A corporation whose shares are held by a single shareholder or a closely-knit group of shareholders (such as a family) is known as a close corporation. The shares of stock are not traded publicly. Many of these types of corporations are small firms that in the past would have been operated as a sole proprietorship or partner¬ship, but have been incorporated in order to obtain the advantages of limited liability or a tax benefit or both. This type of employment agreement might be in order for the chief operating officer of such a corporation.

South Carolina Employment of Executive or General Manager in a Closely Held Corporate Business

Description

How to fill out Employment Of Executive Or General Manager In A Closely Held Corporate Business?

Have you encountered a scenario where you require documents for various businesses or specific activities on a daily basis.

There are numerous legal document templates accessible online, yet finding reliable ones can be challenging.

US Legal Forms offers an extensive collection of form templates, such as the South Carolina Employment of Executive or General Manager in a Closely Held Corporate Business, designed to comply with both state and federal regulations.

Once you find the appropriate form, click on Acquire now.

Select the pricing plan you prefer, provide the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, proceed to download the South Carolina Employment of Executive or General Manager in a Closely Held Corporate Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you require and verify that it is for the correct city/state.

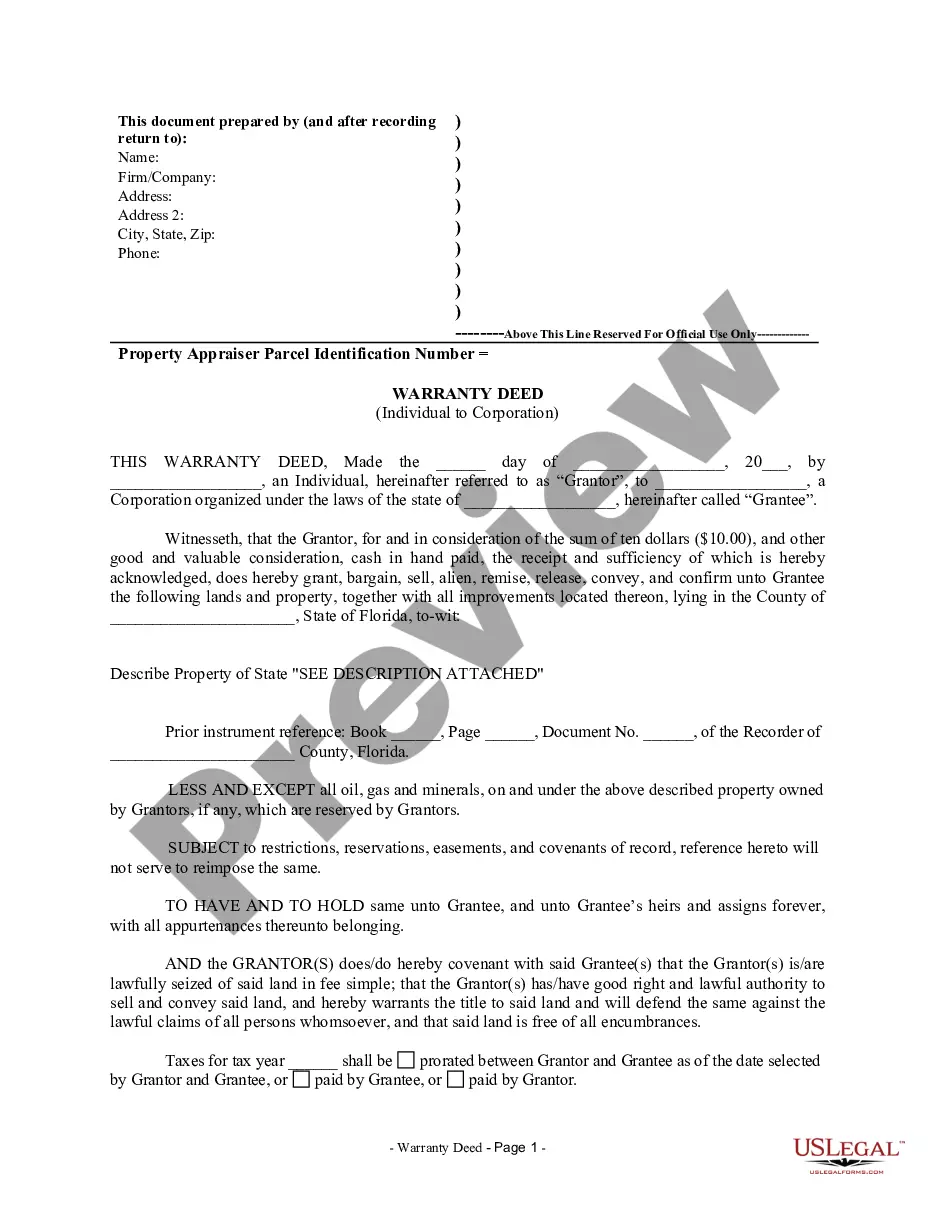

- Use the Review feature to examine the form.

- Read the description to ensure you have selected the right document.

- If the form is not what you are looking for, utilize the Search field to locate the form that suits your needs.

Form popularity

FAQ

The Business Corporation Act establishes the framework for corporate operations in South Carolina. It includes guidelines on formation, governance, and dissolution of corporations. For those engaged in the South Carolina Employment of Executive or General Manager in a Closely Held Corporate Business, familiarizing themselves with this act is crucial for compliant business practices.

Yes, South Carolina has historically enforced blue laws that restrict certain sales on Sundays, including silverware. While many of these laws have been relaxed, it is still wise to verify local regulations before making purchases. This knowledge is beneficial for business owners in the South Carolina Employment of Executive or General Manager in a Closely Held Corporate Business context.

SC Code 33 44 504 focuses on the appointment and removal of corporate officers. This provision helps structure decision-making within a corporation, which is essential for effective governance. For those managing a closely held corporate business in South Carolina, understanding this code is important for ensuring proper executive management.

SC Code of Laws Section 33 44 202 relates to the authority and responsibilities of officers in a corporation. This section outlines the powers given to executive or general managers, ensuring they operate within legal bounds. This knowledge is vital for anyone engaged in South Carolina Employment of Executive or General Manager in a Closely Held Corporate Business.

Yes, South Carolina mandates that corporations file annual reports with the Secretary of State. This requirement helps maintain accurate public records and ensures compliance with state laws. For those involved in the South Carolina Employment of Executive or General Manager in a Closely Held Corporate Business, timely filing is crucial to avoid penalties.

Rule 34 allows parties to request the production of documents and other tangible items relevant to a case. This process promotes transparency and aids in fact-finding during litigation. Understanding Rule 34 is essential for effective management of legal disputes in the context of South Carolina Employment of Executive or General Manager in a Closely Held Corporate Business.

Even if your business has no income, you are generally required to file IRS Form 1120 for your corporation. This filing maintains compliance and provides transparency about your financial status. It's essential to address these obligations, especially in the context of South Carolina Employment of Executive or General Manager in a Closely Held Corporate Business. If you're unsure about your situation, consider utilizing the services of US Legal Forms to ensure you file correctly and on time.

Section 44-33-34 of the South Carolina Code outlines regulations regarding management and operations within certain businesses. It is essential for legal compliance, especially in closely held corporations. When navigating South Carolina Employment of Executive or General Manager in a Closely Held Corporate Business, understanding these legal frameworks helps you manage your business effectively.

Yes, South Carolina does require DBA filing if you choose to operate under a name other than your legal business name. This filing is typically done at the county level and ensures that your business name is registered. For those involved in South Carolina Employment of Executive or General Manager in a Closely Held Corporate Business, staying compliant with this requirement is essential for smooth operations.

Filing a DBA in South Carolina is required if your business name differs from your legal business name. This filing helps protect your business identity and enables easier recognition by clients. If you pursue South Carolina Employment of Executive or General Manager in a Closely Held Corporate Business, having a DBA can bolster your company’s presence in the market.