South Carolina Withdrawal of Partner refers to the legal process through which a partner exits a business or organization in the state of South Carolina. This can apply to various types of partnerships, including general partnerships, limited partnerships, and limited liability partnerships. The withdrawal of a partner from a South Carolina partnership can occur for different reasons, such as the expiration of a partnership term, the achievement of a partnership objective, or the voluntary departure of a partner. Additionally, a partner may be forced to withdraw due to circumstances like death, incapacity, bankruptcy, or a breach of the partnership agreement. There are several types of South Carolina Withdrawal of Partner that individuals or businesses may encounter. These include: 1. Voluntary Withdrawal: This occurs when a partner voluntarily decides to exit the partnership. The departing partner must typically provide written notice to the remaining partners and follow the withdrawal procedure outlined in the partnership agreement or the South Carolina Uniform Partnership Act. 2. Involuntary Withdrawal: In some cases, a partner may be involuntarily withdrawn from the partnership due to events such as death, incapacity, or bankruptcy. The partnership agreement should outline the consequences and procedures to be followed in such circumstances. 3. Expulsion: Expulsion of a partner can take place when other partners decide to terminate the partnership relationship with a particular partner due to various reasons. The partnership agreement should clearly outline the grounds for expulsion, the procedure to be followed, and any associated consequences. 4. Retirement: A partner may choose to retire from the partnership, voluntarily giving up their ownership interest. Retirement procedures are typically defined in the partnership agreement and may include providing notice and determining the value and distribution of the partner's share. 5. Dissolution: In certain cases, the withdrawal of one partner may trigger the dissolution of the entire partnership. This occurs if the partnership agreement restricts the continuation of the partnership without a specified number of partners. When initiating a South Carolina Withdrawal of Partner, it is crucial to consult both the partnership agreement and the South Carolina Uniform Partnership Act to understand the specific requirements and procedures. Seeking legal advice from a qualified attorney is highly recommended ensuring compliance with relevant laws and protect the rights and interests of all parties involved.

South Carolina Withdrawal of Partner

Description

How to fill out South Carolina Withdrawal Of Partner?

Are you presently in a position for which you require documents for both business or personal reasons frequently.

There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers a multitude of form templates, such as the South Carolina Withdrawal of Partner, that are crafted to comply with federal and state regulations.

Access all the document templates you have purchased in the My documents menu.

You can obtain an additional copy of the South Carolina Withdrawal of Partner anytime, if needed. Just follow the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Carolina Withdrawal of Partner template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

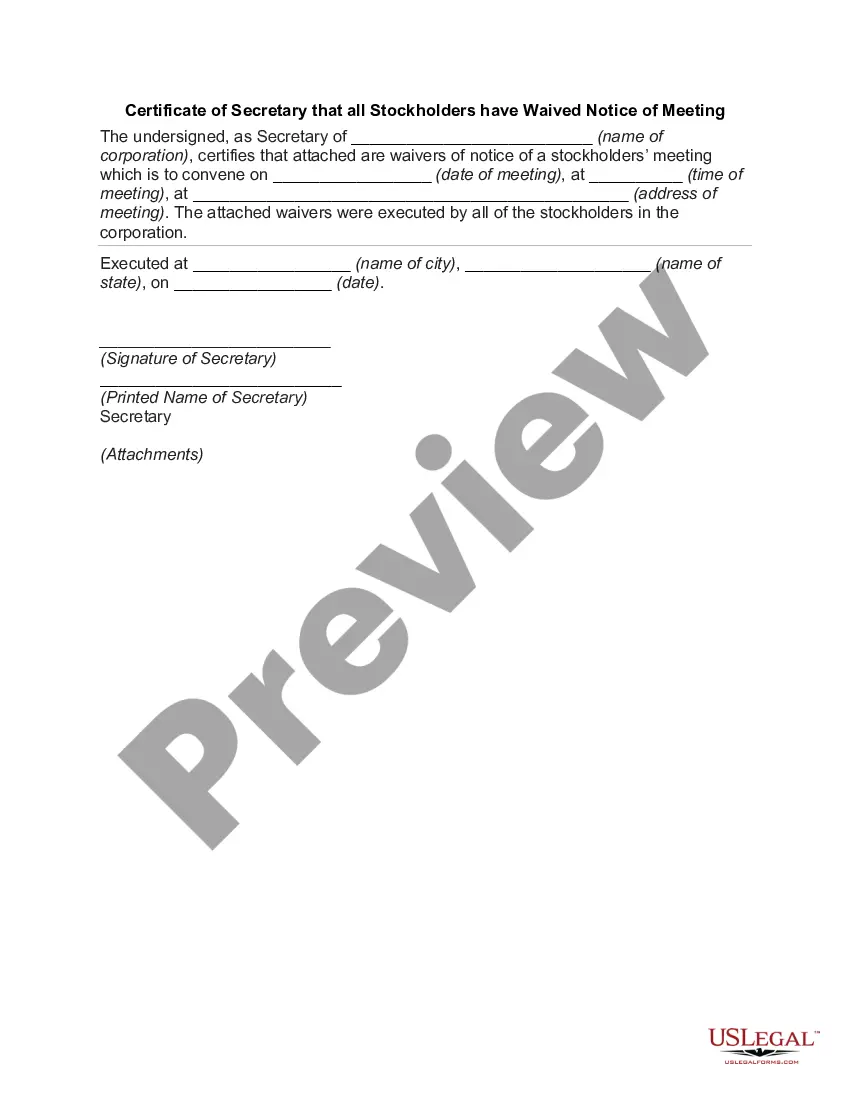

- Use the Preview button to examine the form.

- Check the details to confirm you have selected the correct form.

- If the form is not what you are looking for, utilize the Lookup feature to find the form that meets your needs and specifications.

- Once you locate the appropriate form, click Buy now.

- Select the pricing plan you need, provide the necessary information to create your account, and pay for the order using your PayPal or credit card.

- Choose a convenient paper format and download your version.

Form popularity

FAQ

To form a partnership in South Carolina, partners need to register their business with the state. This includes selecting a business name, drafting a partnership agreement, and obtaining necessary licenses. Understanding these requirements is essential for anyone considering a South Carolina Withdrawal of Partner, as the partnership structure directly impacts tax obligations and personal liability. The US Legal Forms platform offers resources to help you meet these requirements effortlessly.

Filing for legal separation in South Carolina involves submitting a complaint to the family court that outlines your reasons for separation. This process requires you to address issues such as property distribution and child custody, which may potentially affect partner withdrawals. Engaging in the South Carolina Withdrawal of Partner process during legal separation can complicate matters, so consulting legal expertise is advisable. The US Legal Forms platform can help guide you through the necessary paperwork effectively.

Non-resident withholding in South Carolina pertains to taxes deducted from the income of partners who do not reside in the state. The tax, which is typically at a rate of 5%, ensures the state recovers taxes due on income sourced from South Carolina. Understanding this aspect is vital when considering a South Carolina Withdrawal of Partner, as timely and accurate withholding promotes seamless transitions. Make sure to consult with experienced professionals for guidance.

The withholding rate for nonresident partners in South Carolina is currently set at 5% of the taxable income allocated to the nonresident partner. This rate applies to distributions made by the partnership to nonresidents. Knowing this rate is important for those involved in the South Carolina Withdrawal of Partner process, as it affects the overall tax obligations of the partners. Collaborating with a tax professional can ensure compliance and accurate calculations.

South Carolina requires partnerships to withhold taxes at a certain rate from nonresident partners on their distributive share of South Carolina source income. This includes both income derived from in-state activities and any other income attributed to the state. It's crucial for partnerships to understand these requirements promptly to ensure a smooth South Carolina Withdrawal of Partner process. Keeping accurate records and timely payments is essential to avoid penalties.

In South Carolina, partnerships are required to withhold on distributions made to nonresident partners. This means that if you are a partner who does not reside in South Carolina, the partnership is responsible for withholding state taxes from your share of the income. Understanding these responsibilities is essential for proper South Carolina Withdrawal of Partner procedures. Compliance helps avoid any unexpected tax liabilities.

To change ownership of an LLC in South Carolina, members must first review their operating agreement for any outlined procedures. This usually involves drafting an amendment to the operating agreement and possibly filing documentation with the South Carolina Secretary of State. Thoroughly documenting the South Carolina Withdrawal of Partner is crucial for legal protection and ensuring a smooth transition of ownership. Utilizing services like US Legal Forms can simplify this process significantly.

Removing a partner from a partnership firm in South Carolina typically requires following the guidelines established in the partnership agreement. If such guidelines do not exist, partners may need to reach a mutual agreement for removal. It’s essential that all partners discuss the implications and responsibilities stemming from the South Carolina Withdrawal of Partner. Seeking legal guidance can help clarify the necessary steps and responsibilities.

To dissolve a partnership in South Carolina, partners should first review their partnership agreement to understand the terms of dissolution. If there is no agreement, partners can informally agree to dissolve by mutual consent. It's advisable to settle any debts and distribute remaining assets fairly. Consulting a legal professional can aid in ensuring a smooth process, especially when dealing with South Carolina Withdrawal of Partner matters.

In South Carolina, a domestic partner refers to two individuals who share an intimate and committed relationship. This relationship typically includes shared responsibilities and emotional support. It is important to understand that the term may not carry the same legal recognition across all aspects of law. Therefore, it is crucial to consult legal resources when navigating the complexities related to the South Carolina Withdrawal of Partner.

Interesting Questions

More info

Find out more about how to protect yourself from unfair legal claims. Read More Legal Service Providers Legal services can be a rewarding part of every lawyer's professional life. Legal advice is the best defense to any kind of legal liability claim, not just claims against the law firm itself. Read More Litigation Planning Litigators need to plan for all eventualities and have an understanding of how their strategies may change in the future. Read More Law firm reviews A number of law firms currently offer a “law firm reviews” feature to give potential clients a chance to try on a different brand of legal help. Read More The Law Society's Legal Practice Guidelines The Law Society of New South Wales has undertaken a wide-ranging project to review and update the laws of New South Wales in order to respond to the demands of the new legal profession. Read More The legal profession and the law is one of the fastest changing professions in modern history.