This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

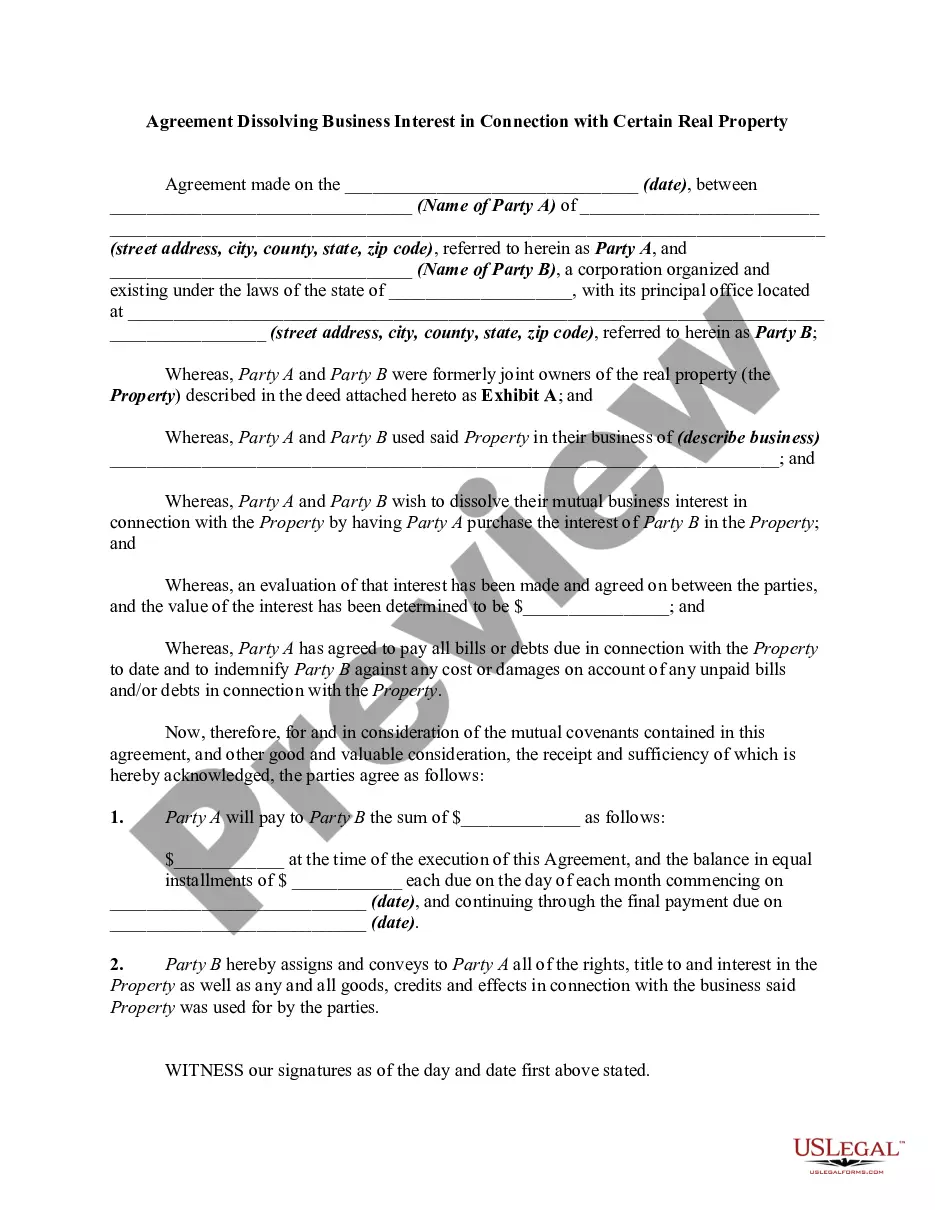

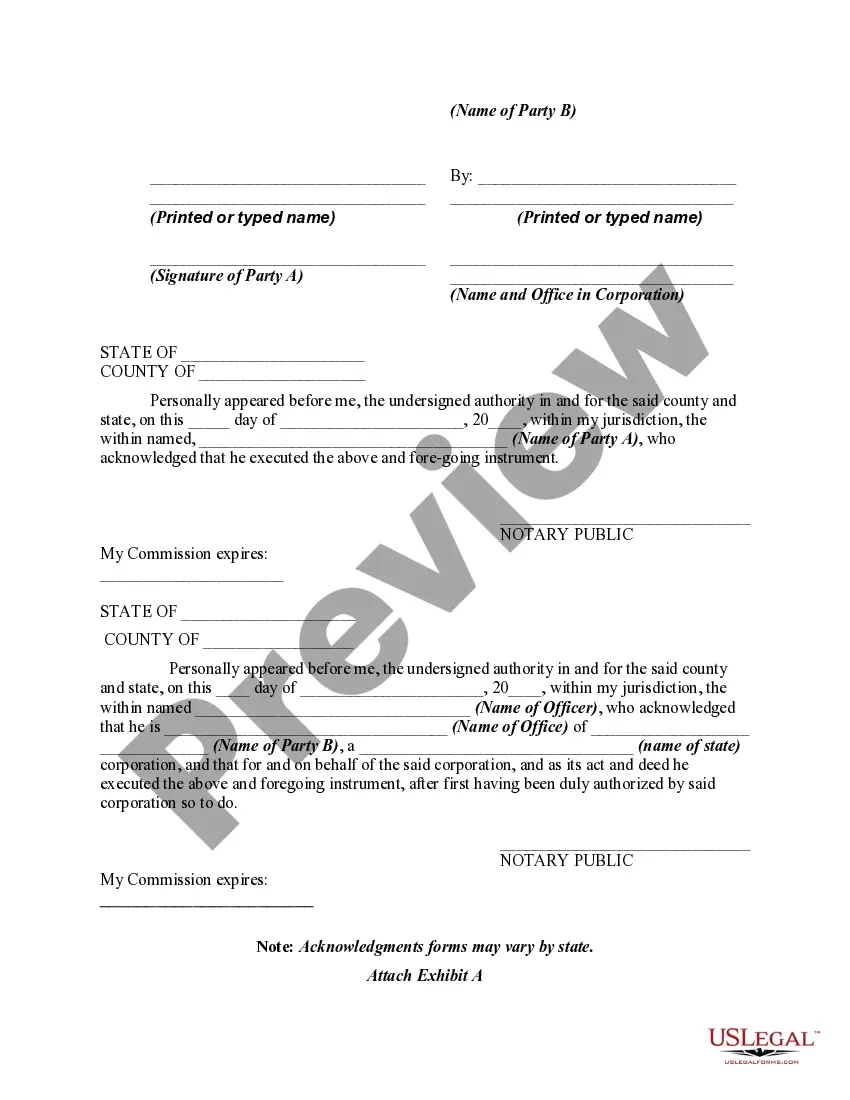

The South Carolina Agreement Dissolving Business Interest in Connection with Certain Real Property is a legal document that outlines the terms and conditions for the dissolution of a business entity's interest in a specific piece of real estate located in South Carolina. This agreement is important when partners or co-owners of a business decide to terminate their relationship and need to allocate their rights and responsibilities related to the property in question. The following are the different types of South Carolina Agreement Dissolving Business Interest in Connection with Certain Real Property: 1. LLC (Limited Liability Company) Dissolution Agreement: This type of agreement is specific to LCS that decide to dissolve their business interest in real property located in South Carolina. It clearly outlines the procedures, financial aspects, and other relevant terms associated with the dissolution process. 2. Partnership Dissolution Agreement: In the case of a partnership, this agreement addresses the dissolution of the partnership's interest in the South Carolina real property. It details how the property will be distributed or sold, and how profits or losses from the sale will be divided among the partners. 3. Corporation Dissolution Agreement: This type of agreement deals with the dissolution of a corporation's interest in certain real property located in South Carolina. It covers the obligations, rights, and procedures to be followed during the dissolution process and ensures a smooth transition of ownership. The South Carolina Agreement Dissolving Business Interest in Connection with Certain Real Property typically includes various essential components, such as: 1. Parties: The agreement identifies the parties involved, including the business entity or entities, co-owners, and any legal representatives. 2. Property Description: It provides a detailed description of the real property involved, including the address, legal description, and any associated assets or fixtures. 3. Terms of Dissolution: This section specifies the effective date of the dissolution, the objectives of the agreement, and the rights and obligations of each party during the process. 4. Property Distribution: This clause outlines how the real property will be distributed or sold, including any financial considerations, profit sharing arrangements, or debts to be settled. 5. Release and Indemnification: The agreement may include a release clause stating that all parties involved release each other from any future claims or liabilities related to the property. 6. Governing Law: This section specifies that the agreement is governed by the laws of South Carolina, ensuring compliance with the state's legal requirements. 7. Signatures: The agreement concludes with the signatures of all parties involved, acknowledging their consent and understanding of the terms. In conclusion, the South Carolina Agreement Dissolving Business Interest in Connection with Certain Real Property is a legally binding document that ensures a fair and orderly dissolution of a business entity's interest in a specific real property. Understanding the different types and key elements of this agreement is crucial for individuals or businesses in South Carolina seeking to dissolve their business relationship and settle property-related matters.The South Carolina Agreement Dissolving Business Interest in Connection with Certain Real Property is a legal document that outlines the terms and conditions for the dissolution of a business entity's interest in a specific piece of real estate located in South Carolina. This agreement is important when partners or co-owners of a business decide to terminate their relationship and need to allocate their rights and responsibilities related to the property in question. The following are the different types of South Carolina Agreement Dissolving Business Interest in Connection with Certain Real Property: 1. LLC (Limited Liability Company) Dissolution Agreement: This type of agreement is specific to LCS that decide to dissolve their business interest in real property located in South Carolina. It clearly outlines the procedures, financial aspects, and other relevant terms associated with the dissolution process. 2. Partnership Dissolution Agreement: In the case of a partnership, this agreement addresses the dissolution of the partnership's interest in the South Carolina real property. It details how the property will be distributed or sold, and how profits or losses from the sale will be divided among the partners. 3. Corporation Dissolution Agreement: This type of agreement deals with the dissolution of a corporation's interest in certain real property located in South Carolina. It covers the obligations, rights, and procedures to be followed during the dissolution process and ensures a smooth transition of ownership. The South Carolina Agreement Dissolving Business Interest in Connection with Certain Real Property typically includes various essential components, such as: 1. Parties: The agreement identifies the parties involved, including the business entity or entities, co-owners, and any legal representatives. 2. Property Description: It provides a detailed description of the real property involved, including the address, legal description, and any associated assets or fixtures. 3. Terms of Dissolution: This section specifies the effective date of the dissolution, the objectives of the agreement, and the rights and obligations of each party during the process. 4. Property Distribution: This clause outlines how the real property will be distributed or sold, including any financial considerations, profit sharing arrangements, or debts to be settled. 5. Release and Indemnification: The agreement may include a release clause stating that all parties involved release each other from any future claims or liabilities related to the property. 6. Governing Law: This section specifies that the agreement is governed by the laws of South Carolina, ensuring compliance with the state's legal requirements. 7. Signatures: The agreement concludes with the signatures of all parties involved, acknowledging their consent and understanding of the terms. In conclusion, the South Carolina Agreement Dissolving Business Interest in Connection with Certain Real Property is a legally binding document that ensures a fair and orderly dissolution of a business entity's interest in a specific real property. Understanding the different types and key elements of this agreement is crucial for individuals or businesses in South Carolina seeking to dissolve their business relationship and settle property-related matters.