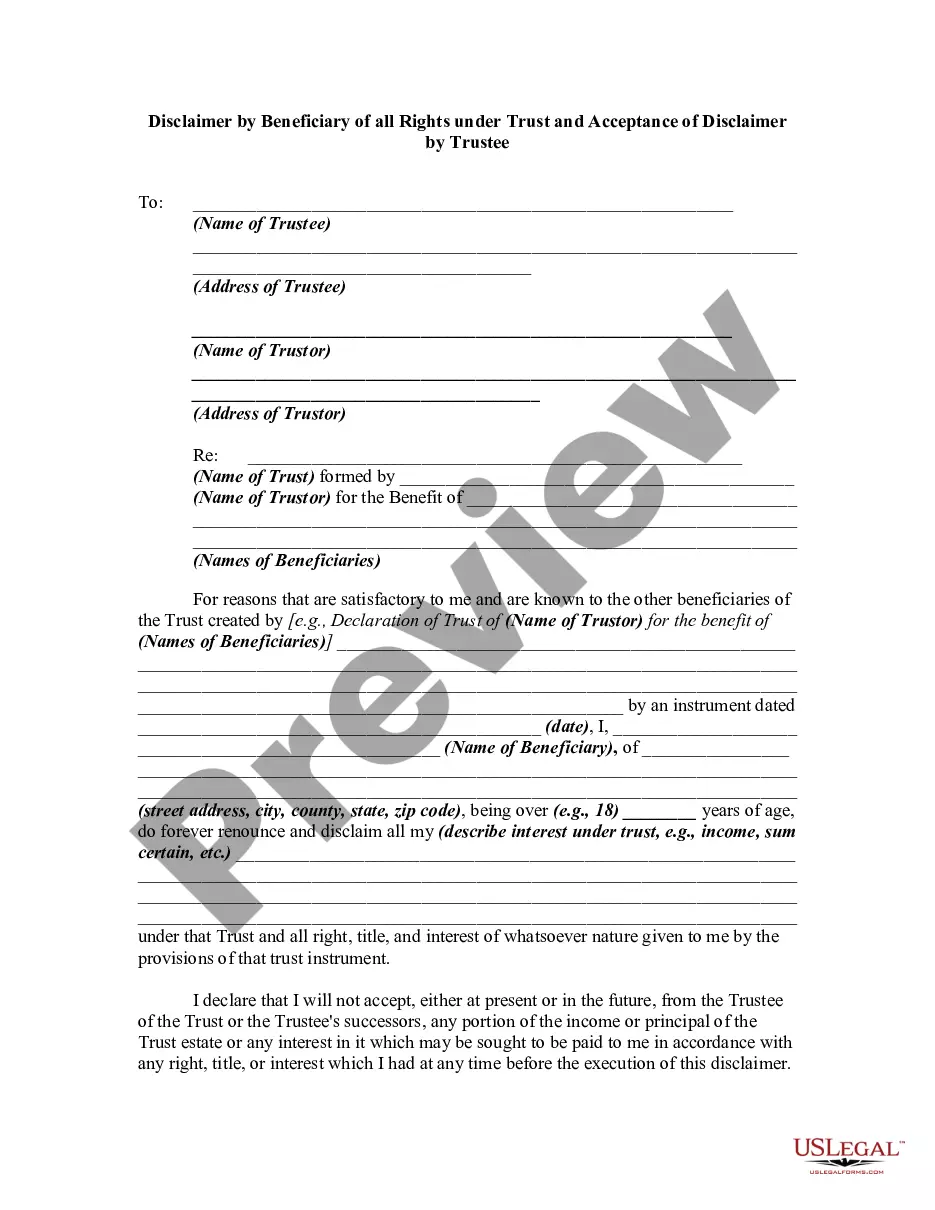

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept of an estate which has been conveyed to him. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Carolina Disclaimer by Beneficiary of all Rights in Trust

Description

How to fill out Disclaimer By Beneficiary Of All Rights In Trust?

US Legal Forms - among the largest collections of legal documents in the United States - provides a vast assortment of legal document templates that you can download or print.

By using the website, you can find thousands of forms for business and personal needs, categorized by types, states, or keywords. You will discover the most recent versions of documents like the South Carolina Disclaimer by Beneficiary of all Rights in Trust in just a few moments.

If you already have a monthly subscription, Log In to obtain the South Carolina Disclaimer by Beneficiary of all Rights in Trust from your US Legal Forms library. The Acquire button will appear on each form you review. You will have access to all previously downloaded forms from the My documents tab of your account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the purchase.

Select the format and download the form to your device. Make modifications. Fill in, edit, print, and sign the downloaded South Carolina Disclaimer by Beneficiary of all Rights in Trust. Each template saved in your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the South Carolina Disclaimer by Beneficiary of all Rights in Trust with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to examine the form's content.

- Check the form information to confirm you have the appropriate form.

- If the form does not meet your needs, utilize the Lookup field at the top of the screen to find one that does.

- If you are content with the form, confirm your selection by clicking the Buy now button.

- Then, choose the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Yes, a beneficiary can renounce their interest under a trust, which is often done to achieve specific financial or personal goals. This renunciation process can enhance estate planning considerations. By following the procedures outlined in a South Carolina Disclaimer by Beneficiary of all Rights in Trust, beneficiaries can navigate this decision smoothly.

A trust beneficiary can certainly disclaim their interest in the trust. This action is typically governed by South Carolina law, enabling beneficiaries to renounce their rights effectively. Utilizing a South Carolina Disclaimer by Beneficiary of all Rights in Trust offers a clear framework for this important decision.

Yes, declining to be a beneficiary of a trust is possible through a formal disclaimer. This process allows you to refuse the benefits of the trust without adverse consequences on your part. Leveraging the guidelines of a South Carolina Disclaimer by Beneficiary of all Rights in Trust can make this action more straightforward.

Certainly, a beneficiary of a trust can disclaim their interest. This process, recognized in South Carolina, allows beneficiaries to formally decline their rights to the trust property. Utilizing a South Carolina Disclaimer by Beneficiary of all Rights in Trust can simplify this process, ensuring that all legal requirements are met.

Yes, beneficiaries can refuse their inheritance in South Carolina. This refusal is often formalized through a legal procedure known as a disclaimer. By doing this, beneficiaries may specify their intention to renounce their rights in the trust, aligning with the South Carolina Disclaimer by Beneficiary of all Rights in Trust.

SC Code 62 5 501 pertains to the South Carolina laws governing disclaimers of property by beneficiaries. This statute outlines the conditions under which beneficiaries can legally refuse inheritance, ensuring that any disclaimers are executed according to state regulations. Familiarizing yourself with this code is crucial for a proper understanding of the disclaimer process.

A beneficiary may want to disclaim property to avoid tax burdens, address family dynamics, or align with personal financial strategies. By executing a disclaimer, they can pass their share to other beneficiaries, which may provide better overall financial outcomes for everyone involved. Understanding the South Carolina Disclaimer by Beneficiary of all Rights in Trust can offer valuable insights into this choice.

While a Disclaimer trust can offer flexibility, there are disadvantages to consider. Once a beneficiary disclaims their rights, they cannot later accept those assets, which could lead to unexpected consequences. Additionally, disclaimer trusts may complicate the distribution process and potentially incur legal fees, impacting the overall estate plan.

A Disclaimer by a beneficiary of a trust refers to the act of a beneficiary formally refusing to accept their share of the trust assets. In South Carolina, this legal process allows beneficiaries to decline their rights, which can help mitigate tax liabilities or family disputes. It’s essential to follow specific guidelines to ensure the disclaimer is valid.

Yes, a trust generally avoids probate in South Carolina. When assets are placed in a trust, they no longer belong to the individual, which means they do not enter the probate process upon death. This feature simplifies the transfer of assets and can result in a faster distribution to beneficiaries.