The courts have inherent power to restrain the sale of mortgaged premises in foreclosure proceedings, but are reluctant to exercise such power except where it is shown that particular circumstances, extrinsic to the instrument, would render its enforcement in this manner inequitable and work irreparable injury, and that complainant has no adequate remedy at law. Furthermore, a party must show a probable right of recovery in order to obtain a temporary injunction of a foreclosure action.

South Carolina Complaint or Petition to Enjoin Foreclosure Sale due to Misunderstanding as to Promissory Note's Terms of Payment upon Assumption of Note

Description

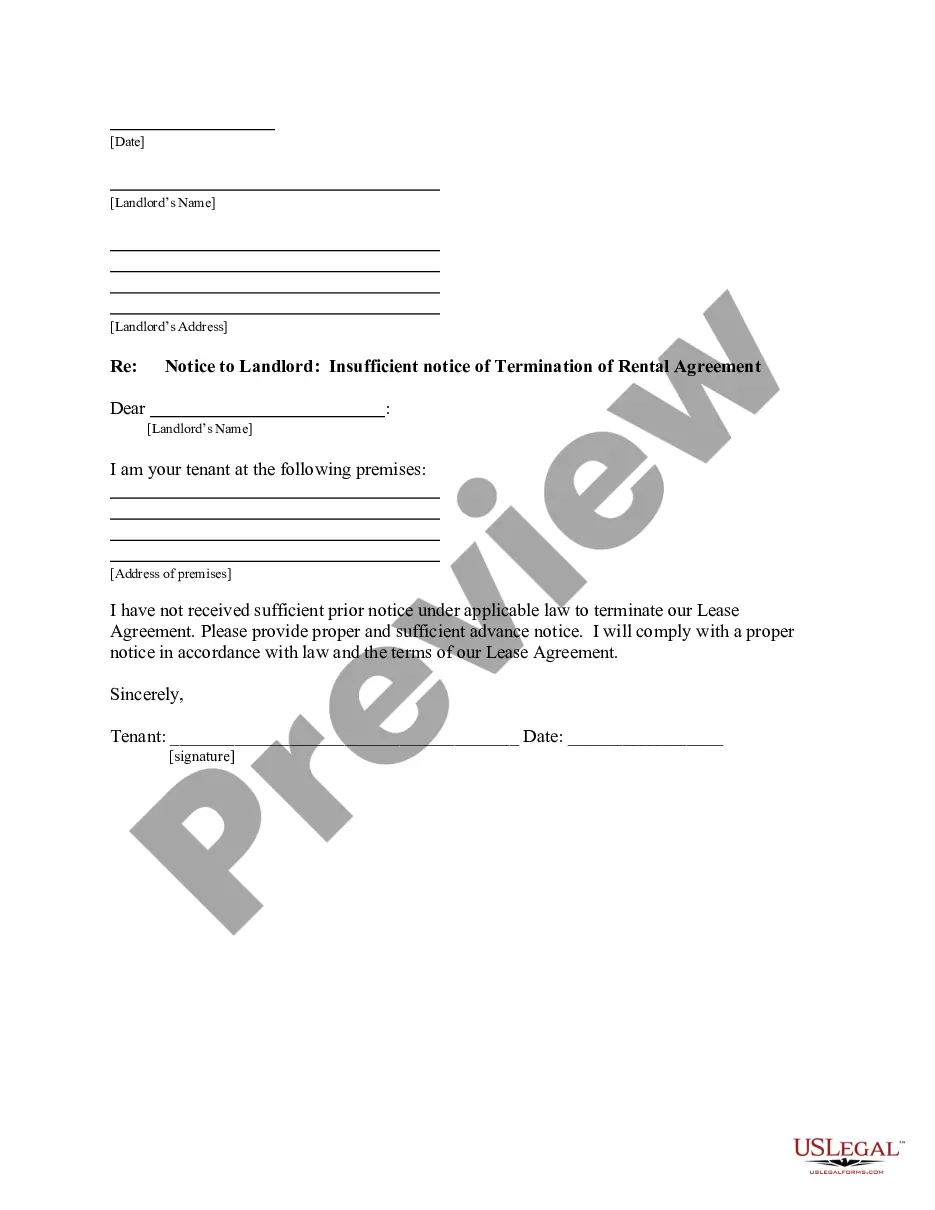

How to fill out Complaint Or Petition To Enjoin Foreclosure Sale Due To Misunderstanding As To Promissory Note's Terms Of Payment Upon Assumption Of Note?

You can dedicate hours online searching for the valid document template that satisfies the state and federal requirements you require.

US Legal Forms provides a multitude of legal forms that are reviewed by professionals.

You can download or print the South Carolina Complaint or Petition to Enjoin Foreclosure Sale due to Misunderstanding regarding the Promissory Note's Terms of Payment upon Assumption of Note from our service.

If available, use the Preview button to review the document template as well. If you wish to find another version of the form, use the Search section to locate the template that meets your needs and requirements. Once you have identified the template you need, click on Buy now to proceed. Choose the pricing plan you need, enter your details, and register for a free account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Locate the format of the document and download it to your device. Make changes to the document if necessary. You are able to complete, modify, sign, and print the South Carolina Complaint or Petition to Enjoin Foreclosure Sale due to Misunderstanding regarding the Promissory Note's Terms of Payment upon Assumption of Note. Obtain and print a multitude of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you possess a US Legal Forms account, you can sign in and click the Acquire button.

- Afterward, you can complete, modify, print, or sign the South Carolina Complaint or Petition to Enjoin Foreclosure Sale due to Misunderstanding regarding the Promissory Note's Terms of Payment upon Assumption of Note.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of the purchased form, navigate to the My documents section and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your state/city that you select.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

To contest a judicial foreclosure, you have to file a written answer to the complaint (the lawsuit). You'll need to present your defenses and explain the reasons why the lender shouldn't be able to foreclose. You might need to defend yourself against a motion for summary judgment and at trial.

Answering the lawsuit can be as simple as drafting a document and writing 'admit' or 'deny' or ?without knowledge? in correlation to each numbered paragraph in the summons. Your answer to the lawsuit must address every allegation individually.

How to Respond to a Foreclosure Summons Step 1: Read the Summons. ... Step 2: Speak to Foreclosure Lawyer. ... Step 3: Decide If You Want to Contest. ... Step 4: Prepare a Mortgage Foreclosure Appearance and Answer to the Complaint. ... Step 5: File the Form with the Court Clerk. ... Step 6: Send a Copy of Your Answer to the Other Parties.

Every paragraph in the complaint is usually given a number. You should respond to each numbered paragraph in the complaint. You can group your responses into those paragraphs you agree with, those you disagree with and those you cannot answer. If you disagree, you DO NOT have to explain why you disagree.

There are three steps to respond to the Summons and Complaint. Answer each issue listed in the Complaint. Assert affirmative defenses. File one copy of the Answer document with the court and serve the plaintiff with another copy.

You must file your ?Answer? to the complaint with the court in your county. Legal help can be found through the Ohio Legal Services Association, the Legal Aid Society of Columbus, or the Ohio State Bar Association. Submitting your ?Answer? to the court slows down the foreclosure process.