A limited review of financial statements is an audit restricted to an examination either for a limited period or of a limited part of the records. A review does not contemplate obtaining an understanding of the entity's internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles.

The definition of nonattest services is very inclusive. It includes, for example, preparation of the client's depreciation schedule and preparation of journal entries even if management has approved the journal entries. I have confirmed these examples directly with the AICPA ethics division. The definition of nonattest services includes preparation of tax returns.

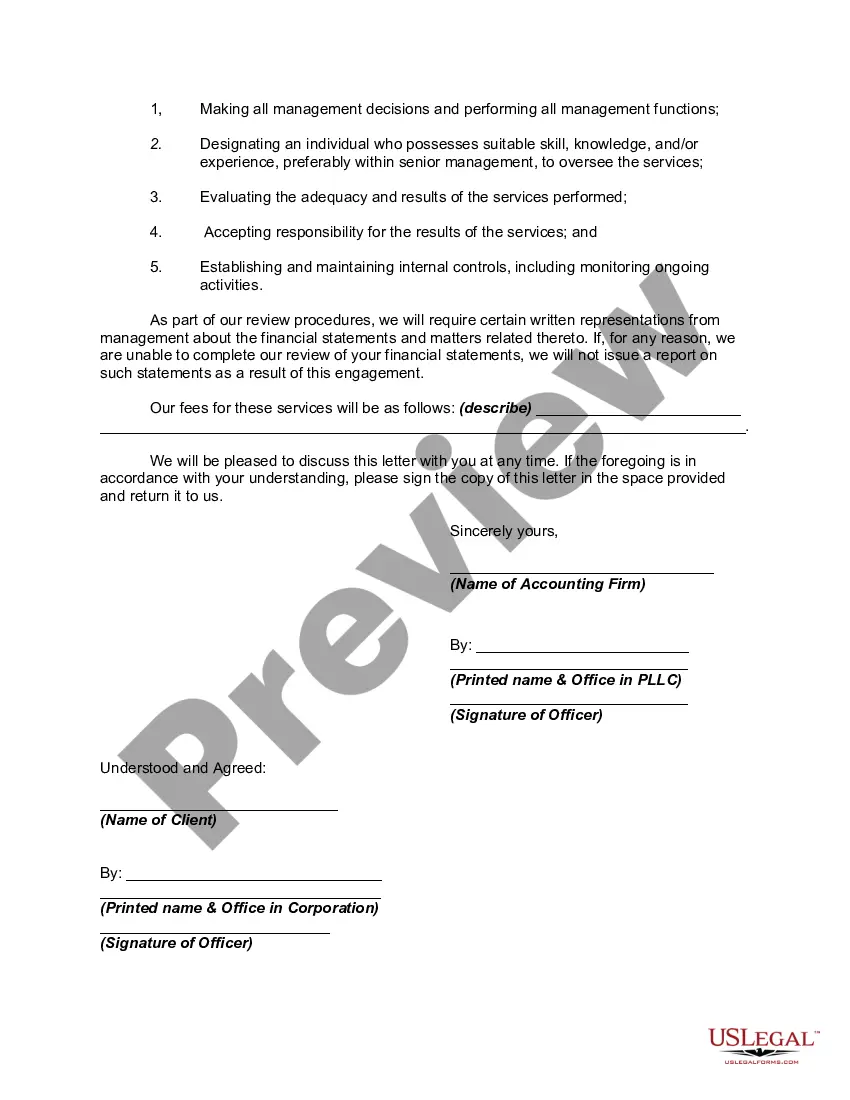

South Carolina Engagement Letter for Review of Financial Statements by Accounting Firm is a formal agreement between a certified public accounting firm and a client, specifying the terms and conditions under which the firm will conduct a review of the client's financial statements. This letter ensures clarity and establishes a professional relationship between both parties. The purpose of the South Carolina Engagement Letter is to outline the scope of the review engagement, define the responsibilities of each party, and establish a timeline for completion. It also sets forth the fees to be charged for the services rendered. The engagement letter acts as a legal document, protecting both the accounting firm and the client by clearly stating the agreed-upon terms. In South Carolina, there are primarily two types of engagement letters used for the review of financial statements by an accounting firm: 1. General Engagement Letter: This type of engagement letter is applicable when the certified public accounting firm performs review engagements for various clients across different industries. It outlines the standard terms and conditions that are commonly applicable to most review engagements. 2. Industry-Specific Engagement Letter: South Carolina also offers industry-specific engagement letters that are tailored to meet the unique requirements of specific sectors, such as healthcare, construction, manufacturing, or not-for-profit organizations. These engagement letters incorporate industry-specific standards and regulations to ensure compliance with relevant guidelines. Key elements typically included in a South Carolina Engagement Letter for Review of Financial Statements by an Accounting Firm are: 1. Identification of Parties: The engagement letter clearly identifies the accounting firm, its address, and contact details, as well as the client's name, address, and contact information. 2. Objective and Scope: The letter states that the accounting firm will perform a review of the client's financial statements and highlights the limitations inherent in a review engagement compared to an audit engagement. It defines the purpose, extent, and timelines of the review. 3. Responsibilities: The engagement letter outlines the responsibilities of both the accounting firm and the client. It states that the client will provide the necessary financial records and documentation, while the accounting firm will perform the review based on professional standards. 4. Fees and Billing: The engagement letter specifies the fee structure and billing arrangements for the review engagement. It may mention the hourly rates, fixed fees, or any other agreed-upon pricing methodology. It could also indicate any upfront deposits or payment terms. 5. Professional Standards: The engagement letter states that the accounting firm will perform the review in accordance with Generally Accepted Accounting Principles (GAAP) and other relevant professional standards, including the standards set by the American Institute of Certified Public Accountants (AICPA). 6. Confidentiality: The engagement letter highlights the importance of confidentiality and assures the client that the accounting firm will maintain the privacy of all financial information disclosed during the review process. 7. Termination Clause: The engagement letter includes a clause that allows for termination by either party, with or without cause, along with the notice period required for such termination. A well-drafted South Carolina Engagement Letter for Review of Financial Statements by an Accounting Firm is crucial for ensuring a clear understanding between the accounting firm and the client and minimizing potential disputes. It provides both parties with a solid framework within which they can collaborate and work towards achieving the client's objectives while complying with relevant regulations and professional standards.South Carolina Engagement Letter for Review of Financial Statements by Accounting Firm is a formal agreement between a certified public accounting firm and a client, specifying the terms and conditions under which the firm will conduct a review of the client's financial statements. This letter ensures clarity and establishes a professional relationship between both parties. The purpose of the South Carolina Engagement Letter is to outline the scope of the review engagement, define the responsibilities of each party, and establish a timeline for completion. It also sets forth the fees to be charged for the services rendered. The engagement letter acts as a legal document, protecting both the accounting firm and the client by clearly stating the agreed-upon terms. In South Carolina, there are primarily two types of engagement letters used for the review of financial statements by an accounting firm: 1. General Engagement Letter: This type of engagement letter is applicable when the certified public accounting firm performs review engagements for various clients across different industries. It outlines the standard terms and conditions that are commonly applicable to most review engagements. 2. Industry-Specific Engagement Letter: South Carolina also offers industry-specific engagement letters that are tailored to meet the unique requirements of specific sectors, such as healthcare, construction, manufacturing, or not-for-profit organizations. These engagement letters incorporate industry-specific standards and regulations to ensure compliance with relevant guidelines. Key elements typically included in a South Carolina Engagement Letter for Review of Financial Statements by an Accounting Firm are: 1. Identification of Parties: The engagement letter clearly identifies the accounting firm, its address, and contact details, as well as the client's name, address, and contact information. 2. Objective and Scope: The letter states that the accounting firm will perform a review of the client's financial statements and highlights the limitations inherent in a review engagement compared to an audit engagement. It defines the purpose, extent, and timelines of the review. 3. Responsibilities: The engagement letter outlines the responsibilities of both the accounting firm and the client. It states that the client will provide the necessary financial records and documentation, while the accounting firm will perform the review based on professional standards. 4. Fees and Billing: The engagement letter specifies the fee structure and billing arrangements for the review engagement. It may mention the hourly rates, fixed fees, or any other agreed-upon pricing methodology. It could also indicate any upfront deposits or payment terms. 5. Professional Standards: The engagement letter states that the accounting firm will perform the review in accordance with Generally Accepted Accounting Principles (GAAP) and other relevant professional standards, including the standards set by the American Institute of Certified Public Accountants (AICPA). 6. Confidentiality: The engagement letter highlights the importance of confidentiality and assures the client that the accounting firm will maintain the privacy of all financial information disclosed during the review process. 7. Termination Clause: The engagement letter includes a clause that allows for termination by either party, with or without cause, along with the notice period required for such termination. A well-drafted South Carolina Engagement Letter for Review of Financial Statements by an Accounting Firm is crucial for ensuring a clear understanding between the accounting firm and the client and minimizing potential disputes. It provides both parties with a solid framework within which they can collaborate and work towards achieving the client's objectives while complying with relevant regulations and professional standards.