A Transmutation Agreement is a marital contract that provides that the ownership of a particular piece of property will, from the date of the agreement forward, be changed. Spouses can transmute, partition, or exchange community property to separate property by agreement. According to some authority, separate property can be transmuted into community property by an agreement between the spouses, but there is also authority to the contrary.

South Carolina Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property

Description

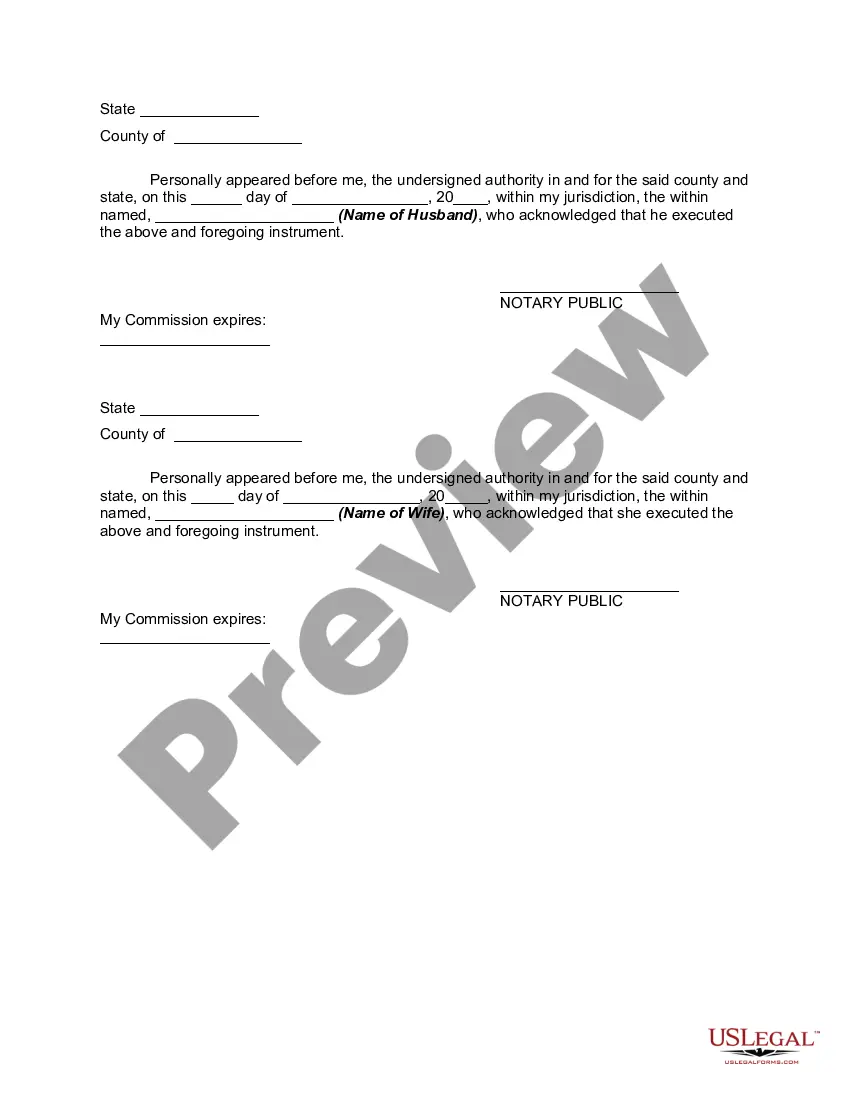

How to fill out Transmutation Or Postnuptial Agreement To Convert Community Property Into Separate Property?

US Legal Forms - a leading collection of legal documents in the United States - offers a variety of legal template options that you can acquire or print.

By using the website, you can find numerous forms for business and personal purposes, categorized by type, state, or keywords. You can access the most recent templates of forms such as the South Carolina Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property in just a few minutes.

If you already have an account, Log In and obtain the South Carolina Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property from the US Legal Forms library. The Download button will be visible on every form you examine. You can view all previously saved forms in the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device.Make adjustments. Fill out, edit, print, and sign the saved South Carolina Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property. All templates added to your account do not expire and remain your property indefinitely. Thus, if you wish to obtain or print another version, simply go to the My documents section and click on the form you need. Access the South Carolina Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property with US Legal Forms, one of the largest collections of legal template options. Utilize a vast array of professional and state-specific templates that fulfill your business or personal requirements.

- Ensure you have selected the appropriate form for your location/state.

- Click the Preview button to review the content of the form.

- Check the form details to be sure you have chosen the correct document.

- If the form does not meet your requirements, use the Search box at the top of the page to find one that does.

- Once satisfied with the form, confirm your choice by clicking on the Acquire now button.

- Then, select your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

Writing a postnuptial agreement involves several key steps, starting with identifying and detailing all assets and liabilities. Next, both parties should express their intentions regarding property division and any other marital terms. Using a structured format, like the South Carolina Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, can aid in creating a comprehensive and clear agreement. It’s wise to seek legal advice to ensure the document meets all necessary legal standards.

A postnuptial agreement can hold up in court if it is drafted properly and meets South Carolina's legal standards. To ensure enforceability, the agreement should be fair, voluntary, and signed by both parties without coercion. By utilizing the South Carolina Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, you create a clear, documented framework that increases the likelihood of judicial acceptance.

To transmute separate property to community property in South Carolina, you must clearly express your intent to do so, typically through a written agreement. This agreement should detail your decisions regarding the property and include both parties' signatures. The South Carolina Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property is a valuable tool for this process, ensuring your wishes are legally recognized.

Transmutation of separate property involves changing the classification of ownership from separate property to community property through agreement between spouses. This process is particularly relevant in South Carolina, where property rights can significantly impact financial outcomes in a divorce. A South Carolina Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property can help couples navigate these changes smoothly. Working with a legal professional can ensure that your transmutation terms meet all requirements.

The primary purpose of a transmutation agreement is to allow spouses to redefine the status of their property, ensuring clarity and protecting each individual’s financial interests. This is particularly useful in South Carolina, where property classification can greatly influence divorce outcomes. A South Carolina Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property helps couples establish clear ownership and expectations regarding their assets. Legal assistance can enhance the effectiveness of these agreements.

The transmutation rule in South Carolina outlines how property classification can be changed between separate and community property through mutual agreement. This rule emphasizes that both parties must consent to the change, ensuring that all legal requirements are met. In implementing a South Carolina Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, understanding this rule is vital for effective property management. Legal guidance can assist you in achieving your desired outcomes.

Certain topics are not appropriate for inclusion in a postnuptial agreement, such as provisions related to child custody and child support. These matters are determined by family court and must be in the best interest of the child. When creating a South Carolina Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, it is important to focus on asset division and financial matters. Consulting a legal expert can help you navigate these limitations effectively.

Yes, postnuptial agreements are enforceable in South Carolina provided they meet specific legal requirements. These agreements must be entered into voluntarily and with full disclosure of assets by both parties. A well-crafted South Carolina Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property can provide clarity and protection for your financial interests. Legal guidance can enhance the enforceability of these agreements.

A transmutation agreement specifically addresses the reclassification of property, while a postnuptial agreement can cover a broader range of financial and property issues between spouses. Both agreements allow couples to redefine how they manage their assets post-marriage. However, a South Carolina Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property focuses on changing the legal status of property types. Knowing the differences can help you choose the right approach for your needs.

Transmutation of non-marital property in South Carolina refers to the legal process where non-marital assets become community property or vice versa. This typically occurs through an agreement between spouses, allowing them to change the classification of their property. A South Carolina Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property can facilitate this process effectively. Understanding this concept is crucial for couples wishing to manage their property rights.