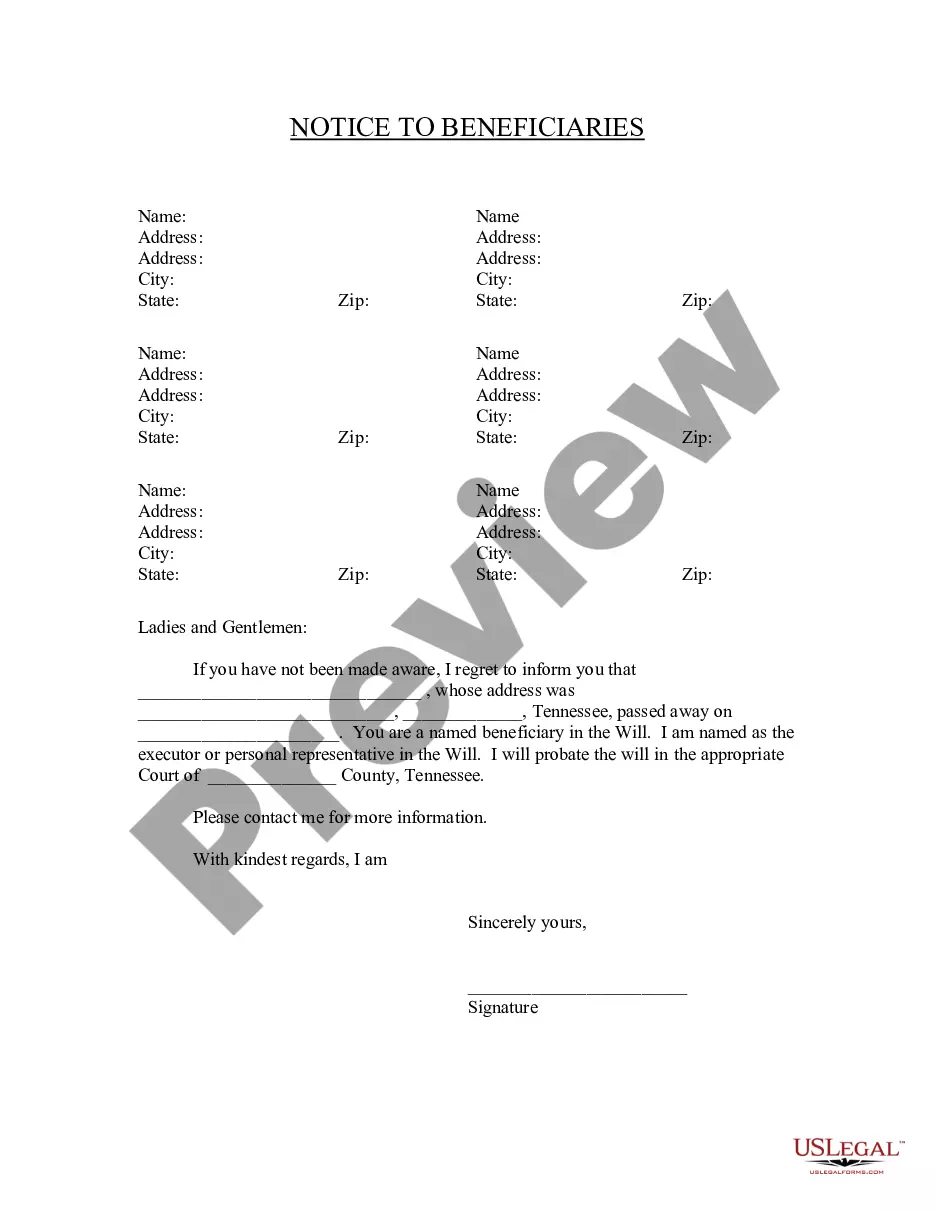

Description

How to fill out South Carolina Sample Letter For Demand For Payment - Final Notice Before Legal Action?

Are you currently in a scenario where you require documentation for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the South Carolina Sample Letter for Demand for Payment - Final Notice Before Legal Action, which can be customized to fulfill federal and state requirements.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the South Carolina Sample Letter for Demand for Payment - Final Notice Before Legal Action at any time, if necessary. Simply click the required form to download or print the document.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent mistakes. The service provides professionally crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the South Carolina Sample Letter for Demand for Payment - Final Notice Before Legal Action template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the appropriate city/county.

- Utilize the Preview option to review the form.

- Check the description to confirm you have selected the correct form.

- If the form isn’t what you are seeking, use the Search field to find the form that suits your needs.

- When you find the right form, click on Buy now.

- Select the payment plan you prefer, enter the required information to create your account, and complete the payment via PayPal or Visa or Mastercard.

Form popularity

FAQ

An example of a final demand letter typically includes your name, address, and the date at the top, followed by the recipient's information. It should state the amount owed, a brief account of previous requests for payment, and declare this as the last chance before legal action is taken. You may find value in using a South Carolina Sample Letter for Demand for Payment - Final Notice Before Legal Action as a framework to ensure all important details are included.

When writing a final notice for payment, start with an overview of the debt, including the amount and any prior payment arrangements. Clearly state that this is your final notice before pursuing legal options. Keep the tone professional yet firm, emphasizing the consequences of non-payment. A South Carolina Sample Letter for Demand for Payment - Final Notice Before Legal Action can be extremely helpful in crafting your notice.

A final letter of demand should clearly detail the outstanding balance and explain any previous communications regarding the issue. Clearly state that this is the final notice before legal action, which adds seriousness to the situation. It's beneficial to reference a South Carolina Sample Letter for Demand for Payment - Final Notice Before Legal Action, as it offers a professional format and language to effectively convey your message.

Writing a demanding payment letter involves clarity and directness. Start with your contact information, followed by the recipient's details, then state the amount owed and the reason. Make it clear that payment is expected promptly, and consider including a South Carolina Sample Letter for Demand for Payment - Final Notice Before Legal Action to guide your writing, as it ensures you cover all essential aspects.

To send a final demand letter, first ensure it is properly formatted and clearly states the amount owed, due date, and any applicable interest. You might choose to send it via certified mail to confirm receipt. This method provides proof of delivery, which is crucial if legal actions arise. Utilizing a South Carolina Sample Letter for Demand for Payment - Final Notice Before Legal Action can streamline this process.

To effectively end a letter of demand, reiterate your request for payment and specify a deadline for response. You may also mention possible next steps if payment is not received, which can include legal action. Using a clear and firm tone instills urgency, making your intentions known. Remember, incorporating a South Carolina Sample Letter for Demand for Payment - Final Notice Before Legal Action can enhance the professionalism of your letter.

A final letter before legal action is a formal notice that alerts the debtor about impending legal proceedings due to non-payment. It serves not only as a warning but also as a last attempt to resolve the issue amicably. Using a South Carolina Sample Letter for Demand for Payment - Final Notice Before Legal Action provides a structured approach to this important communication, ensuring all necessary details are included.

The final notice before formal legal proceedings is a critical step in the debt collection process, serving as a final alert to the debtor. It typically includes a specific timeframe for payment and an outline of potential legal actions if the debt remains unpaid. A South Carolina Sample Letter for Demand for Payment - Final Notice Before Legal Action can be an essential resource in drafting this important communication.

To write a letter requesting payment, be clear and direct about the outstanding amount and payment terms. Provide all relevant details, such as due dates and prior attempts to collect the debt. Using a South Carolina Sample Letter for Demand for Payment - Final Notice Before Legal Action can streamline the process, ensuring all necessary points are effectively addressed.

The meaning of final notice for payment is a last warning issued to a debtor before pursuing legal action. It informs them that their account is overdue and specifies the consequences of non-payment, which may include legal proceedings. Employing a South Carolina Sample Letter for Demand for Payment - Final Notice Before Legal Action can help convey the urgency and seriousness of the situation.

Interesting Questions

More info

Insurance Benefits Find your information in our database USCIS Immigrant Filing Status Filing Form Options Appointment Free Consultation Additional Resources Tips “In an increasingly global economy, a foreign-born labor force that must find high-paying jobs with adequate hours, the skills needed for those jobs, a reliable internet connection, and the ability to get along in an unfamiliar or sometimes difficult environment is a challenge for employers and the immigrants themselves. “ — David Actor The economic crisis has taken a toll on immigrants in the US, as more and more Americans are looking for cheap foreign labor or outsourcing to overseas. Companies are using the recession as a reason to eliminate workers altogether or to bring more low-skilled labor by increasing the use of temporary labor and the use of guest workers. As of April, there were 6.2 million job vacancies for high-skilled foreign workers in the US, while there were 2.3 million in the US.