A South Carolina Irrevocable Letter of Credit is a legally binding document issued by a financial institution in South Carolina, guaranteeing payment to a beneficiary upon presentation of specified documents or fulfillment of certain conditions. This financial instrument ensures secure transactions and acts as a form of assurance for parties involved in trade or business agreements. Irrevocable: The South Carolina Irrevocable Letter of Credit cannot be modified or revoked without the consent of all parties involved, providing a higher level of security and guarantee to the recipient. Beneficiary: The beneficiary of the South Carolina Irrevocable Letter of Credit is the party, typically the seller or the party delivering goods or services, who will receive payment upon compliance with the terms and conditions outlined in the letter. Financial Institution: The South Carolina Irrevocable Letter of Credit is issued by a bank or financial institution with a solid reputation, ensuring the credibility of the guarantee provided. Types of South Carolina Irrevocable Letter of Credit: 1. Commercial Letter of Credit: This type of letter of credit is commonly used in international trade transactions, ensuring that the seller will receive payment once the stipulated documents, such as invoices, shipping documents, or certificates of origin, are presented to the bank. 2. Standby Letter of Credit: This form of letter of credit acts as a backup mechanism when the primary payment method fails. It assures the beneficiary that they will receive payment if the applicant fails to fulfill their contractual obligations. 3. Revolving Letter of Credit: A revolving letter of credit provides a financial guarantee over a specified period or for a particular amount, as agreed upon between the parties involved. It can be used repeatedly within the agreed period or limit. 4. Transferable Letter of Credit: This type of letter of credit allows the beneficiary (usually an intermediary) the option to further transfer the letter of credit to one or more subsequent beneficiaries. It is particularly useful in complex trade transactions where intermediary parties are involved. In conclusion, the South Carolina Irrevocable Letter of Credit is a crucial instrument that facilitates secure trade and financial transactions. Its irrevocable nature, various types, and the involvement of a reputable financial institution contribute to its importance in ensuring smooth and reliable business practices within the state.

South Carolina Irrevocable Letter of Credit

Description

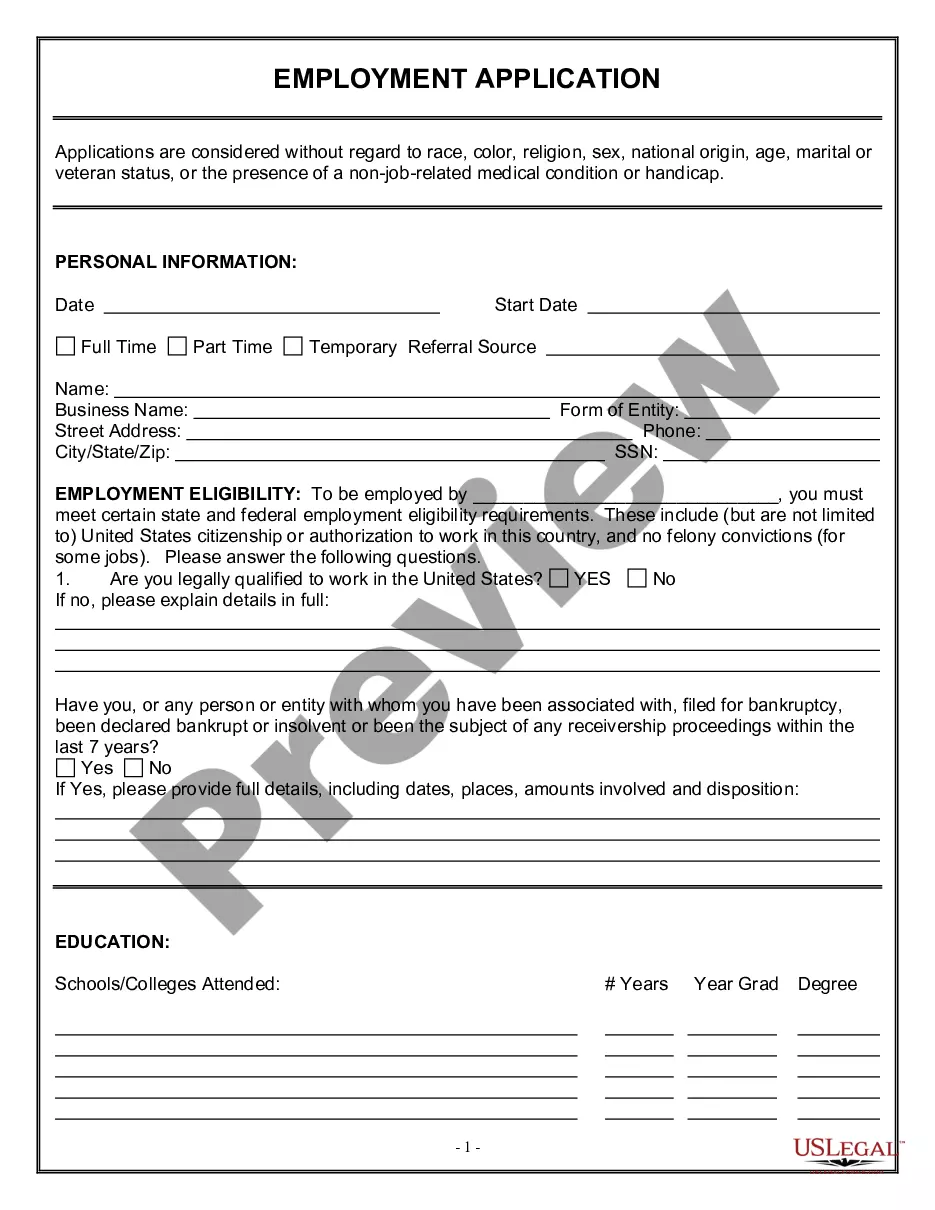

How to fill out South Carolina Irrevocable Letter Of Credit?

It is possible to devote hours on the web looking for the legitimate document design that meets the state and federal requirements you need. US Legal Forms gives 1000s of legitimate types which are evaluated by specialists. You can easily down load or printing the South Carolina Irrevocable Letter of Credit from the services.

If you already possess a US Legal Forms account, it is possible to log in and then click the Acquire option. Following that, it is possible to comprehensive, edit, printing, or indicator the South Carolina Irrevocable Letter of Credit. Every single legitimate document design you acquire is your own eternally. To have another backup associated with a obtained kind, proceed to the My Forms tab and then click the corresponding option.

If you are using the US Legal Forms site for the first time, adhere to the straightforward guidelines listed below:

- Initial, be sure that you have selected the right document design for that region/area of your choice. Look at the kind information to ensure you have chosen the proper kind. If available, use the Review option to appear throughout the document design too.

- If you want to get another version of the kind, use the Lookup discipline to discover the design that meets your needs and requirements.

- When you have identified the design you need, click on Buy now to continue.

- Pick the costs program you need, enter your references, and sign up for a merchant account on US Legal Forms.

- Total the purchase. You may use your Visa or Mastercard or PayPal account to pay for the legitimate kind.

- Pick the format of the document and down load it in your system.

- Make changes in your document if needed. It is possible to comprehensive, edit and indicator and printing South Carolina Irrevocable Letter of Credit.

Acquire and printing 1000s of document templates using the US Legal Forms website, which offers the largest collection of legitimate types. Use skilled and status-specific templates to deal with your organization or individual requirements.

Form popularity

FAQ

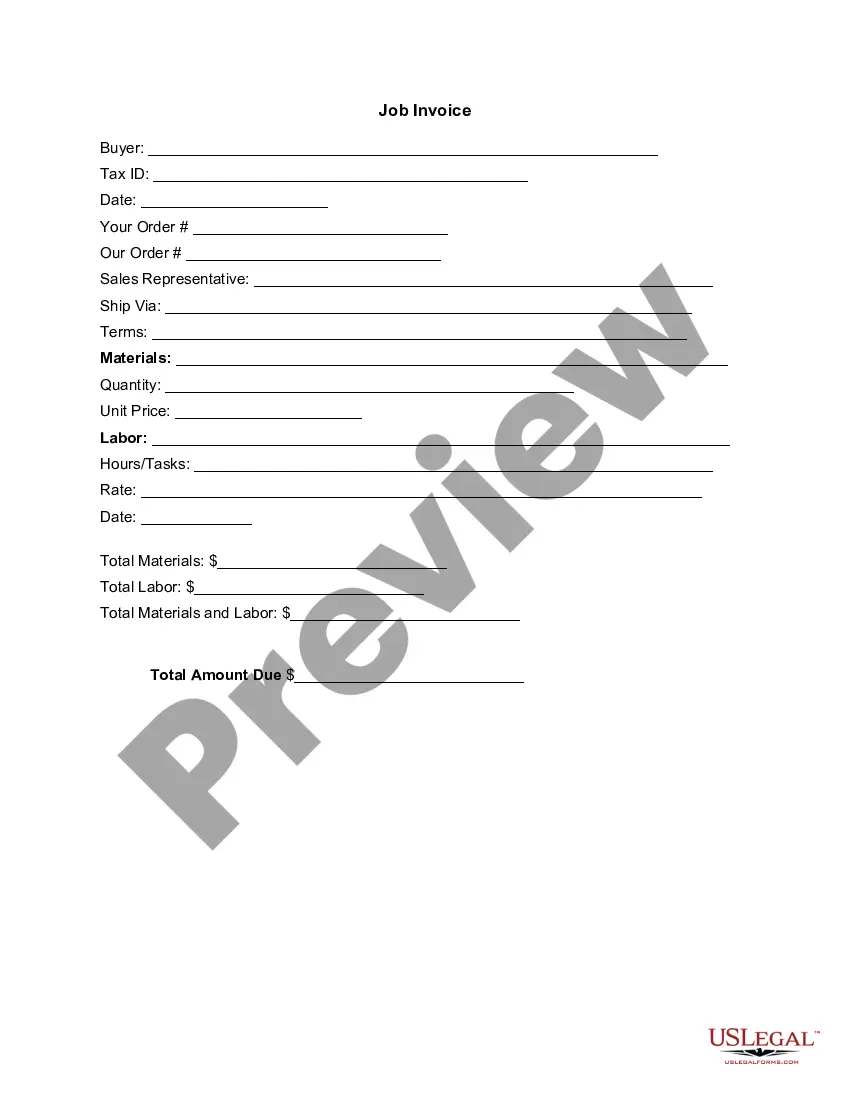

A buyer will typically pay anywhere between 0.75% and 1.5% of the transaction's value, depending on the locations of the issuing banks. Sellers may find that their fees are structured slightly differently.

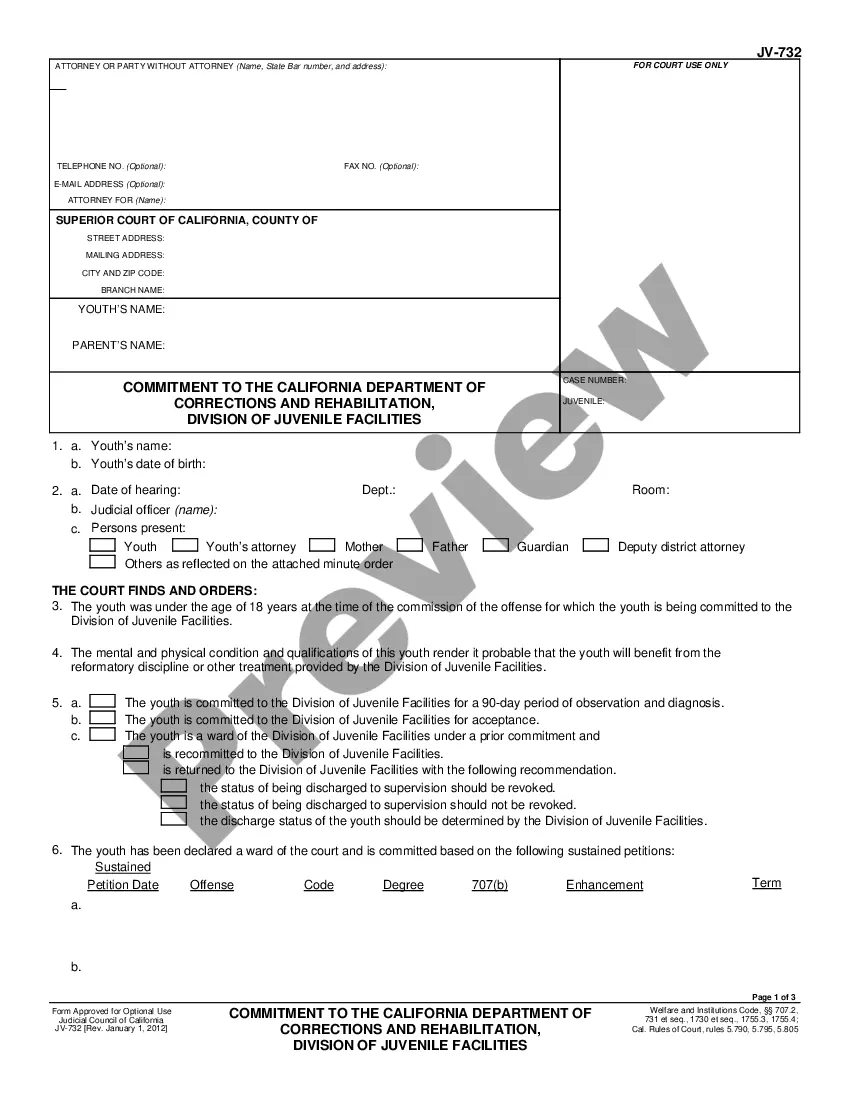

A sight LC becomes due as soon as the beneficiary presents the proof of delivery or proof of shipment, and other ancillary documents. On the other hand, a Time LC needs certain days to pass after submitting a letter of credit, proof of delivery or shipment, and other required documents, before the payment becomes due.

An irrevocable letter of credit is a financial instrument used in international trade to ensure payment security for sellers and provide assurance to buyers. It is issued by a bank on behalf of the buyer, guaranteeing that the seller will receive payment upon complying with the specified terms and conditions.

Common types of letters of credit A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees.

Letters of credit are similar to bank guarantees (BGs), with the difference being that bank guarantees are used for a variety of different situations ? while letters of credit are mainly used for import/export. A letter of credit is also known as a documentary credit (DC or D/C) and is a form of trade finance.

Banks will usually charge a fee for a letter of credit, which can be a percentage of the total credit that they are backing. The cost of a letter of credit will vary by bank and the size of the letter of credit. For example, the bank may charge 0.75% of the amount that it's guaranteeing.

For a secured revocable letter of credit, the buyer has to give a personal guarantee or mortgage security. For an unsecured revocable letter of credit, the bank checks the creditworthiness of the buyer. Please note in both instances, the bank can revoke the LC.

An irrevocable letter of credit must be obtained through the bank. You should not try to craft a letter or adapt somebody else's letter of credit. Doing so can put you at risk of an expensive legal battle, potentially overseas.