South Carolina Sale of Goods, Buyers Specs

Description

How to fill out Sale Of Goods, Buyers Specs?

You can allocate several hours online trying to locate the authentic document template that satisfies the federal and state requirements you will need.

US Legal Forms offers a vast array of authentic forms that can be reviewed by professionals.

You can easily download or print the South Carolina Sale of Goods, Buyers Specifications from your service.

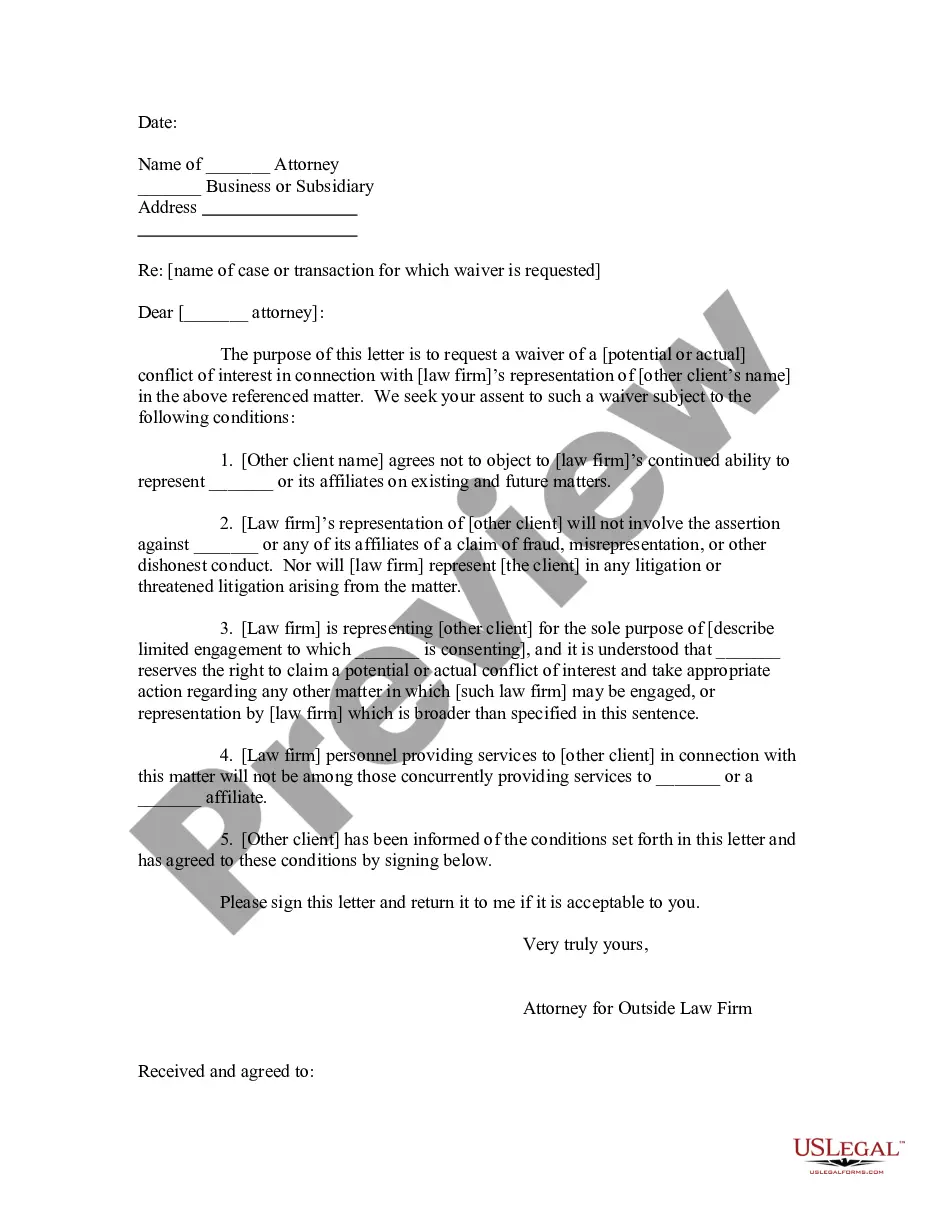

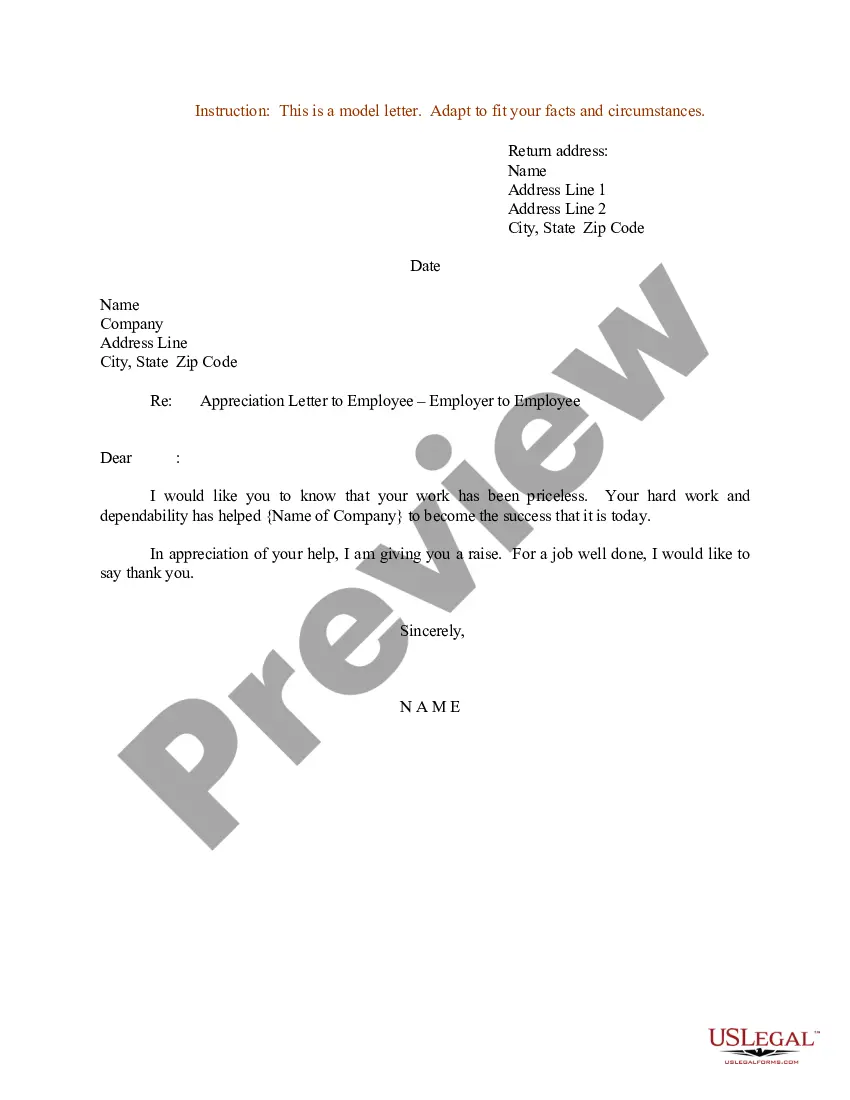

If available, utilize the Review button to examine the document template as well.

- If you possess a US Legal Forms account, you can sign in and click the Download button.

- After that, you can complete, modify, print, or sign the South Carolina Sale of Goods, Buyers Specifications.

- Every authentic document template you acquire is yours forever.

- To obtain an additional copy of the purchased form, navigate to the My documents tab and click the related button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your state/city of choice.

- Review the form outline to confirm you have chosen the appropriate form.

Form popularity

FAQ

As previously mentioned, items like certain groceries, clothing, and medical supplies are exempt from sales tax in South Carolina. Additionally, specific educational and charitable organizations may qualify for exemptions. Understanding these details is crucial for anyone engaging in the South Carolina Sale of Goods, Buyers Specs, as it can significantly impact overall costs. For further guidance, consider utilizing resources available on the uslegalforms platform.

Yes, in South Carolina, maintenance services are generally subject to sales tax. This includes labor costs associated with repairs and maintenance on personal property. For individuals and businesses involved in the South Carolina Sale of Goods, Buyers Specs, it is essential to account for these taxes when budgeting for such services. If you require clarification or assistance, the uslegalforms platform can provide valuable resources.

For a sale contract to be valid, it must include essential components such as an offer, acceptance, and consideration. In the context of the South Carolina Sale of Goods, the contract should also define the specifics of the goods being sold and the terms accepted by both parties. This legal foundation protects your interests and ensures a smooth transaction.

Law 56-5-1270 in South Carolina relates to the operation of vehicles on highways, but it also impacts commercial transactions involving vehicles. It sets regulations to ensure safe and legal operation, which indirectly affects sales contracts for vehicles. Understanding such laws is vital for buyers and sellers to ensure compliance during the South Carolina Sale of Goods.

SC Code 37-2-308 pertains to the regulation of the sale of goods in South Carolina. It highlights specific provisions regarding the rights and responsibilities of buyers and sellers in a sales agreement. This law is crucial for understanding how transactions must be conducted, ensuring fairness in South Carolina's marketplace.

The Nexus threshold in South Carolina refers to the level of business activity that requires you to collect sales tax. Generally, if your business maintains a physical presence or a certain level of sales in the state, you have Nexus. Staying informed about these regulations is crucial for businesses engaged in the South Carolina Sale of Goods, Buyers Specs, so you remain compliant.

A vendor's license and a seller's permit serve different purposes in South Carolina. A vendor's license is typically required for businesses operating in municipalities, while a seller's permit is necessary for businesses collecting sales tax on taxable sales. To fully understand these distinctions, especially in relation to the South Carolina Sale of Goods, Buyers Specs, consulting a legal advisor may be beneficial.