A joint venture is a relationship between two or more people who combine their labor or property for a single business undertaking. They share profits and losses equally, or as otherwise provided in the joint venture agreement. The single business undertaking aspect is a key to determining whether or not a business entity is a joint venture as opposed to a partnership.

A joint venture is very similar to a partnership. In fact, some States treat joint ventures the same as partnerships with regard to partnership statutes such as the Uniform Partnership Act. The main difference between a partnership and a joint venture is that a joint venture usually relates to the pursuit of a single transaction or enterprise even though this may require several years to accomplish. A partnership is generally a continuing or ongoing business or activity. While a partnership may be expressly created for a single transaction, this is very unusual. Most Courts hold that joint ventures are subject to the same principles of law as partnerships.

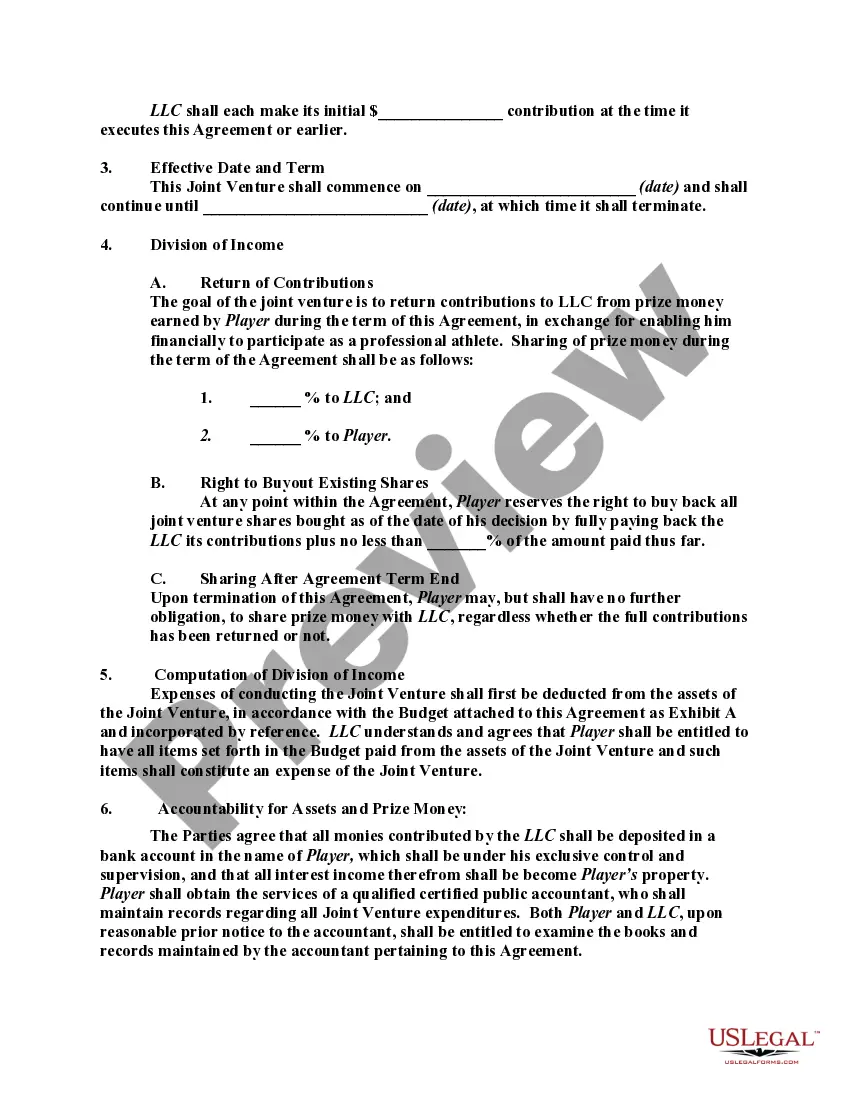

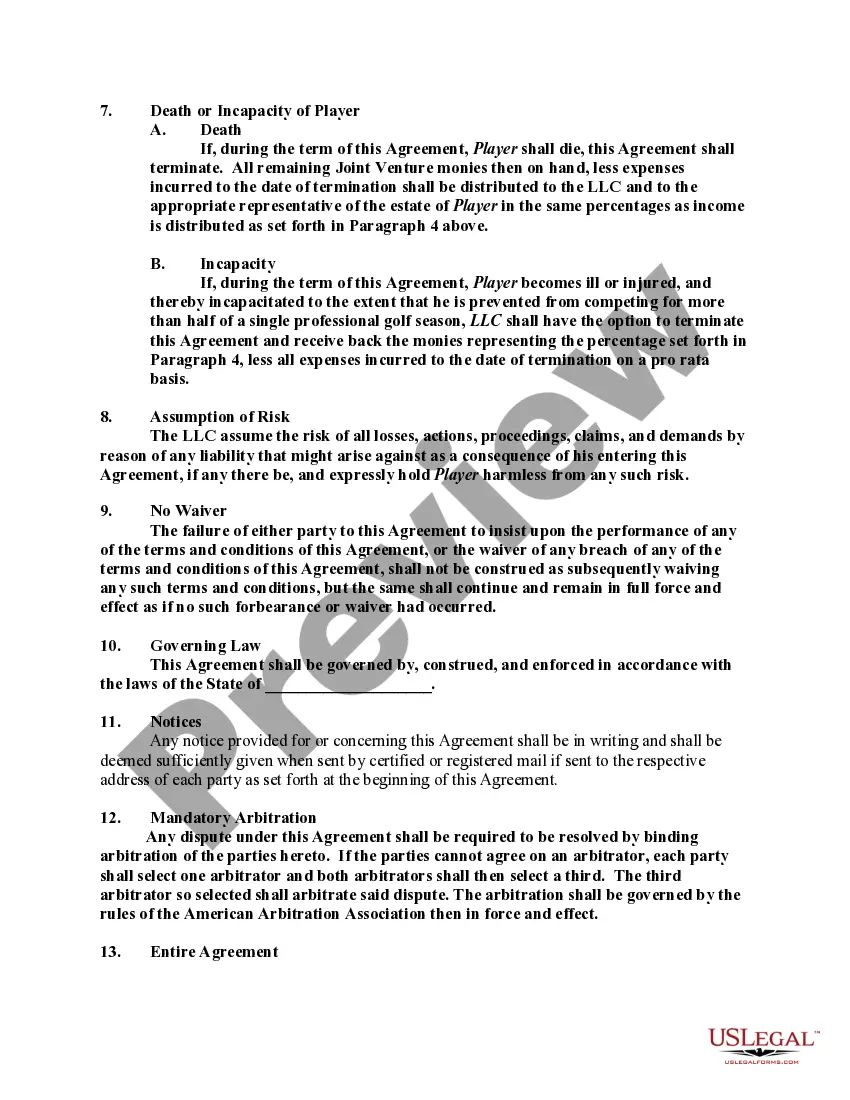

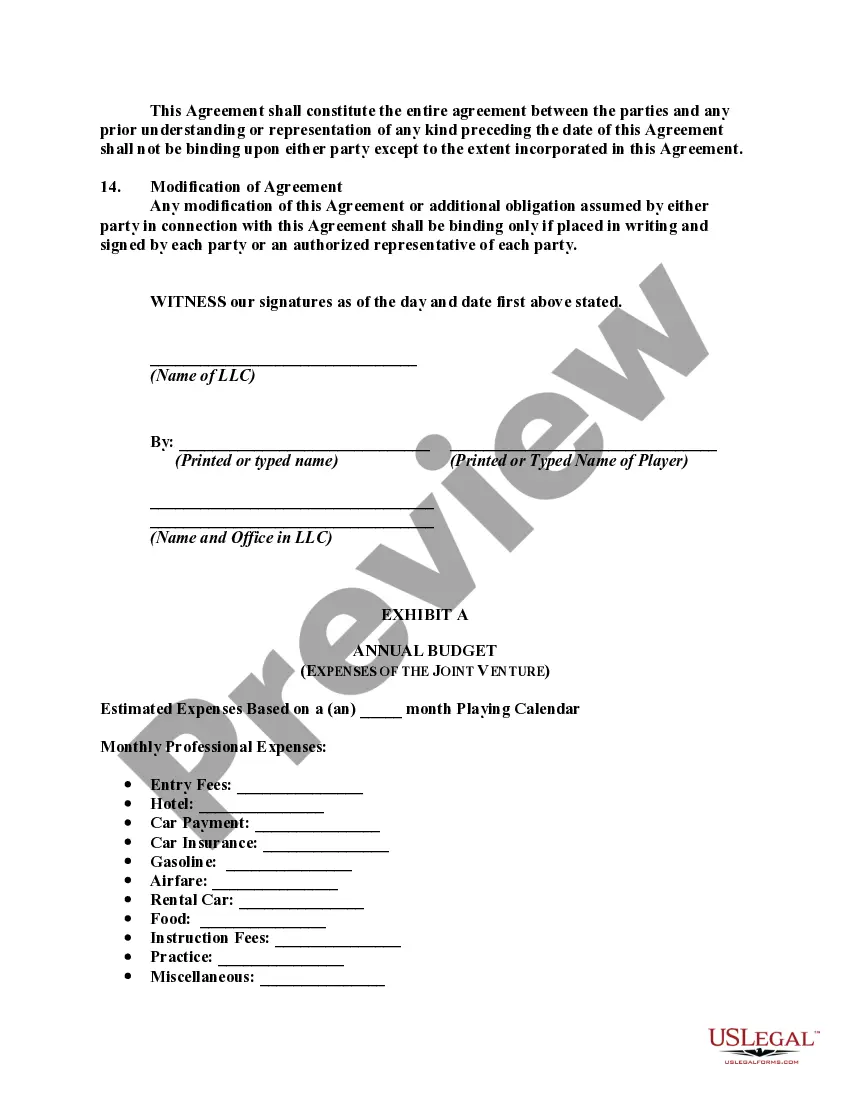

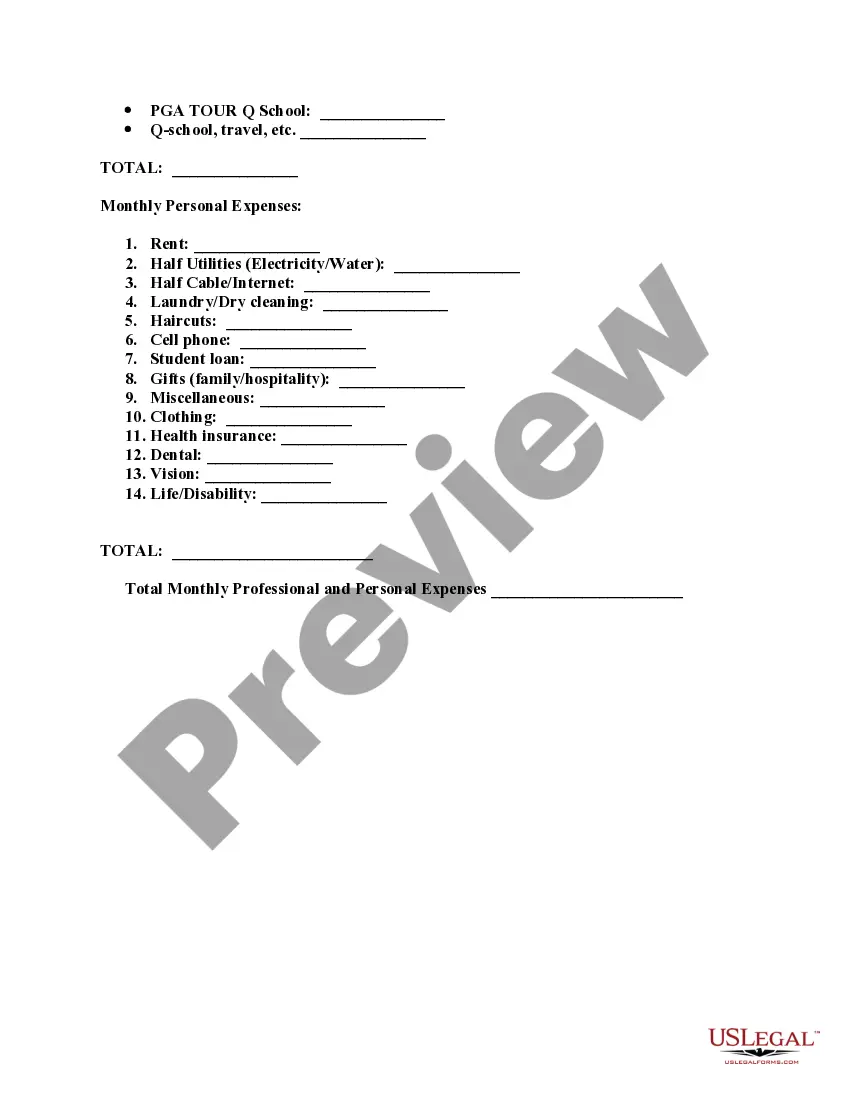

South Carolina Joint Venture Agreement: A Comprehensive Partnership between a Limited Liability Company and Professional Golfer for Sponsorship and Funding Introduction: In South Carolina, a Joint Venture Agreement between a Limited Liability Company (LLC) and a Professional Golfer serves as a legally binding contract for collaboration in sponsorship and financial support. This strategic alliance aims to leverage the LLC's resources and the golfer's skills and reputation to drive mutual success in the golf industry. Different variations of such agreements may exist based on specific partnership objectives. Let's explore the crucial components of a South Carolina Joint Venture Agreement between an LLC and a Professional Golfer for sponsorship and funding. 1. Parties Involved: The agreement outlines the participating entities, explicitly identifying the LLC and the Professional Golfer. It establishes their roles, responsibilities, and obligations within the joint venture. 2. Objective and Scope: The agreement clearly defines the goals and scope of the joint venture, which primarily involves sponsorships and fundraising efforts within the golf industry. It highlights the key activities and initiatives that the joint venture will undertake to achieve these goals. 3. Contributions and Investments: This section outlines the financial and non-financial contributions of each party. The LLC may provide funds, marketing resources, administrative support, event planning services, and access to a network of sponsors. The Professional Golfer, on the other hand, contributes their golfing expertise, public image, and personal endorsements to attract sponsors and raise funds. 4. Profit Distribution and Loss Allocation: The agreement stipulates how profits and losses will be shared between the LLC and the Professional Golfer. This may be based on a predetermined percentage allocation or other mutually agreed-upon methods. 5. Sponsorship Obligations: The joint venture outlines the responsibilities of both parties toward existing and potential sponsors. It includes developing sponsorship packages, securing sponsorship agreements, and ensuring fulfillment of sponsor obligations through mutual collaboration. 6. Event Organization and Participation: If the joint venture involves hosting golf tournaments, exhibitions, or events, this section of the agreement details the responsibilities, logistics, and financial arrangements related to organizing such activities. It may also cover participation in existing tournaments or professional competitions. 7. Intellectual Property Rights: To protect the joint venture's brand and reputation, this segment addresses issues related to the use of names, logos, trademarks, and other intellectual property. It clarifies any licensing arrangements required for branding and endorsements. 8. Duration and Termination: The agreement specifies the duration of the joint venture and under what circumstances it may be terminated. This should include provisions for dispute resolution and liability limitation. Types of South Carolina Joint Venture Agreements between an LLC and a Professional Golfer for Sponsorship and Funding: 1. Exclusive Joint Venture: This type of agreement establishes an exclusive partnership between the LLC and the Professional Golfer, enabling them to collaborate solely with each other and work towards mutual success. 2. Non-Exclusive Joint Venture: In a non-exclusive joint venture agreement, the LLC and Professional Golfer have the freedom to engage in other partnerships concurrently. This allows them to explore additional sponsorship opportunities and diversify their sources of funding. Conclusion: A South Carolina Joint Venture Agreement between a Limited Liability Company and Professional Golfer for sponsorship and funding is an essential legal contract that outlines the terms, obligations, and objectives of their collaboration. It ensures that both parties understand their roles, contributions, and responsibilities, leading to a mutually beneficial partnership within the golf industry.South Carolina Joint Venture Agreement: A Comprehensive Partnership between a Limited Liability Company and Professional Golfer for Sponsorship and Funding Introduction: In South Carolina, a Joint Venture Agreement between a Limited Liability Company (LLC) and a Professional Golfer serves as a legally binding contract for collaboration in sponsorship and financial support. This strategic alliance aims to leverage the LLC's resources and the golfer's skills and reputation to drive mutual success in the golf industry. Different variations of such agreements may exist based on specific partnership objectives. Let's explore the crucial components of a South Carolina Joint Venture Agreement between an LLC and a Professional Golfer for sponsorship and funding. 1. Parties Involved: The agreement outlines the participating entities, explicitly identifying the LLC and the Professional Golfer. It establishes their roles, responsibilities, and obligations within the joint venture. 2. Objective and Scope: The agreement clearly defines the goals and scope of the joint venture, which primarily involves sponsorships and fundraising efforts within the golf industry. It highlights the key activities and initiatives that the joint venture will undertake to achieve these goals. 3. Contributions and Investments: This section outlines the financial and non-financial contributions of each party. The LLC may provide funds, marketing resources, administrative support, event planning services, and access to a network of sponsors. The Professional Golfer, on the other hand, contributes their golfing expertise, public image, and personal endorsements to attract sponsors and raise funds. 4. Profit Distribution and Loss Allocation: The agreement stipulates how profits and losses will be shared between the LLC and the Professional Golfer. This may be based on a predetermined percentage allocation or other mutually agreed-upon methods. 5. Sponsorship Obligations: The joint venture outlines the responsibilities of both parties toward existing and potential sponsors. It includes developing sponsorship packages, securing sponsorship agreements, and ensuring fulfillment of sponsor obligations through mutual collaboration. 6. Event Organization and Participation: If the joint venture involves hosting golf tournaments, exhibitions, or events, this section of the agreement details the responsibilities, logistics, and financial arrangements related to organizing such activities. It may also cover participation in existing tournaments or professional competitions. 7. Intellectual Property Rights: To protect the joint venture's brand and reputation, this segment addresses issues related to the use of names, logos, trademarks, and other intellectual property. It clarifies any licensing arrangements required for branding and endorsements. 8. Duration and Termination: The agreement specifies the duration of the joint venture and under what circumstances it may be terminated. This should include provisions for dispute resolution and liability limitation. Types of South Carolina Joint Venture Agreements between an LLC and a Professional Golfer for Sponsorship and Funding: 1. Exclusive Joint Venture: This type of agreement establishes an exclusive partnership between the LLC and the Professional Golfer, enabling them to collaborate solely with each other and work towards mutual success. 2. Non-Exclusive Joint Venture: In a non-exclusive joint venture agreement, the LLC and Professional Golfer have the freedom to engage in other partnerships concurrently. This allows them to explore additional sponsorship opportunities and diversify their sources of funding. Conclusion: A South Carolina Joint Venture Agreement between a Limited Liability Company and Professional Golfer for sponsorship and funding is an essential legal contract that outlines the terms, obligations, and objectives of their collaboration. It ensures that both parties understand their roles, contributions, and responsibilities, leading to a mutually beneficial partnership within the golf industry.