South Carolina Sample Letter for Authorization for Late Return

Description

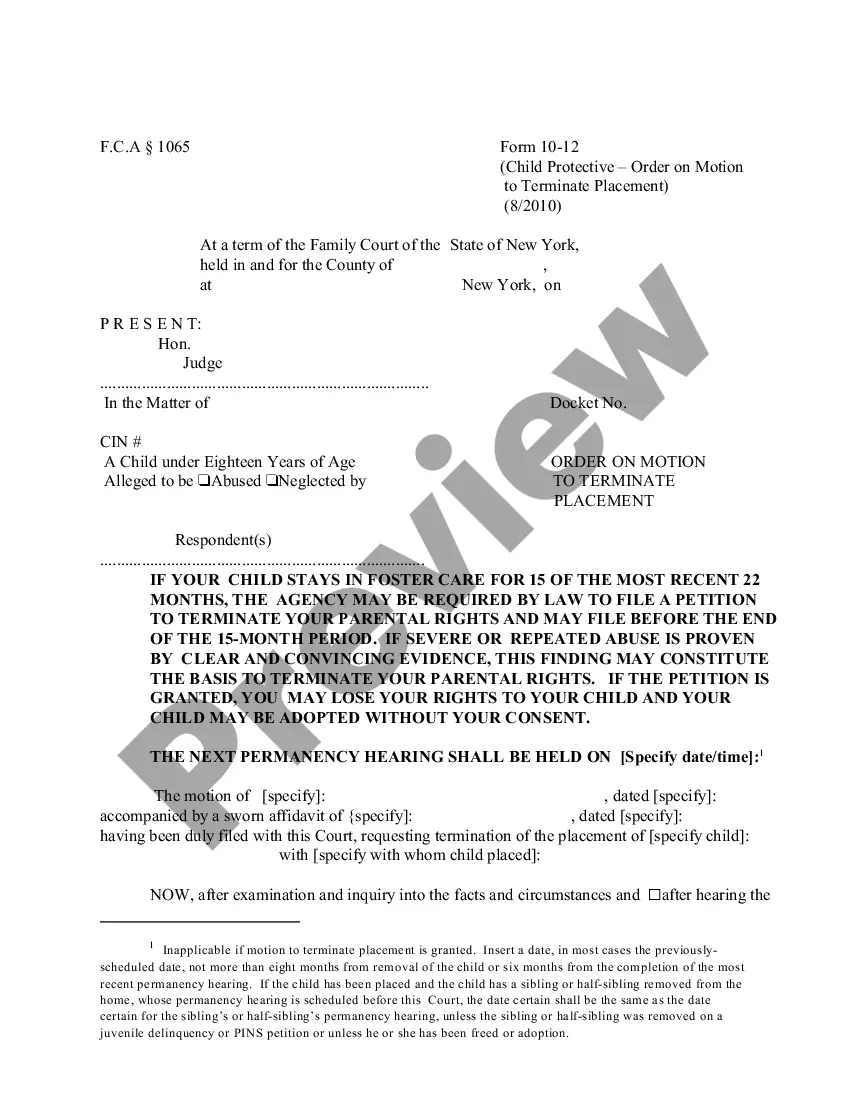

How to fill out Sample Letter For Authorization For Late Return?

Selecting the optimal legal document template can be a challenge. Obviously, there are numerous templates accessible online, but how can you locate the legal form you desire? Utilize the US Legal Forms website. This service offers thousands of templates, including the South Carolina Sample Letter for Authorization for Late Return, suitable for both business and personal needs. All forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to retrieve the South Carolina Sample Letter for Authorization for Late Return. Use your account to browse the legal forms you have purchased previously. Go to the My documents tab in your account to obtain another copy of the document you require.

If you are a new user of US Legal Forms, here are straightforward instructions you can follow: First, ensure you have chosen the correct form for your locality/state. You can review the document using the Preview button and read the document description to ensure it is suitable for you. If the form does not satisfy your requirements, utilize the Search field to find the appropriate form. Once you are confident that the form is accurate, click the Buy now button to obtain the form.

- Select the pricing plan you prefer and enter the necessary information.

- Create your account and pay for the order using your PayPal account or credit/debit card.

- Choose the file format and download the legal document template to your device.

- Complete, edit, print, and sign the received South Carolina Sample Letter for Authorization for Late Return.

- US Legal Forms is the largest library of legal forms where you can view various document templates.

- Utilize the service to download professionally-created documents that comply with state regulations.

Form popularity

FAQ

The subsistence allowance on the SC1040 refers to a specific amount that taxpayers may deduct for certain work-related traveling expenses. This allowance can be advantageous for individuals who incur costs while performing services away from home. Understanding this allowance can contribute to a more accurate calculation of your tax return. If you need extra time to gather necessary documentation, using a South Carolina Sample Letter for Authorization for Late Return can provide the required flexibility.

The SC1040 form is the official tax form for South Carolina residents to report their income, claim exemptions, and calculate their tax owed. This form is a critical component of filing state taxes, and it largely mirrors the federal 1040 form but includes state-specific regulations and requirements. Properly completing the SC1040 form is vital to ensure compliance with state law. If you encounter difficulties, a South Carolina Sample Letter for Authorization for Late Return can assist in gaining more time.

The SC2848 form, which authorizes an individual to represent you before the South Carolina Department of Revenue, should be sent to the address listed on the form instructions. Typically, this mailing address may vary based on whether you are submitting it for administrative issues or appeals. Ensure that you properly fill out the form and keep copies for your records. Should you miss a deadline, having a South Carolina Sample Letter for Authorization for Late Return handy can help manage your situation.

Any residents of South Carolina who earn income during the tax year must file a SC 1040 form. Additionally, non-residents who earn income from South Carolina sources are also required to file. It's essential to meet the state's filing deadlines to avoid penalties. If you're preparing a late submission, consider using a South Carolina Sample Letter for Authorization for Late Return to streamline the process.

The 1040 form is used to report an individual's annual income to the IRS in the United States. This form helps taxpayers calculate their total taxable income and determine how much tax they owe or how much refund they can expect. When filing this form, understanding elements like deductions and credits is crucial for maximizing your tax benefits. For those dealing with late submissions, a South Carolina Sample Letter for Authorization for Late Return can be helpful.

To submit Form SC2848, which is the South Carolina Power of Attorney form, you must complete the form with the relevant details, including the taxpayer's and representative's information. After filling out the form, you can mail it to the South Carolina Department of Revenue for processing. This process can be complicated, so utilizing the South Carolina Sample Letter for Authorization for Late Return can help streamline your submission and communication.

A federal tax return generally includes your income from various sources, deductions, tax credits, and personal information. It summarizes your financial activity for the year, helping the IRS determine your tax liability. Ensuring accuracy is critical to avoid issues. The South Carolina Sample Letter for Authorization for Late Return could be beneficial if you need to amend your return or respond to inquiries.

Certain items must be added back to your federal taxable income when calculating your South Carolina taxes. These can include state income tax deductions and certain federal credits that are not recognized in South Carolina. It's advisable to carefully review these additions with accurate documentation. Using the South Carolina Sample Letter for Authorization for Late Return can assist in navigating these details effectively.

You can mail your South Carolina tax return to the appropriate address based on the type of tax return you're submitting. For individual income tax returns, the mailing address is generally the South Carolina Department of Revenue. Make sure to double-check and ensure you're using the correct address to avoid processing delays. If you are submitting a late return, consider using the South Carolina Sample Letter for Authorization for Late Return to streamline communication.

South Carolina offers several tax advantages, including lower income tax rates and various exemptions for retirees and small businesses. Additionally, there are tax credits available that can benefit residents. By understanding your options, you can optimize your tax situation. The South Carolina Sample Letter for Authorization for Late Return is a useful resource for individuals navigating these advantages.