The "look through" trust can affords long term IRA deferrals and special protection or tax benefits for the family. But, as with all specialized tools, you must use it only in the right situation. If the IRA participant names a trust as beneficiary, and the trust meets certain requirements, for purposes of calculating minimum distributions after death, one can "look through" the trust and treat the trust beneficiary as the designated beneficiary of the IRA. You can then use the beneficiary's life expectancy to calculate minimum distributions. Were it not for this "look through" rule, the IRA or plan assets would have to be paid out over a much shorter period after the owner's death, thereby losing long term deferral.

South Carolina Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account

Description

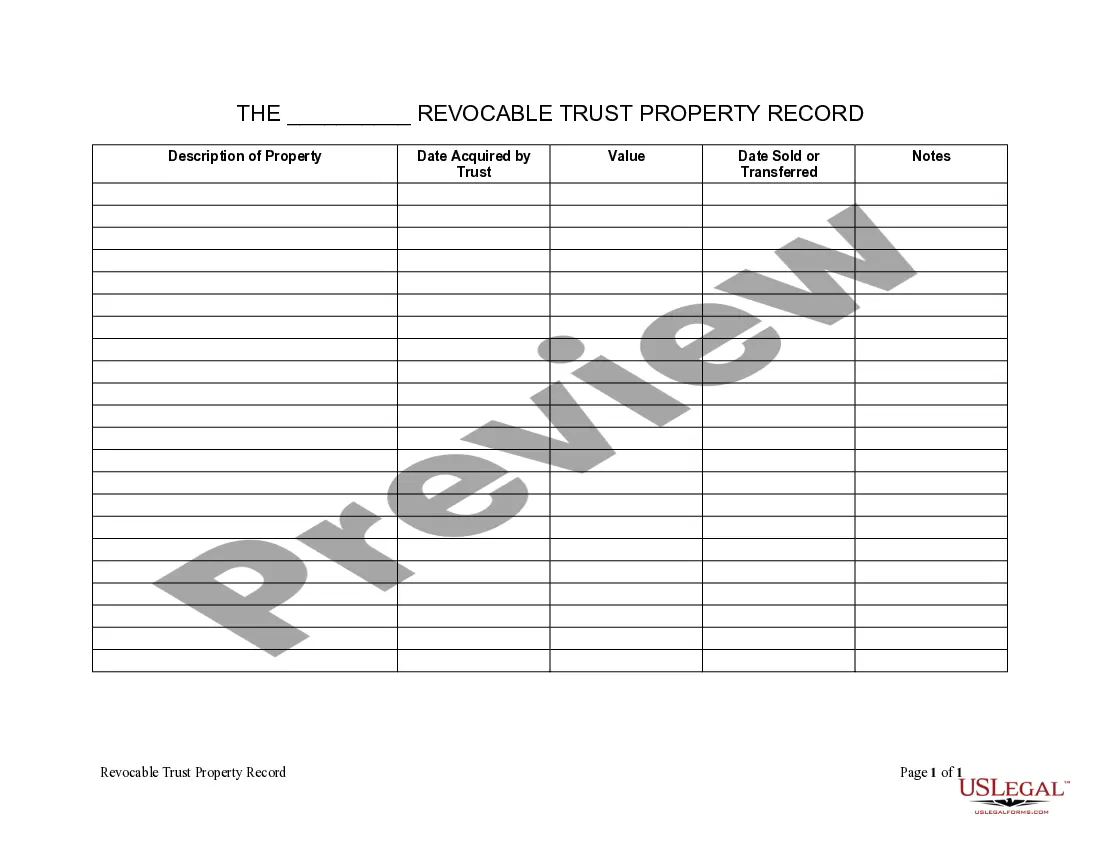

How to fill out Irrevocable Trust As Designated Beneficiary Of An Individual Retirement Account?

Are you currently in a circumstance where you require documents for either business or personal reasons almost every day.

There are numerous authentic document templates accessible online, but discovering ones you can trust is challenging.

US Legal Forms offers thousands of template forms, including the South Carolina Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, which are created to meet state and federal regulations.

Once you find the right form, click Buy now.

Choose the pricing plan you want, complete the required information to create your account, and pay for your order using PayPal or a credit card.

- If you are familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the South Carolina Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Search for the form you need and ensure it is for your specific city/county.

- Use the Preview feature to examine the form.

- Read the description to ensure that you have chosen the correct form.

- If the form is not what you are looking for, use the Search box to find the form that suits your needs.

Form popularity

FAQ

Naming your South Carolina Irrevocable Trust as the beneficiary of your 401k can provide significant advantages, such as controlled distribution and potential tax benefits. This approach helps secure your legacy and ensures your assets are managed according to your specific desires. However, it's crucial to consult with a professional to navigate the implications effectively.

An example of beneficiary designation involves naming a specific individual or entity to receive your assets upon your passing. For instance, you might designate your spouse or a South Carolina Irrevocable Trust as the beneficiary for your retirement account. This arrangement ensures that your wishes are honored, facilitating a smooth transfer of assets without going through probate.

To fill out a beneficiary designation, begin by gathering the necessary personal information. Include the legal names and relationships of your chosen beneficiaries. For maximum effectiveness, consider designating a South Carolina Irrevocable Trust as your beneficiary, as it can provide controlled asset management and distribution according to your wishes. Ensure that all information is current and accurate to avoid potential delays.

You should avoid naming individuals who may not align with your long-term financial goals or those with financial irresponsibility. Additionally, naming a minor child might complicate the distribution process, as a guardian would need to manage their assets. However, using a South Carolina Irrevocable Trust as the designated beneficiary can help streamline your intentions and avoid these issues.

To fill out a beneficiary designation form, start by clearly identifying the account type, such as an Individual Retirement Account. Next, provide the name and Social Security number of the beneficiary, ensuring accuracy. If you plan to name a South Carolina Irrevocable Trust as the designated beneficiary, include the trust's name and date. Finally, sign and date the form to validate your choices.

A common mistake parents make is failing to clearly outline how the trust fund should be managed and distributed. Establishing a South Carolina Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account requires clear instructions and communication among family members. Engaging legal and financial professionals can help avoid confusion and ensure that your wishes for the trust are understood and honored.

When you name a trust as a beneficiary, you face several disadvantages, such as increased tax liabilities and potential complications in asset distribution. A South Carolina Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can result in higher tax rates, as trusts often incur taxes at lower income thresholds. It’s crucial to weigh these factors with an expert to ensure your estate plan aligns with your intentions.

Putting your IRA in a trust can complicate your estate management and increase your tax burden. A South Carolina Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can limit access to funds and restrict options for beneficiaries. Instead, consider discussing your estate plan with a financial advisor who understands your goals and objectives before making any decisions.

One reason to avoid naming a trust as a beneficiary is the potential for losing tax advantages. A South Carolina Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account may not allow for the tax-efficient transfer of assets compared to individual beneficiaries. Furthermore, the administrative complexities can lead to delays and misunderstandings during the distribution of the funds.

Yes, a trust can be named as a beneficiary of a retirement account, but it requires careful planning. A South Carolina Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can serve a purpose if structured properly. It's essential to work with a knowledgeable professional to prepare the trust documents to meet IRS regulations and safeguard your beneficiaries' interests.