South Carolina Escrow Instructions in Short Form

Description

How to fill out Escrow Instructions In Short Form?

Are you in a situation where you require documents for both organizational or personal purposes nearly every day.

There are numerous legal document templates available online, but locating versions you can trust is challenging.

US Legal Forms provides a vast array of template forms, including the South Carolina Escrow Instructions in Short Form, which are designed to fulfill federal and state requirements.

Choose a suitable file format and download your copy.

Access all the templates you have purchased in the My documents section. You can obtain an additional copy of South Carolina Escrow Instructions in Short Form anytime, if necessary. Just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can download the South Carolina Escrow Instructions in Short Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is the right local/area version.

- Use the Review button to verify the form.

- Check the details to confirm that you have chosen the correct form.

- If the form does not meet your needs, utilize the Search box to find a form that aligns with your requirements.

- When you find the appropriate form, click Purchase now.

- Select the pricing plan you wish, complete the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

Form popularity

FAQ

To mail the SC form WH-1612, which pertains to state withholding tax for employers, send it to the South Carolina Department of Revenue. The mailing address will be provided on the form itself to ensure you direct it to the correct location. Timely submission of this form is essential to maintain compliance with state tax regulations. For further assistance and insight, explore UsLegalForms, which can help you navigate South Carolina Escrow Instructions in Short Form.

The SC1120 form, which is the South Carolina corporate tax return, should be mailed to the South Carolina Department of Revenue. The appropriate mailing address can typically be found on the form itself or its accompanying instructions. Ensuring you mail this form to the correct address is vital for timely processing and compliance. If you need assistance with this or related tax questions, consider relying on UsLegalForms for more clarity on South Carolina Escrow Instructions in Short Form.

Yes, South Carolina has a specific state tax withholding form known as the SC W4. This form must be filled out by employees to communicate their withholding preferences to employers. By using the SC W4 correctly, employees can ensure the appropriate amount of taxes is withheld from their wages. For easy access to resources and forms, check platforms like UsLegalForms, which also provide important details like South Carolina Escrow Instructions in Short Form.

The SC W4 form is a state-specific withholding certificate used in South Carolina. Employees complete this form to indicate their tax withholding preferences, which employers then use to determine how much state income tax to deduct from their paychecks. Proper completion of the SC W4 helps ensure that employees are not under- or over-withheld, promoting accurate tax filing. For further details and guidance, consult UsLegalForms, particularly when following South Carolina Escrow Instructions in Short Form.

Yes, South Carolina requires the filing of Form 1099-NEC for reporting non-employee compensation. Businesses must provide this form to both the recipient and the South Carolina Department of Revenue. Accurate filing is crucial to avoid penalties and ensure compliance with state tax laws. To streamline this process, you can access templates and guidance on platforms like UsLegalForms, which emphasize the importance of South Carolina Escrow Instructions in Short Form.

South Carolina does require a state withholding form for tax purposes. This form, known as the SC W4, helps employers determine the correct amount of state tax to withhold from an employee's paycheck. By accurately completing and submitting the SC W4, both employees and employers can ensure compliance with tax regulations. For assistance, consider using resources like UsLegalForms to stay organized and informed, particularly regarding South Carolina Escrow Instructions in Short Form.

Yes, South Carolina implements a state payroll tax that applies to employees' earnings. Employers are responsible for withholding this tax from their employees' wages and submitting it to the state. This payroll tax is essential for funding state health, education, and other public services. For more information, you can refer to the South Carolina Department of Revenue, ensuring you follow South Carolina Escrow Instructions in Short Form.

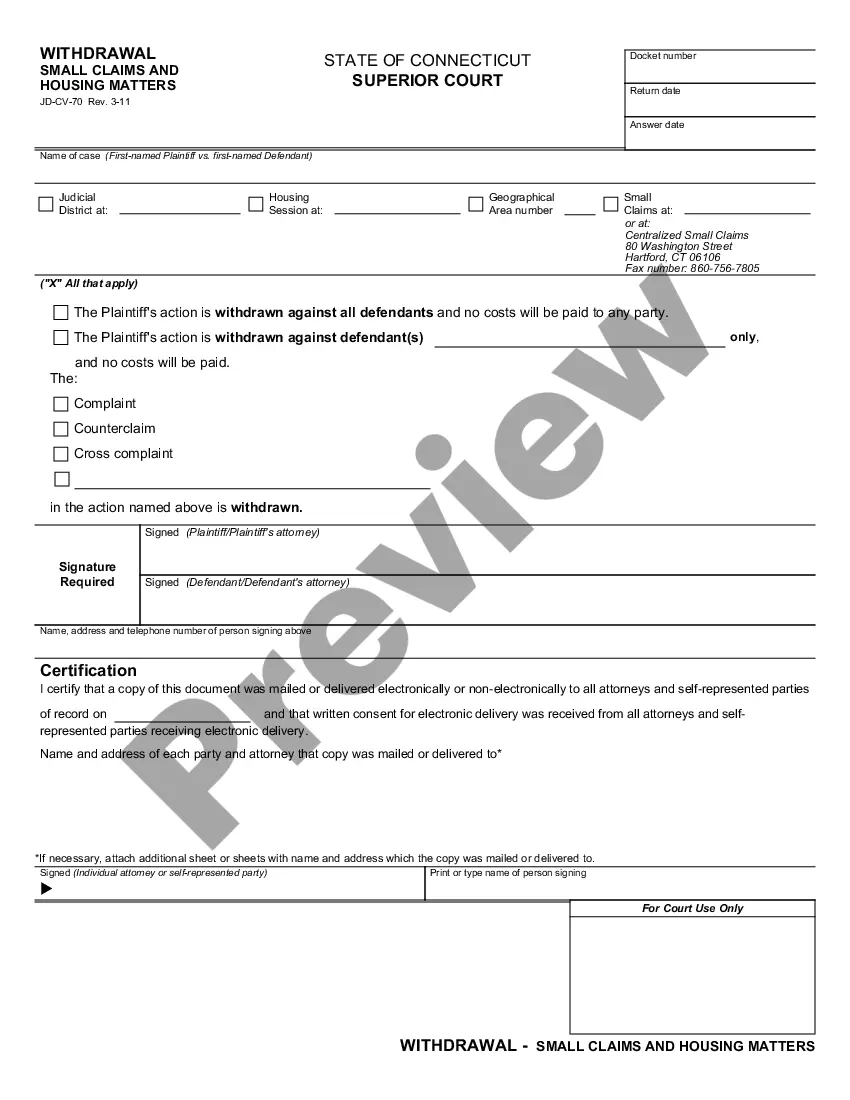

Typically, escrow instructions are detailed guidelines that outline the responsibilities of all parties involved in the transaction. These instructions set out the terms of the escrow agreement, including payment schedules and document submissions. By following South Carolina Escrow Instructions in Short Form, you ensure a clear understanding of your obligations and streamline the process. This can simplify your transactions, making it easier to fulfill your real estate goals.

Escrow is a secure arrangement where a neutral third party holds funds or documents until specific conditions are met. In South Carolina, escrow is often used in real estate transactions, ensuring that both the buyer and seller fulfill their obligations before the exchange. This protects your interests and provides peace of mind during the process. For clear guidance, you can rely on South Carolina Escrow Instructions in Short Form to navigate these procedures smoothly.

Escrow instructions are typically given by the buyer and seller during a real estate transaction. Both parties must agree on the terms and authorize the escrow agent to act on their behalf. Clear and concise South Carolina Escrow Instructions in Short Form can greatly assist in conveying these important directives, ensuring all parties understand their roles and responsibilities.