A South Carolina Non-Disclosure Agreement (NDA) for potential investors is a legal document that aims to protect sensitive and confidential information shared between parties during negotiations or discussions regarding potential investments in South Carolina. This agreement ensures that proprietary information about a business, trade secrets, financial data, marketing strategies, or any other valuable intellectual property is kept confidential and not disclosed to any third parties. Keywords: South Carolina, Non-Disclosure Agreement, potential investors, sensitive information, confidential, proprietary, trade secrets, financial data, marketing strategies, intellectual property, negotiations, discussions. Types of South Carolina Non-Disclosure Agreements for Potential Investors: 1. One-way NDA: This type of agreement is usually initiated by a business seeking potential investors. It binds the receiving party (the potential investor) to maintain confidentiality regarding the disclosed information. 2. Mutual NDA: In a mutual NDA, both parties involved in potential investment discussions agree to maintain confidentiality regarding all confidential information shared with each other. This type of agreement is commonly used when both the business and the potential investor anticipate sharing sensitive information during negotiations. 3. Specific Purpose NDA: This variant of the NDA is designed for a specific purpose or project rather than general use. It outlines the details of the project, the specific information to be protected, and the permitted uses of the disclosed information. 4. Employee NDA: If a potential investor is also an employee or consultant of the business, this type of NDA can be used to protect both the employer's trade secrets and the investor's confidential information. 5. Universal NDA: A universal NDA is a comprehensive agreement that covers all potential investment discussions and interactions. It provides broader protection for sensitive information and is useful when the parties anticipate multiple future collaborations or negotiations. By utilizing a South Carolina Non-Disclosure Agreement for potential investors, businesses can establish trust and protect their valuable information during investment-related negotiations, ensuring that their proprietary assets remain secure.

South Carolina Non Disclosure Agreement

Description

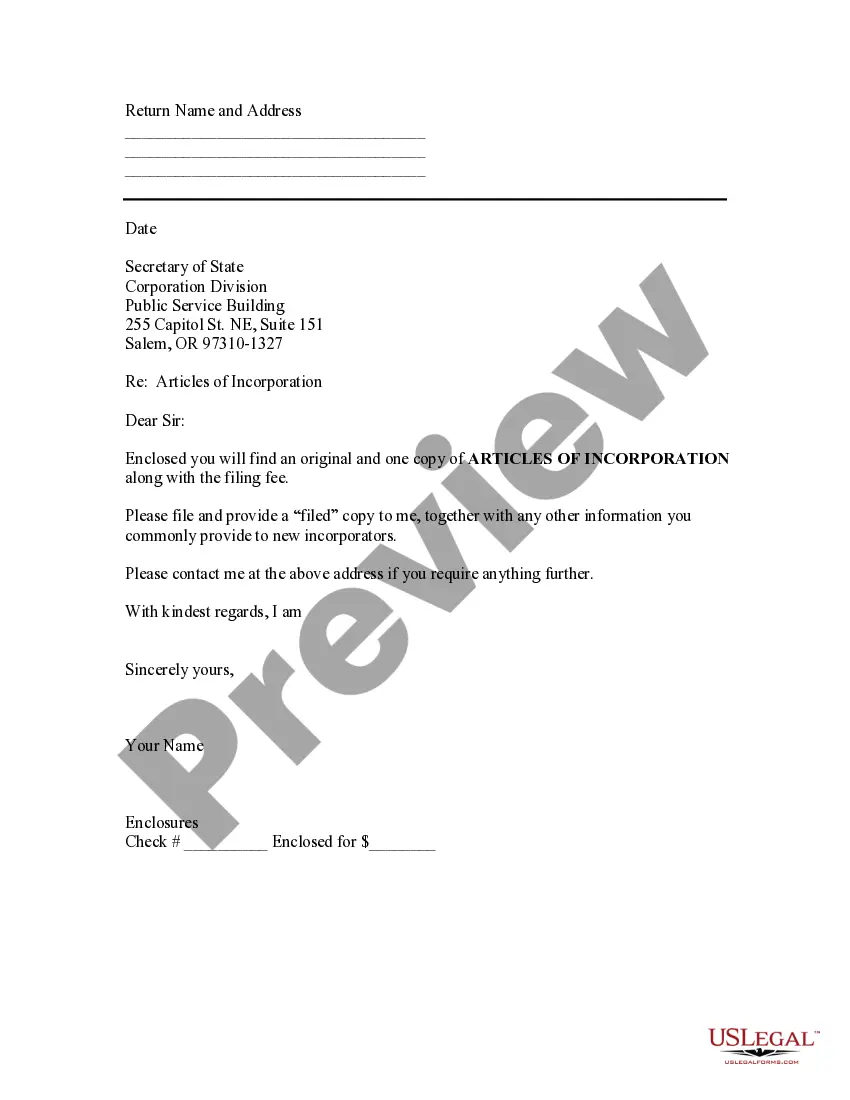

How to fill out South Carolina Non-Disclosure Agreement For Potential Investors?

You might spend countless hours online searching for the official document template that complies with the federal and state regulations you require.

US Legal Forms offers a vast selection of official forms that are reviewed by professionals.

It is easy to download or print the South Carolina Non-Disclosure Agreement for Potential Investors from our platform.

If available, utilize the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then press the Obtain button.

- After that, you can complete, edit, print, or sign the South Carolina Non-Disclosure Agreement for Potential Investors.

- Every official document template you acquire belongs to you permanently.

- To receive another copy of a purchased template, navigate to the My documents section and click on the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the county/region of your choice.

- Check the template description to confirm that you have chosen the appropriate form.

Form popularity

FAQ

To create a legally-binding non-disclosure contract, you must use specific language when defining confidential information, parties, and scope. Broad language that can be interpreted many ways may not hold up in a legal dispute.

Violating an NDA leaves you open to lawsuits from your employer, and you could be required to pay financial damages and possibly associated legal costs. It's illegal to reveal trade secrets or sensitive company information to a competitor.

Having a signed NDA helps deter such idea theft. Without one, it can be difficult to prove that an idea has been stolen. A company hiring outside consultants may also require those individuals, who will be handling sensitive data, to sign an NDA so that they do not disclose those details at any point.

disclosure agreement (NDA) is an agreement in contract law that certain information will remain confidential. As such, an NDA binds a person who has signed it and prevents them from discussing any information included in the contract with any nonauthorized party.

The Key Elements of Non-Disclosure AgreementsIdentification of the parties.Definition of what is deemed to be confidential.The scope of the confidentiality obligation by the receiving party.The exclusions from confidential treatment.The term of the agreement.

How to terminate the NDARead the Duration clauses. Good NDAs will have two different terms of duration.Read the termination clause. Like any other relationship, business partnerships can come to an early end unexpectedly.Read the Return of Information clause.31-Aug-2021

Typical exceptions to the definition of confidential information include (i) information publicly known or in the public domain prior to the time of disclosure, (ii) information publicly known and made generally available after disclosure through no action or inaction of the recipient, (ii) information already in the

Violating an NDA can have serious consequences NDAs are legally binding contracts. If an employee has violated an NDA, then the company may take legal action. The most common claims in NDA lawsuits include: Breach of the contract (such as the breach of NDA)

Key elements of Non-disclosure AgreementIdentification of the parties that are signing the agreement. A precise definition of what is considered confidential under the agreement. The clear reason as to why the information is shared and for what purpose.

To create a legally-binding non-disclosure contract, you must use specific language when defining confidential information, parties, and scope. Broad language that can be interpreted many ways may not hold up in a legal dispute.

Interesting Questions

More info

IPA Staff Website Troubleshooting Contact The Board of Directors Adobe, Microsoft Word, and other open, non-disclosure agreements (NDAs) are used in many fields, as are confidential, non-disclosure agreements (NDAs), all of which are designed to prevent trade secrets being disclosed. However, in recent years the use of NDA agreements has become much less common, with many companies instead opting for business licenses that may allow for better marketing flexibility and flexibility with terms. It is vital that you read these rules carefully, as they can affect all aspects of your business dealings. The purpose of this document is to provide a basic overview of the use of commercial agreements and commercial confidentiality, and to help ensure that you understand their significance and their potential for being misused. 1) Introduction If you are entering into a contract with someone, you are bound by the agreement you are negotiating.