US Legal Forms - one of many greatest libraries of authorized kinds in the USA - offers an array of authorized document themes you are able to obtain or print out. Utilizing the web site, you will get thousands of kinds for organization and person functions, categorized by classes, suggests, or keywords.You can find the most recent models of kinds such as the South Carolina Renunciation and Disclaimer of Interest in Life Insurance Proceeds within minutes.

If you currently have a subscription, log in and obtain South Carolina Renunciation and Disclaimer of Interest in Life Insurance Proceeds from the US Legal Forms library. The Download key will appear on every develop you view. You have accessibility to all previously acquired kinds in the My Forms tab of your respective bank account.

In order to use US Legal Forms for the first time, listed here are simple instructions to help you get started:

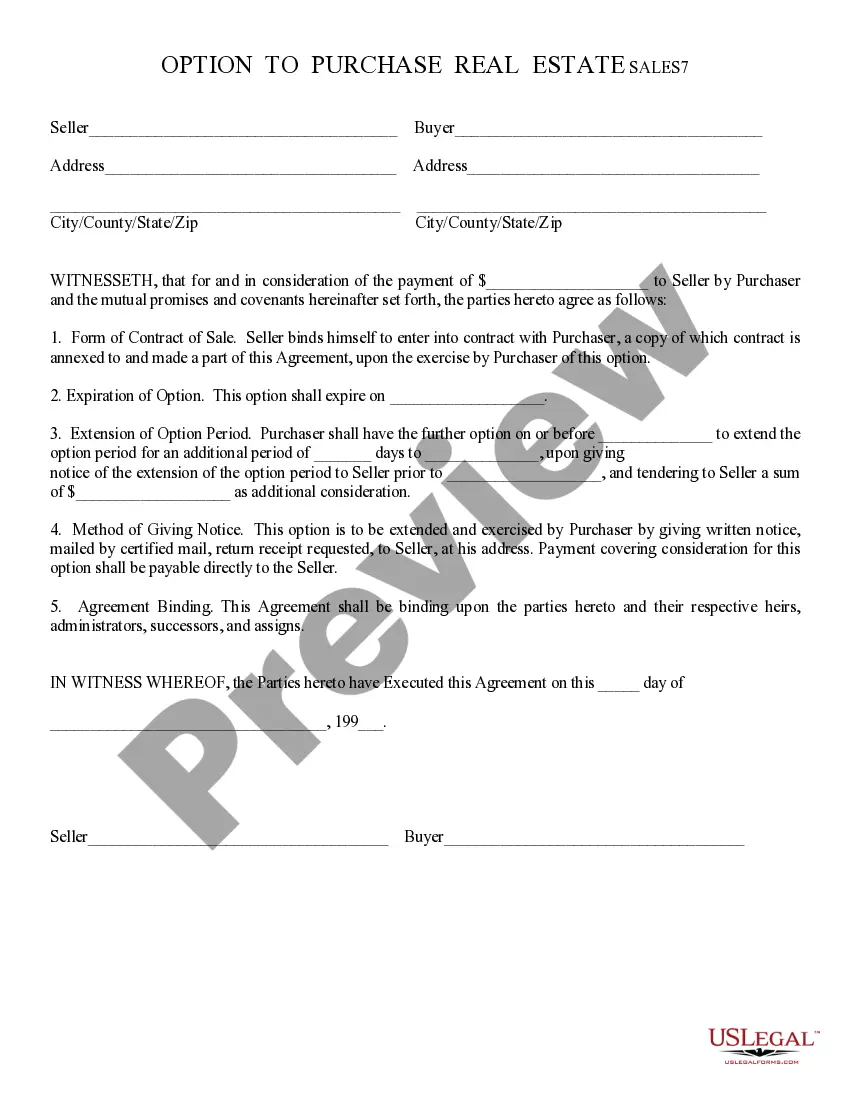

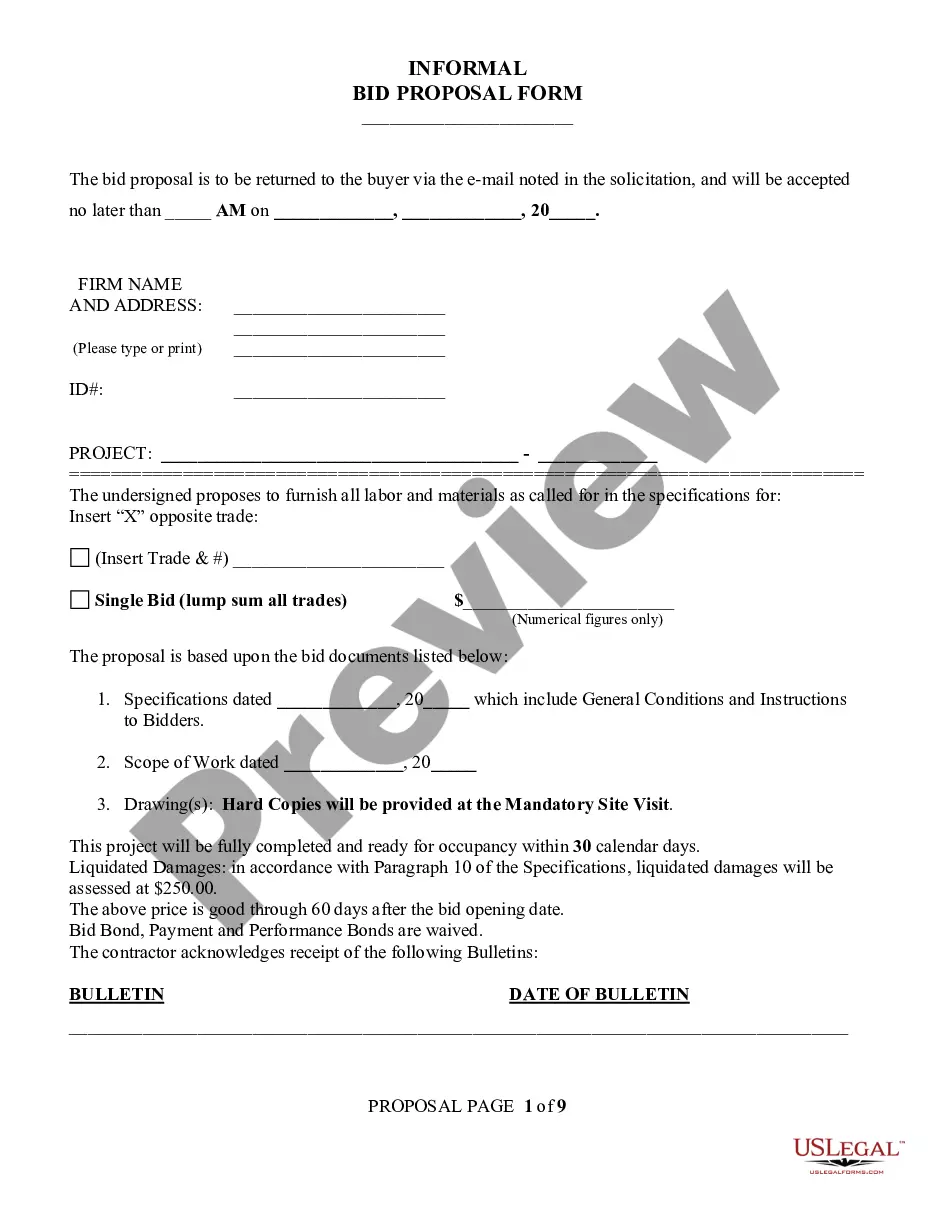

- Be sure you have picked out the right develop for the metropolis/state. Click the Review key to review the form`s content. Look at the develop outline to ensure that you have chosen the proper develop.

- In the event the develop doesn`t suit your demands, utilize the Lookup industry on top of the monitor to obtain the one who does.

- When you are happy with the form, confirm your choice by clicking the Get now key. Then, pick the rates program you want and give your references to sign up for the bank account.

- Method the financial transaction. Make use of charge card or PayPal bank account to finish the financial transaction.

- Pick the structure and obtain the form on the product.

- Make alterations. Fill up, edit and print out and indicator the acquired South Carolina Renunciation and Disclaimer of Interest in Life Insurance Proceeds.

Every single web template you included with your bank account lacks an expiration particular date which is yours eternally. So, if you want to obtain or print out an additional version, just visit the My Forms segment and click on around the develop you require.

Gain access to the South Carolina Renunciation and Disclaimer of Interest in Life Insurance Proceeds with US Legal Forms, the most comprehensive library of authorized document themes. Use thousands of specialist and state-particular themes that fulfill your company or person demands and demands.