South Carolina Comprehensive Commercial Deed of Trust and Security Agreement is a key legal document used in real estate transactions within the state of South Carolina. This agreement serves as a security mechanism for lenders, providing them with a lien on the property as collateral, offering protection in case of default or breach of contract by the borrower. The comprehensive commercial deed of trust and security agreement outlines the terms and conditions between the borrower (typically a business entity) and the lender. It includes important details such as the description of the property, the amount of the loan, the interest rate, repayment terms, and any additional terms agreed upon by both parties. This agreement also includes provisions regarding the borrower's responsibilities such as property maintenance, insurance requirements, and compliance with zoning laws and environmental regulations. It typically grants the lender the right to inspect the property and take appropriate action in case of non-compliance. In South Carolina, there are two main types of comprehensive commercial deeds of trust and security agreements: 1. Standard Comprehensive Commercial Deed of Trust and Security Agreement: This is the most commonly used form that outlines the general terms and conditions applicable to commercial real estate transactions in the state. It provides a standard framework for lenders and borrowers, ensuring clarity and consistency in their contractual relationship. 2. Customized Comprehensive Commercial Deed of Trust and Security Agreement: This type of agreement is tailored to meet specific requirements of a particular transaction. It may include additional provisions, special clauses, or modifications to the standard agreement, allowing lenders and borrowers to customize the terms according to their needs. To conclude, the South Carolina Comprehensive Commercial Deed of Trust and Security Agreement is a vital legal document that safeguards the interests of lenders and borrowers in commercial real estate transactions. It provides clarity and security by outlining the terms and conditions of the loan and establishing a lien on the property. Whether using the standard form or a customized version, this agreement plays a crucial role in maintaining transparency and fairness during such transactions.

South Carolina Comprehensive Commercial Deed of Trust and Security Agreement

Description

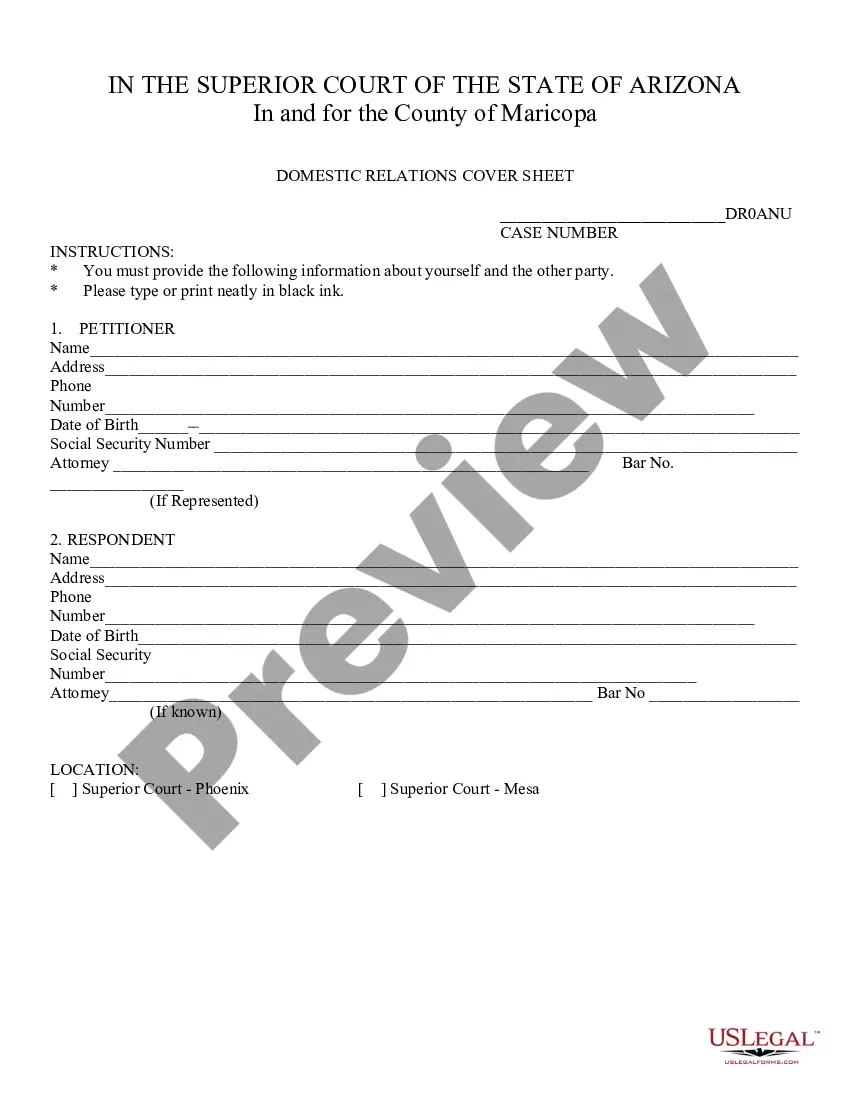

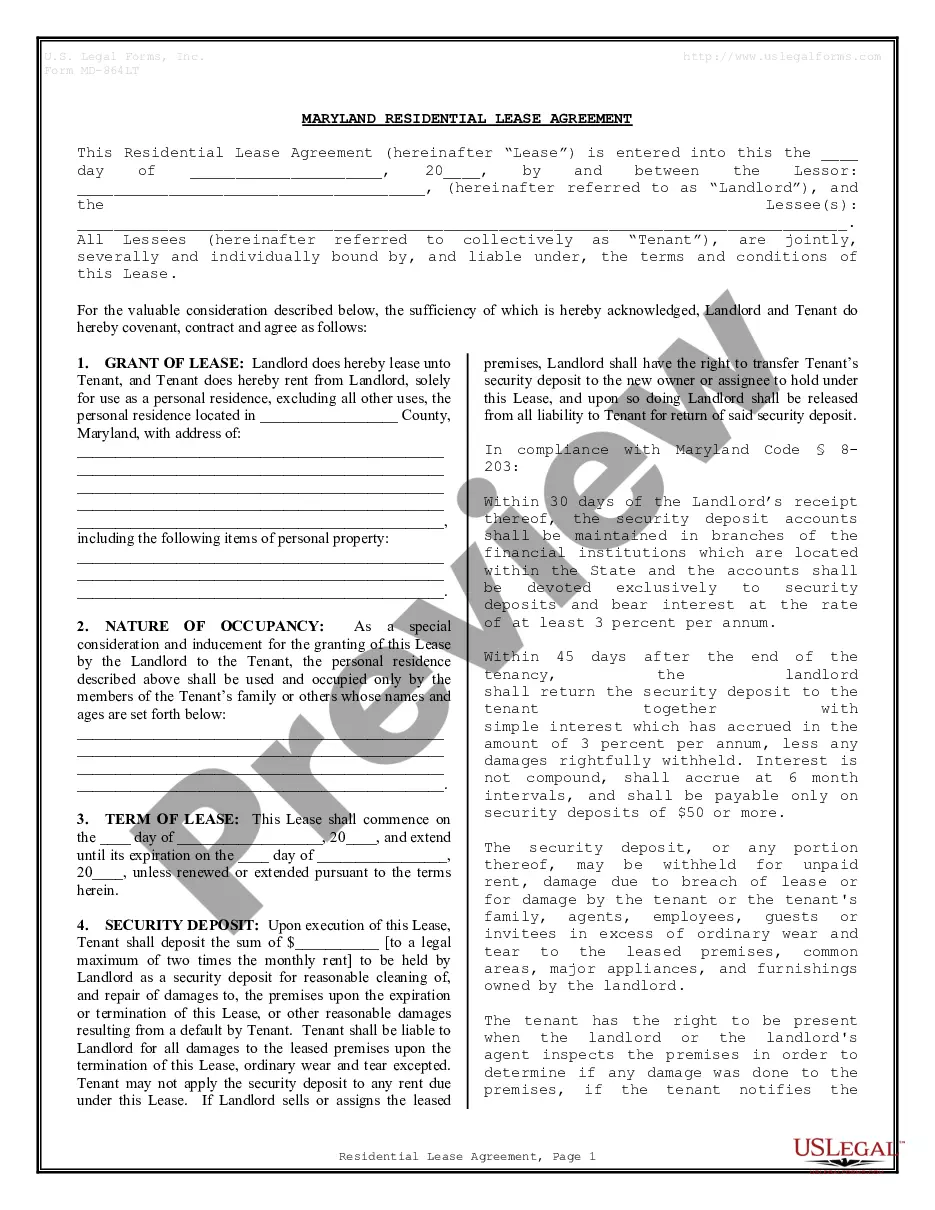

How to fill out South Carolina Comprehensive Commercial Deed Of Trust And Security Agreement?

If you have to complete, down load, or print out authorized file web templates, use US Legal Forms, the largest assortment of authorized types, that can be found online. Make use of the site`s easy and handy lookup to get the files you need. Different web templates for business and personal reasons are categorized by classes and says, or search phrases. Use US Legal Forms to get the South Carolina Comprehensive Commercial Deed of Trust and Security Agreement in just a few clicks.

If you are previously a US Legal Forms consumer, log in to your bank account and click on the Down load key to obtain the South Carolina Comprehensive Commercial Deed of Trust and Security Agreement. You can also entry types you earlier acquired from the My Forms tab of the bank account.

If you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for your right city/region.

- Step 2. Utilize the Review option to look over the form`s content material. Do not overlook to learn the explanation.

- Step 3. If you are not satisfied with the type, make use of the Research area on top of the display to get other types of your authorized type design.

- Step 4. When you have discovered the form you need, click on the Buy now key. Opt for the costs program you prefer and put your accreditations to register to have an bank account.

- Step 5. Method the transaction. You can use your bank card or PayPal bank account to accomplish the transaction.

- Step 6. Find the formatting of your authorized type and down load it on your own system.

- Step 7. Total, change and print out or indication the South Carolina Comprehensive Commercial Deed of Trust and Security Agreement.

Every single authorized file design you buy is the one you have forever. You possess acces to each and every type you acquired in your acccount. Select the My Forms segment and decide on a type to print out or down load again.

Be competitive and down load, and print out the South Carolina Comprehensive Commercial Deed of Trust and Security Agreement with US Legal Forms. There are thousands of professional and express-certain types you can use for your personal business or personal requires.

Form popularity

FAQ

What is a General Security Agreement? A GSA is a contract signed between two parties, a borrower and a lender. The GSA protects the lender by creating a security interest in all or some of the assets of the borrower. In sum, the GSA outlines the terms and conditions of the loan, and lists the assets used for security.

A security agreement is not used to transfer any interest in real property (land/real estate), only personal property. The document used by lenders to obtain a lien on real property is a mortgage or deed of trust.

Trust deeds are an alternative to mortgages in certain states. Instead of an agreement directly between a lender and a borrower, a trust deed places the title of a property in the hands of a third party, or trustee.

Security agreement definition If a borrower defaults, the security agreement allows the lender to collect the borrower's collateral and either sell it or hold onto it until the loan is repaid. Some security agreements allow the lender to sell the collateral immediately.

For a Deed of Trust, the parties involved are the lender, the borrower, and a neutral third party who will serve as a trustee. The title of the property is held as security for the loan and held by the trustee for the benefit of the lender. The title is released from the trust once the loan is paid.

The security deed is an interest in real estate which gives legal title of property to the lender of the mortgage for the term of the mortgage note. Trust deed is a written instrument legally conveying property to a trustee often used to secure an obligation such as a mortgage or promissory note.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Trustee: This is the third party who will hold the legal title to the real property. Beneficiary: This is the lender.